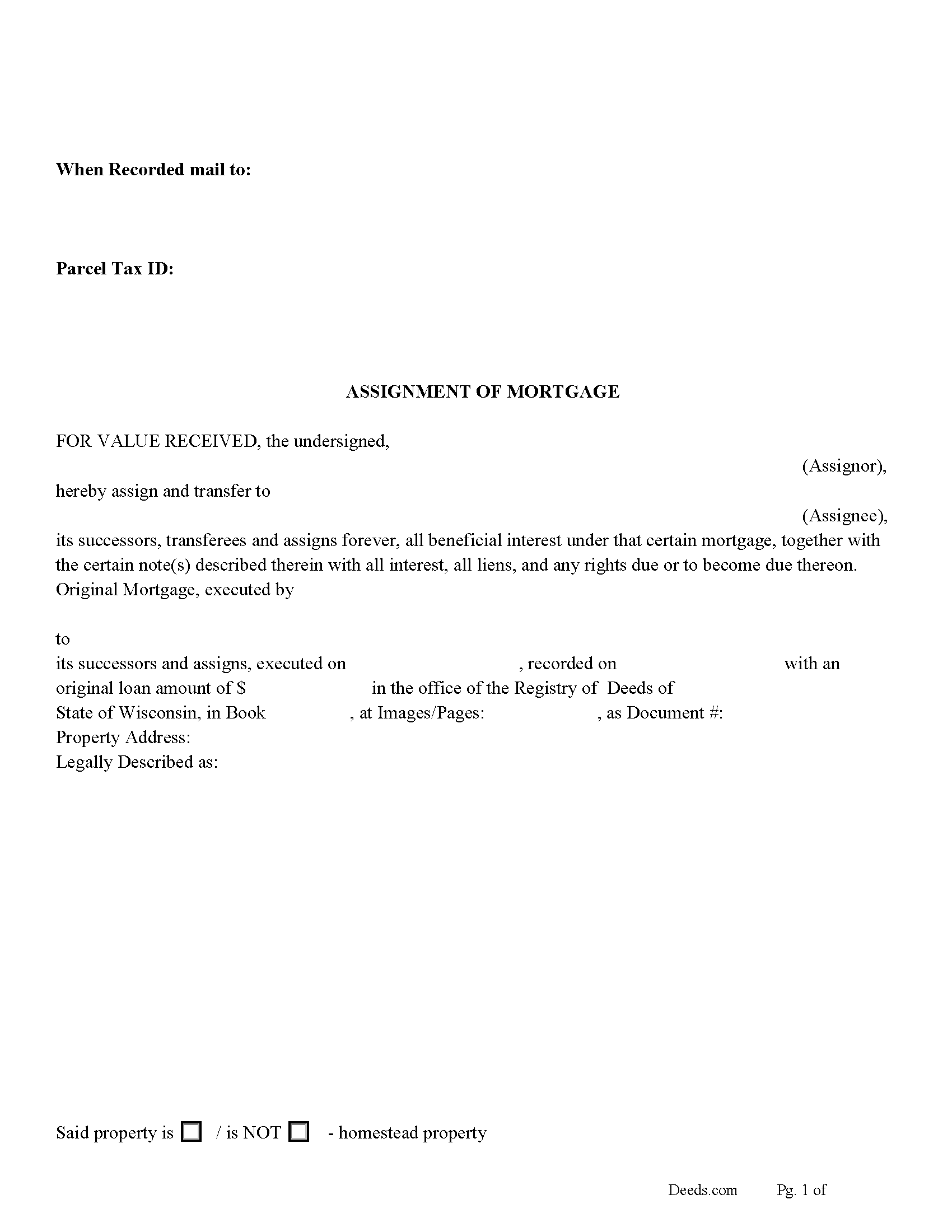

Marathon County Assignment of Mortgage Form

Marathon County Assignment of Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

