Garfield County Mechanics Lien Notice to Construction Lender Form

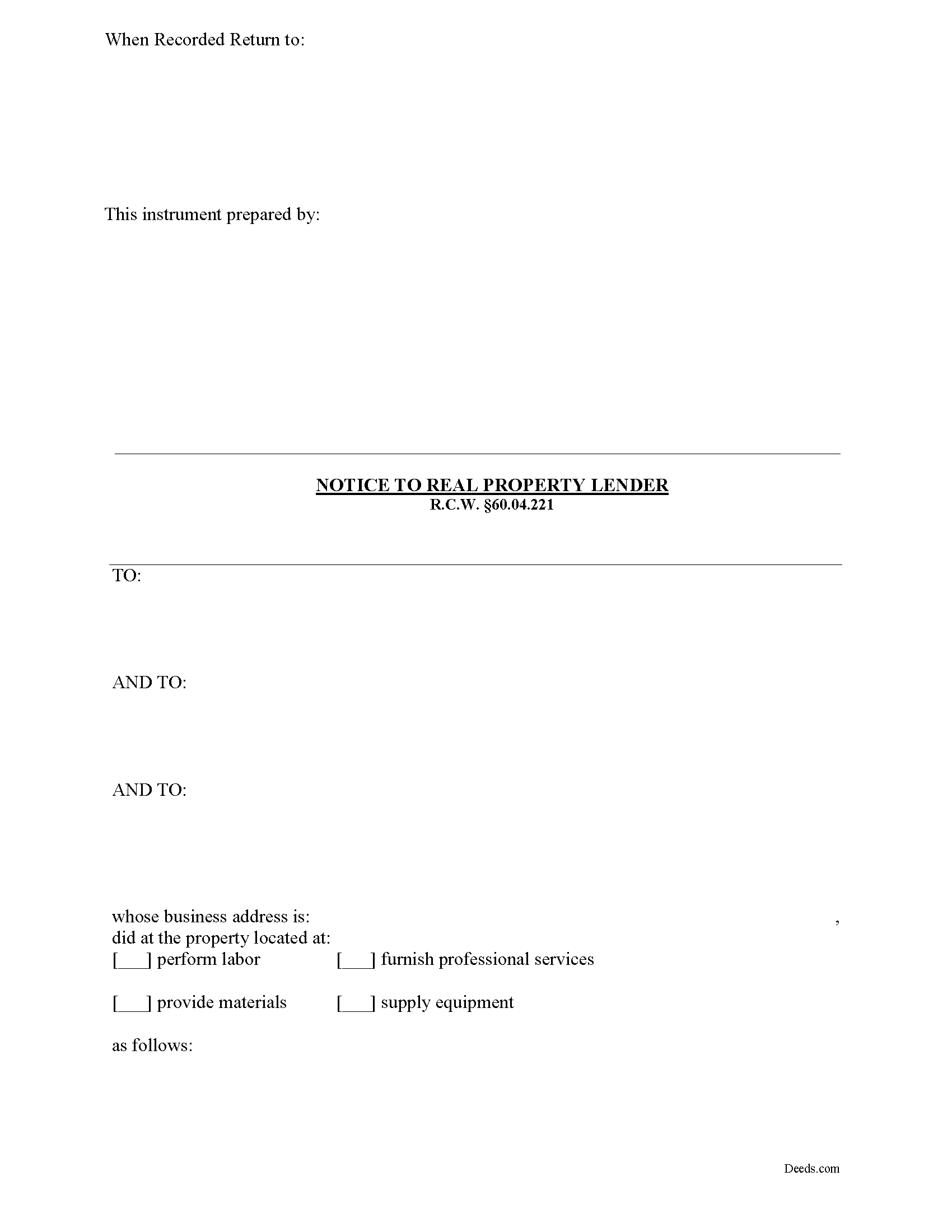

Garfield County Mechanics Lien Notice to Construction Lender Form

Fill in the blank Mechanics Lien Notice to Construction Lender form formatted to comply with all Washington recording and content requirements.

