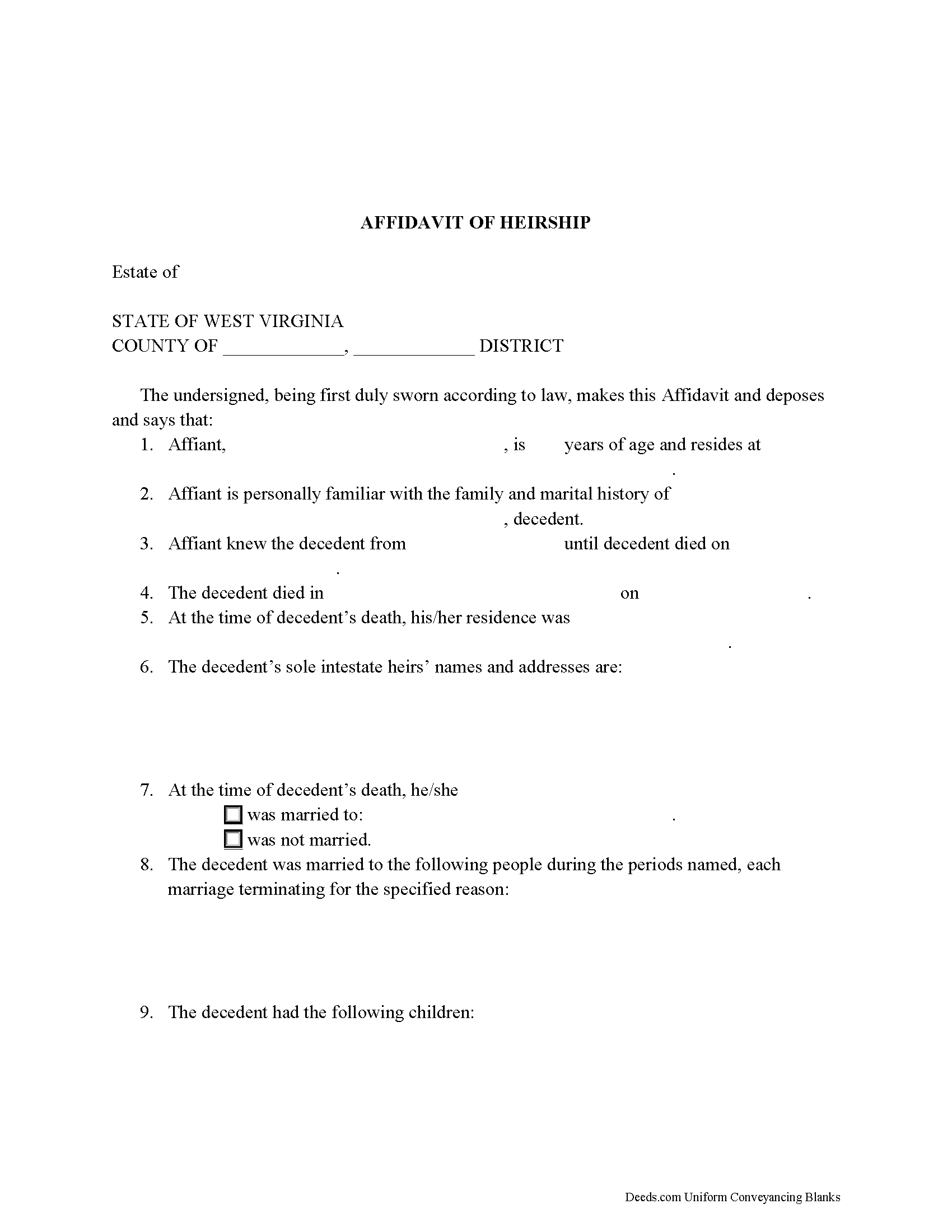

Wayne County Affidavit of Heirship Form

Wayne County Affidavit of Heirship Form

Fill in the blank form formatted to comply with all recording and content requirements.

