Garfield County Trustee Deed Form

Garfield County Trustee Deed Form

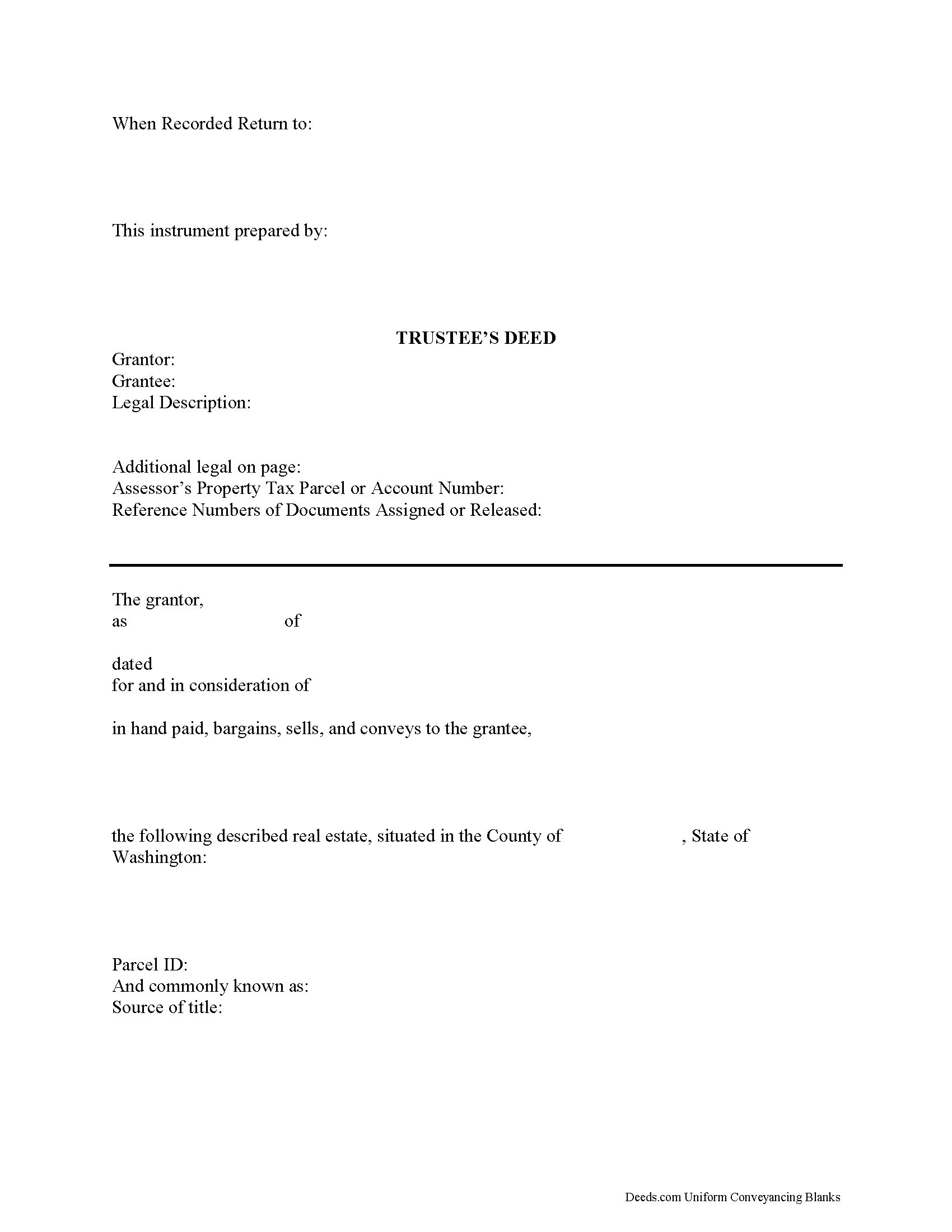

Fill in the blank form formatted to comply with all recording and content requirements.

