Pleasants County Release of Deed of Trust Form (West Virginia)

All Pleasants County specific forms and documents listed below are included in your immediate download package:

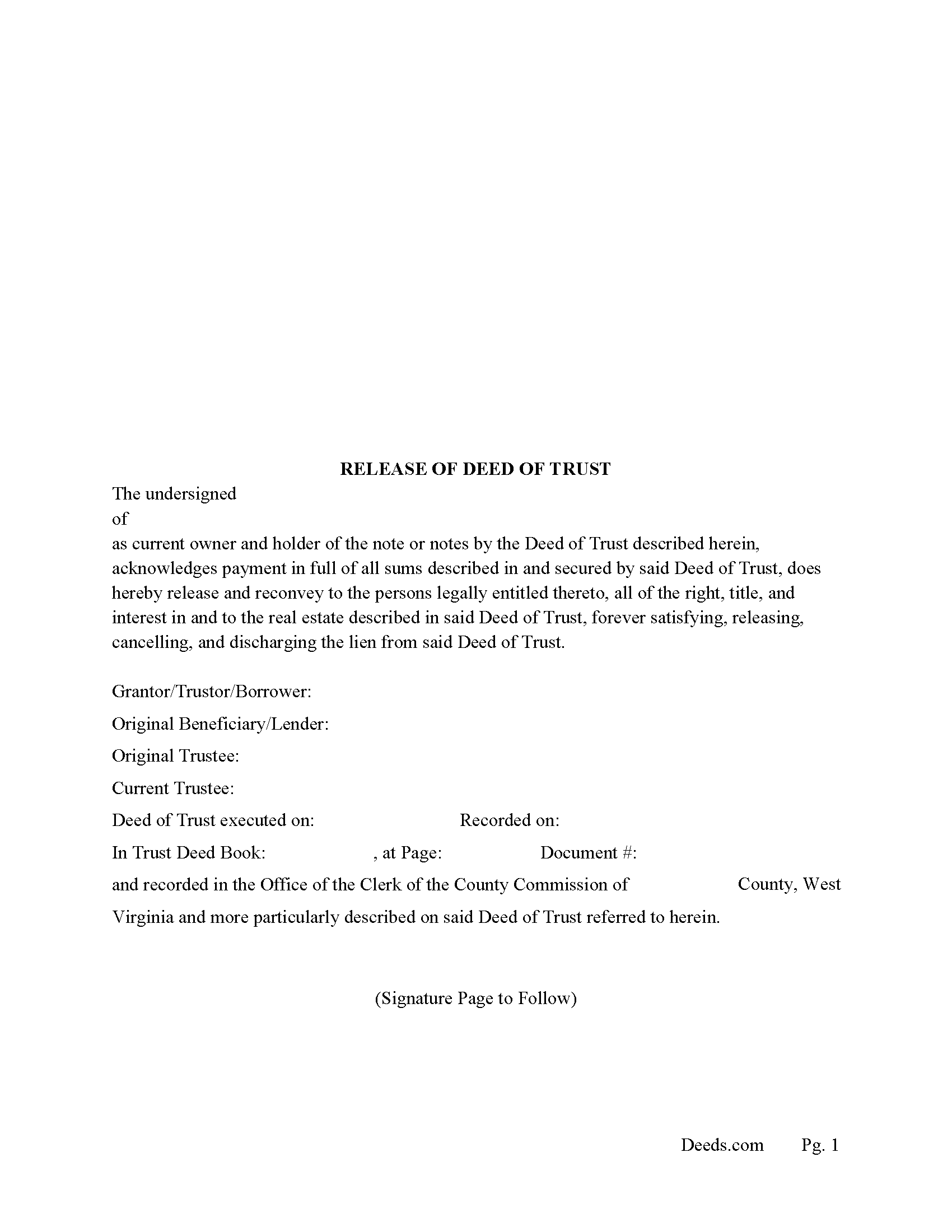

Release of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Pleasants County compliant document last validated/updated 5/31/2024

