Sawyer County Personal Representative Deed Form

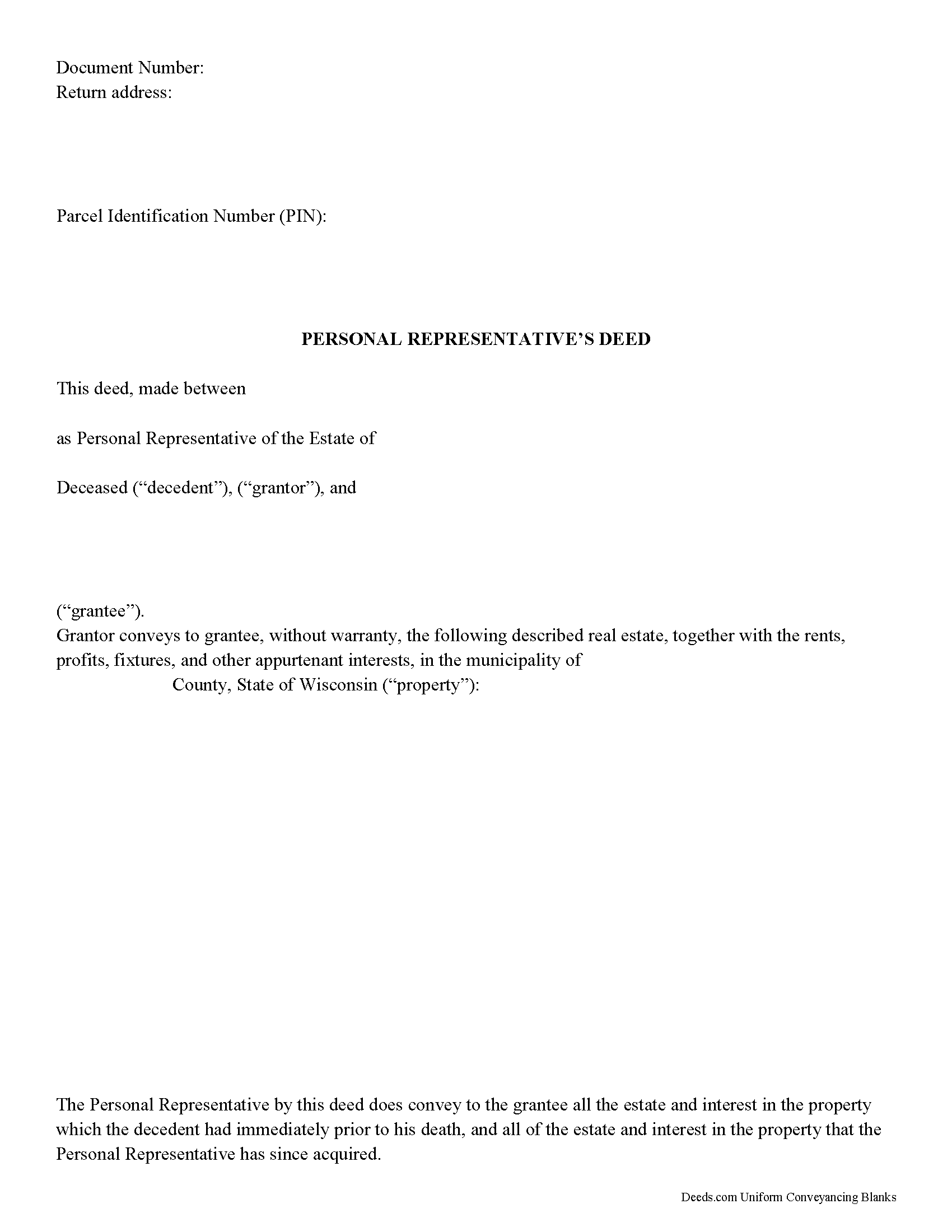

Sawyer County Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

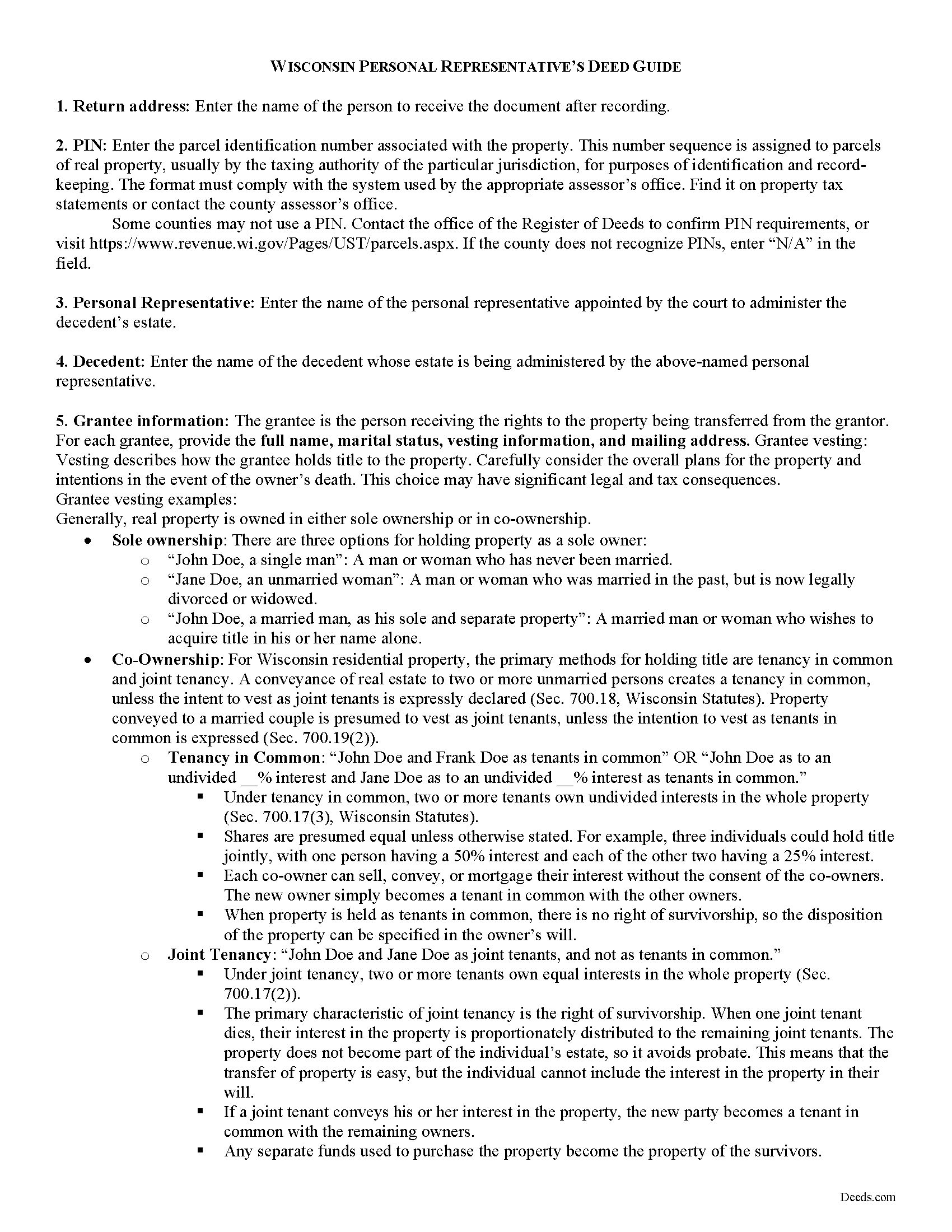

Sawyer County Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

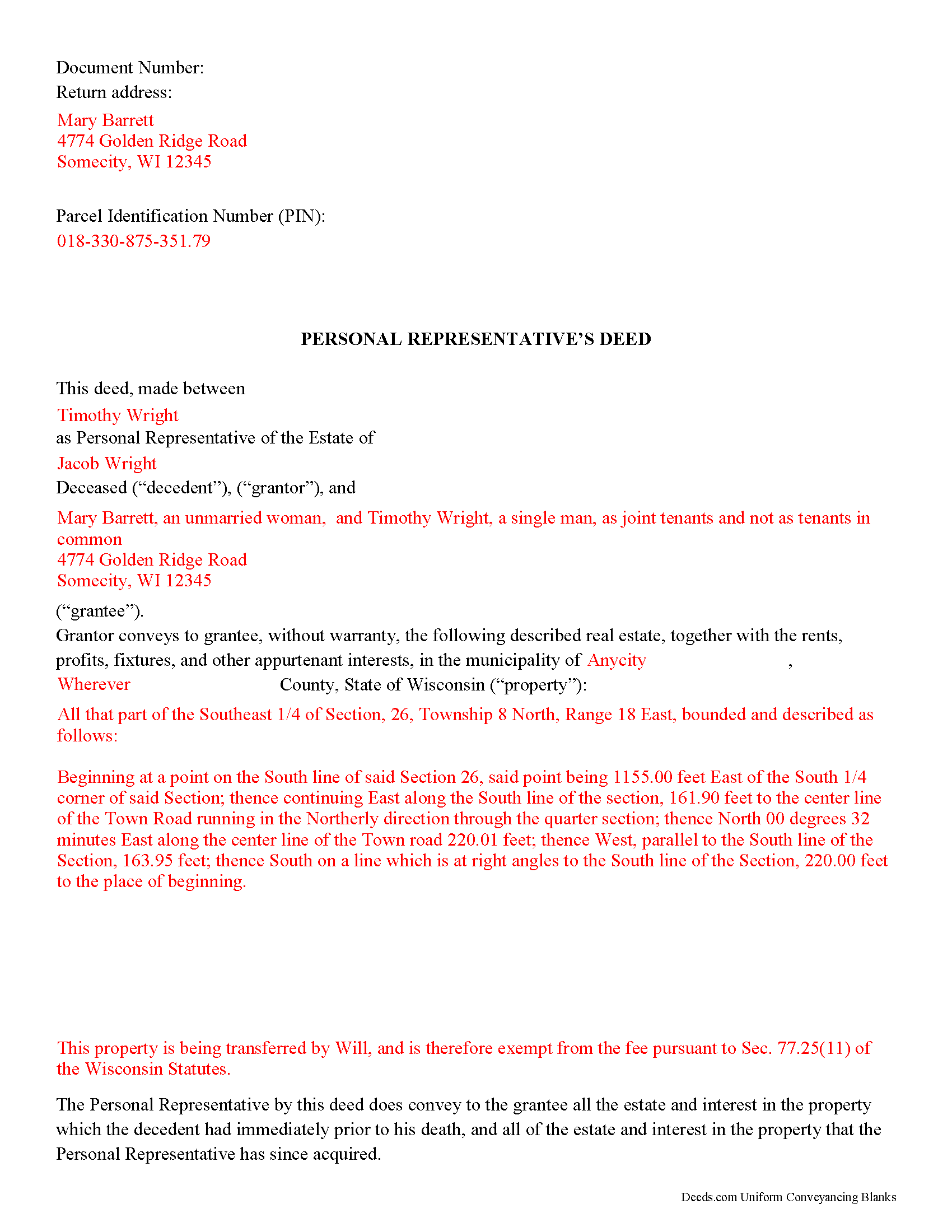

Sawyer County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Sawyer County documents included at no extra charge:

Where to Record Your Documents

Sawyer County Register of Deeds

Hayward, Wisconsin 54843-6584

Hours: Monday - Friday 8:00 am - 4:00 pm

Phone: (715) 634-4867

Recording Tips for Sawyer County:

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Sawyer County

Properties in any of these areas use Sawyer County forms:

- Couderay

- Edgewater

- Exeland

- Hayward

- Ojibwa

- Radisson

- Stone Lake

- Winter

Hours, fees, requirements, and more for Sawyer County

How do I get my forms?

Forms are available for immediate download after payment. The Sawyer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sawyer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sawyer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sawyer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sawyer County?

