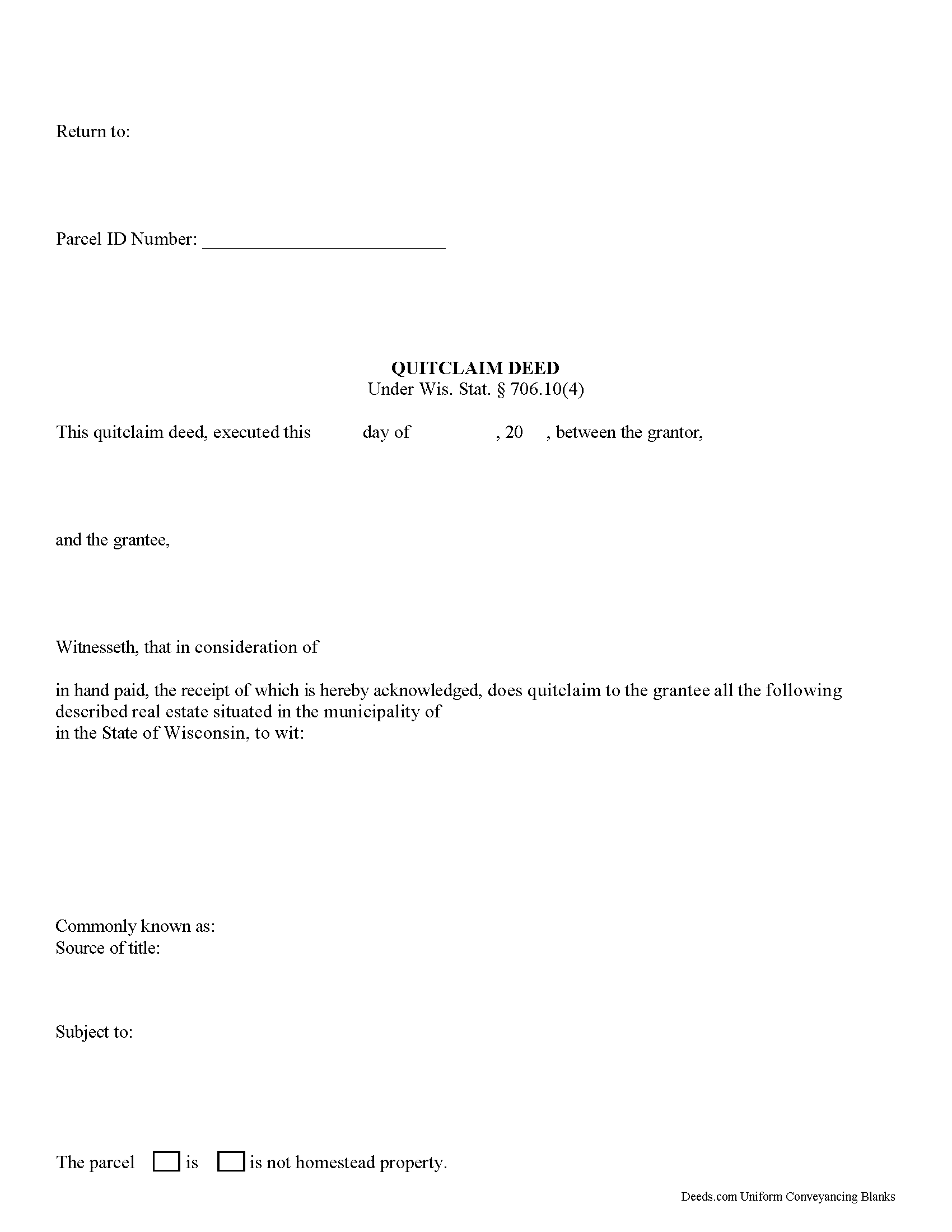

Taylor County Quitclaim Deed Form

Taylor County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Wisconsin recording and content requirements.

