Kenosha County Special Warranty Deed Form

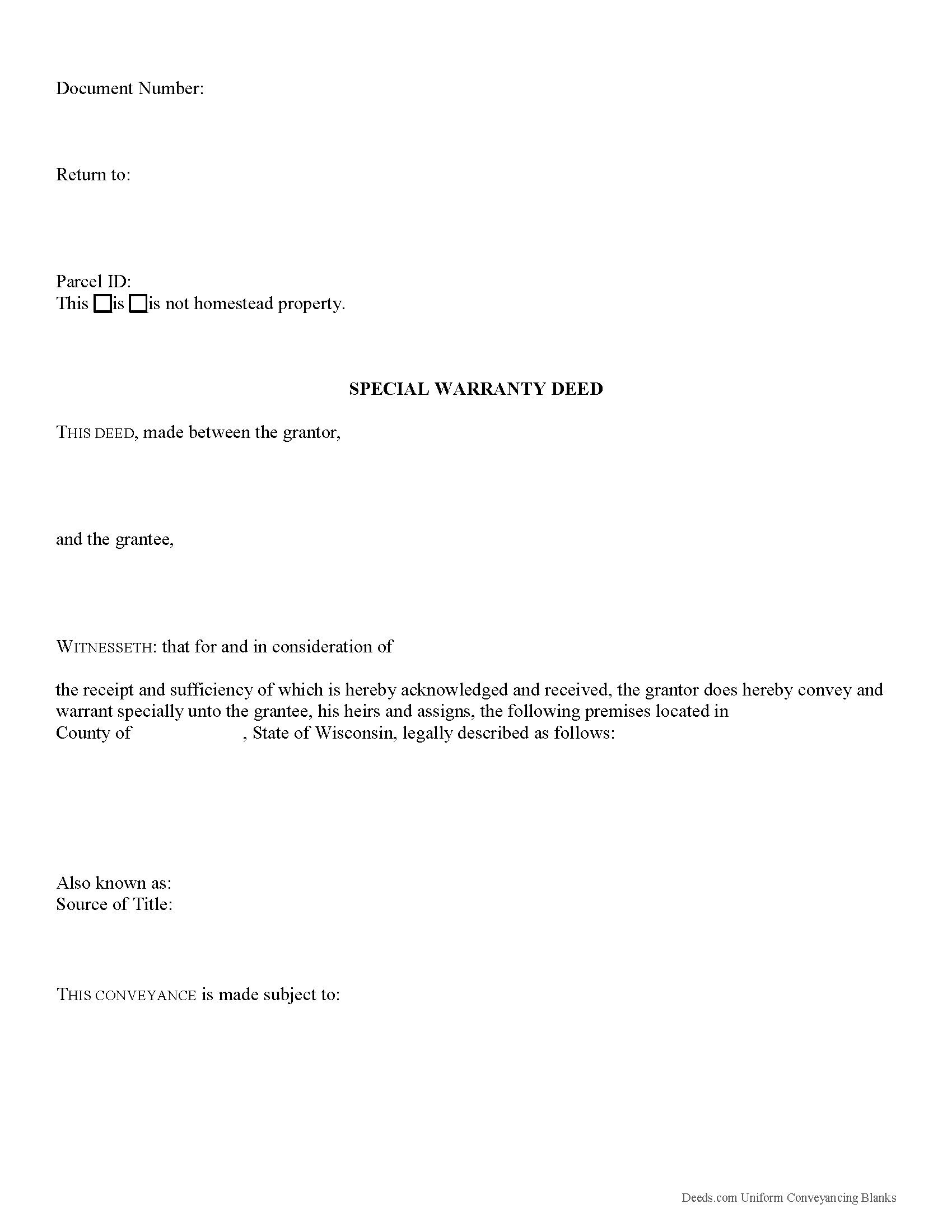

Kenosha County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

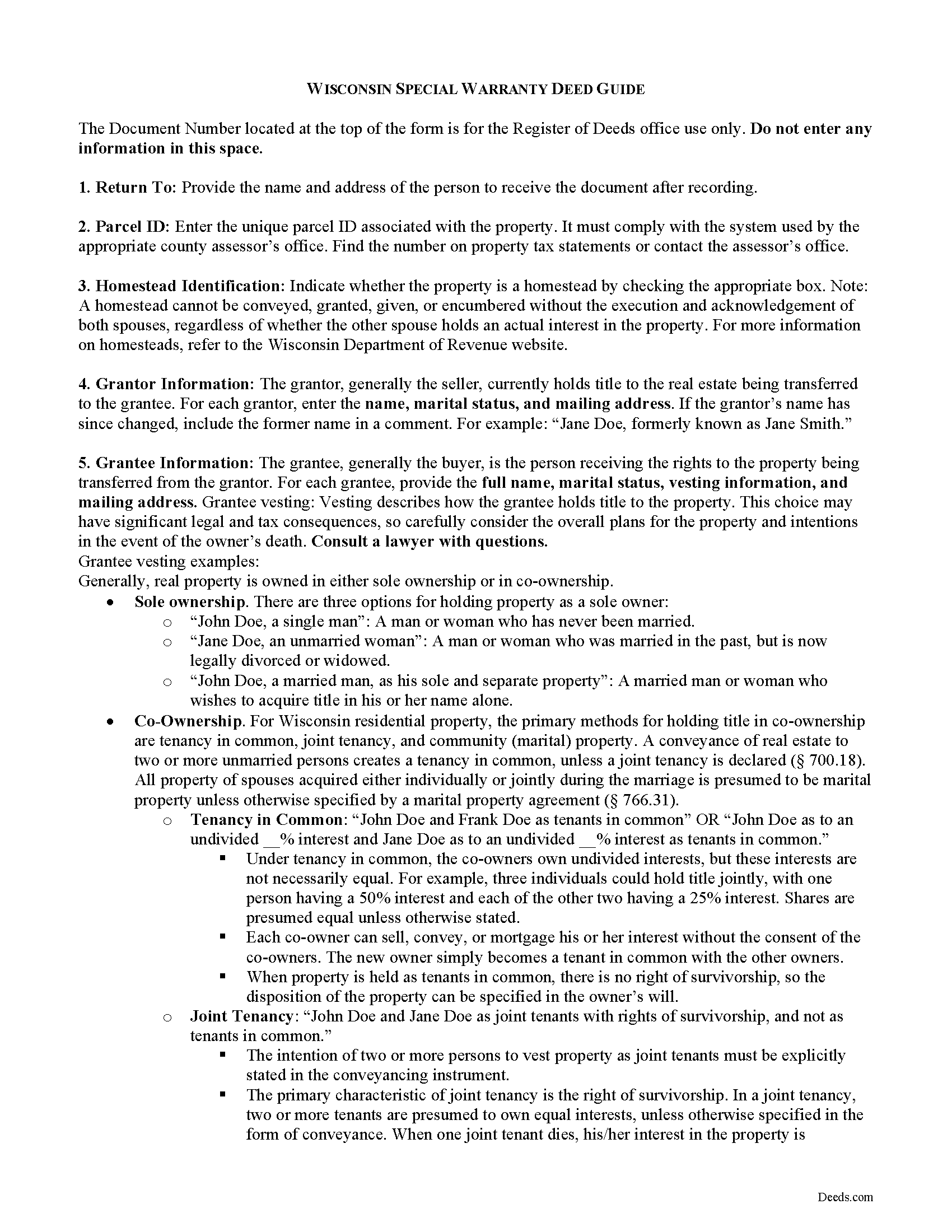

Kenosha County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

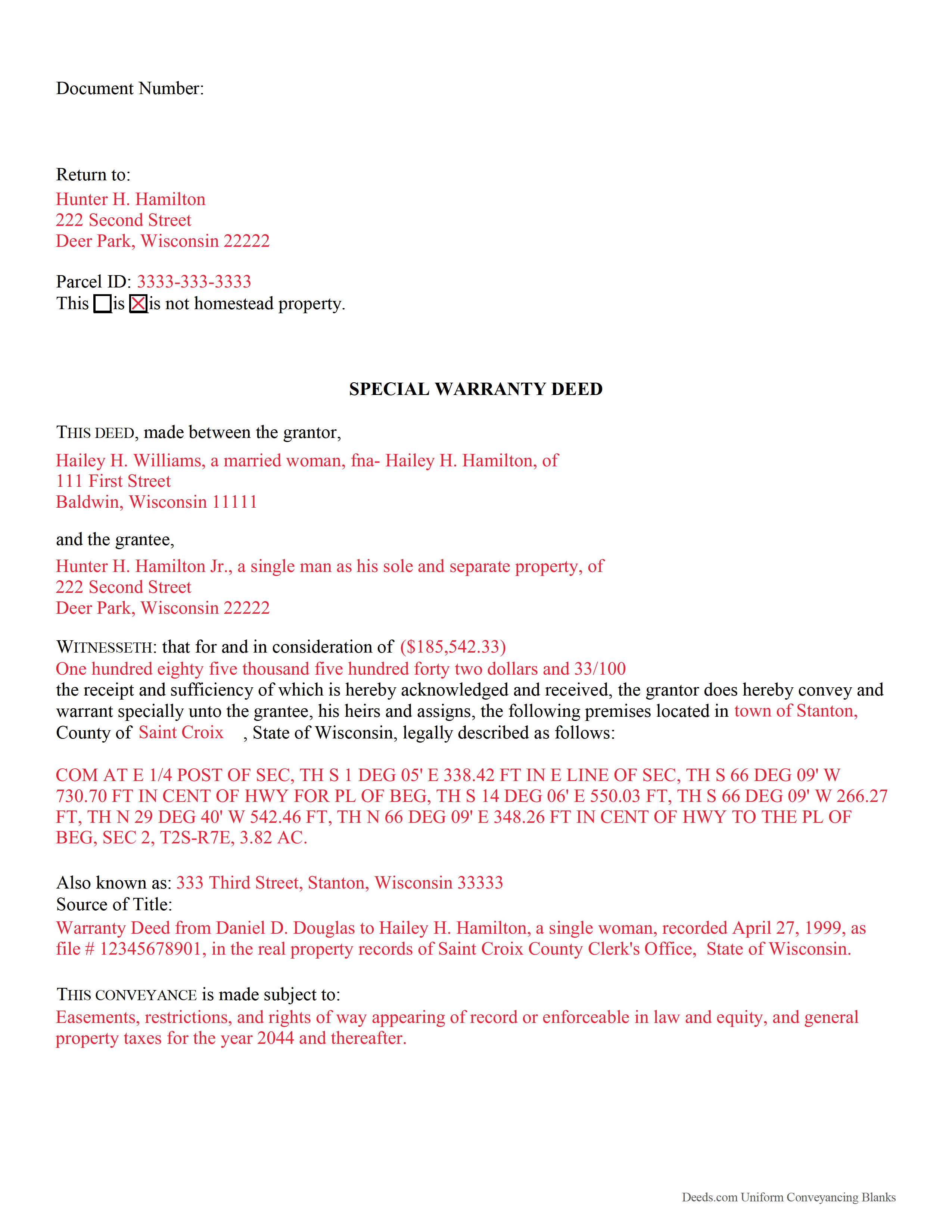

Kenosha County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Kenosha County documents included at no extra charge:

Where to Record Your Documents

Kenosha County Register

Kenosha, Wisconsin 53140

Hours: 8:00 to 5:00 Mon-Fri

Phone: (262) 653-2441

County Center Satellite Station

Bristol, Wisconsin 53104

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: 262-857-1845

Recording Tips for Kenosha County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Kenosha County

Properties in any of these areas use Kenosha County forms:

- Bassett