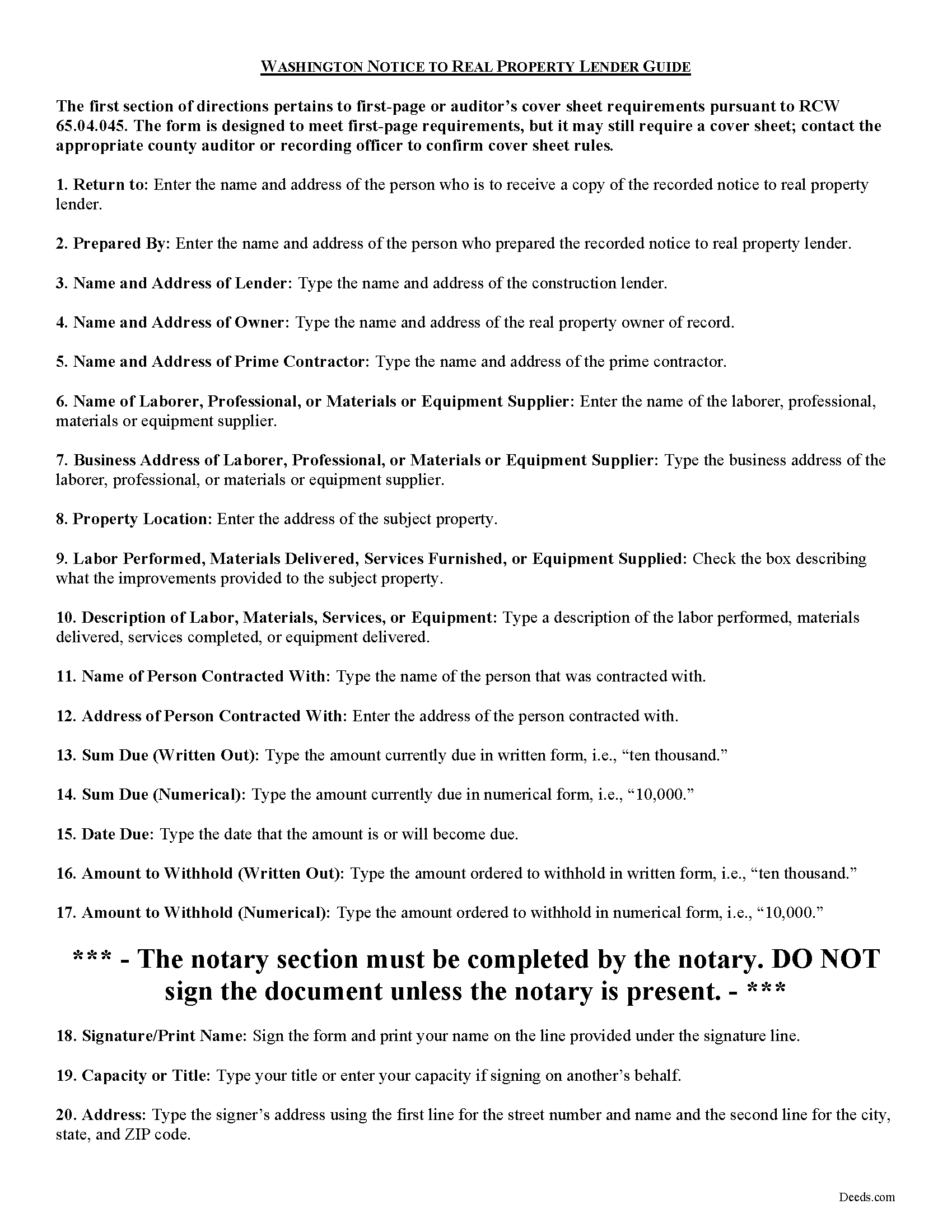

Garfield County Notice to Construction Lender Guide

Line by line guide explaining every blank on the form.

