Adams County Transfer on Death to Beneficiary Form

Adams County Transfer on Death to Beneficiary Form

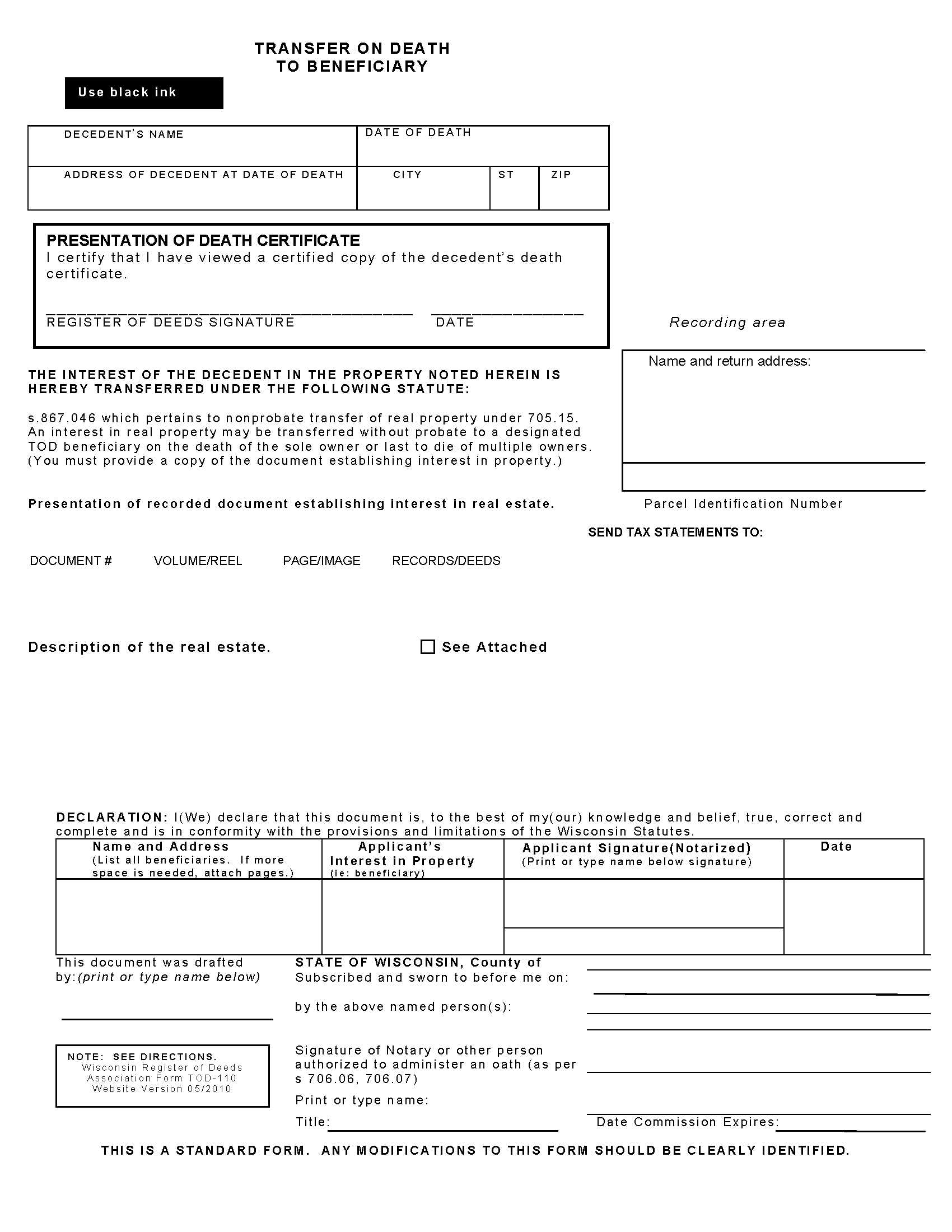

Fill in the blank form formatted to comply with all recording and content requirements.