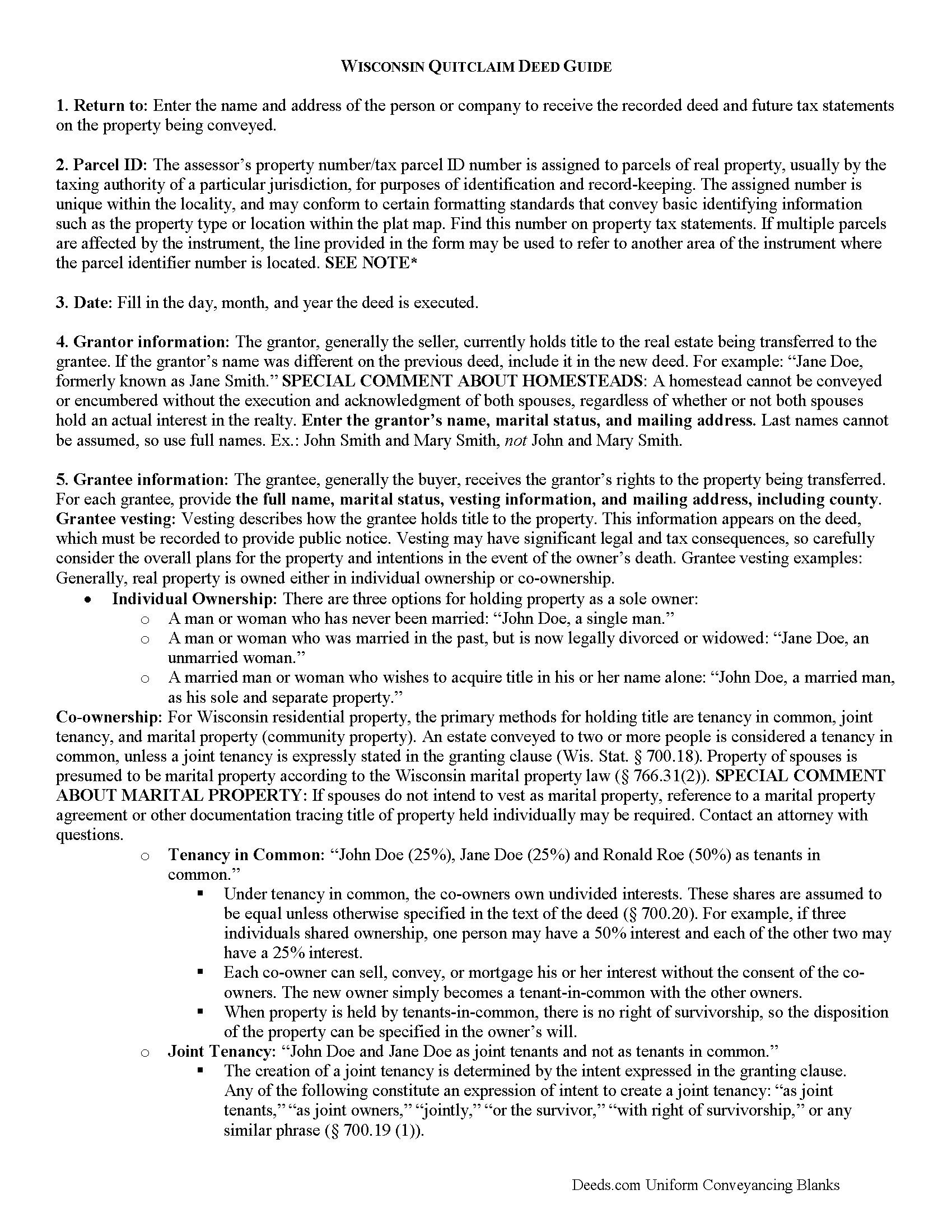

Taylor County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

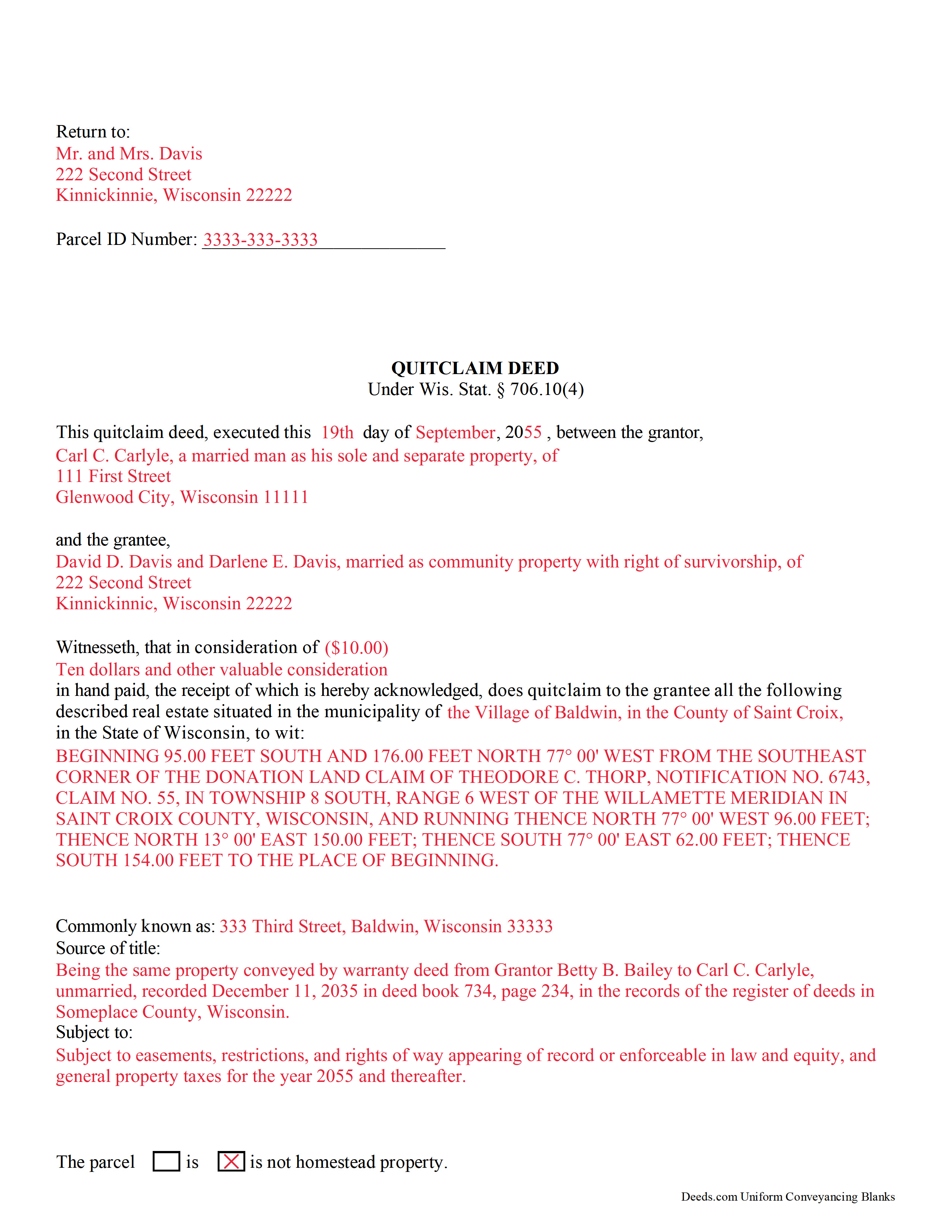

Taylor County Completed Example of the Quitclaim Deed Document

Example of a properly completed Wisconsin Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Taylor County documents included at no extra charge:

Where to Record Your Documents

Taylor County Register of Deeds

Medford, Wisconsin 54451

Hours: 8:30 to 4:30 M-F

Phone: (715) 748-1483

Recording Tips for Taylor County:

- Verify all names are spelled correctly before recording

- Avoid the last business day of the month when possible

- Both spouses typically need to sign if property is jointly owned

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Taylor County

Properties in any of these areas use Taylor County forms:

- Gilman

- Hannibal

- Jump River

- Lublin

- Medford

- Rib Lake

- Stetsonville

- Westboro

Hours, fees, requirements, and more for Taylor County

How do I get my forms?

