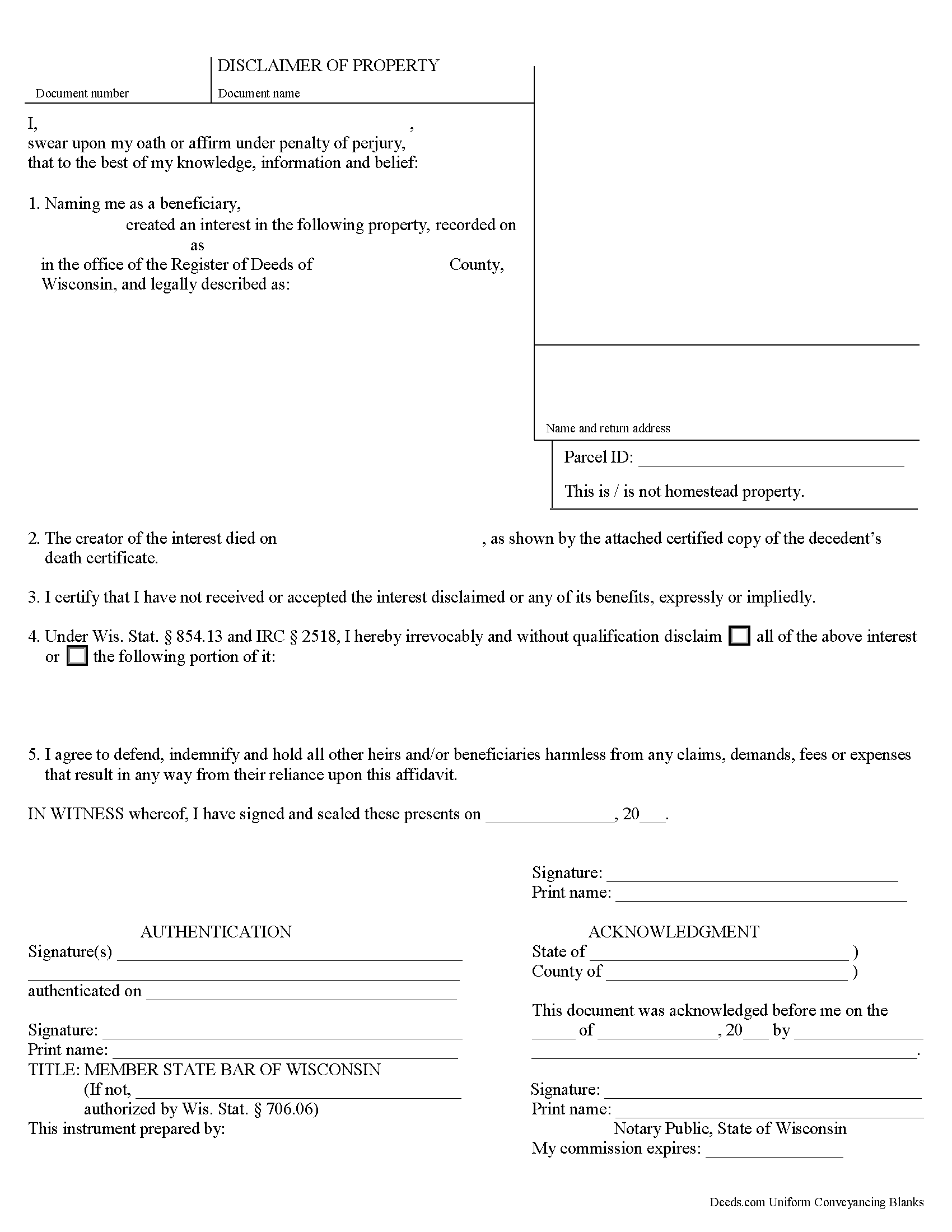

Marathon County Disclaimer of Interest Form

Marathon County Disclaimer of Interest form

Fill in the blank form formatted to comply with all recording and content requirements.