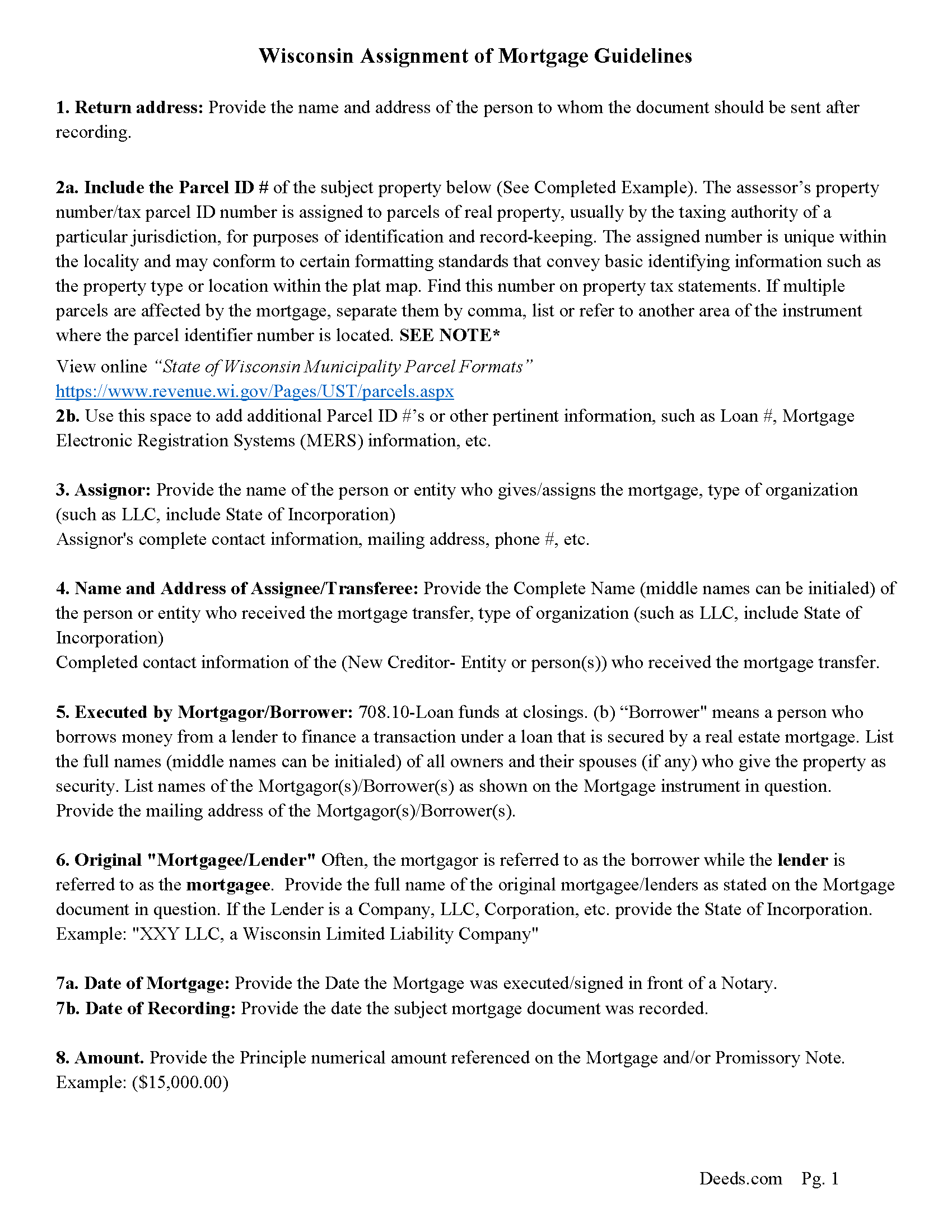

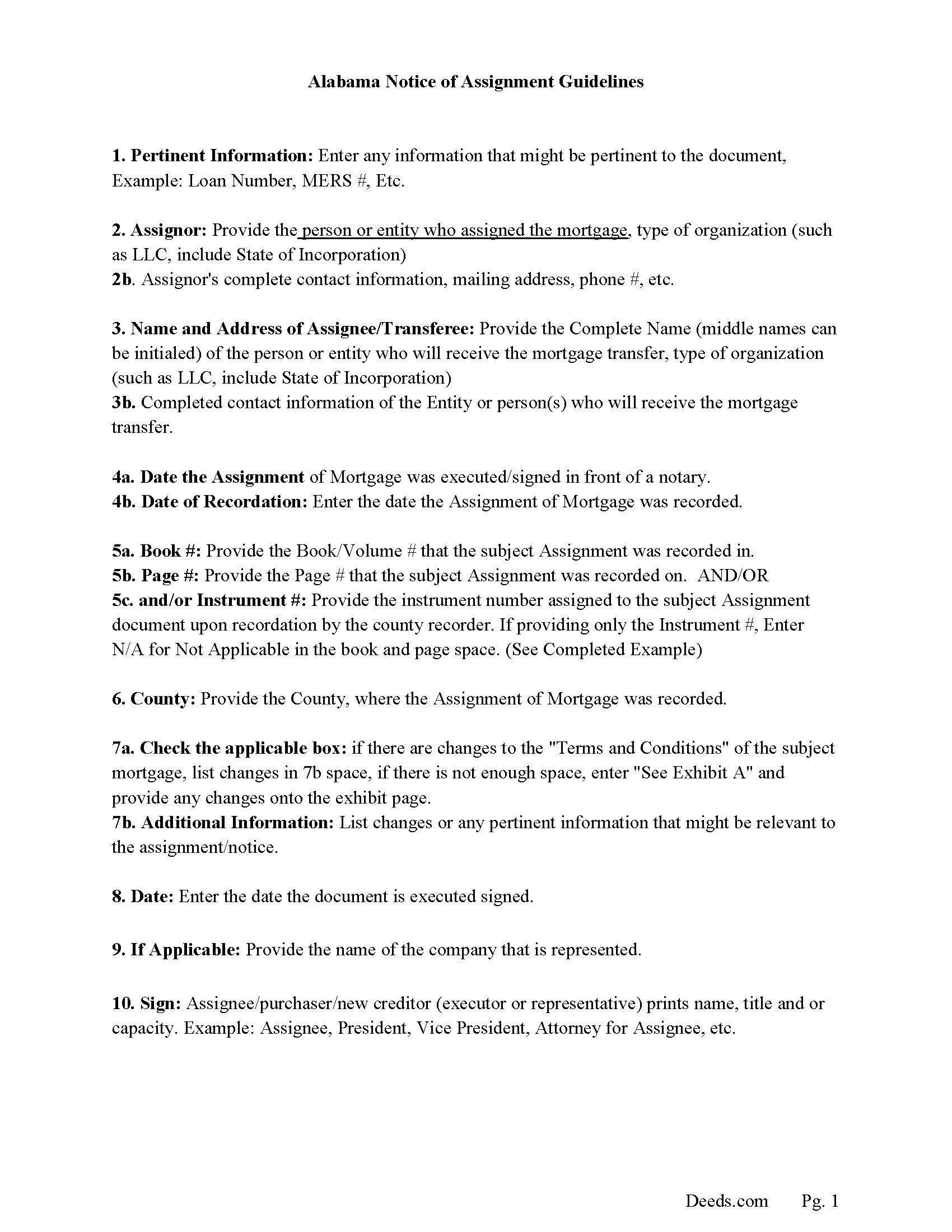

Marathon County Assignment of Mortgage Guidelines

Line by line guide explaining every blank on the form.