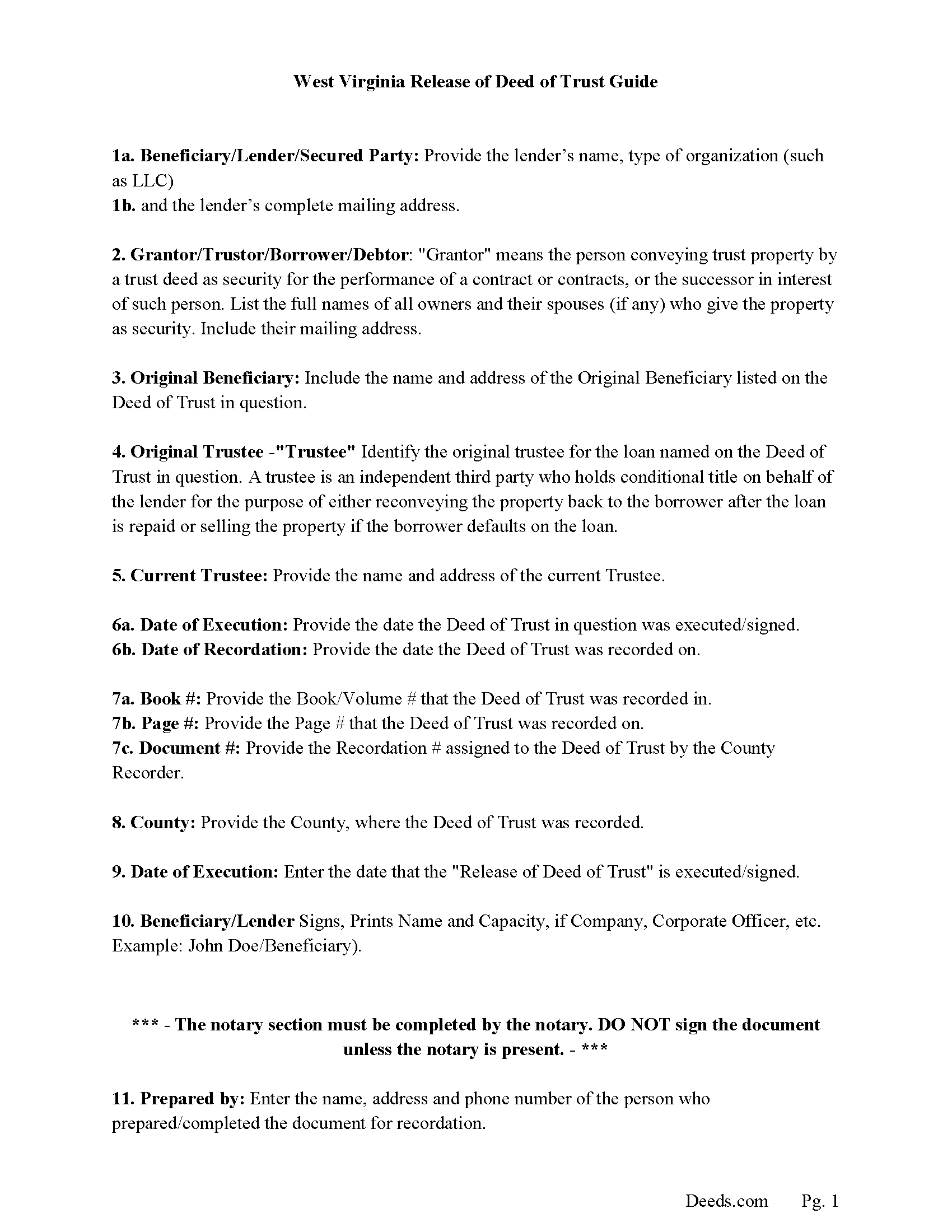

Release Guidelines

Line by line guide explaining every blank on the form.

