Kenosha County Certificate of Trust Form

Kenosha County Certificate of Trust Form

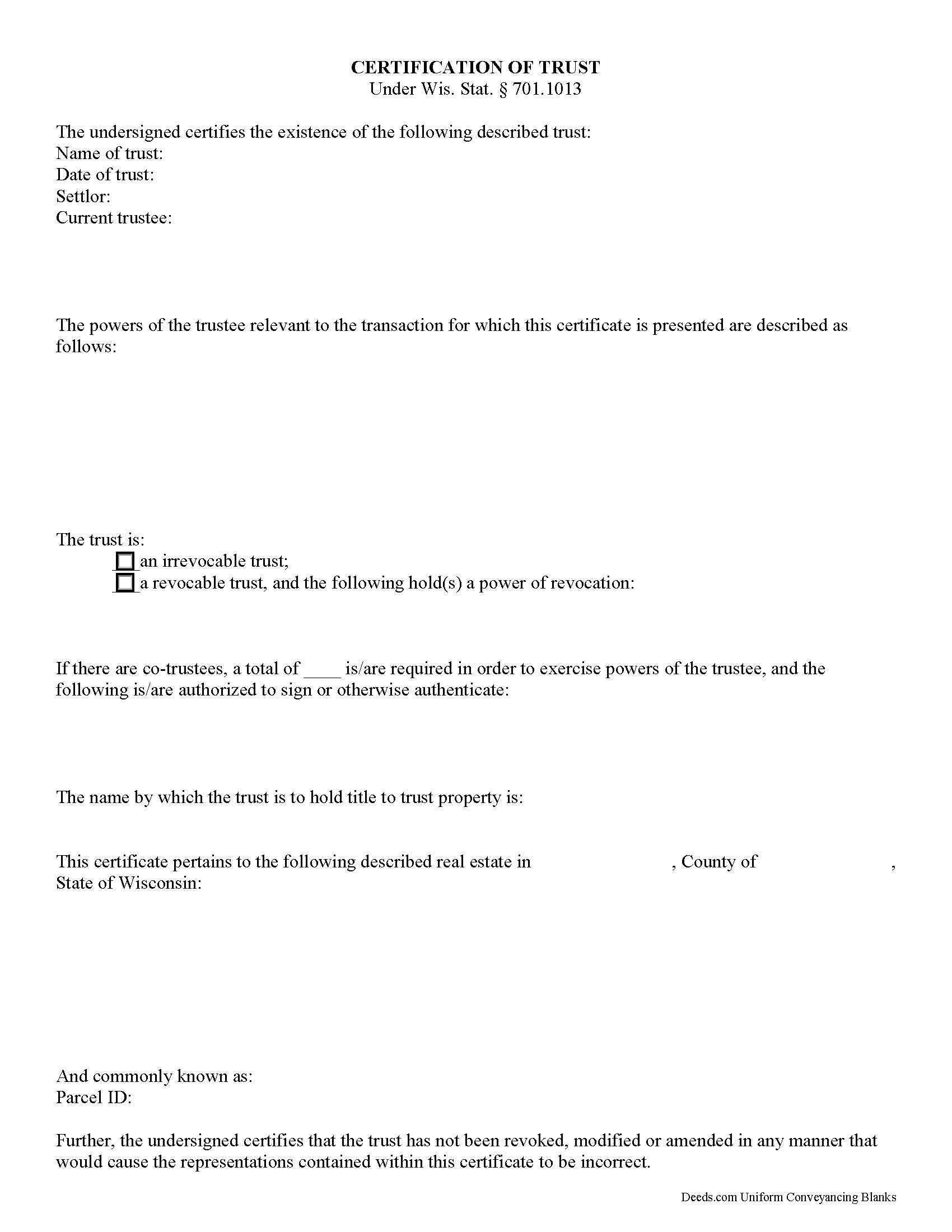

Fill in the blank form formatted to comply with all recording and content requirements.