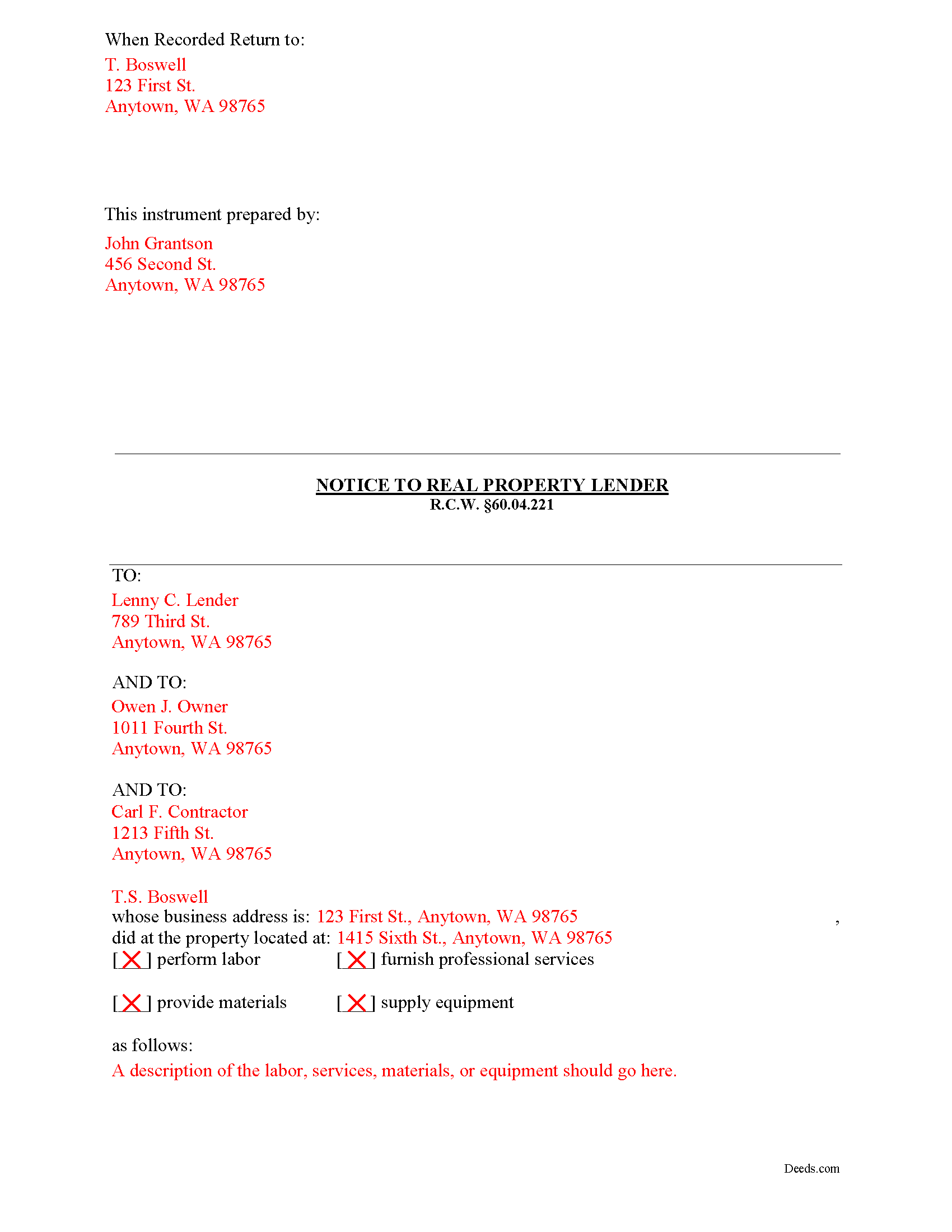

Garfield County Completed Example of the Notice to Construction Lender Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Washington and Garfield County documents included at no extra charge:

Where to Record Your Documents

Garfield County Auditor: Recording

Pomeroy , Washington 99347

Hours: 8:30 to 5:00 M-F

Phone: (509) 843-1411

Recording Tips for Garfield County:

- Documents must be on 8.5 x 11 inch white paper

- Leave recording info boxes blank - the office fills these

- Make copies of your documents before recording - keep originals safe

- Ask about their eRecording option for future transactions

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Garfield County

Properties in any of these areas use Garfield County forms:

- Pomeroy

Hours, fees, requirements, and more for Garfield County

How do I get my forms?

Forms are available for immediate download after payment. The Garfield County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Garfield County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Garfield County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Garfield County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Garfield County?

Recording fees in Garfield County vary. Contact the recorder's office at (509) 843-1411 for current fees.

Questions answered? Let's get started!

Getting a Construction Lender to Withhold Funds

As part of the construction lien process, you might find it useful to send a notice to the construction lender ordering the lender to withhold distribution of funds from the loan proceeds until you are paid. This is another potential weapon in the lien claimant's arsenal. In some states, this notice is called as a "stop notice" because it instructions the lender to stop payment. The notice can be used as a first step or as an alternative to securing a mechanic's lien.

Any potential lien claimant who has not received a payment within five days after the date required by their contract, invoice, employee benefit plan agreement, or purchase order may give a notice to a construction lender within thirty-five days of the date required for payment of the contract, invoice, employee benefit plan agreement, or purchase order. See R.C.W. 60.04.221(1).

The notice must be signed by the potential lien claimant or some person authorized to act on his or her behalf. R.C.W. 60.04.221(2). The notice must be provided in writing to the lender at the office administering the construction financing, along with a copy given to the owner and the appropriate prime contractor. R.C.W. 60.04.221(3).

Two methods can be used to serve the notice: (1) mailing the notice by certified or registered mail to the lender, owner, and appropriate prime contractor; or (2) delivering or serving the notice personally and obtaining evidence of delivery in the form of a receipt or other acknowledgment signed by the lender, owner, and appropriate prime contractor, or an affidavit of service. Id.