Included Pleasants County compliant document last validated/updated 8/13/2024

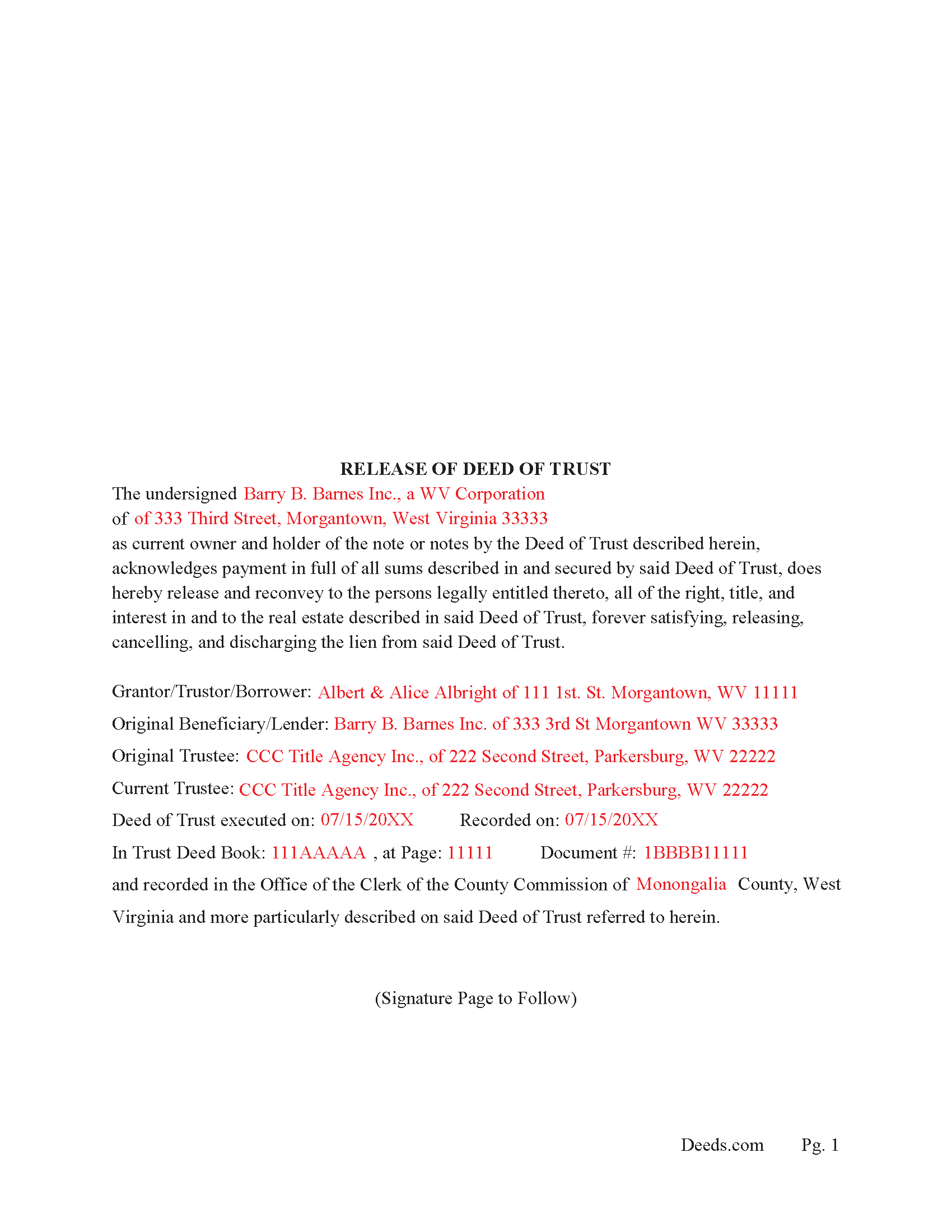

Completed Example of the Release of Deed of Trust

Example of a properly completed form for reference.

Included Pleasants County compliant document last validated/updated 10/3/2024

The following West Virginia and Pleasants County supplemental forms are included as a courtesy with your order:

When using these Release of Deed of Trust forms, the subject real estate must be physically located in Pleasants County. The executed documents should then be recorded in the following office:

Pleasants County Clerk

301 Court Lane, St Marys, West Virginia 26170-1333

Hours: Monday - Friday 8:00 am - 4:30 pm

Phone: (304) 684-3542 or 3513

Local jurisdictions located in Pleasants County include:

- Belmont

- Saint Marys

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Pleasants County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Pleasants County using our eRecording service.