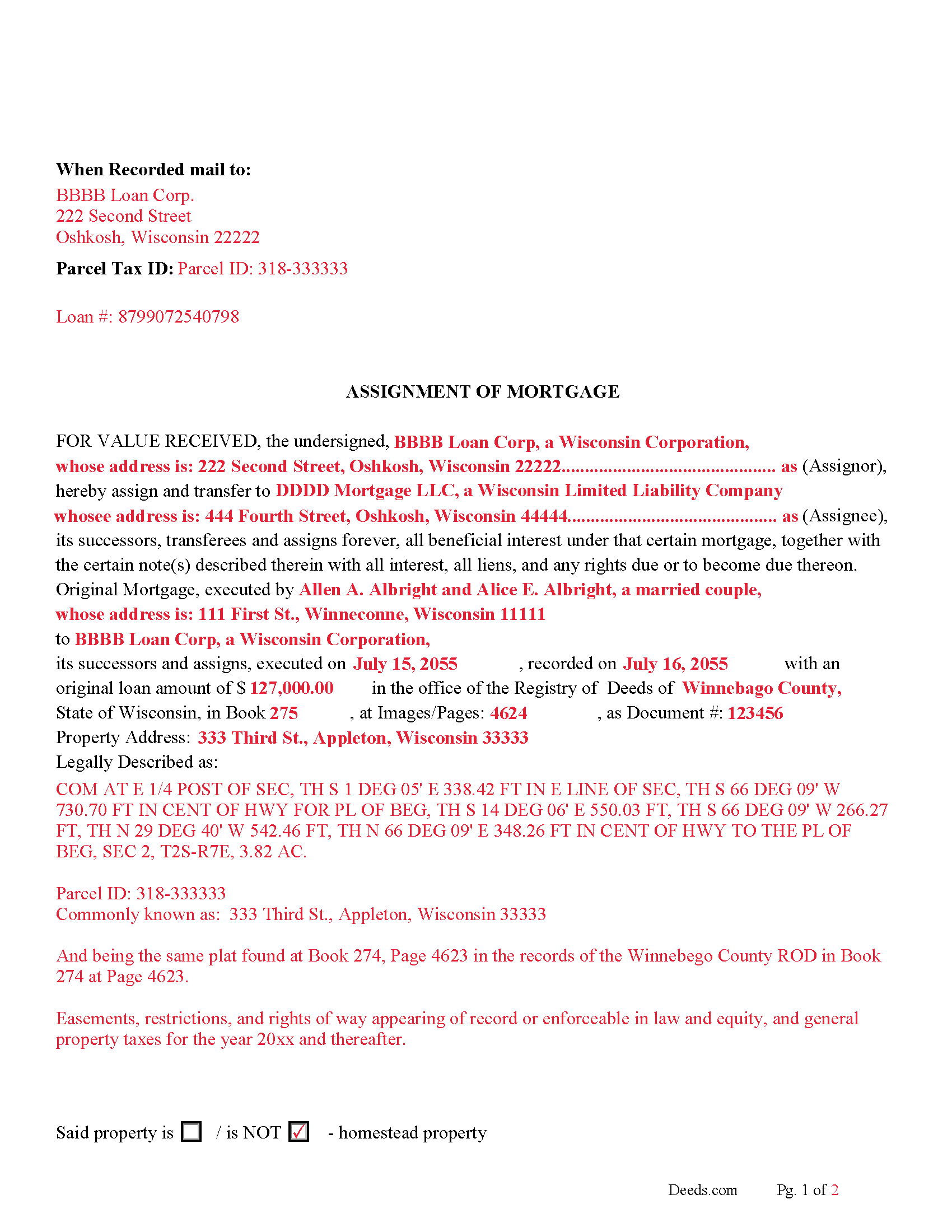

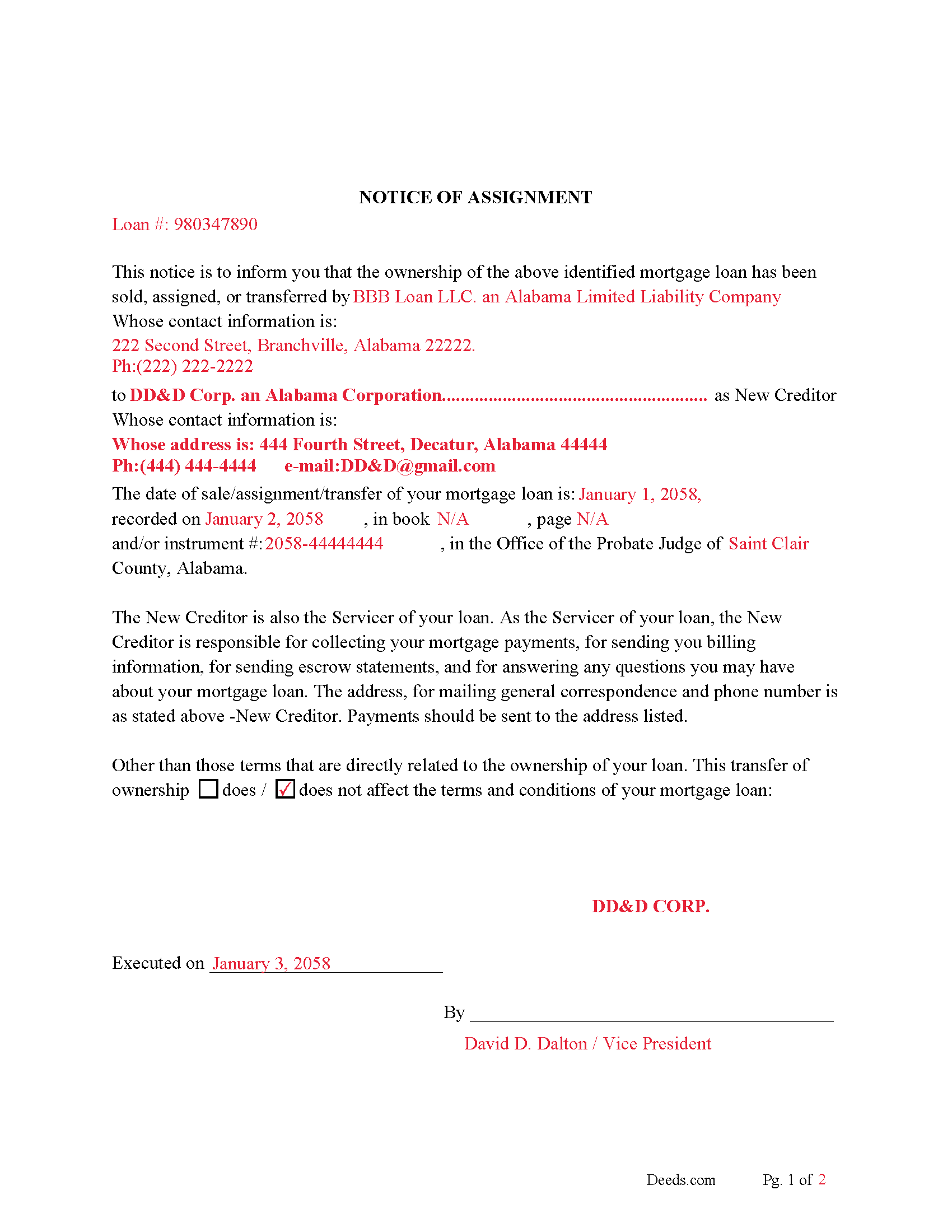

Marathon County Completed Example of the Assignment of Mortgage Document

Line by line guide explaining every blank on the form.