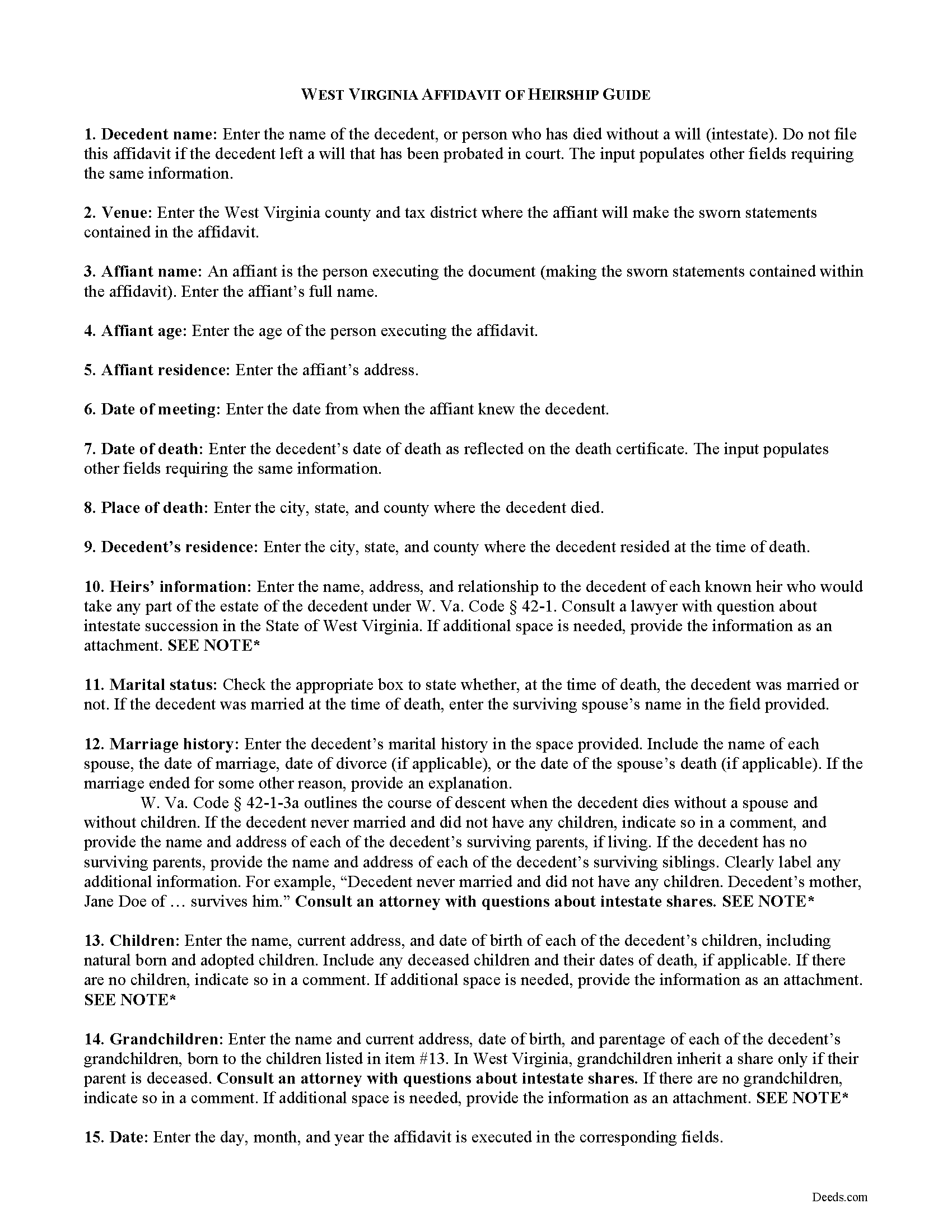

Wayne County Affidavit of Heirship Guide

Line by line guide explaining every blank on the form.

