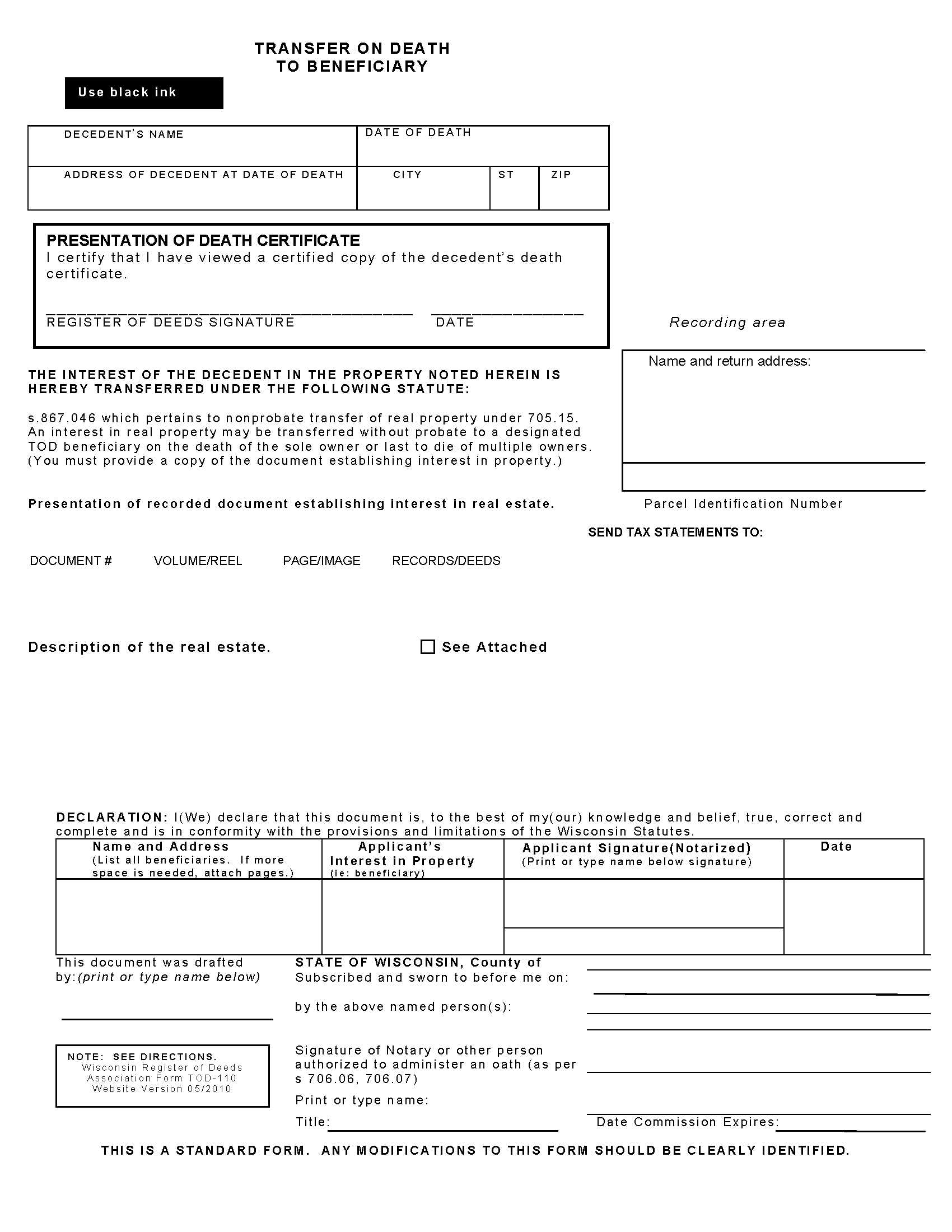

Kenosha County Transfer on Death to Beneficiary Form

Kenosha County Transfer on Death to Beneficiary Form

Fill in the blank form formatted to comply with all recording and content requirements.