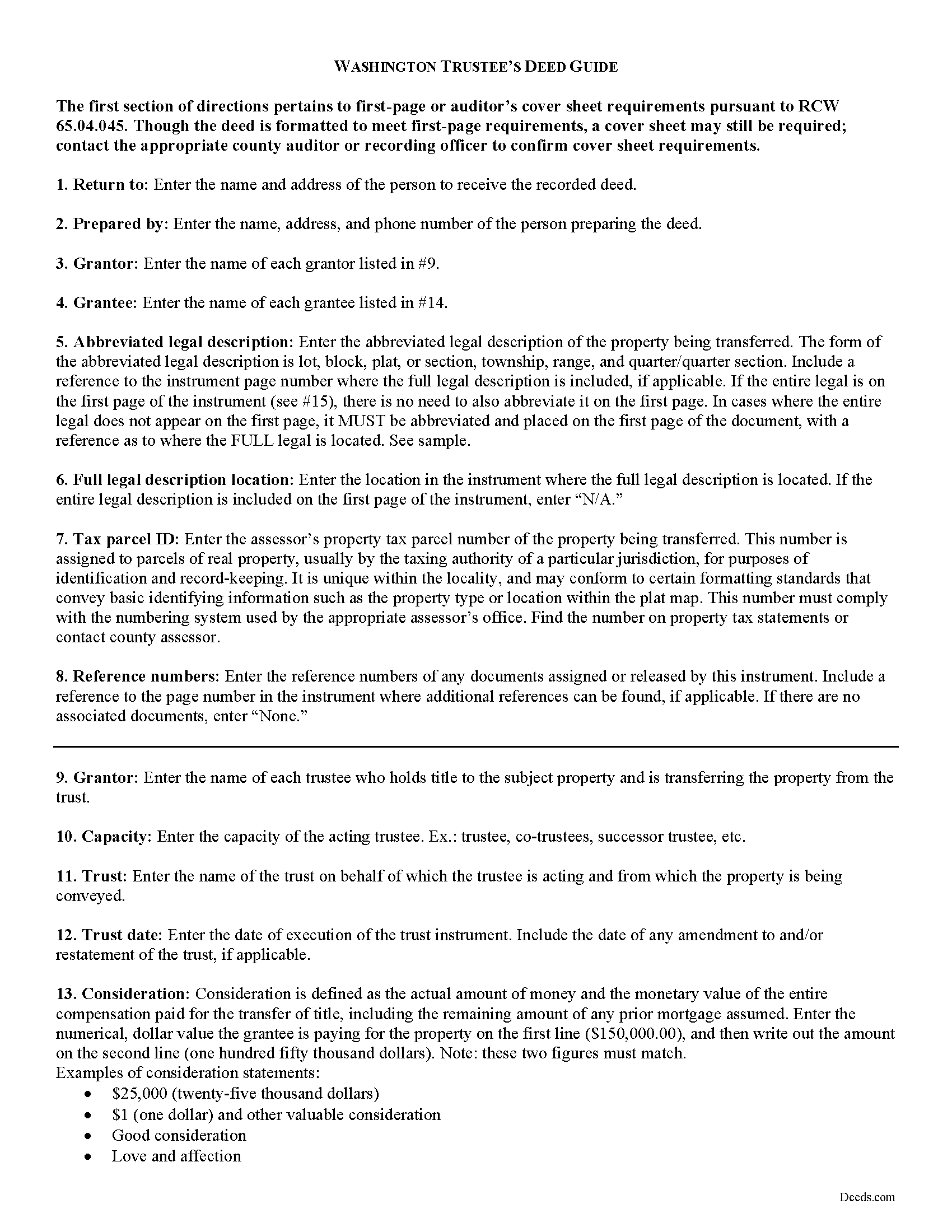

Garfield County Trustee Deed Guide

Line by line guide explaining every blank on the form.