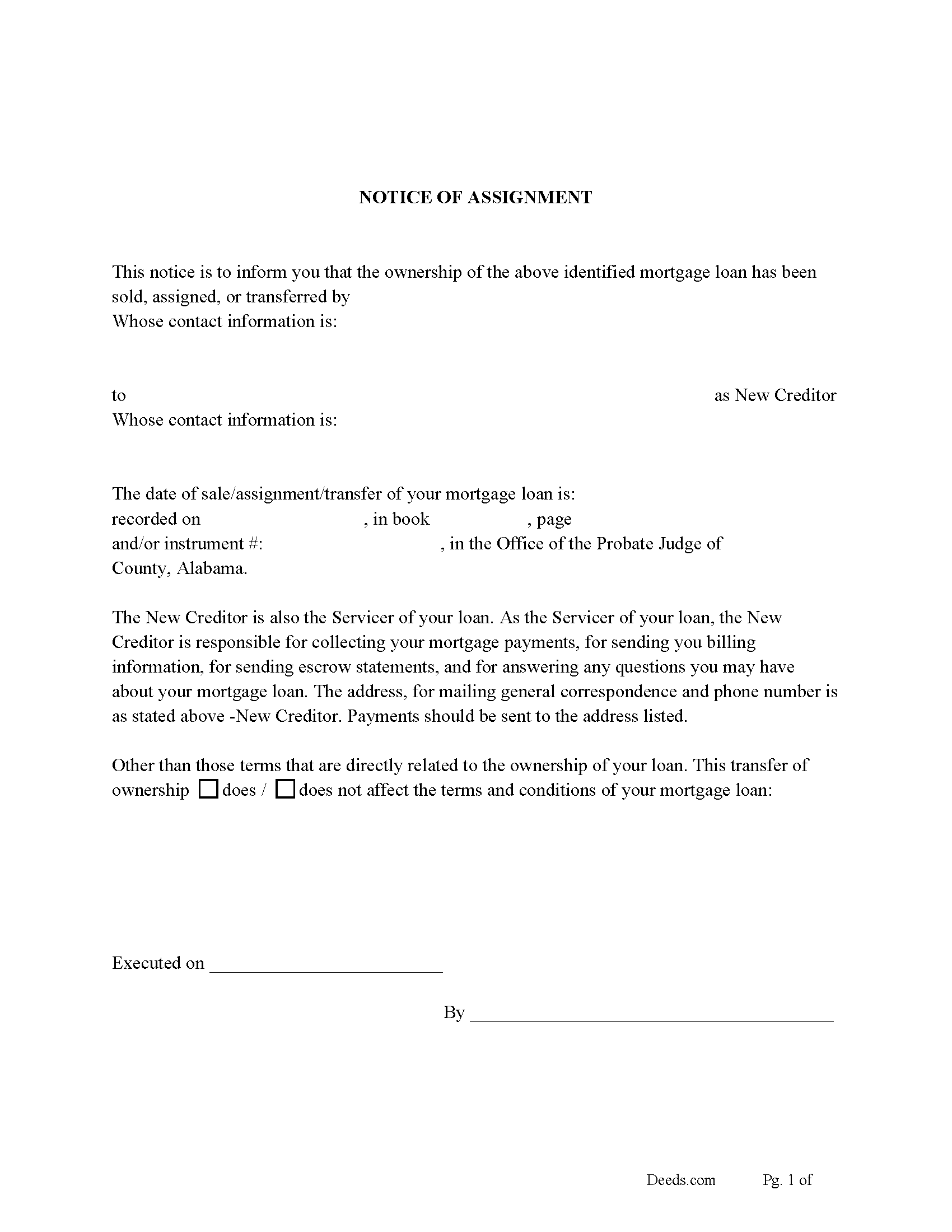

Marathon County Notice of Assignment of Mortgage Form

Fill in the blank form formatted to comply with content requirements.

Marathon County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

Marathon County Notice of Assignment-Completed Example

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Marathon County documents included at no extra charge:

Where to Record Your Documents

Marathon County RoD

Wausau, Wisconsin 54403

Hours: Monday - Friday 8:00am to 4:30pm (After 4:15 p.m. the record can be picked up or mailed the following business day)

Phone: 715-261-1470

Recording Tips for Marathon County:

- Verify all names are spelled correctly before recording

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Marathon County

Properties in any of these areas use Marathon County forms:

- Aniwa

- Athens

- Brokaw

- Edgar

- Eland

- Elderon

- Galloway

- Hatley

- Marathon

- Mosinee

- Ringle

- Rothschild

- Schofield

- Spencer

- Stratford

- Unity

- Wausau

Hours, fees, requirements, and more for Marathon County

How do I get my forms?

Forms are available for immediate download after payment. The Marathon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marathon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marathon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marathon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marathon County?

Recording fees in Marathon County vary. Contact the recorder's office at 715-261-1470 for current fees.