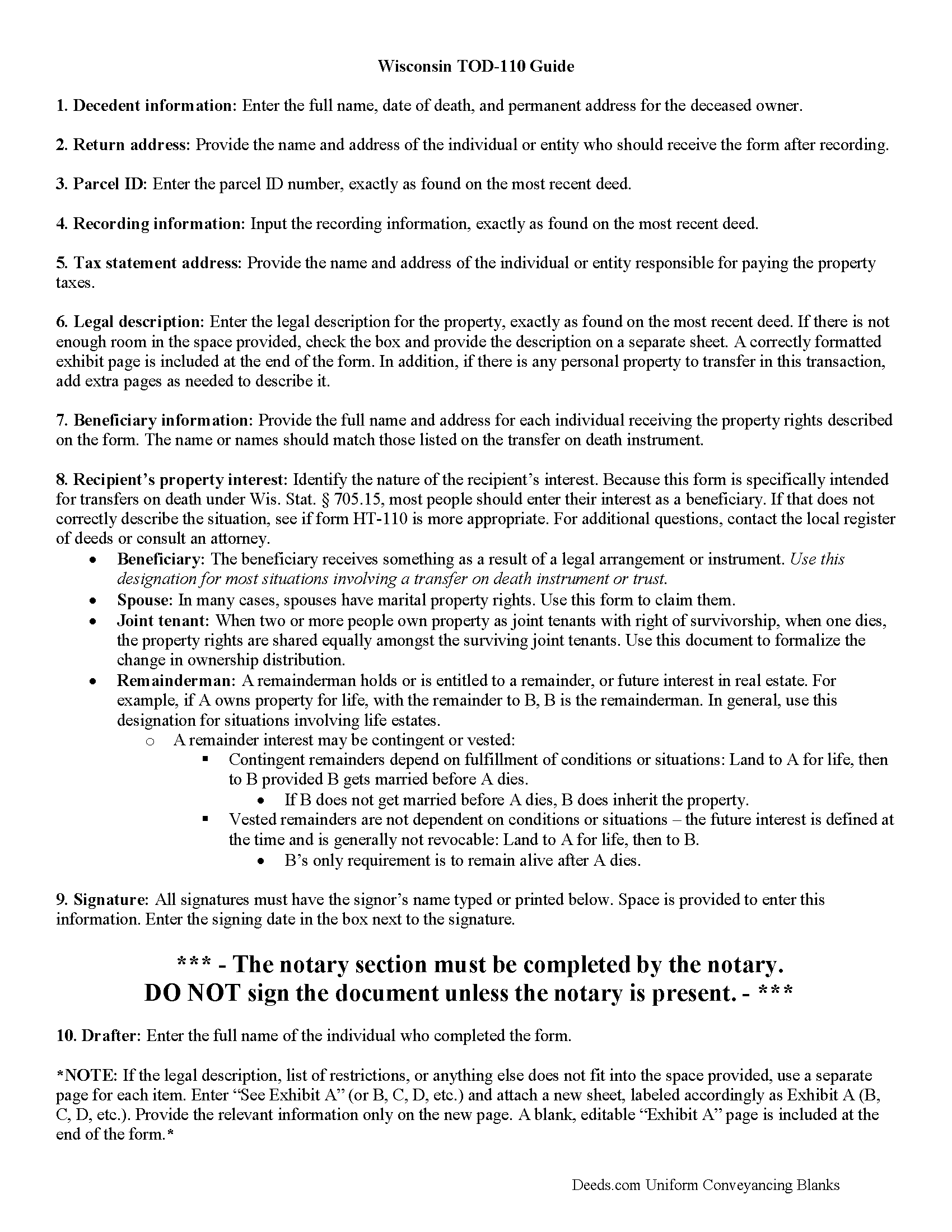

Kenosha County Transfer on Death to Beneficiary Guide

Line by line guide explaining every blank on the form.

