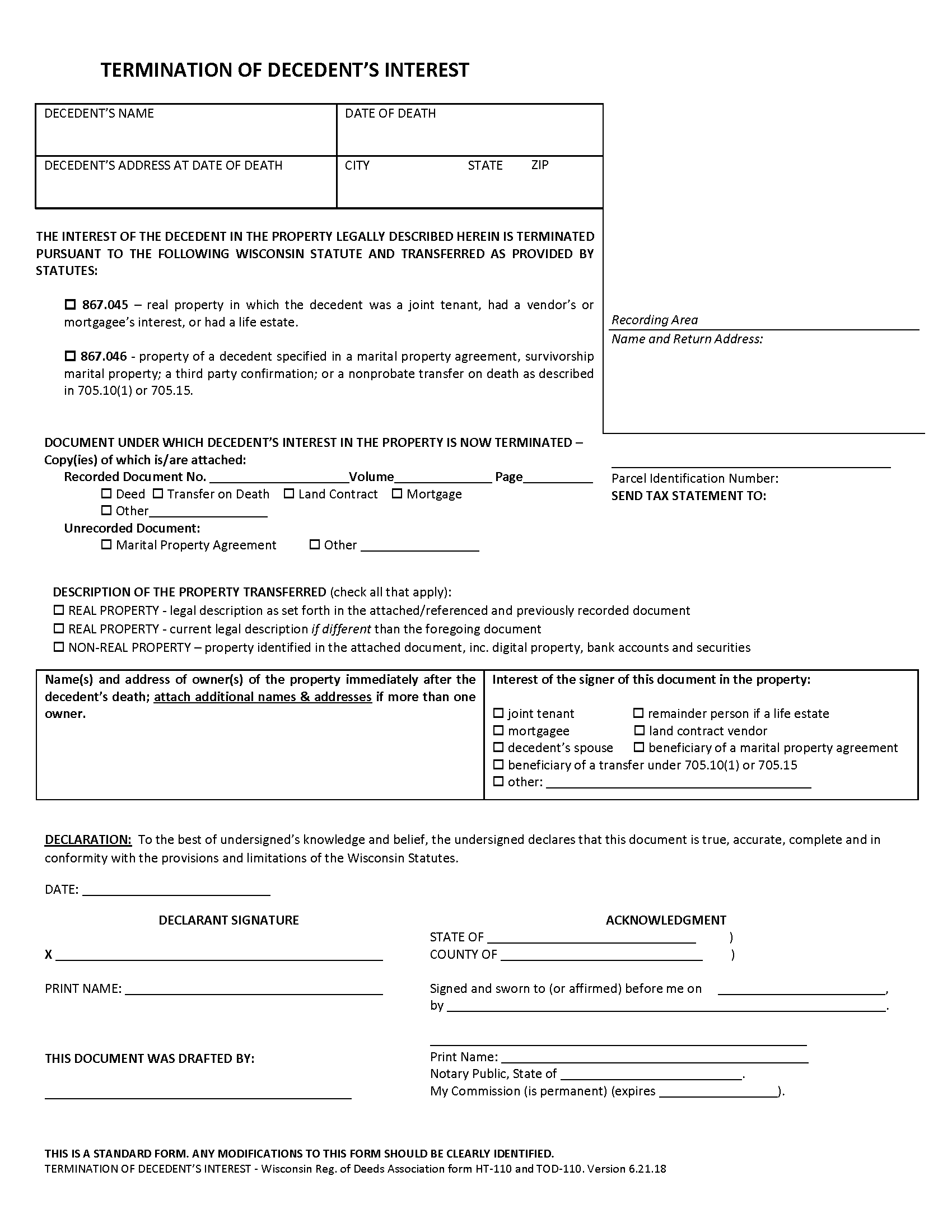

Taylor County Termination of Decedent Property Interest Form

Taylor County Termination of Decedents Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