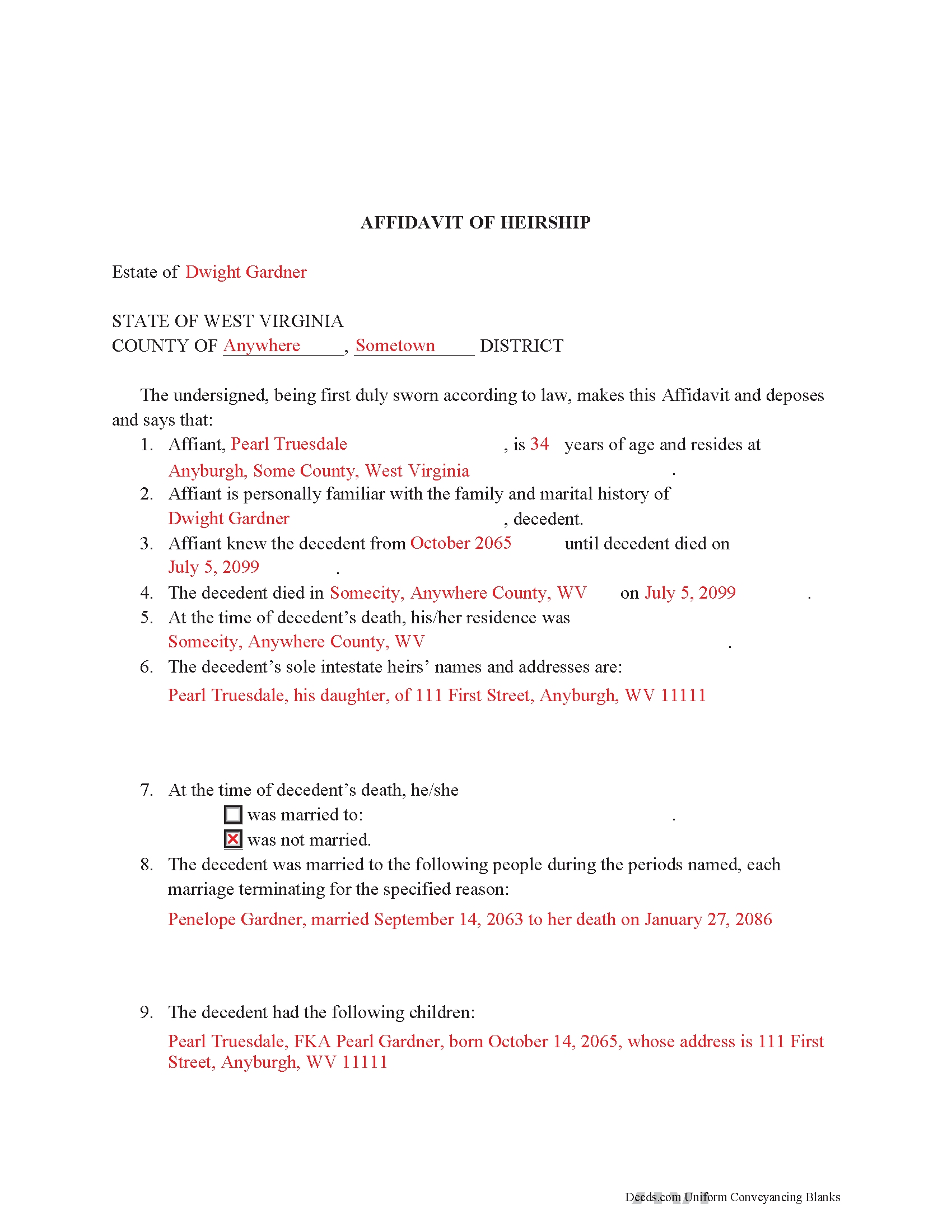

Wayne County Completed Example of the Affidavit of Heirship Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional West Virginia and Wayne County documents included at no extra charge:

Where to Record Your Documents

Wayne County Clerk

Wayne, West Virginia 25570

Hours: 8:00 to 4:00 M-W, F; Th until 7:00

Phone: (304) 272-6362

Recording Tips for Wayne County:

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Request a receipt showing your recording numbers

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Wayne County

Properties in any of these areas use Wayne County forms:

- Ceredo

- Crum

- Dunlow

- East Lynn

- Fort Gay

- Genoa

- Huntington

- Kenova

- Kiahsville

- Lavalette

- Prichard

- Shoals

- Wayne

- Wilsondale

Hours, fees, requirements, and more for Wayne County

How do I get my forms?

Forms are available for immediate download after payment. The Wayne County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wayne County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wayne County?

Recording fees in Wayne County vary. Contact the recorder's office at (304) 272-6362 for current fees.

Questions answered? Let's get started!

An affidavit of heirship establishes the lawful heirs of a decedent's estate when he or she dies intestate (without a will).