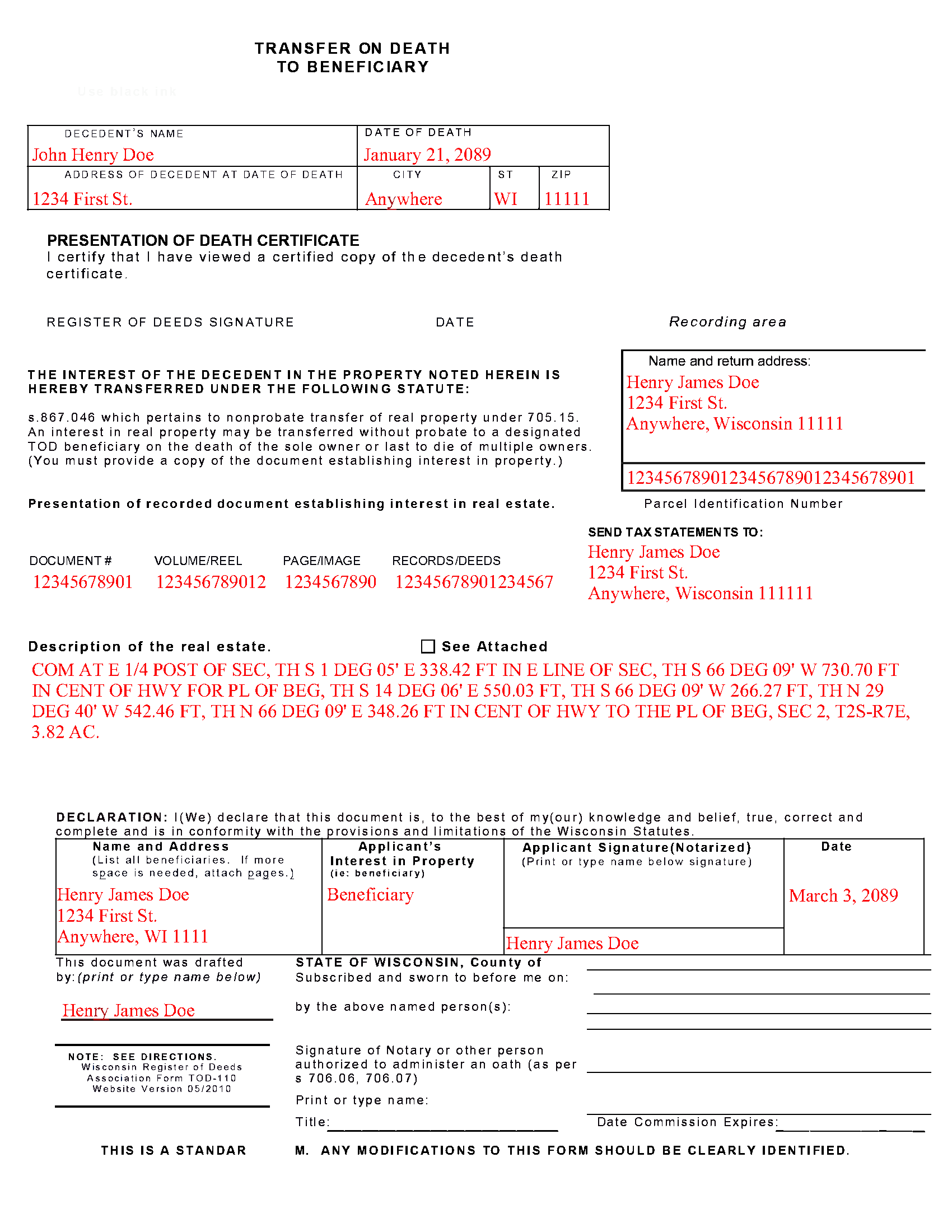

Kenosha County Completed Example of the Transfer on Death to Beneficiary Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Kenosha County documents included at no extra charge:

Where to Record Your Documents

Kenosha County Register

Kenosha, Wisconsin 53140

Hours: 8:00 to 5:00 Mon-Fri

Phone: (262) 653-2441

County Center Satellite Station

Bristol, Wisconsin 53104

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: 262-857-1845

Recording Tips for Kenosha County:

