Pleasants County Personal Representative Deed Form (West Virginia)

All Pleasants County specific forms and documents listed below are included in your immediate download package:

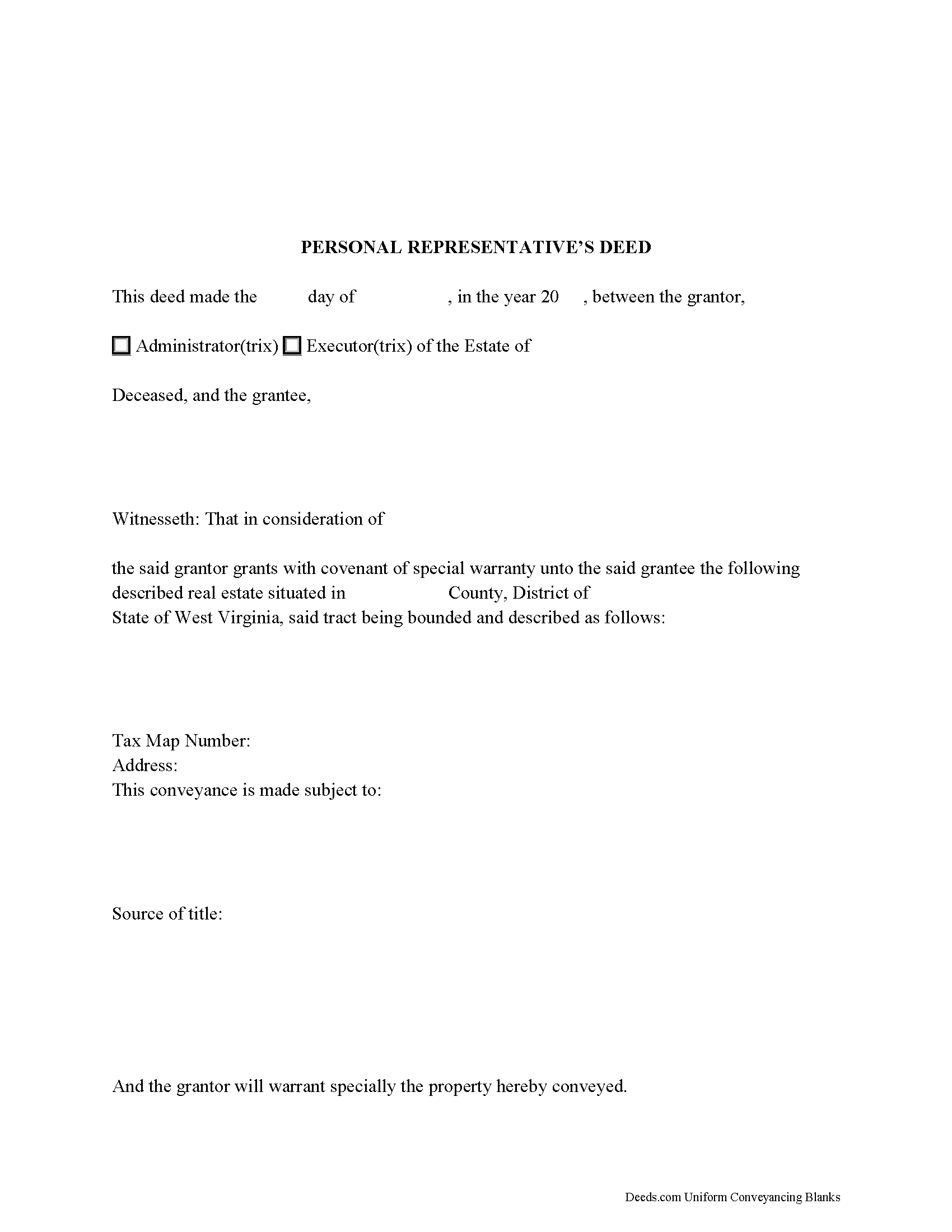

Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Pleasants County compliant document last validated/updated 9/3/2024