Recording fees in Sawyer County vary. Contact the recorder's office at (715) 634-4867 for current fees.

Questions answered? Let's get started!

Transfer or Sale of a Decedent's Real Estate in Wisconsin

At its most basic, probate means to prove a decedent's will. The term "probate," however, is frequently used to describe the legal process of estate administration, which includes intestate estate succession in addition to probating wills. Estates are called intestate when the decedent (deceased person) does not leave a will. Probate ensures that a decedent's estate is lawfully transferred pursuant to the provisions of his will or to the state's laws of intestate succession.

Property that does not transfer by means of a survivorship or beneficiary designation is subject to probate. Estates requiring formal or informal probate involve the appointment of a personal representative (PR), a fiduciary appointed by the court to administer the estate in accordance with Wisconsin's Probate Code, located at Chs. 851-882 of the Wisconsin Statutes. This article will focus on informal administration; formal administration may be necessary depending on such factors as specifications in the will and whether all persons having an interest in the estate agree on the administration. Consult a lawyer with questions.

The first step to administration is opening the estate by submitting a petition for administration in the circuit court of the county where the decedent resided at the time of death. If there is a will, it must be delivered to the probate registrar. If the testator (person making a will) has filed the will with the court for safekeeping, the court shall contact the person named in the will to administer the estate (Wis. Stat. Sec. 856.03). Upon petition, the court will set a time for proving the will (if applicable), determining heirship, and appointing a personal representative (Sec. 856.11).

To evidence the authority of a PR to act on behalf of the estate, the court grants Domiciliary Letters to the qualifying person. The person named in the decedent's will has priority in appointment, followed by any person interested in the estate or the person's nominee, under discretion of the court (Sec. 856.21). With the issuance of letters, the PR is granted the general powers and duties of a personal representative under Ch. 857, Wisconsin Statutes, to administer the estate as required by law.

