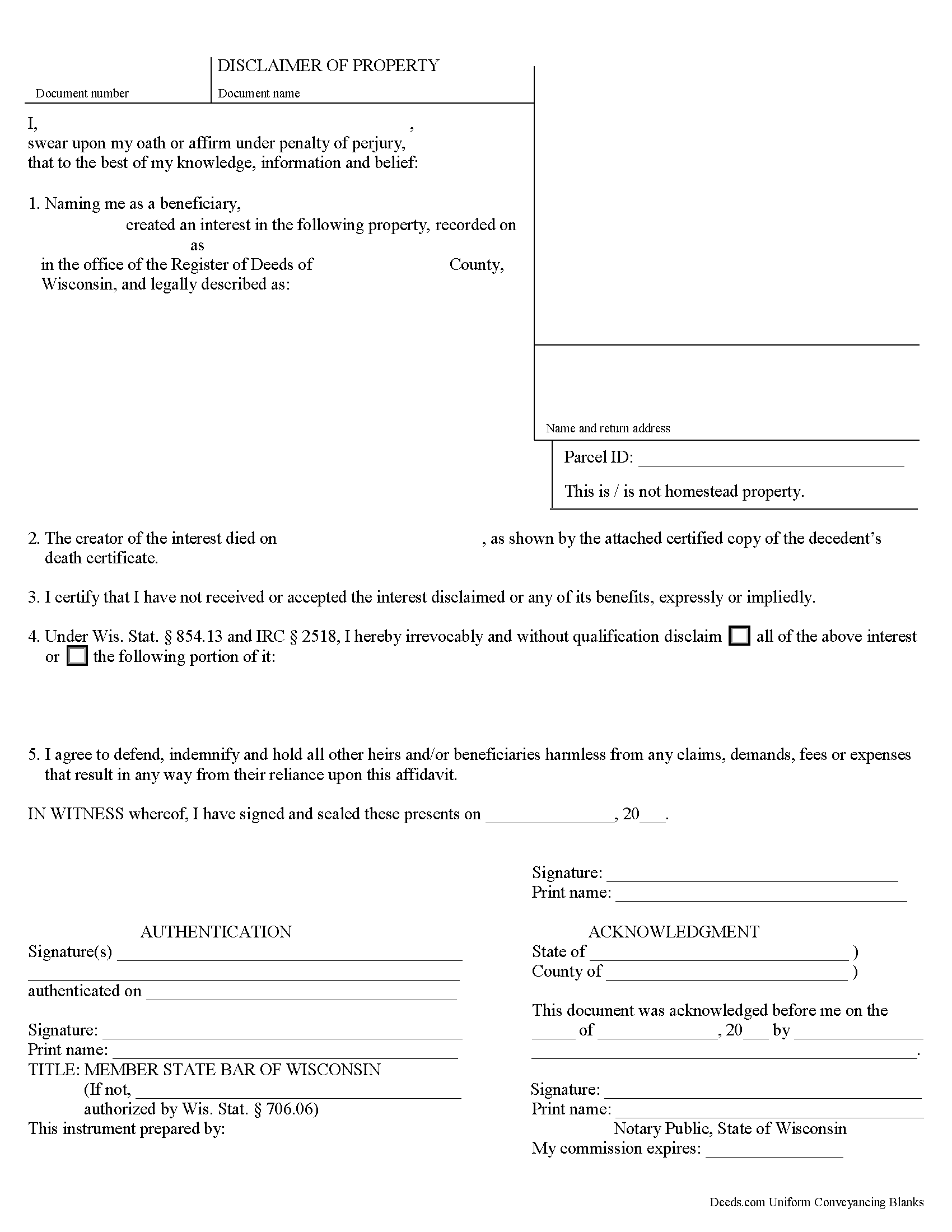

Brown County Disclaimer of Interest Form

Brown County Disclaimer of Interest form

Fill in the blank form formatted to comply with all recording and content requirements.

