Crawford County Transfer on Death to Beneficiary Form

Crawford County Transfer on Death to Beneficiary Form

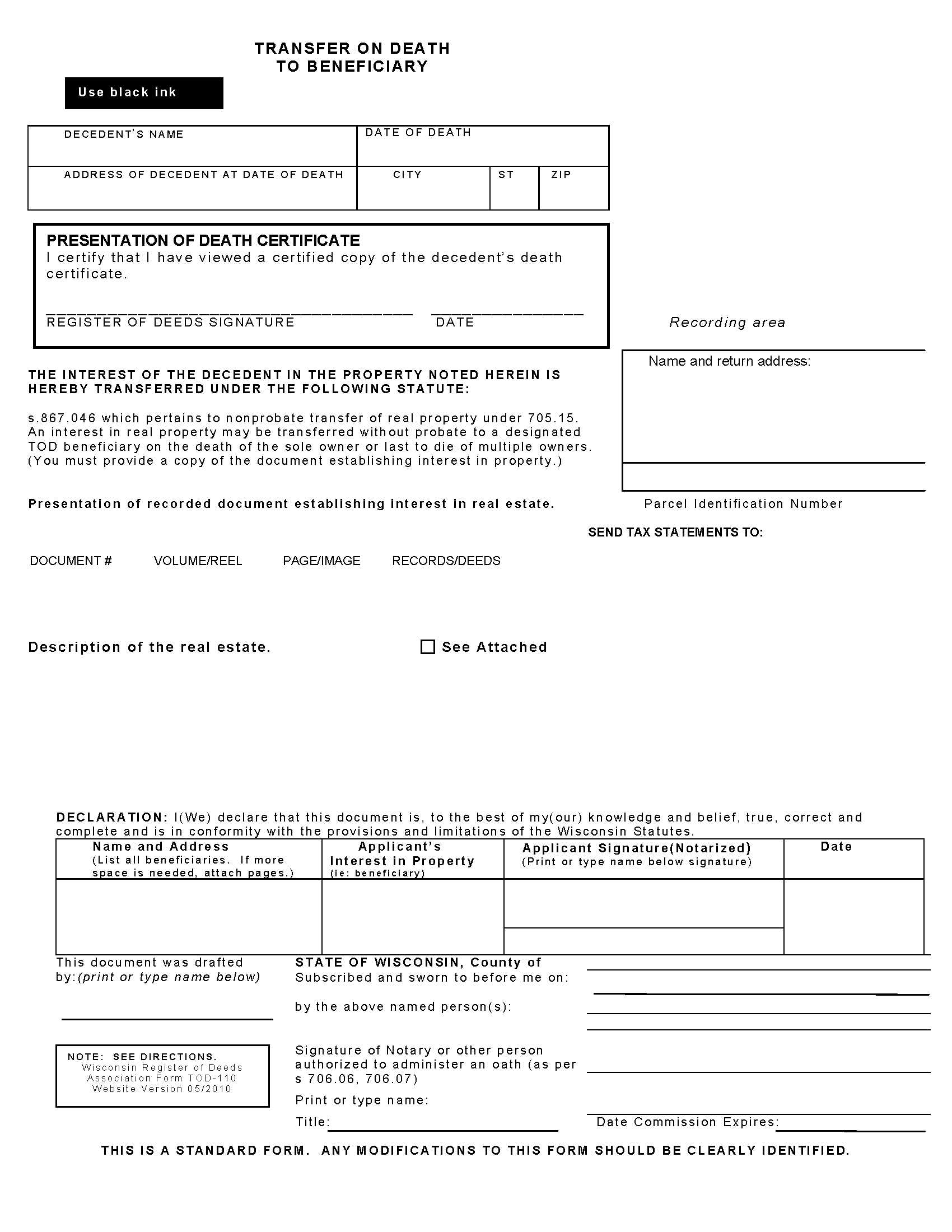

Fill in the blank form formatted to comply with all recording and content requirements.