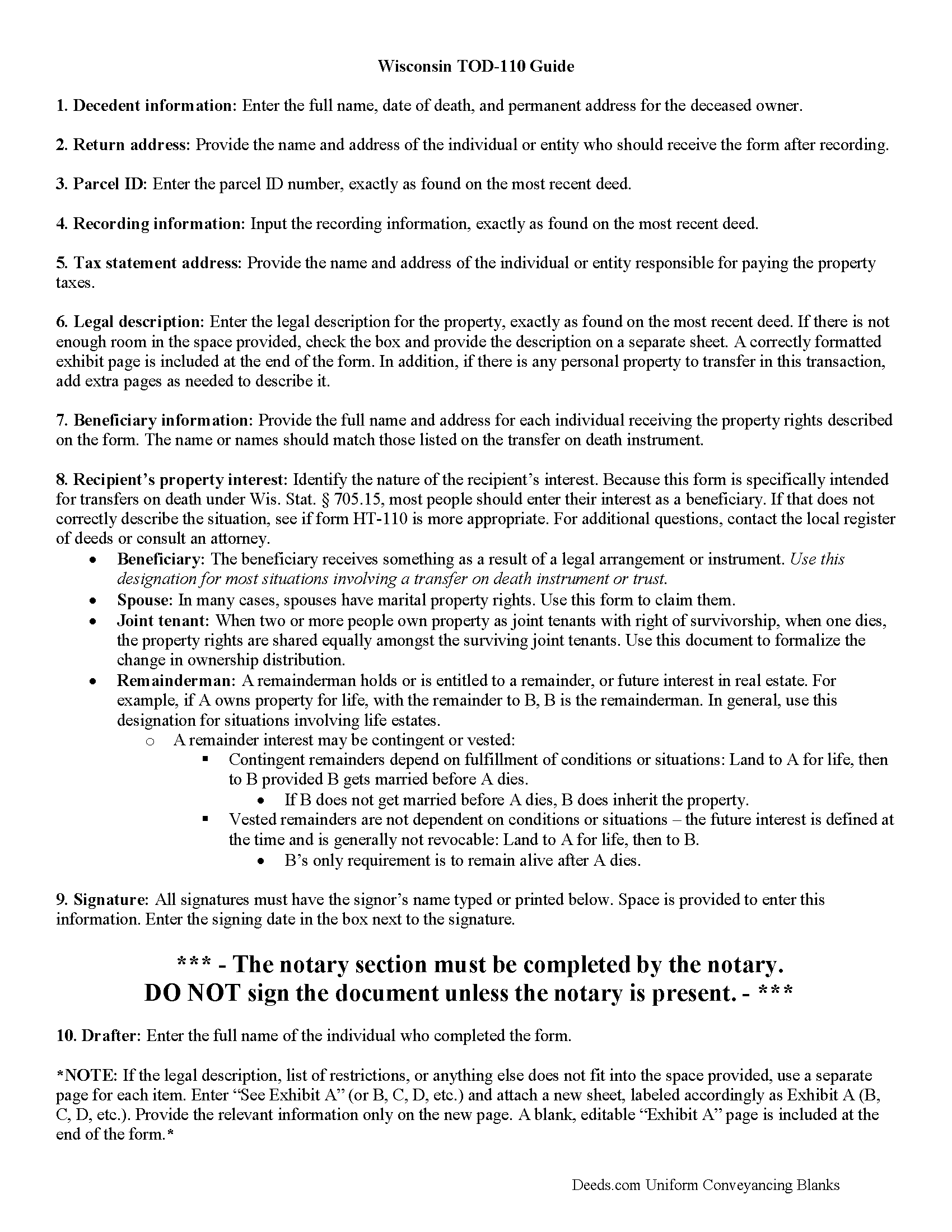

Adams County Transfer on Death to Beneficiary Guide

Line by line guide explaining every blank on the form.