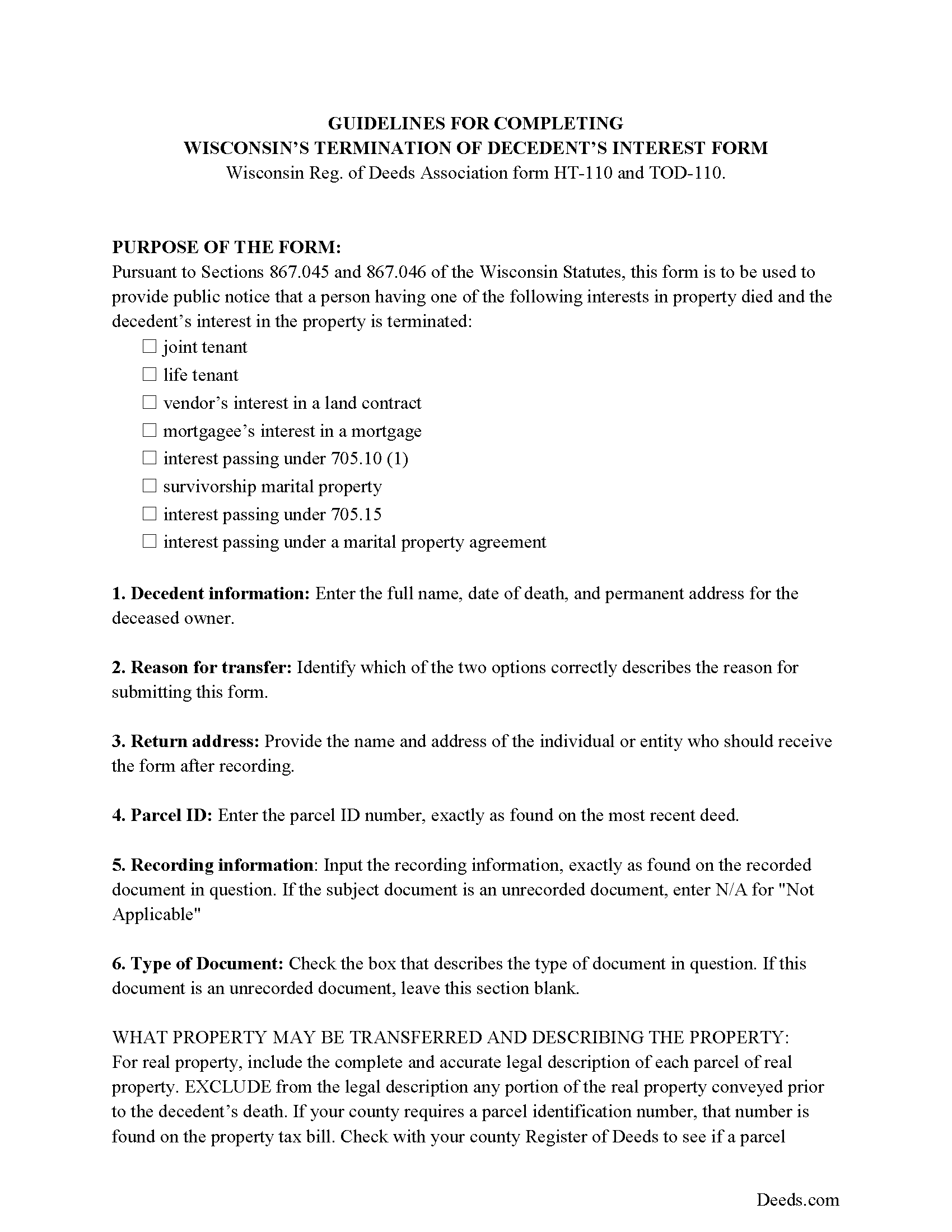

Taylor County Termination of Decedents Interest Guide

Line by line guide explaining every blank on the form.