Questions answered? Let's get started!

Use this form to transfer/assign a previously recorded mortgage, frequently used when an existing mortgage has been sold. In this form the current holder/assignor of the mortgage assigns it to another party/assignee. To protect lien rights this form is recorded in the Wisconsin Registry of Deeds in the County where the property is located.

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, Wisconsin recording numbers, changes in loan, etc. Included are "Notice of Assignment of Mortgage" forms.

The Truth and lending act requires that borrowers be notified when their mortgage debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

Section 404 of the Act amends Section 131 of "Truth in Lending Act" to add a new subsection (g) which provides that, in addition to other disclosures required by the TILA, not later than 30 days after the date on which a mortgage loan is sold or otherwise transferred or assigned to a third party, the creditor that is the new owner or assignee of the debt shall notify the borrower in writing of the transfer. The notice must include the identity, address and telephone number of the new creditor; the date of the transfer; how to reach an agent or party having authority to act on behalf of the new creditor; the location of the place where transfer of ownership of the debt is recorded; and any other relevant information regarding the new creditor.

(Wisconsin AOM Package includes form, guidelines, and completed example)For use in Wisconsin only.

Important: Your property must be located in Marathon County to use these forms. Documents should be recorded at the office below.

This Assignment of Mortgage meets all recording requirements specific to Marathon County.

Our Promise

The documents you receive here will meet, or exceed, the Marathon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marathon County Assignment of Mortgage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Linda K.

July 5th, 2019

This service was easy, quick, and to the point. It was a lifesaver! Downloaded quickly and without issues. I was able to fill out a soecifice form for my state and county, which saved me from making errors from a universal form.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph B.

September 8th, 2022

All very good

Thank you!

Charles C.

August 29th, 2021

While most of the material is available elsewhere, this puts it all together and can save a lot of time. It included some additional information on California SB2 exemptions that was a big help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy W.

November 6th, 2020

This was very easy to use to record my NOC. With the new COVID restrictions, I can't record my NOC in person and I'm working from home. This was a huge convenience and easy to use. I submitted the NOC late in the day and had the recorded NOC the next day.

Thank you!

Susan S.

July 28th, 2020

The actual transfer of deed form seems to be the only one not fillable in Adobe. Seems odd.

Thank you!

CORA T.

January 17th, 2022

very convenient and quick access

Thank you!

Walton A.

February 3rd, 2022

Thanks ..this was very helpful and easy!

Thank you!

Curtis G.

May 18th, 2020

Easy to use.

Thank you!

Archie POA G.

January 25th, 2020

got what I ordered, as expected, in good time

Thank you!

Maria-Luisa: M.

February 24th, 2021

So far so good!

Thank you!

ANA I p.

December 14th, 2020

Wow this was nice that I could used the service . Love it

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah B.

September 30th, 2021

I was skeptical after experiencing other websites. However not only did we get the form we needed for a fraction of the cost vs going to an attorney, the additional resources (guides and samples) made the completion of the Enhanced Life Quitclaim deed quite simple, quick, and painless. We were having difficulty getting my mom to agree to meeting with an attorney or even considering a Lady Bird deed. Deeds.com gave us the ability to move forward with necessary actions with family members walking my mom through the steps, explaining the process and giving her plenty of time to find the needed information. She became part of the process which made it easy for her at a time when decision making was hard. We did everything in the comfort of her own home. I can't think of a better experience or service and I would consider Deeds.com for future needs.

Thank you for the kinds words Deborah. We appreciate you taking the time to share your experience.

Eddie S.

May 19th, 2022

love the site very helpful and easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Adriana B.

December 29th, 2023

The explanations about the processes and descriptions of the forms makes it easy to understand which forms to use.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Matthew M.

February 15th, 2023

Needed copy of deed in trust. Found info here, paid on line and then printed the docs. Easy to use, no driving to city offices, No parking fees, no waiting in line. Done fast and easy. Love it.

Thank you for your feedback. We really appreciate it. Have a great day!