Kenosha County Certificate of Trust Guide

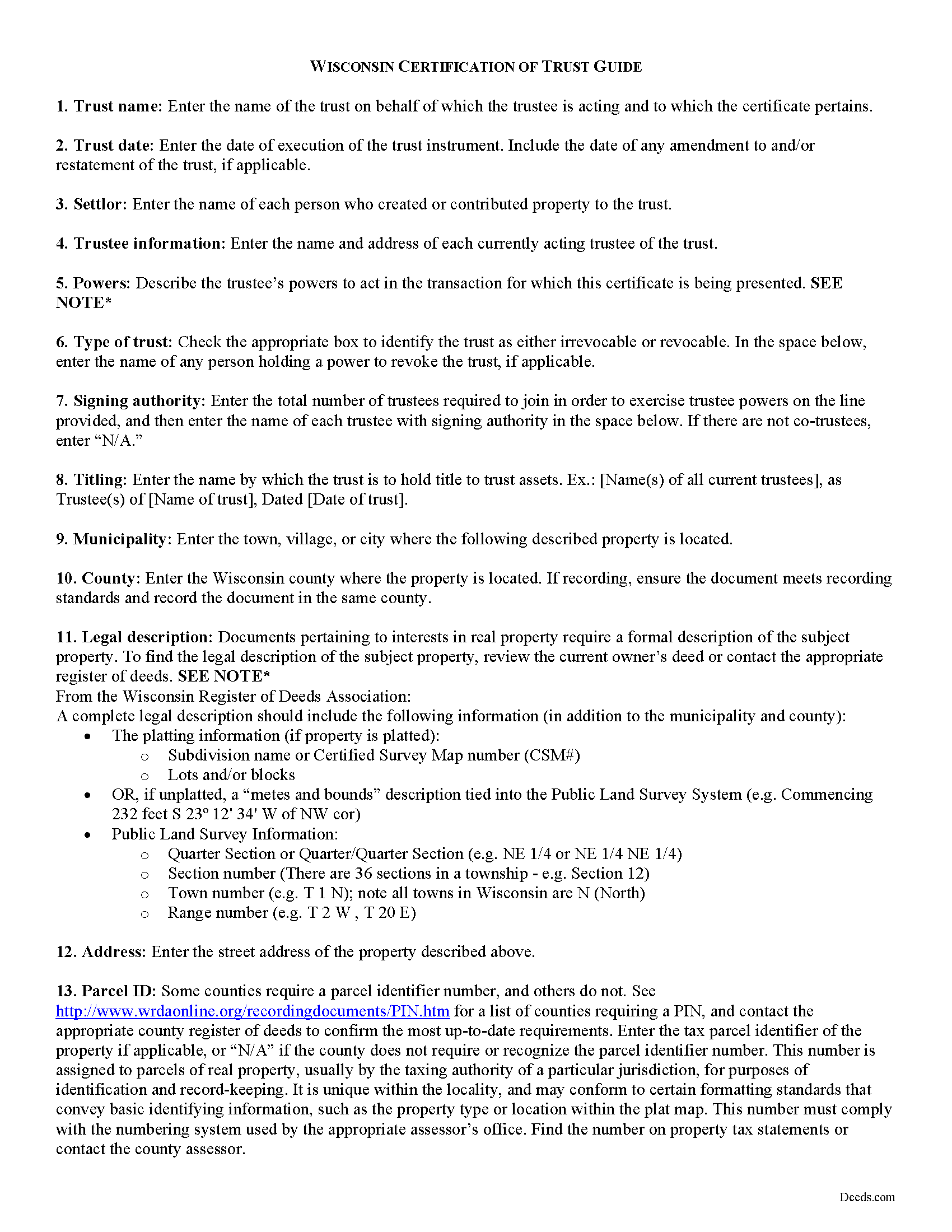

Line by line guide explaining every blank on the form.