- Documents must be on 8.5 x 11 inch white paper

- Leave recording info boxes blank - the office fills these

- Both spouses typically need to sign if property is jointly owned

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Kenosha County

Properties in any of these areas use Kenosha County forms:

- Bassett

- Benet Lake

- Bristol

- Camp Lake

- Kenosha

- New Munster

- Pleasant Prairie

- Powers Lake

- Salem

- Silver Lake

- Somers

- Trevor

- Twin Lakes

- Wilmot

- Woodworth

Hours, fees, requirements, and more for Kenosha County

How do I get my forms?

Forms are available for immediate download after payment. The Kenosha County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kenosha County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kenosha County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kenosha County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kenosha County?

Recording fees in Kenosha County vary. Contact the recorder's office at (262) 653-2441 for current fees.

Questions answered? Let's get started!

Transfer to Beneficiary -- TOD-110

Completing the Change of Property Rights from a Wisconsin Transfer on Death Deed

When a grantor/owner of real estate under a Wisconsin transfer on death deed dies, the named beneficiary or beneficiaries gain the rights to the property by function of law. Even though this transfer is, in theory, automatic, the best way to ensure accurate and up-to-date ownership records is to file a completed and notarized transfer on death to beneficiary form TOD-110 with the register of deeds for the county where the land is located. By recording this document, the new owner formalizes the transfer and provides public notice of the new status.

(Wisconsin TOD to Beneficiary Package includes form, guidelines, and completed example)

Important: Your property must be located in Kenosha County to use these forms. Documents should be recorded at the office below.

This Transfer on Death to Beneficiary meets all recording requirements specific to Kenosha County.

Our Promise

The documents you receive here will meet, or exceed, the Kenosha County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kenosha County Transfer on Death to Beneficiary form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Melanie K.

December 27th, 2019

Great service! Super easy to use! I used the service to download a deed notice to do a TOD on a property in Fairfax County, VA. Just a heads up that Fairfax County required me to add the last deed book and page # onto the deed notice but otherwise all was just as they required!

Thank you!

Gayela C.

September 13th, 2019

Easy to use and I really like having the guides that come along with the forms.

Thank you!

GISELLE G.

May 26th, 2022

Quick and easy. I will definitely use this services again.

Thank you!

luisana w.

September 9th, 2022

Super easy, excellente

Thank you!

Barbara P.

March 18th, 2025

Easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Byron M.

March 10th, 2022

This is a great service and a time saver for the company. We get fast responses and a detailed explanation if something additional is needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa G.

January 4th, 2019

Rec'd downloads for quitclaim deed process in Florida. Recorded with the clerk of courts today and the form was done perfectly--she had no changes to make. Well worth the money--thanks

Glad to hear Lisa, we appreciate you taking the time to leave your feedback.

Regina A.

February 19th, 2019

I needed to look for a recorded document and found what I was looking for. Thank you for the great service.

Thank you for your feedback. We really appreciate it. Have a great day!

Lucille F.

December 9th, 2019

Instructions very detailed and clear.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin C.

August 10th, 2022

Nice site but $30 to download a blank form is a bit much.

Thank you for your feedback. We really appreciate it. Have a great day!

Dyanna B.

April 23rd, 2024

Got what I needed. Easy access.

Thank you for your positive words! We’re thrilled to hear about your experience.

Anita W.

June 18th, 2020

Love this site. It has been truly helpful and easy to navigate.

Thank you Anita, glad we could help.

Judie G.

February 2nd, 2022

Review: Forms are on point, to the point, and cover the vast majority of situations. Would not suggest if your deal is overly complicated but most situations are not complicated at all.

Thank you!

Suzan B.

July 24th, 2019

Using Deeds.com could not have been easier. The examples and line-by-line instructions helped a lot! I am so glad I found you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan Mary S.

August 24th, 2020

Thank you for the thorough assortment of forms!

Thank you for your feedback. We really appreciate it. Have a great day!