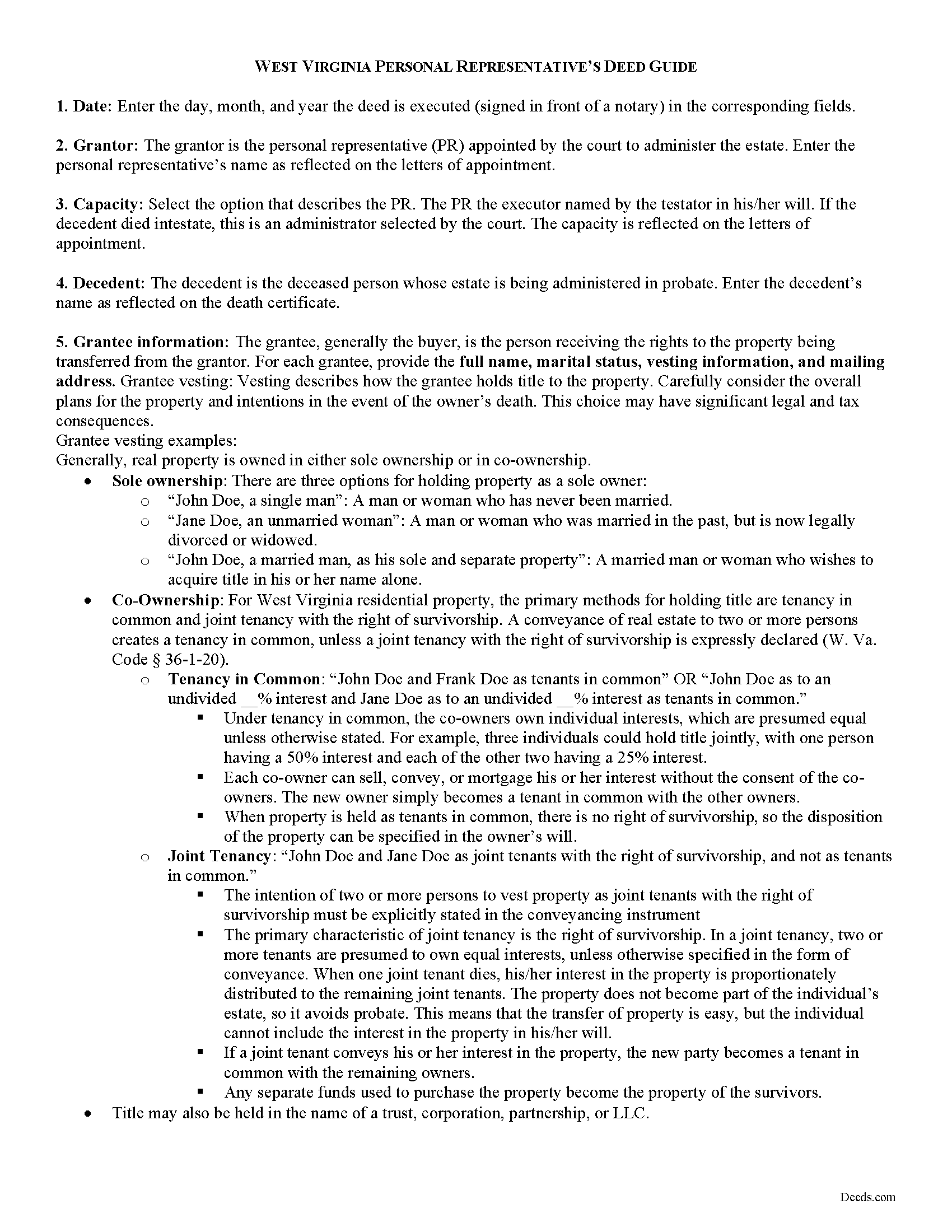

Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

Included Pleasants County compliant document last validated/updated 10/11/2024

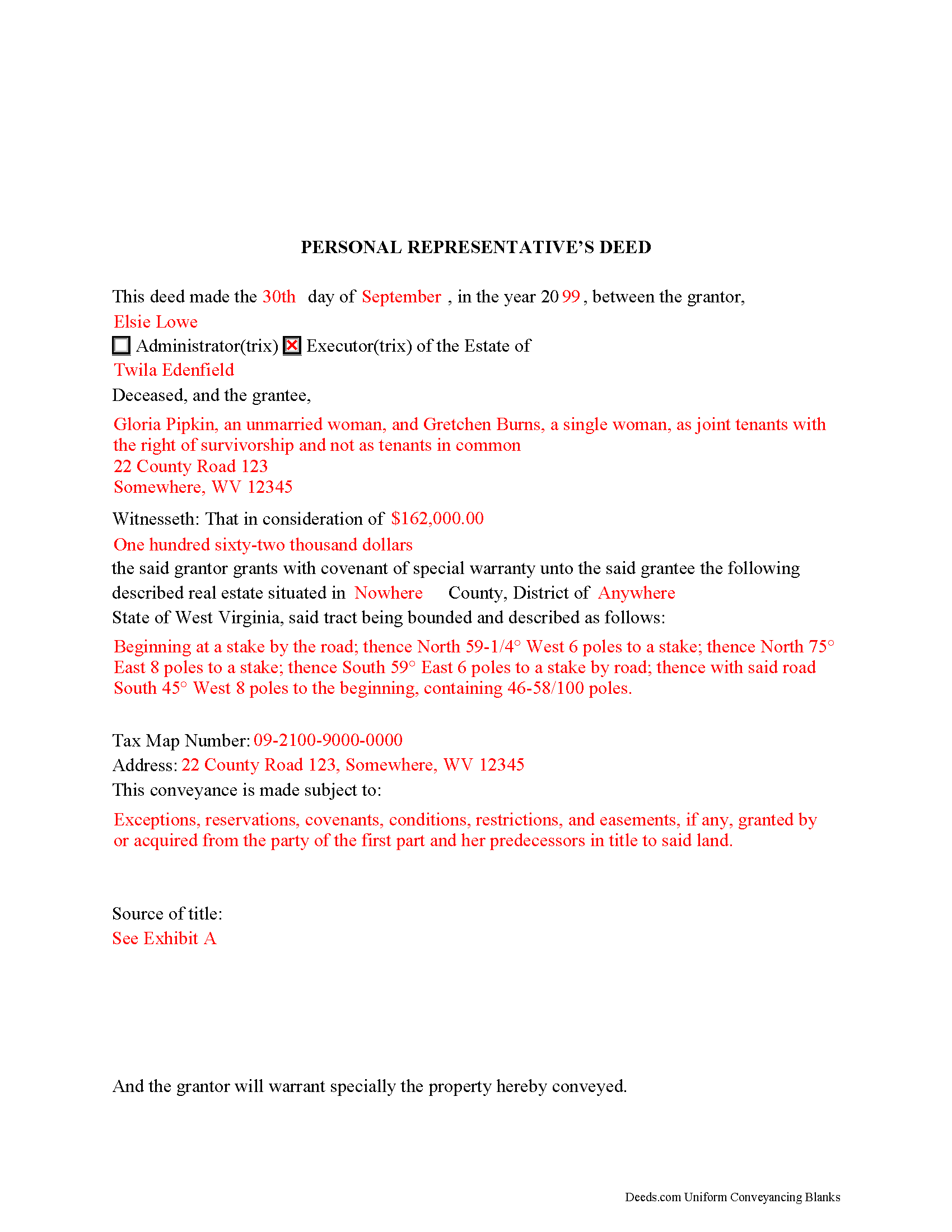

Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

Included Pleasants County compliant document last validated/updated 9/6/2024

The following West Virginia and Pleasants County supplemental forms are included as a courtesy with your order:

When using these Personal Representative Deed forms, the subject real estate must be physically located in Pleasants County. The executed documents should then be recorded in the following office:

Pleasants County Clerk

301 Court Lane, St Marys, West Virginia 26170-1333

Hours: Monday - Friday 8:00 am - 4:30 pm

Phone: (304) 684-3542 or 3513

Local jurisdictions located in Pleasants County include:

- Belmont

- Saint Marys

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Pleasants County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Pleasants County using our eRecording service.

Are these forms guaranteed to be recordable in Pleasants County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pleasants County including margin requirements, content requirements, font and font size requirements.

