Waushara County Contractor Notice of Intent to File Lien Form

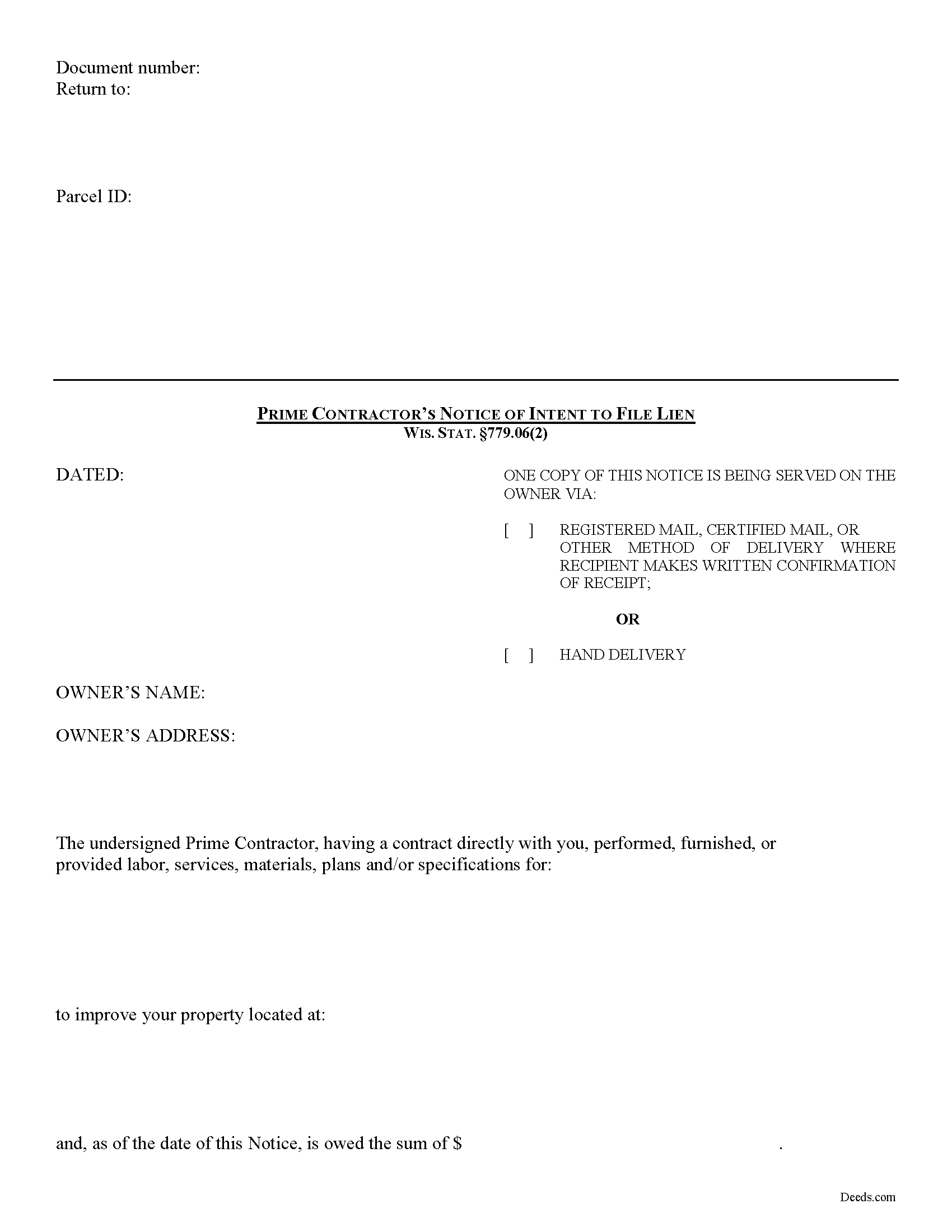

Waushara County Contractor Notice of Intent to File Lien

Fill in the blank form formatted to comply with all recording and content requirements.