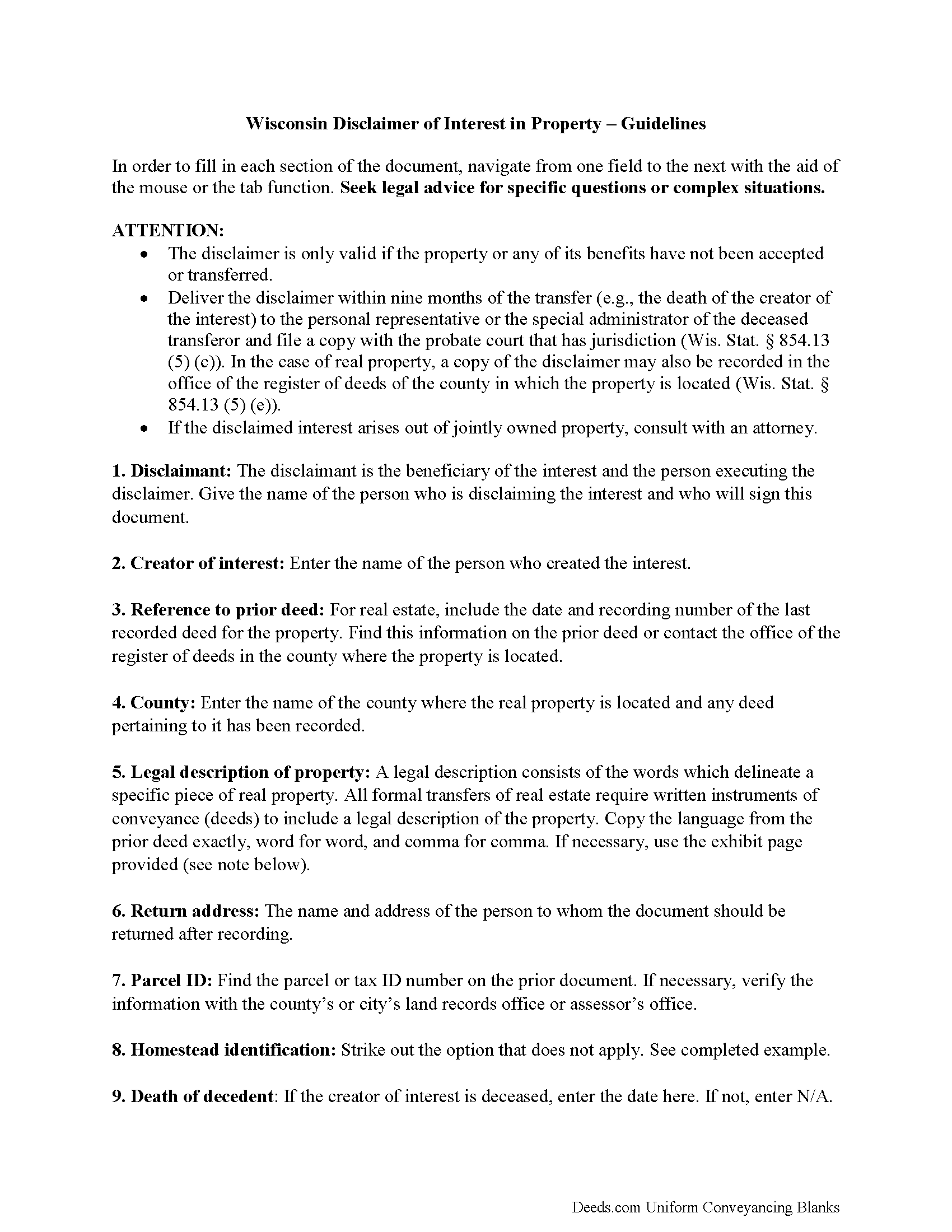

Marathon County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

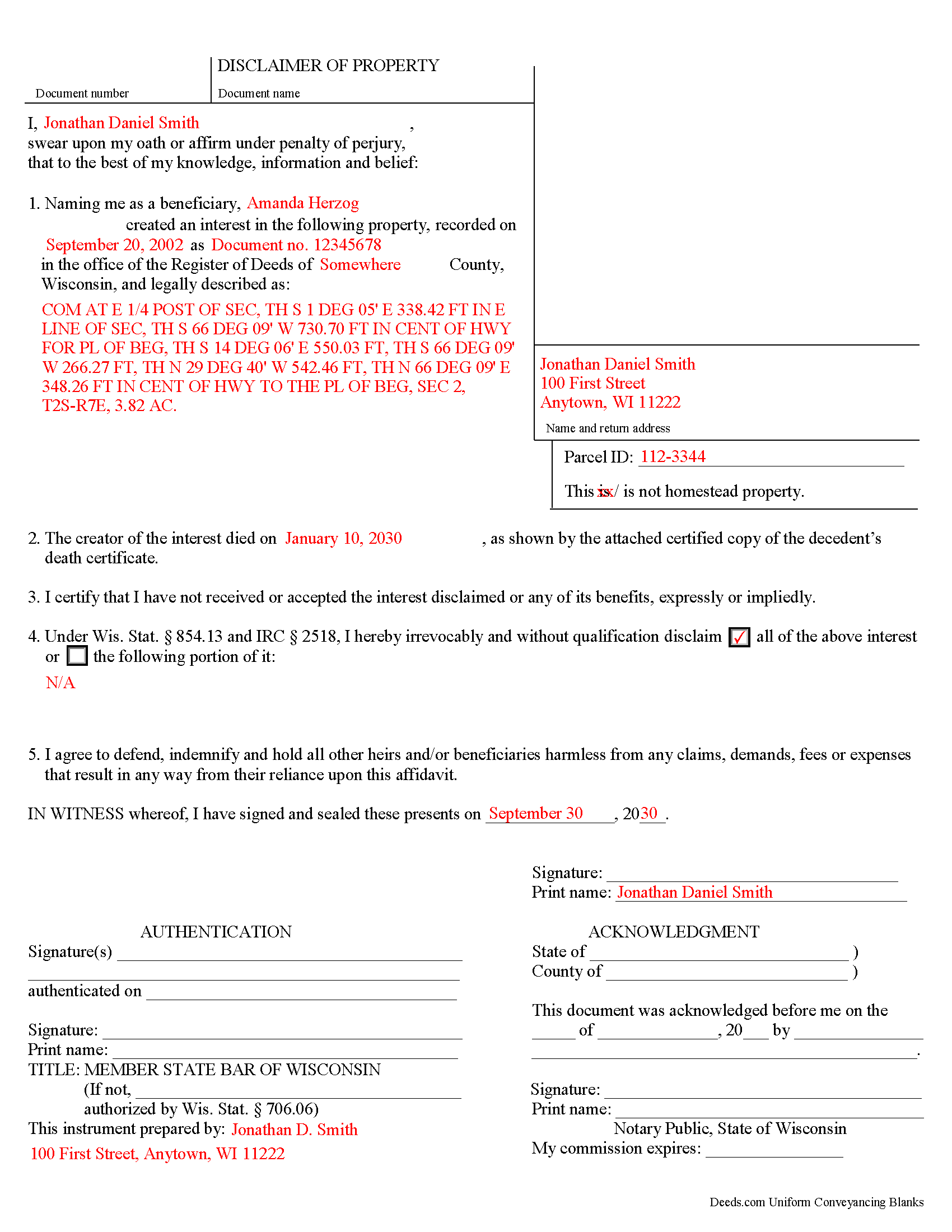

Marathon County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Marathon County documents included at no extra charge:

Where to Record Your Documents

Marathon County RoD

Wausau, Wisconsin 54403

Hours: Monday - Friday 8:00am to 4:30pm (After 4:15 p.m. the record can be picked up or mailed the following business day)

Phone: 715-261-1470

Recording Tips for Marathon County:

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

- Ask about accepted payment methods when you call ahead

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Marathon County

Properties in any of these areas use Marathon County forms:

- Aniwa

- Athens

- Brokaw

- Edgar

- Eland

- Elderon

- Galloway

- Hatley

- Marathon

- Mosinee

- Ringle

- Rothschild

- Schofield

- Spencer

- Stratford

- Unity

- Wausau

Hours, fees, requirements, and more for Marathon County

How do I get my forms?