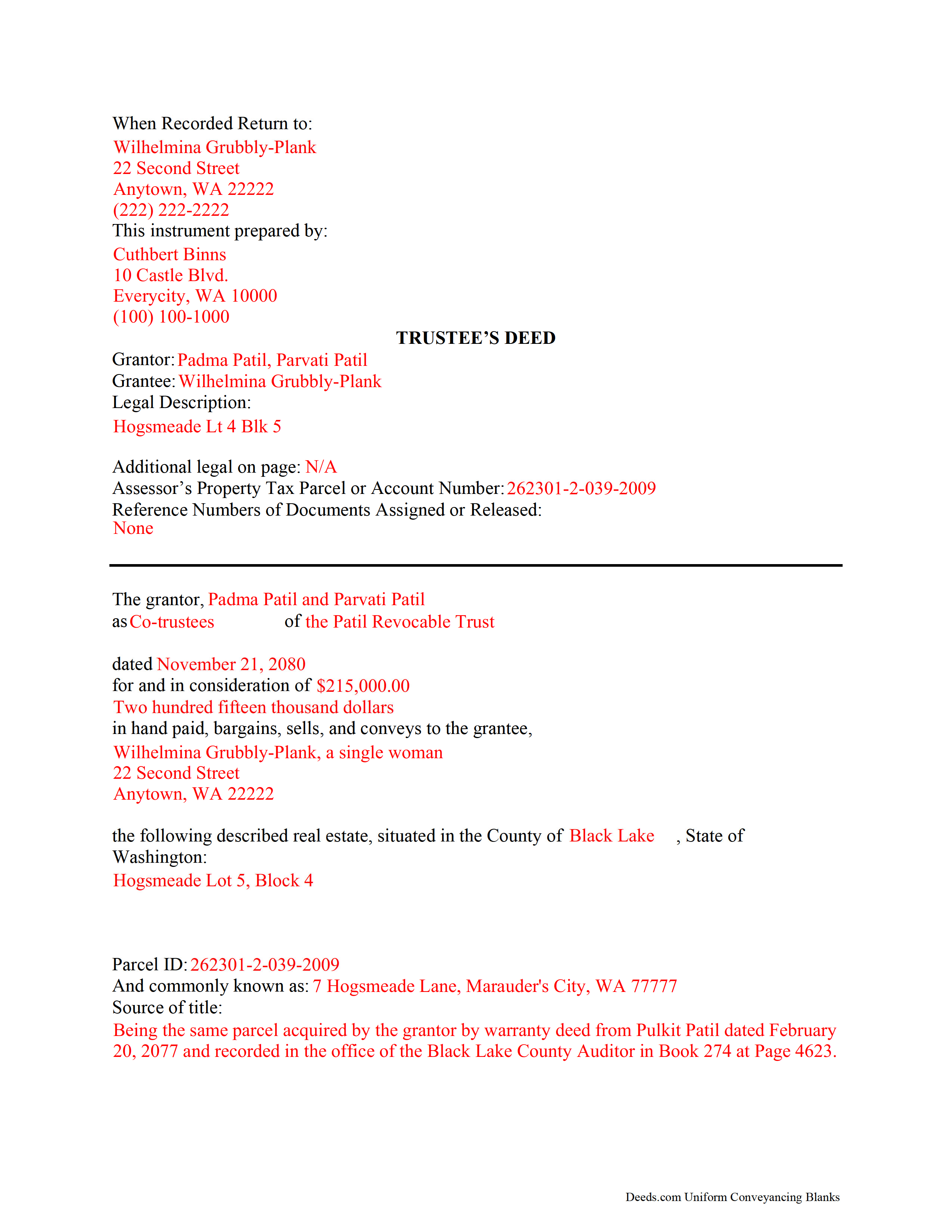

Garfield County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Washington and Garfield County documents included at no extra charge:

Where to Record Your Documents

Garfield County Auditor: Recording

Pomeroy , Washington 99347

Hours: 8:30 to 5:00 M-F

Phone: (509) 843-1411

Recording Tips for Garfield County:

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Garfield County

Properties in any of these areas use Garfield County forms:

- Pomeroy

Hours, fees, requirements, and more for Garfield County

How do I get my forms?

Forms are available for immediate download after payment. The Garfield County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Garfield County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Garfield County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Garfield County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Garfield County?

Recording fees in Garfield County vary. Contact the recorder's office at (509) 843-1411 for current fees.

Questions answered? Let's get started!

Washington State Trustee's Deed to Convey Living Trust Property

Transferring real property from a living trust requires a trustee's deed, not to be confused with the trustee's deed following foreclosure of a deed of trust. The trustee's deed to convey living trust real estate in Washington State is a bargain and sale deed (a statutory form in Washington under RCW 64.04.040) that has been descriptively named for the executing party.

In a living trust, a settlor transfers assets to another person (the trustee) for the benefit of someone else (the beneficiary). In many living trust arrangements, these roles may be performed by the same person, so long as the sole trustee is not also the sole beneficiary. The living trust is an estate planning tool established by the settlor (by the execution of a trust instrument and the funding of the trust), who receives the benefit of the trust during his lifetime. The settlor administers the trust during his lifetime as trustee, though not always, and typically designates a successor trustee to replace him as trustee in the event of death or incapacitation.