Forms are available for immediate download after payment. The Taylor County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Taylor County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Taylor County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Taylor County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Taylor County?

Recording fees in Taylor County vary. Contact the recorder's office at (715) 748-1483 for current fees.

Questions answered? Let's get started!

A quitclaim deed, according to the prerequisites for transfers as defined under section 706.02 (1) of the Wisconsin Annotated Statutes, needs to identify the parties, the land, and the interest conveyed along with any material terms or conditions. The grantor's signature is needed in order to record a quitclaim deed. If the conveyance alienates any interest of a married person in a homestead under Sec. 706.01(7) of the Wisconsin Annotated Statutes, it must be signed or joined in a separate conveyance on behalf of each spouse. The Register of Deeds can refuse to record a quitclaim deed unless specific standardization requirements are met. These standardization requirements are further explained below according to county.

The first recorded quitclaim deed will have priority over later recordings involving the same real estate. The Wisconsin Annotated Statutes 706.08(1) permit that if a quitclaim deed is not recorded, it is "void as against any subsequent purchaser, in good faith and for a valuable consideration, of the same real estate or any portion of the same real estate whose conveyance is recorded first". This is known as a race-notice statute recording act, which does not create a criminal penalty for not recording, but is meant to provide incentive to record.

(Wisconsin QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Taylor County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Taylor County.

Our Promise

The documents you receive here will meet, or exceed, the Taylor County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Taylor County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Robert P.

November 3rd, 2020

Overall, your website was straightforward and easy to navigate. I was able to accomplish what I needed to do very quickly. If needed again, I would certainly use and recommend others to use deeds.com.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ann M.

February 11th, 2022

I was extremely pleased with how easy this process was, and how quickly my document was recorded. I will definitely use this again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James L.

February 15th, 2022

The process to obtain online forms was simple and straight forward and uncomplicated.

Thank you for your feedback. We really appreciate it. Have a great day!

James R.

September 1st, 2021

Useful and quick.

Thank you!

ALAN C.

April 22nd, 2019

Everything was as advertised, and easily downloaded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

vickie w.

February 22nd, 2020

easy & convenience .good service

Thank you for your feedback. We really appreciate it. Have a great day!

Andrew B.

January 3rd, 2022

Very easy to use and I appreciate the fees being charged after the submission.

Thank you!

John V.

June 17th, 2020

getting the proper forms was easy--filling them out, not so much

Thank you!

Colleen P.

May 4th, 2020

It was frustrating to get the scans done but that might have been due to a learning curve. After 4 tries they were accepted. I couldn't figure out how to delete or close the failed attempts. Waiting to see if Recorder office has changed the title.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth N.

April 3rd, 2019

I love how easy it is to understand and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

tamica l.

March 31st, 2022

Excellent Service! Fast and friendly. Thank you will use again!

Thank you!

Linda B.

March 26th, 2022

the forms are easy to understand. How do I go about getting the deed recorded and is there a charge.

Thank you for your feedback. We really appreciate it. Have a great day!

Sara S.

January 8th, 2021

Deed.com was very user friendly, made recording convenient and fast responses. I do recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert H.

January 10th, 2024

Easy to use and understand. I am glad to have found this resource.

Your appreciative words mean the world to us. Thank you and we look forward to serving you again!

Monique C.

August 21st, 2020

Very quick and efficient service! I will continue to use them for future reference.

Thank you!