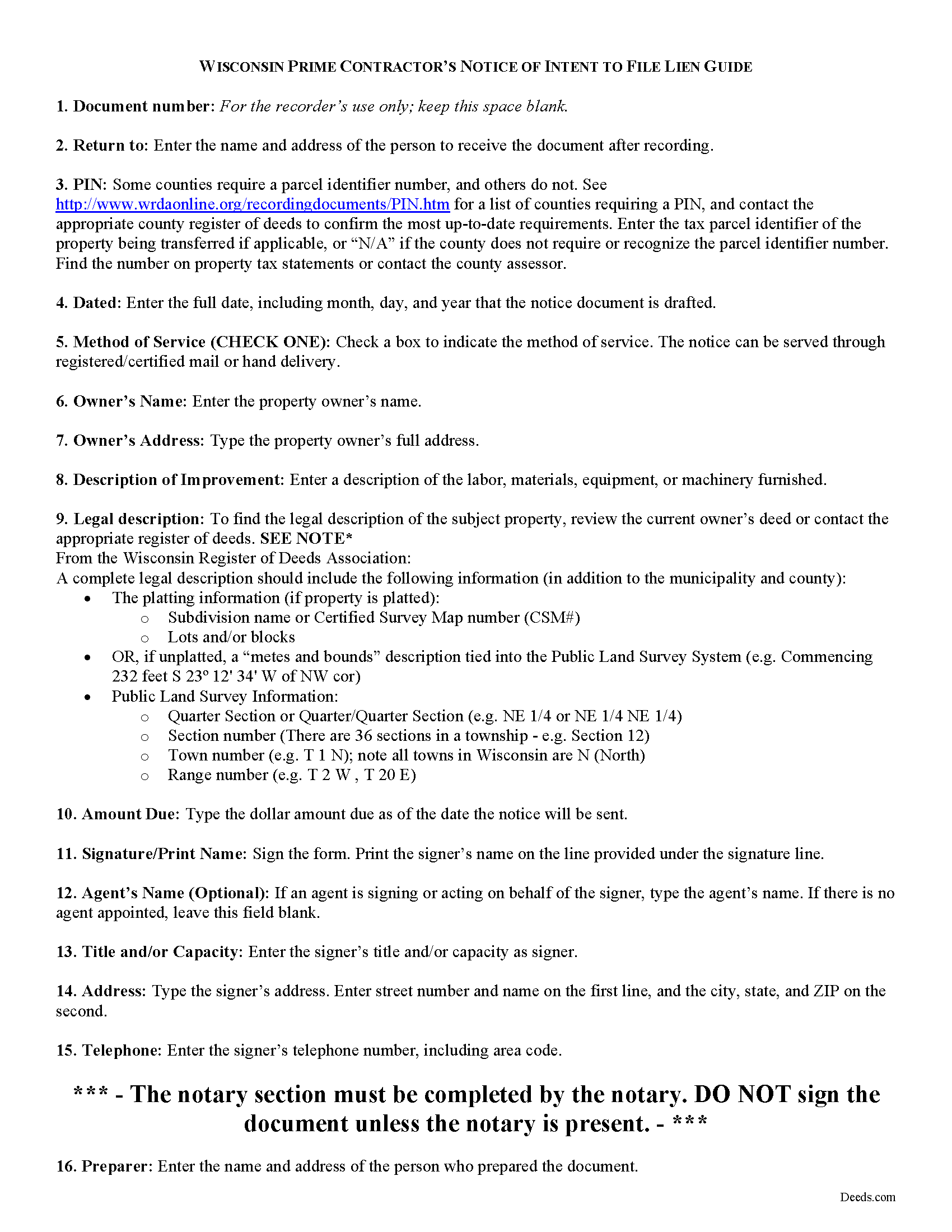

Waushara County Contractor Notice of Intent to File Lien Guide

Line by line guide explaining every blank on the form.