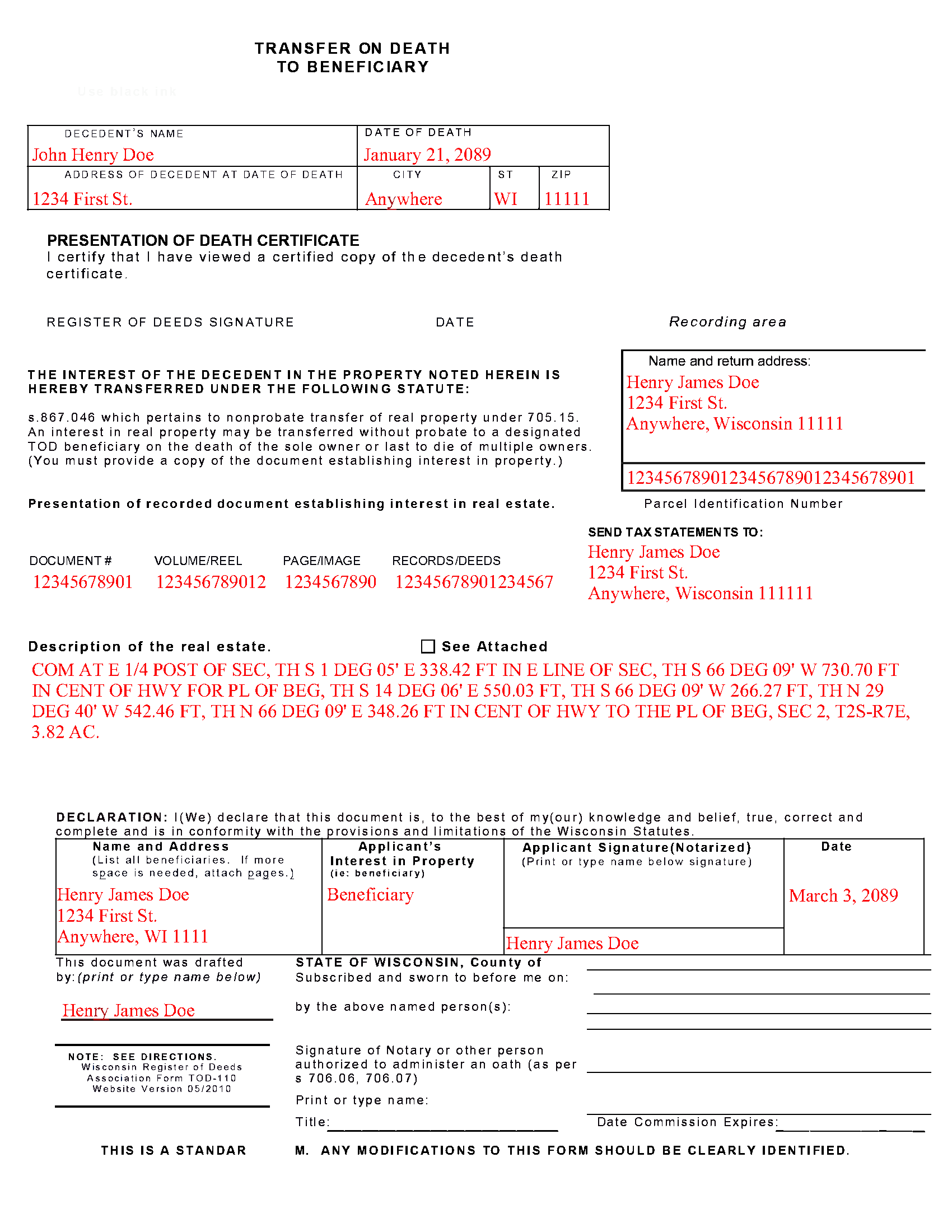

Adams County Completed Example of the Transfer on Death to Beneficiary Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Adams County documents included at no extra charge:

Where to Record Your Documents

Adams County

Friendship, Wisconsin 53934

Hours: Monday - Friday 8:00am - 4:30pm

Phone: 608-339-4206

Recording Tips for Adams County:

- Bring your driver's license or state-issued photo ID

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Adams County

Properties in any of these areas use Adams County forms:

- Adams

- Arkdale

- Dellwood

- Friendship

- Grand Marsh

Hours, fees, requirements, and more for Adams County

How do I get my forms?