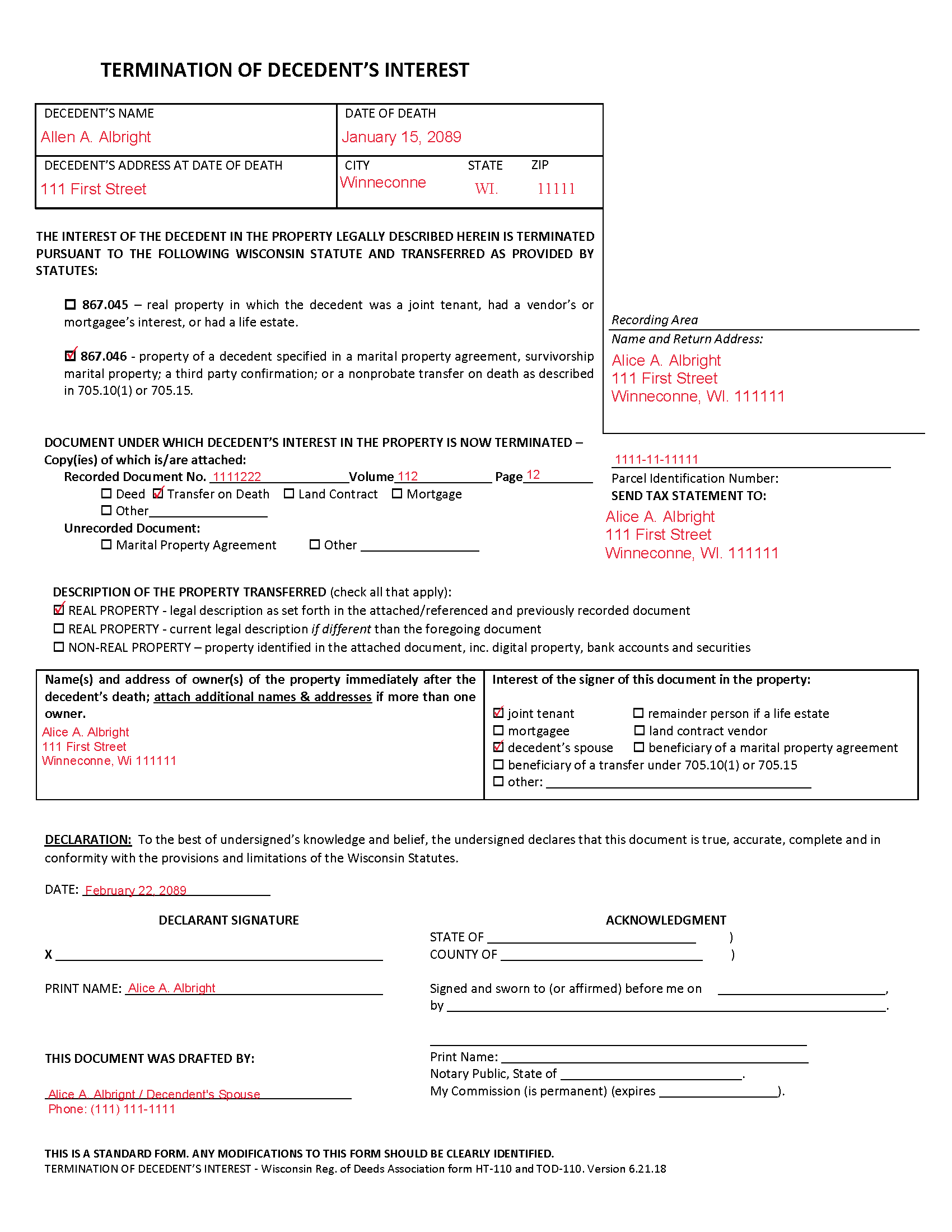

Taylor County Completed Example of the Termination of Decedents Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Taylor County documents included at no extra charge:

Where to Record Your Documents

Taylor County Register of Deeds

Medford, Wisconsin 54451

Hours: 8:30 to 4:30 M-F

Phone: (715) 748-1483

Recording Tips for Taylor County:

- Double-check legal descriptions match your existing deed

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Taylor County

Properties in any of these areas use Taylor County forms:

- Gilman

- Hannibal

- Jump River

- Lublin

- Medford

- Rib Lake

- Stetsonville

- Westboro

Hours, fees, requirements, and more for Taylor County

How do I get my forms?