Forms are available for immediate download after payment. The Marathon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marathon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marathon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marathon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marathon County?

Recording fees in Marathon County vary. Contact the recorder's office at 715-261-1470 for current fees.

Questions answered? Let's get started!

Under the Code of Wisconsin, the beneficiary of an interest in property may renounce the gift, either in part or in full (Wis. Stat. 854.13 (2) (d)). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest.

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant (Wis. Stat. 854.13 (3)).

Deliver the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative or the special administrator of the deceased transferor and file a copy with the probate court that has jurisdiction (Wis. Stat. 854.13 (5) (c)). In the case of real property, a copy of the disclaimer may also be recorded in the office of the register of deeds of the county in which the property is located (Wis. Stat. 854.13 (5) (e)).

A disclaimer is irrevocable and binding for the disclaiming party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property. If the disclaimed interest arises out of jointly-owned property, seek legal advice as well.

(Wisconsin DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Marathon County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Marathon County.

Our Promise

The documents you receive here will meet, or exceed, the Marathon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marathon County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Carol S.

February 18th, 2022

Unfortunately for me this website was of no help, due to the amount of paperwork that needed to be submitted. One thing I can say they responded with answer really quickly. If this is a website that only deals with quick and fast deed issues, then it should indicate what they can and cannot do.

Thank you for your feedback. We really appreciate it. Have a great day!

Jay P.

June 4th, 2021

Great site, even for Tech dummies like me. Easy to use and VERY prompt! Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth S.

December 30th, 2018

Navigating the site was fine, but the service was not able to find my deed. Still have not received my refund.

Thanks for your feedback Kenneth. Sorry we were not able to pull the deed for your property. We voided your payment on December 28, 2018. Sometimes, depending on your financial institution, it can take a few days for the pending charge (hold) to expire.

CHARLES H.

December 3rd, 2022

Easy to fill-in forms, easy instructions, worth purchasing

Thank you!

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! I do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat. Fortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

Angela J M.

September 29th, 2023

Quick turnaround (about 24hrs) easy process.

Thank you for your feedback. We really appreciate it. Have a great day!

Wesley R T.

December 9th, 2020

Great service and easy use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James H.

January 14th, 2020

Very satisfied. Download was easy, completing the form was easy, got our signatures notarized and submitted it to the register of deeds. The only item was that the register of deeds did not immediately recognize the TOD deed form as the usual form they receive. After carefully reviewing all the information and wording on the deed she accepted it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maria C.

June 3rd, 2022

Amazing service truly great to work with your team on a difficult filing!

Thank you!

Cynthia H.

September 5th, 2021

Thank you for having these forms so reasonable and easy to access. I only WISH I would have looked here 1st, spent way to much valuable time trying to get help with this deed. This was so EASY and quick... THANK YOU THANK YOU Highly Recommend

Thank you!

MARC G.

June 26th, 2020

Very easy. Very helpful.

Thank you!

Susan N.

December 1st, 2019

Hope to get form printed out Ok.

Thank you!

Kathleen T.

March 25th, 2020

Perfect in every way, the guide was a big help in a few areas that I had questions on. Overall the average person should have no issues with the forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

VICKI R.

July 15th, 2020

Thank you for your helpful information.

Thank you!

RONALD L W.

August 11th, 2022

Easy access of downloadable forms for use by Pennsylvania, Allegheny County residents.

Thank you for your feedback. We really appreciate it. Have a great day!