Forms are available for immediate download after payment. The Adams County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Adams County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Adams County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Adams County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Adams County?

Recording fees in Adams County vary. Contact the recorder's office at 608-339-4206 for current fees.

Questions answered? Let's get started!

Transfer to Beneficiary -- TOD-110

Completing the Change of Property Rights from a Wisconsin Transfer on Death Deed

When a grantor/owner of real estate under a Wisconsin transfer on death deed dies, the named beneficiary or beneficiaries gain the rights to the property by function of law. Even though this transfer is, in theory, automatic, the best way to ensure accurate and up-to-date ownership records is to file a completed and notarized transfer on death to beneficiary form TOD-110 with the register of deeds for the county where the land is located. By recording this document, the new owner formalizes the transfer and provides public notice of the new status.

(Wisconsin TOD to Beneficiary Package includes form, guidelines, and completed example)

Important: Your property must be located in Adams County to use these forms. Documents should be recorded at the office below.

This Transfer on Death to Beneficiary meets all recording requirements specific to Adams County.

Our Promise

The documents you receive here will meet, or exceed, the Adams County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Adams County Transfer on Death to Beneficiary form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Joanna L.

September 12th, 2019

This is a great tool. It is easy to use and saves me a lot of time.

Thank you for your feedback. We really appreciate it. Have a great day!

Joni S.

February 6th, 2024

Excellent service, no hassle, easy to use, affordable, best service -- hands down. I thought it would be difficult for me to record a deed in Florida while residing in California but you made it so easy. I will tell everyone about your service. Thank you.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

William M.

May 22nd, 2021

On multiple tries, I could not get validation mail through my Yahoo email address. I tried Gmail, worked the first time. The rest of the process was super easy and fast.

Thank you!

Vicki G.

November 24th, 2020

Thank you for this service, saved me from driving down town. It was quick and very easy to navigate. Have a great Thanksgiving break.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin B.

January 14th, 2025

Ordered the Ohio Land Contract forms for Jefferson County. It was an awesome purchase for $28 bucks. Easy and straight forward for someone like me with no real estate background to make my own land contract and save a couple grand hiring an attorney to copy and paste one to me. I'll be buying the same package for every county I invest in!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Gerald S.

November 7th, 2020

Very pleased with the services provided by deeds.com. Quick response time after information was provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William V.

July 18th, 2021

I finally got it. Thanks, William Vickery

Thank you!

Doreen A.

February 13th, 2024

Easy to navigate Efficient Service

Your kind words warm our hearts. Thank you for sharing your experience!

Kellie Z.

December 4th, 2020

Wow! So much simpler & faster than I had expected. I had thought it would take weeks to get filed & took days- yea! Super easy & speedy!

Thank you!

Debby R.

July 6th, 2021

Very easy to use

Thank you!

Jacqueline B.

November 7th, 2020

Very easy process to have this document recorded through Deeds.com! The amount of time it saved me was greatly appreciated. highly recommend Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Shane S.

May 1st, 2021

Great forms, exactly what I needed. Easy to understand. No problems recording. Thanks!

Thank you!

Michael H.

July 30th, 2019

Found documents I needed quickly and at a reasonable price. MH

Thank you for your feedback. We really appreciate it. Have a great day!

Ken D.

August 17th, 2021

The service was easy, fast, and worked well. I will be back.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jacqueline C.

August 15th, 2019

Was relieved to see your site actually delivered what I paid for.

Thank you!