Forms are available for immediate download after payment. The Taylor County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Taylor County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Taylor County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Taylor County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Taylor County?

Recording fees in Taylor County vary. Contact the recorder's office at (715) 748-1483 for current fees.

Questions answered? Let's get started!

Removing a Deceased Joint Tenant from a Wisconsin Real Estate Deed

Wisconsin laws provide that two or more people may hold real estate as joint tenants with right of survivorship. If one joint tenant dies, his/her share of the property is distributed evenly amongst the remaining co-owners without the need to pass through probate.

To terminate the decedent's interest in the property and to complete the distribution, file a form HT-110 under Wis. Stat. 867.045, with the register of deeds for the county where the property is located.

Recording the form formalizes the transfer of property rights, but the deceased joint tenant's name will still appear on the deed. Complete and record an updated deed from all joint tenants, but identify the deceased co-owner, and convey the property to the survivors only. It might be necessary to provide copies of the original deed, the death certificate, and the recorded HT-110 when submitted the revised deed.

(Wisconsin TODPI Package includes form, guidelines, and completed example)

Important: Your property must be located in Taylor County to use these forms. Documents should be recorded at the office below.

This Termination of Decedent Property Interest meets all recording requirements specific to Taylor County.

Our Promise

The documents you receive here will meet, or exceed, the Taylor County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Taylor County Termination of Decedent Property Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Betty S.

May 2nd, 2022

Thank you for the excellent and complete layout of all forms needed to complete the Affidavit of Death and Heirship, including the notarial officer and an example of how these forms should be completed. This method definitely saves time and money and an answer to my family's Prayers.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel L.

February 11th, 2022

You could make instructions clearer on the download process and when download is complete. You could also group things together for 1 or 2 "big" downloads.

Thank you for your feedback. We really appreciate it. Have a great day!

Jim D.

October 28th, 2020

A bit pricey for someone on a fixed income.

Thank you!

Tisha J.

November 10th, 2021

A quick and efficient way to record! Awesome customer service and SUPER FAST turnaround time.!

Thank you!

Scott R.

September 22nd, 2020

Thanks that was great.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark & Linda W.

December 18th, 2020

Quite simple and easy. Only one critique: It would be easier if the names of the PDF would reflect the name of the deed/form such as 'Controlling tax return' rather than '1579101185SF56863.pdf'. However I love downloading forms rather than mail.

Thank you for your feedback. We really appreciate it. Have a great day!

ANTHONY W.

June 17th, 2020

It's been extremely easy to communicate across this platform.

Thank you!

Kahn B.

May 2nd, 2019

The Quitclaim deed seems pretty simple However I wonder if I can fll out the paper as easily as it looks I appreciate very much the sample and the direction for filling out the deed. Now I am in the process of gathering document to fill out the deed and I think only when after everything done, I may have a clear idea how good the Quitclaim Deed is. I hope I can follow instruction and will successfully done the paperwork. Thank you very much.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna C.

April 1st, 2022

Easy to use.

Thank you!

David K.

April 4th, 2019

Excellent instructions to guide one through the warranty deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Chase J.

June 2nd, 2022

This is the best service. It has made my life so easy when I have to record things with the county! Thanks so much for such a streamlined no hassle process.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steven b.

November 21st, 2021

We used this document in 2018 and it was acceptable to Jackson County Missouri. It worked and is valid. Very happy with the product.

Thanks for the kind words, glad to see you back again. Have a great day!

Bonnie C.

July 28th, 2021

Easy and convenient. Was nice to have just a one time charge without a so-called anual fee/membership. Will use again if needed. May update review after "all is said and done."

Thank you!

Nellouise S.

April 10th, 2019

Documents are ok but I needed to reword some of the verbiage and it cannot be edited without paying a monthly or annual membership. otherwise it is a very nice site.

Thank you for your feedback. We really appreciate it. Have a great day!

Andrew F.

May 25th, 2020

Must admit, I have not really had the chance to search site. Seems to be able to provide good info.

Thank you!