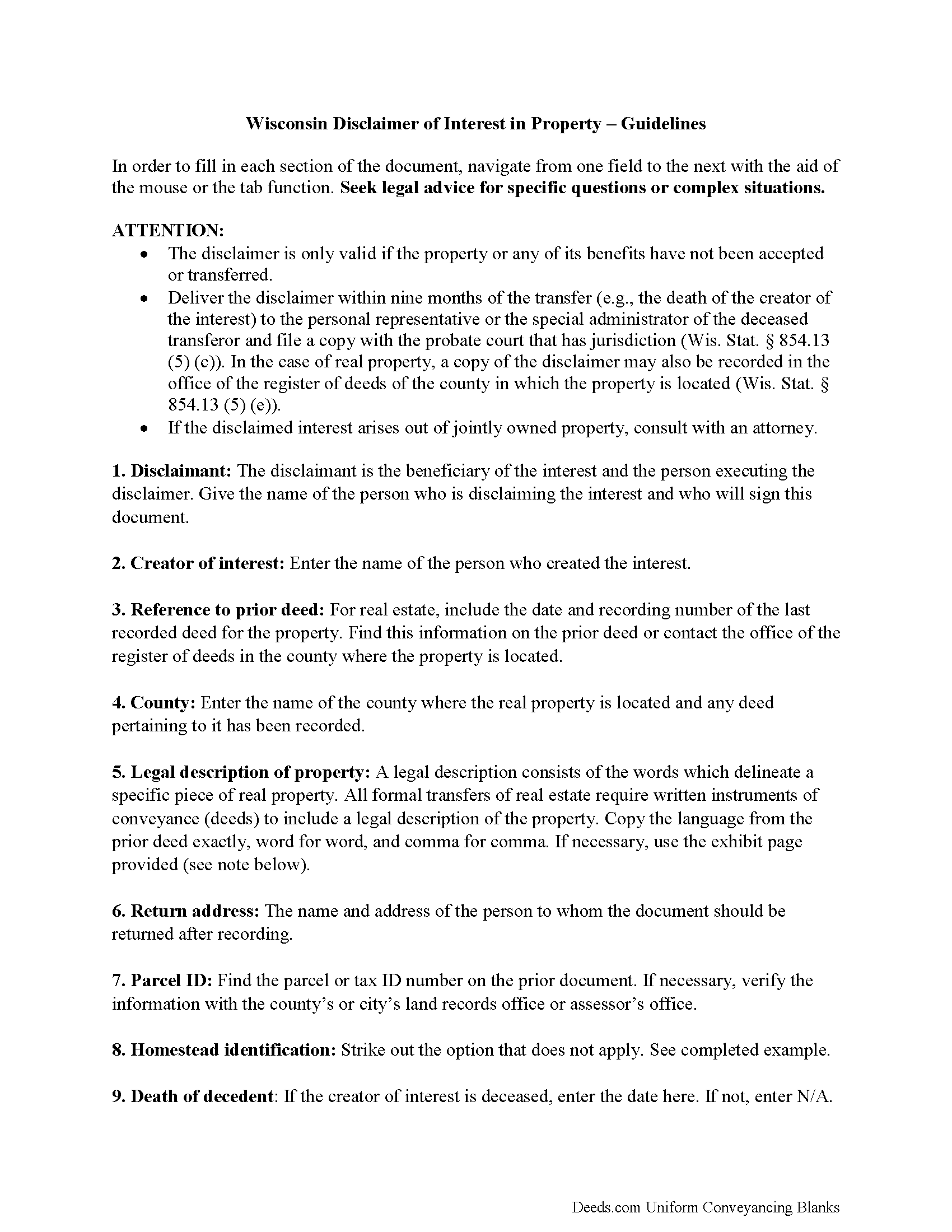

Brown County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

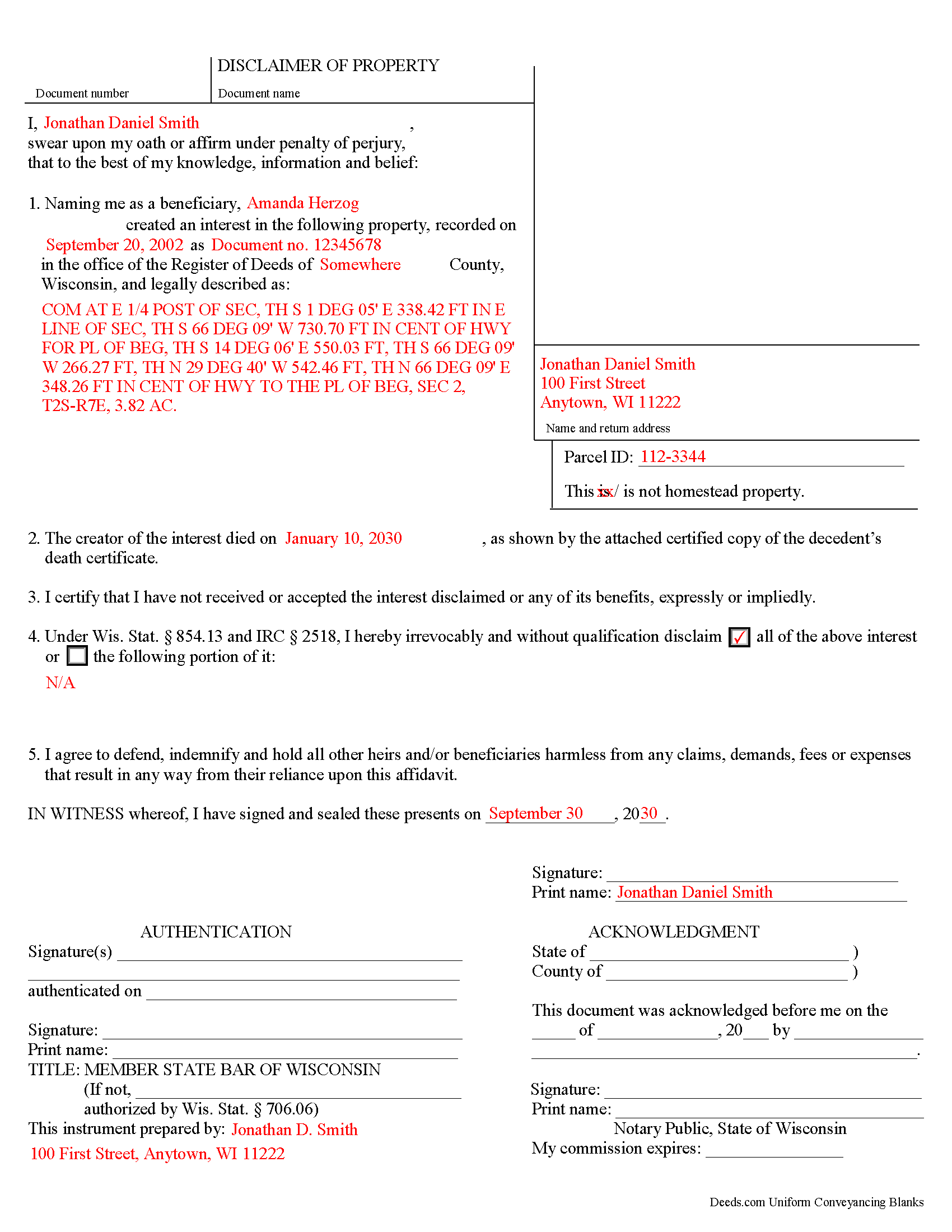

Brown County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Brown County documents included at no extra charge:

Where to Record Your Documents

Register of Deeds

Green Bay, Wisconsin 54301 / 54305-3600

Hours: Monday - Friday 8:00 am - 4:30 pm, Real Estate Recording 8:00 a.m. - 4:00 p.m.