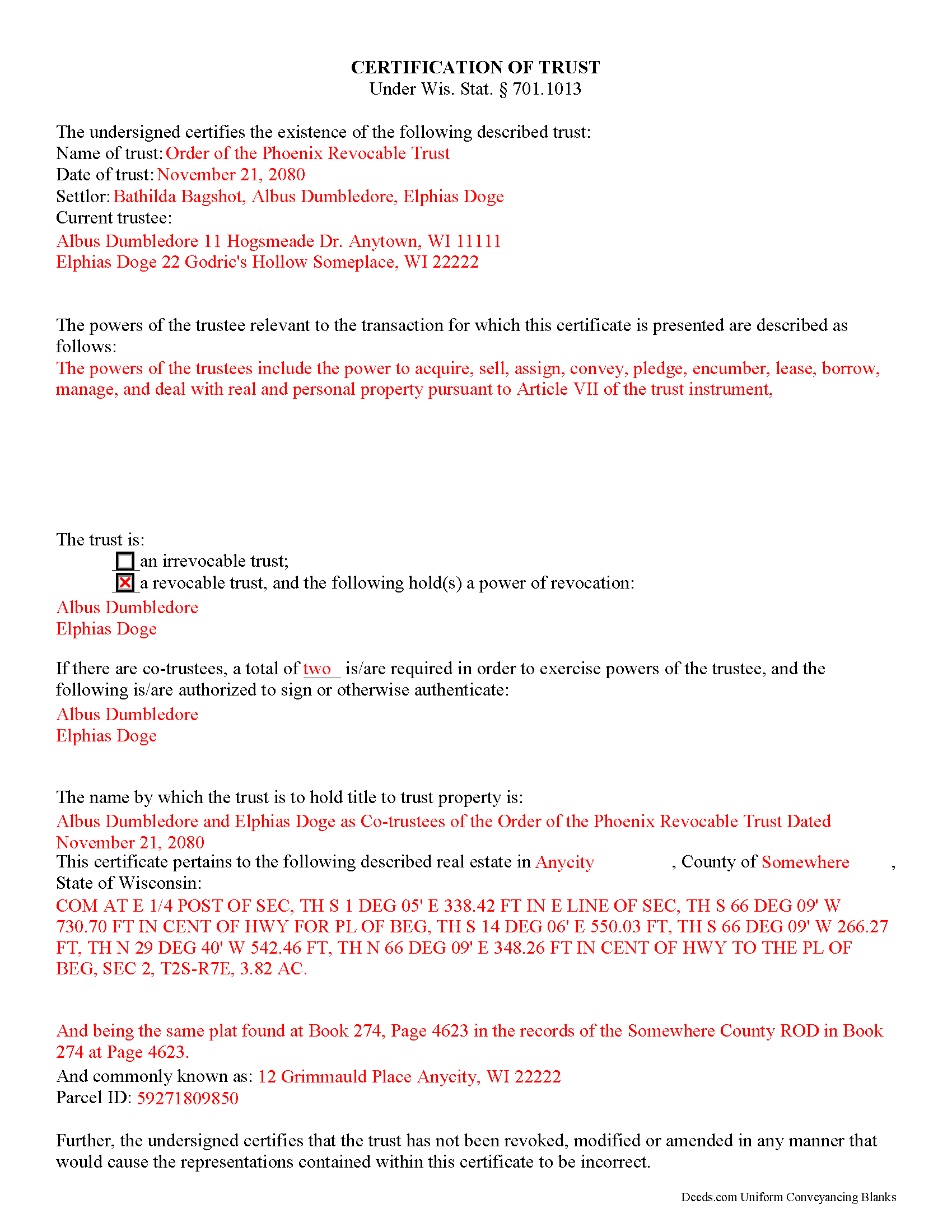

Kenosha County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Kenosha County documents included at no extra charge:

Where to Record Your Documents

Kenosha County Register

Kenosha, Wisconsin 53140

Hours: 8:00 to 5:00 Mon-Fri

Phone: (262) 653-2441

County Center Satellite Station

Bristol, Wisconsin 53104

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: 262-857-1845

Recording Tips for Kenosha County:

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Kenosha County

Properties in any of these areas use Kenosha County forms:

- Bassett

- Benet Lake

- Bristol

- Camp Lake

- Kenosha

- New Munster

- Pleasant Prairie

- Powers Lake

- Salem

- Silver Lake

- Somers

- Trevor

- Twin Lakes

- Wilmot

- Woodworth

Hours, fees, requirements, and more for Kenosha County

How do I get my forms?

Forms are available for immediate download after payment. The Kenosha County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kenosha County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kenosha County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kenosha County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kenosha County?

Recording fees in Kenosha County vary. Contact the recorder's office at (262) 653-2441 for current fees.

Questions answered? Let's get started!

The certificate of trust is an unrecorded document executed by a trustee and presented to a party doing business with the trustee (such as a financial institution). The document is codified as part of the Wisconsin Trust Code at Wis. Stat. 701.1013.

In a trust arrangement, a settlor transfers assets another person who, as trustee, manages them for the benefit of the trust beneficiary. In lieu of presenting the entire trust instrument, which generally goes unrecorded in order to protect the settlor's estate plans, the certificate is an abstract containing only the information required of the trustee in order to conduct the business at hand. The document certifies that the trust exists and that the trustee has the authority to act in the pending transaction on behalf of the trust.