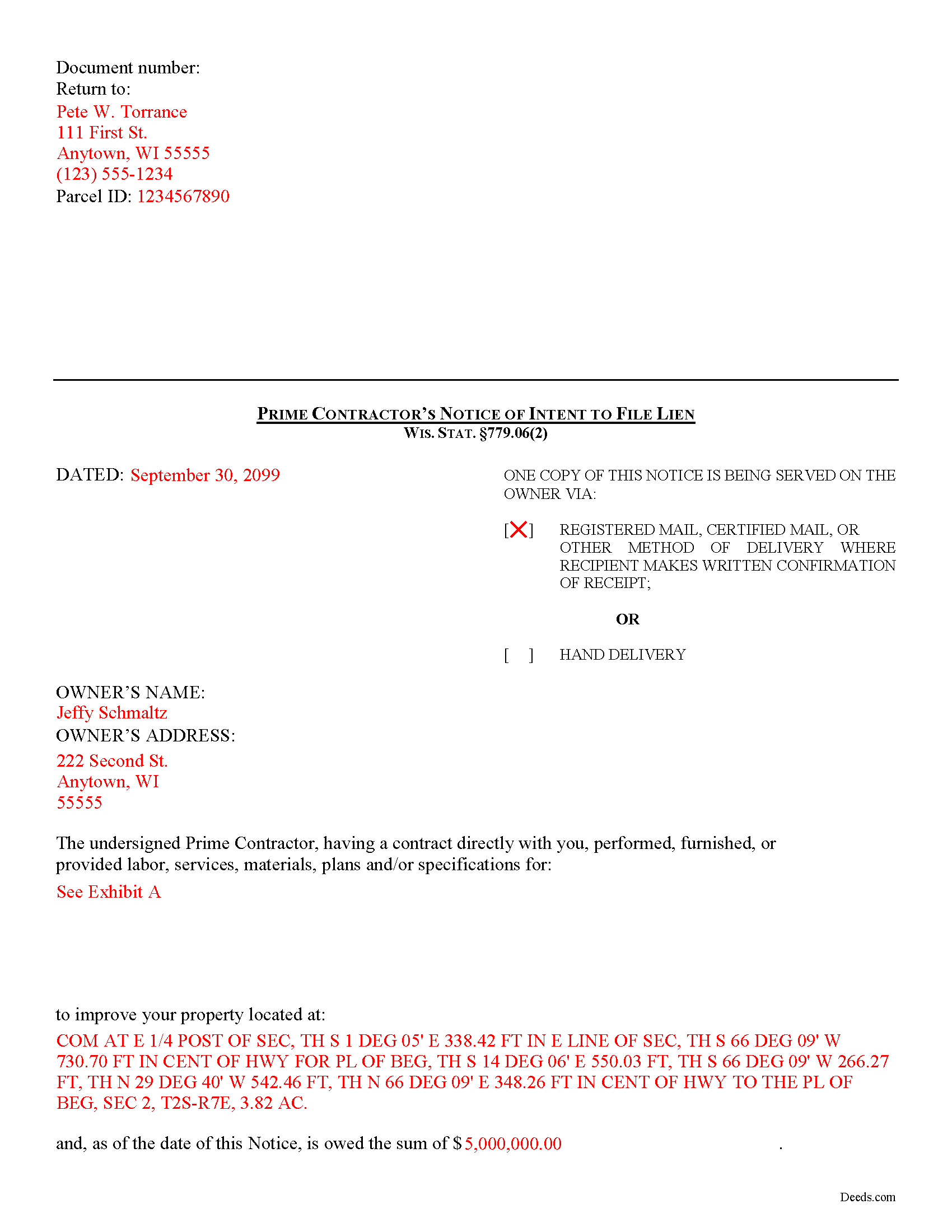

Waushara County Completed Example of the Contractor Notice of Intent to File Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Waushara County documents included at no extra charge:

Where to Record Your Documents

Waushara County Register of Deeds

Wautoma, Wisconsin 54982

Hours: 8:00am to 4:30pm M-F

Phone: (920) 787-0444

Recording Tips for Waushara County:

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

- Leave recording info boxes blank - the office fills these

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Waushara County

Properties in any of these areas use Waushara County forms:

- Coloma

- Hancock

- Pine River

- Plainfield

- Poy Sippi

- Redgranite

- Saxeville

- Wautoma

- Wild Rose

Hours, fees, requirements, and more for Waushara County

How do I get my forms?