Phone: (920) 448-4470

Recording Tips for Brown County:

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Brown County

Properties in any of these areas use Brown County forms:

- De Pere

- Denmark

- Green Bay

- Greenleaf

- New Franken

- Oneida

- Pulaski

- Suamico

- Wrightstown

Hours, fees, requirements, and more for Brown County

How do I get my forms?

Forms are available for immediate download after payment. The Brown County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Brown County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Brown County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Brown County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Brown County?

Recording fees in Brown County vary. Contact the recorder's office at (920) 448-4470 for current fees.

Questions answered? Let's get started!

Under the Code of Wisconsin, the beneficiary of an interest in property may renounce the gift, either in part or in full (Wis. Stat. 854.13 (2) (d)). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest.

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant (Wis. Stat. 854.13 (3)).

Deliver the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative or the special administrator of the deceased transferor and file a copy with the probate court that has jurisdiction (Wis. Stat. 854.13 (5) (c)). In the case of real property, a copy of the disclaimer may also be recorded in the office of the register of deeds of the county in which the property is located (Wis. Stat. 854.13 (5) (e)).

A disclaimer is irrevocable and binding for the disclaiming party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property. If the disclaimed interest arises out of jointly-owned property, seek legal advice as well.

(Wisconsin DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Brown County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Brown County.

Our Promise

The documents you receive here will meet, or exceed, the Brown County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Brown County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Melody L.

November 8th, 2020

Beware, you cannot save the information you typed and change it later. It will be a PDF upon saving. So if you need corrections...you have to start all over!

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin V.

January 5th, 2022

Quick and trouble free experience!

Thank you for your feedback. We really appreciate it. Have a great day!

Mark M.

May 24th, 2020

This Service Provider is amazing!! Needed Notice of Commencement recorded in Broward County, FL.. They got it done..super fast. High;y recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

edward d.

March 19th, 2023

used before awesome forms

Thank you!

Martin P.

April 6th, 2019

The DEEDs website is very easy to navigate and find the required documents. I have not yet had an opportunity to review the documents I purchased and downloaded. That is the reason I have assigned a rating of four stars. I fully hope that can raise my rating to five stars after I've used those documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cyrus A.

July 18th, 2024

Easy site to work with.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Laurie S.

August 11th, 2020

This was super easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paul S.

October 23rd, 2020

Directions were good. It was an easy process. Thank You.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joshua P.

July 27th, 2022

Easy fill in the blanks form. Just FYI make sure you have a copy of whatever deed you are changing and the tax records. You will want the language to be identical.

Thank you for your feedback. We really appreciate it. Have a great day!

Gwen N.

September 16th, 2021

Easy to use

Thank you!

Ralph W.

April 18th, 2020

very professional

Thank you!

Wilma M.

August 7th, 2020

Amazingly easy. Thank you

Thank you!

Ralph H.

May 13th, 2019

It had all the info I was looking for!

Thank you Ralph, we appreciate your feedback.

Liliana H.

July 21st, 2025

I had a great experience using Deeds.com to file my legal document. The whole process was simple and easy to follow. The website walks you through each step, and everything is explained clearly. At one point, I had to resubmit my documents, but even that was quick and easy. There were clear instructions, and I had no trouble making the changes and sending them again. The communication was great too. I was kept updated the whole time, and any questions I had were answered fast. If you need to file legal documents and want a stress-free way to do it, I definitely recommend Deeds.com. They made the whole process smooth from start to finish.

Thank you, Liliana! We really appreciate you taking the time to share your experience. We're glad everything went smoothly and that our team could support you when needed. It means a lot to know you'd recommend us!

DAVID K.

April 5th, 2019

Good so far could use more examples for each section of info. needed. ex. (parcel and alt.ID info where to find and etc. #2 more examples. If it was not for the red print examples helping to fill the form out I could have downloaded free forms, the examples are what made me choose your form !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!