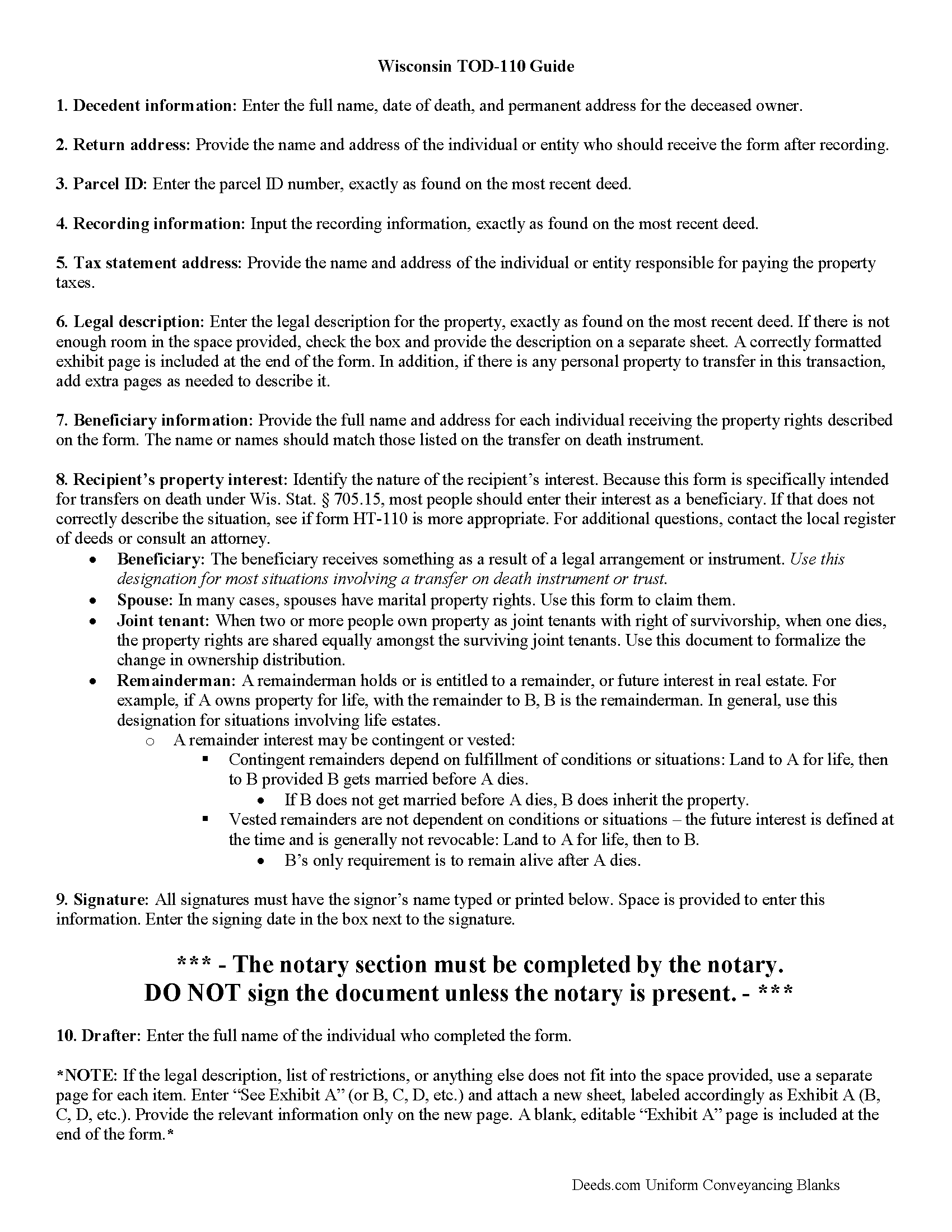

Crawford County Transfer on Death to Beneficiary Guide

Line by line guide explaining every blank on the form.