The notice must include the following information: (1) the name of the person, firm, trustee, or corporation filing the notice, (2) the name of the prime contractor, common law agent, or construction agent ordering the same, (3) a common or street address of the real property being improved or the legal description of the real property, and (4) the name, business address, and telephone number of the lien claimant. R.C.W. 60.04.221(4).

After the lender receives a copy of the notice, the lender must then withhold from the next and subsequent draws the amount claimed to be due as stated in the notice. R.C.W. 60.04.221(5). Alternatively, the lender may obtain from the prime contractor or borrower a payment bond for the benefit of the potential lien claimant in an amount sufficient to cover the amount stated in the potential lien claimant's notice. Id. The lender is obligated to withhold amounts only to the extent that sufficient interim or construction financing funds remain undisbursed as of the date the lender receives the notice. Id.

Once the notice is received by the lender, sums that are withheld shall not be disbursed by the lender, except by the written agreement of the potential lien claimant, owner, and prime contractor, or court order. R.C.W. 60.04.221(6).

If the lender fails to abide by the terms of the notice, then the mortgage, deed of trust, or other encumbrance securing the lender will be made secondary to the lien of the potential lien claimant to the extent of the interim or construction financing wrongfully disbursed, but in no event more than the amount stated in the notice plus costs as fixed by the court, including reasonable attorneys' fees. R.C.W. 60.04.221(7).

Use caution in drafting the notice to the lender and ensure the form is accurate. If there are mistakes, any potential lien claimant will be liable for any loss, cost, or expense, including reasonable attorneys' fees and statutory costs, to a party injured thereby arising out of any unjust, excessive, or premature notice that is filed. R.C.W. 60.04.221(8).

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. If you have any questions about the notice to lender document or any other issues related to liens, please consult with a Washington attorney.

Important: Your property must be located in Garfield County to use these forms. Documents should be recorded at the office below.

This Mechanics Lien Notice to Construction Lender meets all recording requirements specific to Garfield County.

Our Promise

The documents you receive here will meet, or exceed, the Garfield County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Garfield County Mechanics Lien Notice to Construction Lender form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Timothy C.

January 6th, 2022

The process was all very clear and easy -- pay the fee online and download the state and county forms onto my computer. I will do as instructed for the Revocable Transfer on Death Deed, then update my review after I file this with the office of the Sandoval County (New Mexico) Clerk.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marilyn B.

November 1st, 2019

I do not use the internet much and really am not good with it, but your site which my brother told me about was really easy to use. I would recommend your service to others any time. Thanks for making it user friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

timothy s.

March 23rd, 2020

fine job, fellas, fine job

Thank you!

Donald P.

November 12th, 2019

Very fast and efficient. Easy to fill out but was upset the latest tax exemptions ruled in 2014 did not seem to be included. Exclusion of sale to blood relatives, etc. _ the one I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Raymond R C.

September 10th, 2019

Old document deeds were not available and my cost was returned. Was referred to another location and was able to get some help there.

Thank you for your feedback. We really appreciate it. Have a great day!

Lynn T.

June 16th, 2021

great service, thank you

Thank you!

Janet R.

October 21st, 2019

The site was easy to navigate...all the information needed to fill in the forms was included, which was very helpful and a pleasant surprise...form completed in short order...made taking care of business quick and easy...Thanks for the thoughtful and excellent help, I will share the link with others and I will use the site again...Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lacee G.

November 25th, 2019

Great real estate deed forms.

Thank you!

wayne s.

March 25th, 2020

Wonderful forms! Thanks for making this available.

Thank you Wayne, have a great day!

Melvin F.

March 5th, 2021

Was a little frustrated first using your site, but due to my mental state, I expected that! Got what I needed, thank you very much.

Thank you for your feedback. We really appreciate it. Have a great day!

Natasha M.

January 9th, 2024

Your forms, guides, sample deeds and submission process were accessible, easy to understand and simple. I also was pleasantly surprised by the efficiency, professionalism and ease of staff communicating with me after I uploaded the document to ensure the county accepted it. I will continue to use this website to record deeds. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Gail J.

November 23rd, 2021

Great! Got the document I needed

Thank you for your feedback. We really appreciate it. Have a great day!

Kathy P.

November 25th, 2019

I like that the quit claim form was fill in the blank on my computer instead of online, made it so much easier than having to do everything at once, at the mercy of the internet connection. Will refer others here.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Keith M.

September 18th, 2020

Great bargain! Thanks. Easy to download forms. -Keith M

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eddy O.

August 20th, 2022

Your site was very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!