Can the Personal Representative Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Pleasants County that you need to transfer you would only need to order our forms once for all of your properties in Pleasants County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by West Virginia or Pleasants County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Pleasants County Personal Representative Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A personal representative is the fiduciary appointed to administer a decedent's estate in probate. When the decedent dies with a will, the personal representative is the executor named in the will, or, if no executor is named, a qualifying beneficiary. When the decedent dies intestate (without a will), the personal representative selected by the court is called the administrator.

In the course of estate settlement, a personal representative may be required to execute and record a deed conveying real property from the estate following a sale. A decedent may designate in their will the specific real estate to be sold, or an estate's assets may be insufficient to pay its debts, and the personal representative may need to commence a suit in equity to subject the real estate to payment under W. Va. Code 44-8-7.

A fiduciary deed follows the statutory form of a deed under W. Va. Code 36-3-5. In addition, West Virginia requires a Declaration of Consideration or Value confirming the actual consideration paid or monetary value of the property being transferred (W. Va. Code 11-22-6).

Due to the nature of the fiduciary as a representative, a special warranty is typically appropriate. A covenant of special warranty means that the grantor promises to warrant and defend the property for the grantee against claims or demands of the grantor and persons acting by, through, or under him (W. Va. Code 36-4-3). This warranty is more limited than that of a general warranty deed because it does not extend prior to the time the grantor obtained title. In West Virginia, covenants run with the land, meaning they are also binding on any successor in title.

In addition to the statutory contents of a deed, personal representative's deeds contain information about the subject estate, such as the decedent's name and date of death, whether he or she left a will, the personal representative's name and his or her source of authority to sell the subject real estate, such as a testamentary power of sale under W. Va. Code 44-5A-3 or an order by the county commission.

The deed must be signed by the executor or administrator in the presence of a notary public before recording in the County Clerk's office for a valid transfer. The instrument should meet all requirements of form and content for documents relating to real property in West Virginia.

Consult a lawyer with questions about estate administration or personal representative's deeds in West Virginia.

(West Virginia PRD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Pleasants County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pleasants County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4417 Reviews )

Giuseppina M.

October 24th, 2024

Fast, reliable excellent service

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Stacey H.

October 23rd, 2024

This was my first time using Deeds.com and I was very impressed on the professionalism and the expediency of the recording. Will definitely be using them again. rnrnStacey H.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Giuseppina M.

October 23rd, 2024

Love to work with your company

It was a pleasure serving you. Thank you for the positive feedback!

Lillian F.

May 2nd, 2019

I LOVE THE EASE OF GETTING THE INFORMATION I REQUESTED. YOUR SERVICE IS MORE THAN WHAT I EXPECTED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Byron M.

March 10th, 2022

This is a great service and a time saver for the company. We get fast responses and a detailed explanation if something additional is needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Michelle R.

December 23rd, 2022

Fairly easy to use. Need to be able to find platts easy.

Thank you!

Raad A.

November 25th, 2022

Not easy to navigate

Thank you for your feedback.

Barbara P.

August 13th, 2024

So easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dreama R.

May 7th, 2019

Awesome! I had to correct a quit claim deed and the form on your site made it very easy.

Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Louise D.

October 21st, 2022

It was easy to complete the form and I appreciated the sample form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William C.

February 23rd, 2020

Excellent, easy to use. Technically accurate in all information offered.

Thank you!

CHARMAINE G.

August 10th, 2022

Would have paid double for these forms. Thankfully there are professionals making these things, I would have surely messed it up if I tried to do it myself based on my incorrect preconceived ideas.

Thank you!

Lisa M.

June 24th, 2020

Excellent service!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James J.

October 4th, 2021

I couldn't be more pleased or more impressed with the e-recording services I received from deeds.com and from my service representative, KVH. I was able to record documents in approximately half a dozen different counties easily and seamlessly, with a minimum of fuss. The turn around time was incredibly fast. The pricing was incredibly reasonable. I know I have alternatives because, in the past, I have used a competitor service for my recording needs. I won't do that again -- this was an exceptional experience. Thank you for your help!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary K.

November 15th, 2019

Straightforward and pretty easy to use. The only downside is that there is no way to contact them directly. The number on the website is answered only by a voicemail with no return calls.

Pricing seems fair compared to other services and much more efficient that filing "over the counter."

Thank you for your feedback. We really appreciate it. Have a great day!