Real property is transferred into trust by a deed from the settlor, granting the property to the trust in the name of the trustee. Because the trustee now holds legal title to the property, the trustee must execute a deed to remove property from the trust.

The Washington trustee's deed (bargain and sale deed) transfers fee simple interest to the grantee with a limited warranty and contains the express covenants most typically associated with a special warranty deed, namely that "the grantor was seized of an indefeasible estate in fee simple, free from encumbrances, done or suffered from the grantor" except as otherwise limited by the restrictions enumerated on the deed. The grantor also promises that the grantee will have "quiet enjoyment against the grantor, his or her heirs and assigns" (RCW 64.04.040). This type of narrower warranty, limited to the duration of the grantor's title, is commonly used in cases where a trustee is selling property to a third party; due to the nature of a trust, the trustee may have no knowledge of the title prior to his trusteeship, and cannot offer a broader warranty.

The trustee's deed should comply with the statutory form of a bargain and sale deed under RCW 64.04.040 and requires, in addition to the granting trustee's name, recital of the name and date the trust as part of the grantor information. The form should conform to first-page and general recording requirements for documents affecting title to real property in the State of Washington. A third party may request a trustee's certificate under RCW 11.98.075, confirming the trust's existence and the trustee's authority and powers.

Consult a lawyer with questions regarding living trusts and conveyances of real property from living trusts in Washington, as each situation is unique.

(Washington TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Garfield County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Garfield County.

Our Promise

The documents you receive here will meet, or exceed, the Garfield County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Garfield County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Feng T.

November 11th, 2021

Professional product, with clear instructions that gave me high confidence in the accuracy my document. The sample form was super useful. I highly recommend and will reuse Deed.com

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia K.

August 8th, 2019

Able to find the information that I needed.

Thank you!

Marc T.

August 31st, 2021

Walked the document through our county offices today. the directions to fill out the document were awesome and we had no issues, We now have a TOD property. Beats paying an attorney $200.00

Thank you for your feedback. We really appreciate it. Have a great day!

Judy F.

December 29th, 2018

I thought your site was focused on my specific county, but it wasn't. Therefore, I did not complete a transaction.

Thank you for your feedback Judy. Our site is national, we focus on all jurisdictions. Have a great day.

Peter W.

February 28th, 2019

Thanks worked out great

Thank you for the follow up Peter. Have a great day!

Francisco C.

January 25th, 2023

well first time my company is using and this what can say. excellent service im very happy, you guys did my job very professional and quickly so congratulations... i will recommend to every one.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alexander H.

August 17th, 2019

As an experienced attorney new to estate planning, I attest that this website and its documents were very helpful. Their documents including everything one needed to know and was very comprehensive.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Phyllis M.

August 3rd, 2019

Using your site was very easy. I found what my friend said she wanted easily and downloaded it to retype her quitclaim deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah K.

February 2nd, 2023

great job but, I wanted to upload a document. I got it wrong, but the info was good.

Thank you!

Roger W H.

March 31st, 2022

So far GOOD, just can't locate legal description. Will sign in later when have correct info. Thanx!! Rog

Thank you!

Johnny A.

December 15th, 2018

My complete name is Johnny Alicea Rodriguez And the DEED is on my half brother and mine name. Jimmy Dominguez and myself Thanks

victor h.

February 26th, 2022

Easy to use and just what I was looking for

Thank you!

Scott s.

September 2nd, 2022

Information requested was provided and time to reply was quick!

Thank you!

Bobby W.

January 3rd, 2019

The site delivered just what it promised - I needed a specific deed formatted for a specific county/state, and they delivered it at a great price. One note for improvement - it is not intuitively obvious that I could go back and re-download if necessary and this caused me stress, but a follow up email alleviated this. Great service!

Thank you for the kind words Bobby, have a great day!

Anita C.

November 3rd, 2021

I found this site when looking for help filing a quitclaim deed to change my property deed to my married name. I received the correct forms, an example filled out, and a guide specific to my state. I have already submitted it for review to my county assessor's office (they were extremely helpful also) and it looks as if it should sail through. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!