Forms are available for immediate download after payment. The Waushara County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Waushara County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Waushara County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Waushara County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Waushara County?

Recording fees in Waushara County vary. Contact the recorder's office at (920) 787-0444 for current fees.

Questions answered? Let's get started!

Pre-Lien Notices in Wisconsin

Preliminary notices are an important step to securing a mechanic's lien and are often required to ensure the property owner has notice of who is working on his or her property so there is a chance to avoid a lien. Most states mandate the form of notice that must be provided. In Wisconsin, prime contractors are required to serve a notice of intent to file a construction lien

In Wisconsin, a claimant cannot claim a lien right or maintain an action to enforce a lien right, unless the lien claimant serves written notice on the owner of an intent to file a lien claim at least 30 days before timely filing the lien claim. Wis. Stat. 779.06(2). The notice is required whether or not the claimant has been required to and has given a previous notice of furnishing. Id. The notice must briefly describe the nature of the claim, the amount due and the land and improvement to which it relates. Id.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an attorney with questions about sending a notice of intent to file a lien, or for any other issues related to liens in Wisconsin.

Important: Your property must be located in Waushara County to use these forms. Documents should be recorded at the office below.

This Contractor Notice of Intent to File Lien meets all recording requirements specific to Waushara County.

Our Promise

The documents you receive here will meet, or exceed, the Waushara County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Waushara County Contractor Notice of Intent to File Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Deb D.

January 31st, 2019

Excellent website - easy to use, and found exactly the form I needed right away. Highly recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Kitty H.

February 19th, 2019

I have had it reviewed by a mortgage broker and a title manager and both said it was done correctly! Your product and the instructions are what made this possible. It took me several hours as I continued to review your information. I just finished printing and ready to file. Yeah! Thanks! Highly recommend the product!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia K.

August 8th, 2019

Able to find the information that I needed.

Thank you!

Christopher B.

January 13th, 2021

Process went smoothly and will use for my next recording. Only area for improvement would be to provide the ability for the user to delete and replace uploaded documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Roberta J B.

February 17th, 2021

User friendly

Thank you!

MARK S.

March 17th, 2020

Forms seem direct, simple, not what a "big firm" might have, appear sufficient to do the job -- safety in following at least the basics

Thank you!

Betty A.

March 2nd, 2022

You've made it very easy to download the form I needed. Thank you.

Thank you!

Susan M.

March 15th, 2022

Loved my experience with deeds.com! Easy and simple to fill in the form, plus the extra instructions were helpful! I will use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

John K.

June 21st, 2023

Very pleased. Responsive staff and fast recordation.

Thank you for the kind words John. Our staff appreciates you and your feedback. Have an amazing day!

Jennifer C.

January 8th, 2021

Fast turnaround. Very much appreciated!

Thank you!

FRANCIS P.

July 17th, 2022

Finding what I needed was easy. The payment process was easy. Using what I found was easy. Easy-peasy and GREAT results. Professional and succinct all for the price of a steak dinner. I'll be back to DEEDS.COM when I need any paperwork/forms related to deeds.

Thank you for your feedback. We really appreciate it. Have a great day!

raquel f.

July 28th, 2021

Wow!!! that was super easy to record a mechanic lien! I will definitely use your service again but I hope I won't have to.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melanie N.

October 12th, 2019

I'm happy with the forms, thank you.

Thank you!

Grace G.

January 21st, 2019

The Forms I received were perfect for me. I also double ordered one of the forms and you corrected it on the spot. Thanks. (I am a Real Estate Broker)

Thank you!

Robert h.

February 25th, 2019

excellent and simple to use. Great price for this.

Thank you Robert! We really appreciate your feedback.