- Benet Lake

- Bristol

- Camp Lake

- Kenosha

- New Munster

- Pleasant Prairie

- Powers Lake

- Salem

- Silver Lake

- Somers

- Trevor

- Twin Lakes

- Wilmot

- Woodworth

Hours, fees, requirements, and more for Kenosha County

How do I get my forms?

Forms are available for immediate download after payment. The Kenosha County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kenosha County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kenosha County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kenosha County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kenosha County?

Recording fees in Kenosha County vary. Contact the recorder's office at (262) 653-2441 for current fees.

Questions answered? Let's get started!

In Wisconsin, title to real property can be transferred from one party to another using a special warranty deed. When recorded, a special warranty deed conveys an interest in real property to the named grantee with limited warranties of title.

A special warranty deed offers a more limited warranty than a general warranty deed. Special warranty deeds convey real property in fee simple to the grantee, typically with a covenant from the grantor that the property is free from encumbrances made by the grantor. The grantor also covenants that he will defend title against any lawful claim arising by, through, or under the grantor, but none other. This means that the deed will not protect the grantee against title issues that arose prior to the time the grantor acquired title. A special warranty deed is recognizable by the terms "convey and warrant specially," but no warranties are implied in Wisconsin, so any special warranty covenants must be explicitly stated in the deed (706.10(6)).