The certificate includes a statement that the trust exists and contains the name and date of the trust; the names of the settlor and all currently acting trustees; an inventory of the relevant powers of the trustee; and the name by which the trust vests title to property. The form also identifies anyone who holds a power to revoke the trust, and, when there are co-trustees, stipulates the authority of the trustees to authenticate trust documents. Additionally, the certificate requires a statement that the trust has not been modified, amended, or revoked so as to invalidate the facts presented.

In most cases, the certificate is not recorded. It may sometimes accompany a conveyance of real property out of the trust (a trustee's deed), verifying that the trustee has the authority to convey real property and confirming that the property is subject to the trust by providing the legal description of the property, as found in the trust agreement or conveyancing instrument into trust.

Statements made in the certificate may be relied on as fact; Wis. Stat. 701.1013 provides protection for persons relying in good faith on the information presented in the certificate. In addition to the certificate, the trustee may furnish excerpts from the trust instrument designating the trustee and establishing the trustee's power to act in the business at hand. Recipients of a certificate requesting that the trustee furnish the entire trust instrument, however, are open to liability.

The certificate may be signed by any trustee in the presence of a notary public. If the document is submitted for recording, it must conform to standards for recording established at Wis. Stat. 59.43(2m).

Consult a lawyer with questions regarding trusts and certifications of trust in Wisconsin, as each situation is unique.

(Wisconsin COT Package includes form, guidelines, and completed example)

Important: Your property must be located in Kenosha County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust meets all recording requirements specific to Kenosha County.

Our Promise

The documents you receive here will meet, or exceed, the Kenosha County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kenosha County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Alberta P.

April 14th, 2019

form was east to use...instructions came in handy.

Thank you for your feedback. We really appreciate it. Have a great day!

Larry P.

June 27th, 2023

Easy to follow step by step in completing form. Filing successful on first try. Economical cost. Would highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Filomena G.

March 8th, 2025

very helpful

Thank you!

Marilyn G.

June 21st, 2020

Easy to follow instructions

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffrey G.

March 9th, 2023

Transaction went smoothly. The forms in the package were just what was needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine V.

January 29th, 2023

I love simple and easy! This is the model that many businesses should use!

Thank you!

AMY J.

February 16th, 2022

Very easy user friendly thank you for that

Thank you!

Paula B.

August 8th, 2019

I'm transferring a property into a trust and ordered the QuitClaim Deed. Everything was pretty straight forward and user friendly. However, the Additional Information/Instructions for the Preliminary Change of Ownership Report skips from Section "I" to "M" and does not address "K". It would have been very helpful to have an explanation of the difference between the three options in that section. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

charles c.

October 14th, 2020

Great service, well worth the $15 fee. Especially helpful was the review of my documentation and the quick responses. Recommending it to associates who might need this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Sharon G.

December 1st, 2021

I could not be happier with the service afforded by Deeds.com. After having been directed to two other organizations who purportedly performed this service and being told they could not accommodate me, I found Deeds.com. The website is extremely easy to use, the directions are clear and concise. The site updated me regularly as the documents were progressing through the process, and the detailing of costs was great. The turn-around -- which isn't completely in the hands of the site -- was incredibly quick. I'd use this group again without reservation. As a person who'd have to otherwise travel almost five hours to record, this has been heaven-sent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary B.

February 8th, 2023

Your information was orderly and very clear and helpful. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin R.

January 4th, 2024

Deeds.com made a very difficult time in our lives much easier to deal with. So happy that we found this app when we did!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Thomas G.

March 16th, 2020

A few parts are confusing'.Like sending Tax statements to WHO ?/ The rest is simple I hope.Have not tried to record yet

Thank you!

Susan G.

February 17th, 2023

This is very helpful.

Thank you!

Richard A.

June 24th, 2020

Great product. It would be better if the document files were not embedded within other files. It made downloading a little confusing. The titles of the forms did not match exactly word for word, which required a lot of back and forth to make sure I had downloaded the proper document. What would be great is if once you download a document, the hyperlink changed color, or somehow denoted the document had been downloaded. Just a suggestion. You have my email address if you have questions. STILL! Five stars for you guys. I would not let that hiccup dissuade me from buying any form package from you guys. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!