Are these forms guaranteed to be recordable in Pleasants County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pleasants County including margin requirements, content requirements, font and font size requirements.

Can the Release of Deed of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Pleasants County that you need to transfer you would only need to order our forms once for all of your properties in Pleasants County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by West Virginia or Pleasants County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Pleasants County Release of Deed of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In West Virginia a Deed of Trust can be released by a Beneficiary/Lender or by a Trustee. This form is used by the current Lender, holder of the note or notes. For use when the note or notes have been satisfied and a full release is required. (Such release shall be executed and furnished to the debtor within thirty days after the debt has been satisfied.) (WV. Article 12. 38-12-1) (a))

Such release of lien shall be executed by the lienholder and acknowledged before the clerk of the county commission in whose office the lien is recorded or before such other person authorized to take acknowledgments of deeds. Such written release shall be deemed sufficient if it describes the lien to be released by any words that will identify and show an intent to discharge the same. Releases may also be made according to the provisions of section two of this article. (WV. Article 12. 38-12-1) (b))

38-12-8. Recordation of release; effect.

When the release has been so signed and acknowledged, it may be presented for record to the clerk in whose office the lien thereby intended to be released is recorded or docketed, and from and after the time the same is so left for record (which time the clerk shall endorse thereon) such lien shall be discharged and extinguished, and the estate, of whatever kind, bound or affected thereby, shall be deemed to be vested in the former owner or those claiming under him as if such lien had never existed

If a release is not executed as described, the lienholder can be liable to pay,( at the cost of the lienholder who so refuses without good cause and the court shall also award reasonable attorney fees and court costs to the person entitled to such release if such person be the prevailing party.) (WV Article 12 38-12-10)

(West Virginia Release of DOT Package includes form, guidelines, and completed example) For use in West Virginia Only.

Our Promise

The documents you receive here will meet, or exceed, the Pleasants County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pleasants County Release of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4417 Reviews )

Giuseppina M.

October 24th, 2024

Fast, reliable excellent service

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Stacey H.

October 23rd, 2024

This was my first time using Deeds.com and I was very impressed on the professionalism and the expediency of the recording. Will definitely be using them again. rnrnStacey H.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Giuseppina M.

October 23rd, 2024

Love to work with your company

It was a pleasure serving you. Thank you for the positive feedback!

Judy C.

February 13th, 2019

Both sets of deeds were complete and easy to understand. Both states accepted the forms to transfer property.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bobby Y.

June 7th, 2024

I like the content and the availability to conduct valuable business online

Thank you!

Paul D.

July 24th, 2019

Easy to use! The forms were perfect and everything was explained well! Will use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sallie S.

January 24th, 2019

Great speedy service with access to areas beyond my reach.

Thank you Sallie, have a great day!

Thomas N.

March 13th, 2020

Great service, truly helpful & saves time!!

Thank you!

DAVID S.

January 16th, 2019

I was very impressed with the speed at which information was retrieved on my very first search. Unfortunately, the county we were looking for is behind times and has not digitized its information. I will be using Deeds.Com again and appreciate that I was not charged for no information being returned back. Thank You

David S

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas D.

July 10th, 2019

The site is fine with one exception. About half the pdf files I downloaded were corrupted. I could not open them or view their contents. Fortunately, the link continued to work, so after I discovered this, I downloaded the corrupted files again, and they now seem fine. I do not know if my computer or the website caused this odd problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Jose G. C.

October 2nd, 2020

It was OK but unfortunately useless. The jurisdictions are now requesting that documents such as Notices of Commencement not only be recorded at their offices, but also certified. This last service is not provided by Deeds, or at least I could not find it in your website and did not receive a response when I asked if you did. Thus, we are going back to traditional means of recording/certifying

Thank you for your feedback Jose. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Gretchen R.

November 13th, 2019

I can't think of any suggestions for improvement. The documents I needed were readily available. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

PAUL B.

August 18th, 2023

Very fast and efficient reply

Thank you!

ronald d.

February 19th, 2021

I found that the website was laid out well and referenced documents were professionally created.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary W.

June 9th, 2019

Great service. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!