When recorded in the land records where the real property described within is located, the affidavit provides a record of the change in ownership and succession in interest of the within-described assets to the decedent's heir(s). The affidavit is not to be used when a will is probated or a proceeding for the administration of the decedent's estate has been opened.

While anyone can file an affidavit of heirship, the affiant, the person making the sworn statements contained in the affidavit, must have knowledge of the decedent's marital history and family tree in order to complete the affidavit accurately.

The instrument establishes the decedent's martial status at the time of death and whether the decedent left descendants (children, whether natural or adopted, and the children of any deceased child).

In West Virginia, interest in real property from a decedent's estate that does not transfer outside of probate (i.e., property not held with a survivorship designation) transfers by the laws of descent codified at W. Va. Code 42-1).

In general, the surviving spouse inherits a decedent's property. If the decedent has no surviving spouse, his descendants (children) inherit the property. A grandchild inherits the share of a deceased parent, if applicable. If the decedent has neither a surviving spouse nor descendants, his or her parents inherit the property. In the event there are no surviving parents, the decedent's siblings inherit. Always consult a lawyer with questions about intestate succession, as each situation is unique, and the law is complex.

In addition to establishing the decedent's heirs at law, the affidavit also describes all the real and personal property left by the decedent. The affiant must sign the affidavit in the presence of a notary public. Before recording with the land records of the county where the subject property is situated, ensure that the instrument meets standards of form and content for recorded documents in West Virginia.

Consult a lawyer with questions about intestate succession or affidavits of heirship in West Virginia.

(West Virginia Affidavit of Heirship Package includes form, guidelines, and completed example)

Important: Your property must be located in Wayne County to use these forms. Documents should be recorded at the office below.

This Affidavit of Heirship meets all recording requirements specific to Wayne County.

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Affidavit of Heirship form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Emmy M.

August 20th, 2020

I loved using this process to record my deeds. it was fast and everytime I sent a message I received a response very quickly. I am so glad they have this option. for the extra $15 to have the convenience to do it from home and not worry about finding parking, etc. so well worth it!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sallie S.

January 24th, 2019

Great speedy service with access to areas beyond my reach.

Thank you Sallie, have a great day!

Beverly R.

February 2nd, 2022

This was a wonderful experience, easy fast and convenient. Thank you for all your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Norma C.

September 4th, 2019

Great service and process for recording deeds quickly and easily. Also impressed with prompt replies to messages providing clear and specific instructions/guidance.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Erik J.

January 8th, 2021

First time using Deeds.com and feel that your platform is clear and easy to use. I was also pleased with the messaging center and follow-up and also surprised at how quickly our particular deed was recorded and available to view. Having said that, when I first investigated Deeds.com the fee was $15 and as of 1/1/21 it has increased to $19 which I feel is pretty steep for the handling of 1 simple document especially when the turnaround was basically the same day. Your fee was nearly the equivalent of the cost of the Clerk's recording fee. Perhaps you should offer a fee schedule for those of us who are not volume recorders. Just a thought.

Thank you!

Dakota H.

December 19th, 2021

Brilliant idea. Beats working with an attorney who charges $250+ per hour. Thanks.

Thank you!

Phillip S.

February 14th, 2024

I used the Oklahoma Gift Deed transferring property intra-family, and found it easy to complete. I could not find an Oklahoma Affidavit for the new law re citizenship verification, 60 O.S. Sec 121 and found it at another site that was not a fill in online. Oh well. Site was easy to navigate.

We are motivated by your feedback to continue delivering excellence. Thank you!

Jennifer A.

May 20th, 2020

Great site

Thank you!

Ronald C.

October 2nd, 2019

Easy to navigate and very concise

Thank you!

Curtis G.

May 18th, 2020

Easy to use.

Thank you!

Angela B.

September 19th, 2020

Great forms! Quick, easy, and to the point. The completed document, when printed out, looks really professional.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James M.

June 3rd, 2021

Very good experience.

Thank you!

Marion Paul W.

January 31st, 2019

Quick service .Easy download.I ordered Quit Claim and should have ordered warranty deed. I will make it work

Thank you!

Vicki A.

October 29th, 2023

Very fast and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RONALD F.

July 24th, 2020

Great service. Very reasonable cost. All necessary detailed information provided.

Thank you for your feedback. We really appreciate it. Have a great day!