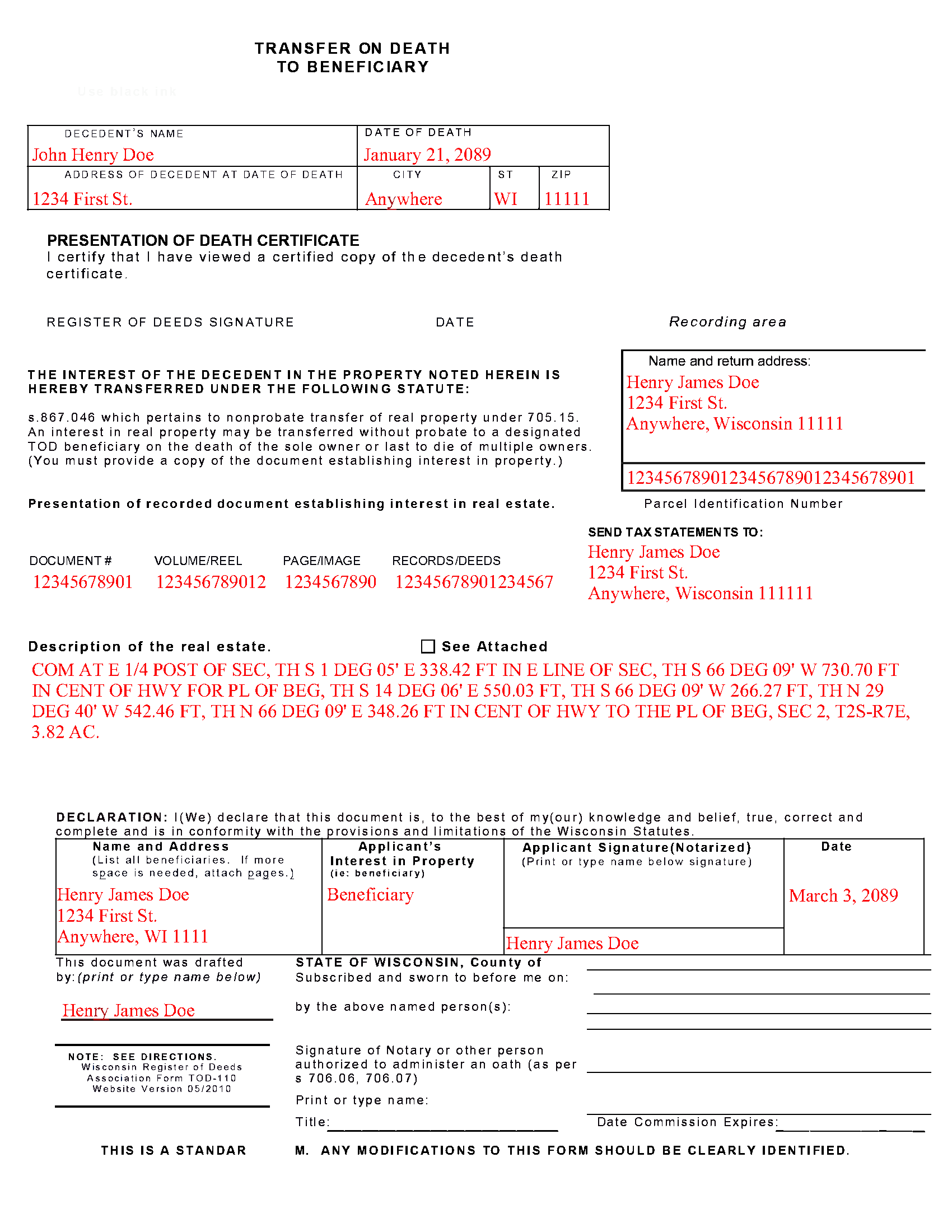

Crawford County Completed Example of the Transfer on Death to Beneficiary Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Crawford County documents included at no extra charge:

Where to Record Your Documents

Crawford County Register of Deeds

Prairie du Chien, Wisconsin 53821

Hours: Monday - Friday 8:00 am - 4:30 pm

Phone: (608) 326-0216, 0219

Recording Tips for Crawford County:

- Ask if they accept credit cards - many offices are cash/check only

- Check margin requirements - usually 1-2 inches at top

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Crawford County

Properties in any of these areas use Crawford County forms:

- Eastman

- Ferryville

- Gays Mills

- Lynxville

- Mount Sterling

- Prairie Du Chien

- Seneca

- Soldiers Grove

- Steuben

- Wauzeka

Hours, fees, requirements, and more for Crawford County

How do I get my forms?