In addition to meeting all state and local standards for recorded documents, a lawful special warranty deed includes the grantor's full name, mailing address, and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Wisconsin residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and community (marital) property. A conveyance of real estate to two or more unmarried persons creates a tenancy in common, unless a joint tenancy is declared (700.18). All property of spouses acquired either individually or jointly during the marriage is presumed to be marital property unless otherwise specified by a marital property agreement (766.31).

Deeds in Wisconsin must be accompanied by a receipt that evidences completion of a Wisconsin Real Estate Transfer Return. The real estate transfer fee is levied based on either the consideration made for the transfer or the current fair market value of the real property, as reflected on the form (77.22(1)). Submit the form electronically via the Wisconsin Department of Revenue website. All conveyances require a completed form or an exemption stated on the face of the deed. Find a list of exempt documents at 77.25.

As with any conveyance of realty, a special warranty deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The finished copy of the deed must be signed by the grantor and notarized. Additionally, the grantor's spouse must join in signing to release rights of homestead, regardless of whether he or she holds an actual interest in the property conveyed. Record the original completed deed, along with any additional materials, at the Register of Deeds office of the county where the property is located. Contact the same office to verify recording fees and accepted forms of payment.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Wisconsin lawyer with any questions related to the transfer of real property.

(Wisconsin SWD Package includes form, guidelines, and completed example)

Important: Your property must be located in Kenosha County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Kenosha County.

Our Promise

The documents you receive here will meet, or exceed, the Kenosha County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kenosha County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Anne-Marie B.

December 30th, 2020

This was the first time I have ever e-recorded a document. The process was smooth and simple. I loved being informed at each step along the way. I am glad I chose deeds.com and plan to use them in the future for all my electronic recording of legal documents.

Thank you!

Joseph K.

May 1st, 2020

I'm very impressed. We're a small nonprofit, and we usually walk our documents into our county offices for recording. So I was a little bit skeptical about how things would work if we did it electronically. But it was a smooth, quick, painless, and reasonably priced process. I expect that this will be our preferred method even after county offices re-open.

Thank you for your feedback. We really appreciate it. Have a great day!

Marie B.

May 21st, 2020

Easily found what I needed. Very helpful. Downloaded the documents, saved to my computer and printed what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

luisana w.

September 9th, 2022

Super easy, excellente

Thank you!

Carolyn S.

January 24th, 2021

This website was very helpful in explaining what a "gift" deed is and how to execute it. I didn't want to incur legal fees for a simple transaction and this website helped me avoid that.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine E.

January 7th, 2021

I was referred to your company, but when i tried to process the recording of a deed to a property in City of Philadelphia my service was rejected. I appreciated the feedback i received from one of your representatives who instructed me in the right process for recording a deed in philadelphia. Thank you for all your help. The deed that needed to be recorded was overnighted yesterday. Stay safe and mask up

Thank you!

sean m.

April 28th, 2021

Wow everything I need in one place... what a concept. thanks Deeds.com for the deeds, the guides and the transfer certificate all included for a great price

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith H.

May 22nd, 2023

This site was so easy. Got my documents in minutes. downloaded and they work perfectly and accurately. I LOVE THIS SITE AND COMPANY!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Chad N.

March 16th, 2021

Thank you for taking care of a recording very quickly. I am very impressed by your service an would recommend to anyone. Easy to navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

W J C.

July 11th, 2019

Good documents. Very helpful.

Thank you!

Chris H.

December 8th, 2020

Fast and Easy. Did not have to leave my office to get this done.

Thank you!

Kimberaley J.

May 24th, 2021

I had no problem printing out the forms, very easy. Also when I called, customer service was very helpful and very polite. Thank you for that, have a great day.

Thank you!

Marilyn O.

March 9th, 2021

Good resource. Got what I needed easily

Thank you for your feedback. We really appreciate it. Have a great day!

Erik J.

January 8th, 2021

First time using Deeds.com and feel that your platform is clear and easy to use. I was also pleased with the messaging center and follow-up and also surprised at how quickly our particular deed was recorded and available to view. Having said that, when I first investigated Deeds.com the fee was $15 and as of 1/1/21 it has increased to $19 which I feel is pretty steep for the handling of 1 simple document especially when the turnaround was basically the same day. Your fee was nearly the equivalent of the cost of the Clerk's recording fee. Perhaps you should offer a fee schedule for those of us who are not volume recorders. Just a thought.

Thank you!

Cassandra C.

February 7th, 2022

I was easy fast and easy to order and download.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!