Among the PR's powers is the power to "sell, mortgage or lease any property in the estate without notice, hearing or court order" under Sec. 860.01, unless restricted or prohibited by the decedent's will (Sec. 860.11). The beneficiary of property specifically devised to him by the decedent must join in the sale of such property (Sec. 860.11(2)). If the will contains any such limitations as to the sale of real property, yet the PR is unable to pay allowances, expenses of administration, or claims on the estate within those limitation, he can petition the court for sale (Sec. 860.11(4)).

To sell or transfer an interest in real estate, the PR executes a personal representative's deed. A PR deed passes title to the named grantee free and clear of the rights of creditors that have been filed and allowed in the estate under Ch. 859 (Sec. 860.05). The PR has no statutory power to make warranties in any sale of real estate binding on the PR or on the estate (Sec. 860.07). The deed conveys all the estate and interest in the property the decedent had immediately prior to his death, and all the estate and any interest in the property the PR has since acquired.

A lawful deed should meet the requirements for content established at Sec. 706.02, identifying the parties and the land involved, the interest conveyed, and any conditions. The grantor must sign and have the deed properly acknowledged under Sec. 706.06. All deeds in Wisconsin require the name of the person who drafted the instrument and full legal description of the property and meet statutory and local standards for formatting recorded instruments (Sec. 59.43).

Record the deed in the office of the register of deeds in each county where the property is situated. Conveyances of real property offered for recording must be accompanied by receipt of an electronic real estate transfer return or note an exemption on the face of the document 706.05(12)). Exemptions to the real estate transfer fee are codified at Sec. 77.25, and include transfers by will, descent, or survivorship (Sec.77.25(11)).

Consult an attorney about personal representative's deeds and informal probate procedures in Wisconsin, as each situation is unique.

(Wisconsin PRD Package includes form, guidelines, and completed example)

Important: Your property must be located in Sawyer County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Sawyer County.

Our Promise

The documents you receive here will meet, or exceed, the Sawyer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sawyer County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

sara g.

June 10th, 2019

THIS WAS A USER FRIENDLY FORM, WAS ABLE TO COMPLETE WITHIN A SHORT TIME. THANK YOU

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Randy F.

March 19th, 2020

SO FAR SO GOOD, DOC'S DOWNLOADED WITHOUT A PROBLEM

Thank you!

Audrey A.

August 19th, 2019

Great!

Thank you!

Eldridge S.

August 5th, 2019

very pleased to attain this important document

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

EVE A.

October 31st, 2022

Site was easy to navigate. I found the lien discharge form I was looking for immediately and the download and completion was simple. Thank you for having a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen U.

December 5th, 2020

This is another great deal that has come out of the quarantine for covid. Saved me hours and days of time. and provides a way to file deeds that really isn't done effectively anyway else. It was also very inexpensive that you would not expect. I didn't even have to leave home.

Thank you for your feedback. We really appreciate it. Have a great day!

James C.

January 15th, 2021

Satisfactory. I was confused and somwhat lost on what to do and what I was getting.

Thank you!

Jay B.

March 17th, 2021

I've never had a problem locating the records I need. I can't imagine what can be done to improve the service.

Thank you!

Merry K.

January 5th, 2024

I am a WA State Attorney and just made my first purchase. The experience was flawless, and I appreciate the sample and the guide, too. The price was extremely reasonable. This was a huge time-saver for me - thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

VICTOR S.

November 16th, 2019

Wow! Nice and easy!

Thank you!

Hideo K.

September 12th, 2023

Very prompt and satisfied with the service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lana B.

February 5th, 2021

Website is easy to use. I ordered the form, filled it out and uploaded it for recording. My only critique is that you can't preview the form before ordering and paying for it. I ordered a Deed of Full Reconveyance form only to find out I needed the Substitution of Trustee and Deedn of Reconveyance form instead. So I wasted $22 on the wrong form.

Thank you for your feedback. Order and payment for the incorrect order has been canceled. Have a wonderful day.

Thomas D.

January 6th, 2019

Can I use this for easement in gross ? Like to grant cousins easement to use river front property with riparian rights ?

Sorry, we are unable to give advice on specific legal situations.

Judie G.

February 2nd, 2022

Review: Forms are on point, to the point, and cover the vast majority of situations. Would not suggest if your deal is overly complicated but most situations are not complicated at all.

Thank you!

Michael L.

March 3rd, 2019

Perfect timely service! Will use again!

Thank you!