Forms are available for immediate download after payment. The Crawford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Crawford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Crawford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Crawford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Crawford County?

Recording fees in Crawford County vary. Contact the recorder's office at (608) 326-0216, 0219 for current fees.

Questions answered? Let's get started!

Transfer to Beneficiary -- TOD-110

Completing the Change of Property Rights from a Wisconsin Transfer on Death Deed

When a grantor/owner of real estate under a Wisconsin transfer on death deed dies, the named beneficiary or beneficiaries gain the rights to the property by function of law. Even though this transfer is, in theory, automatic, the best way to ensure accurate and up-to-date ownership records is to file a completed and notarized transfer on death to beneficiary form TOD-110 with the register of deeds for the county where the land is located. By recording this document, the new owner formalizes the transfer and provides public notice of the new status.

(Wisconsin TOD to Beneficiary Package includes form, guidelines, and completed example)

Important: Your property must be located in Crawford County to use these forms. Documents should be recorded at the office below.

This Transfer on Death to Beneficiary meets all recording requirements specific to Crawford County.

Our Promise

The documents you receive here will meet, or exceed, the Crawford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Crawford County Transfer on Death to Beneficiary form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Sarah N.

July 3rd, 2019

This is not at all the form that I needed. I am trying to disclaim my interest in a property, but this form is much too rigid to work for my case. It would have been nice to know some of the more specific details before purchasing the document.

Thank you for your feedback. Sorry hear of your confusion. We have canceled your order and payment. We do hope that you are able to find something more suitable to your needs. Have a wonderful day.

tim r.

August 15th, 2019

easy sight and extra forms that I can use any time

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michelle I.

April 19th, 2022

I'm happy to have found your service. Very pleased.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gertrude F.

April 24th, 2022

I like that DEEDS.com has a variety of forms tht I may need. However, I was disappointed that I am not able to save the PDF forms after I fill in the spaces. If I need to edit anything, I have to go back to the blank form and redo the whole thing. Perhap I am doing something wrong.

Thank you!

Ena D.

May 5th, 2021

Very easy process. great customer service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura R.

August 13th, 2022

Afficavit worked kind of pricey

Thank you for your feedback. We really appreciate it. Have a great day!

patricia l.

February 16th, 2019

found this site very easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Amy R.

November 18th, 2021

Great personal support via messaging. Website confusing and broken links in emails.

Thank you!

Deborah C.

April 30th, 2022

I just printed out my documents and they are so helpful. Now I will sit and fill out my documents and submit them to the PG County deed Office. Thanks for having this infomation online. Regards,

Thank you!

Larry L.

July 12th, 2022

Great product, worked as it advertised.

Thank you!

Charlene H.

July 22nd, 2025

Deeds.com is a wonderful website. I highly recommend them and would use them again in the future.

Thank you, Charlene! We're so glad to hear you had a great experience. We truly appreciate your recommendation and look forward to helping you again in the future.

Candace K.

April 1st, 2021

I was able to find the Certificate of Trust after a little searching. Once found, the remainder of the process was easy. My task was done in no time. It's a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

Peggy H.

December 9th, 2022

Very good!

Thank you!

Ardith T.

May 18th, 2020

Very clear and complete. Good value.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael L.

December 28th, 2018

I accidentally ordered the wrong deed package. Was looking for a quit claim deed and got a trustee deed. I immediately emailed the company, nothing back from them. I would like to exchange my purchase.

Thank you for your feedback. We replied to your message on December 20th at 2:05 pm, the reply was as follows: As a one time courtesy we have canceled your order/payment for the Trustee Deed document.