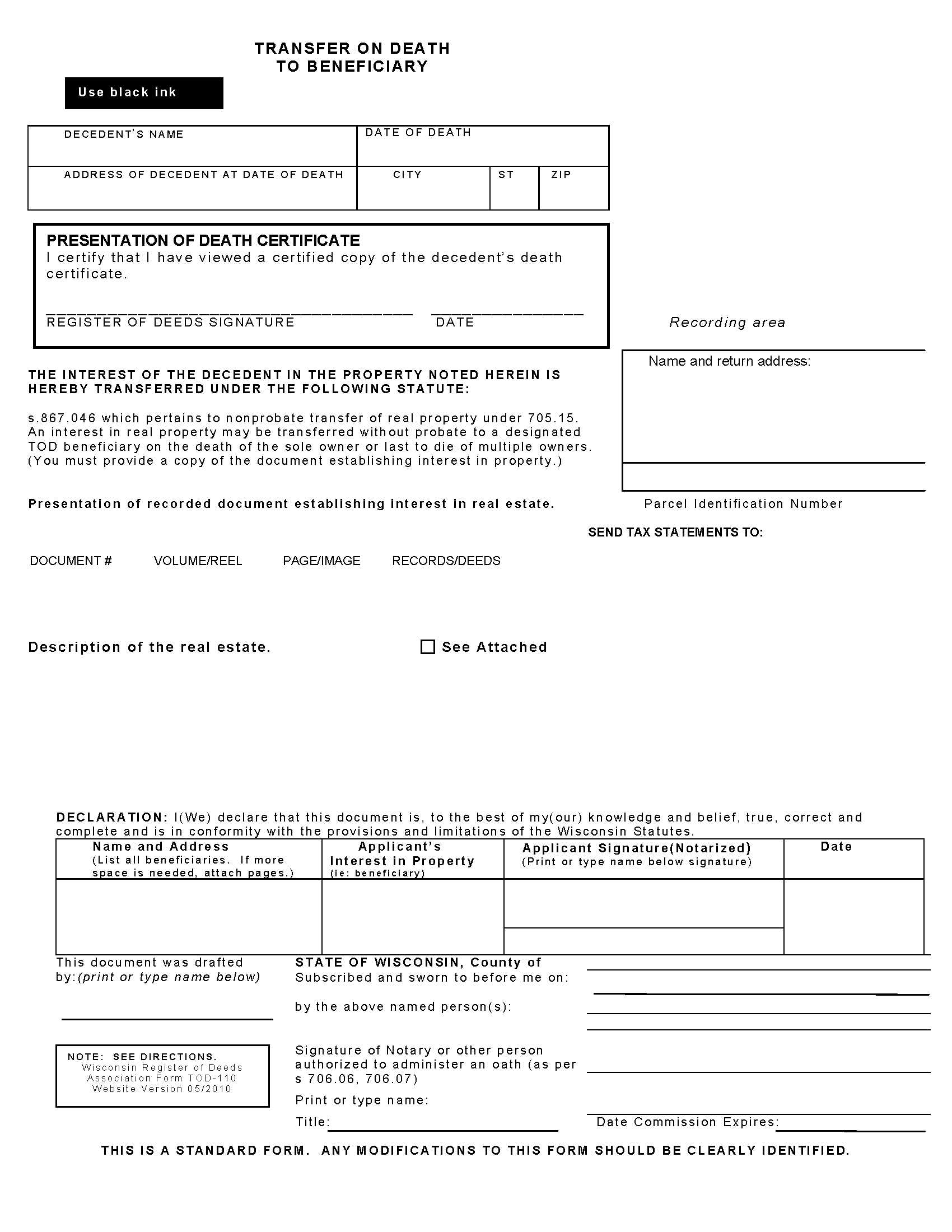

Sawyer County Transfer on Death to Beneficiary Form

Sawyer County Transfer on Death to Beneficiary Form

Fill in the blank form formatted to comply with all recording and content requirements.

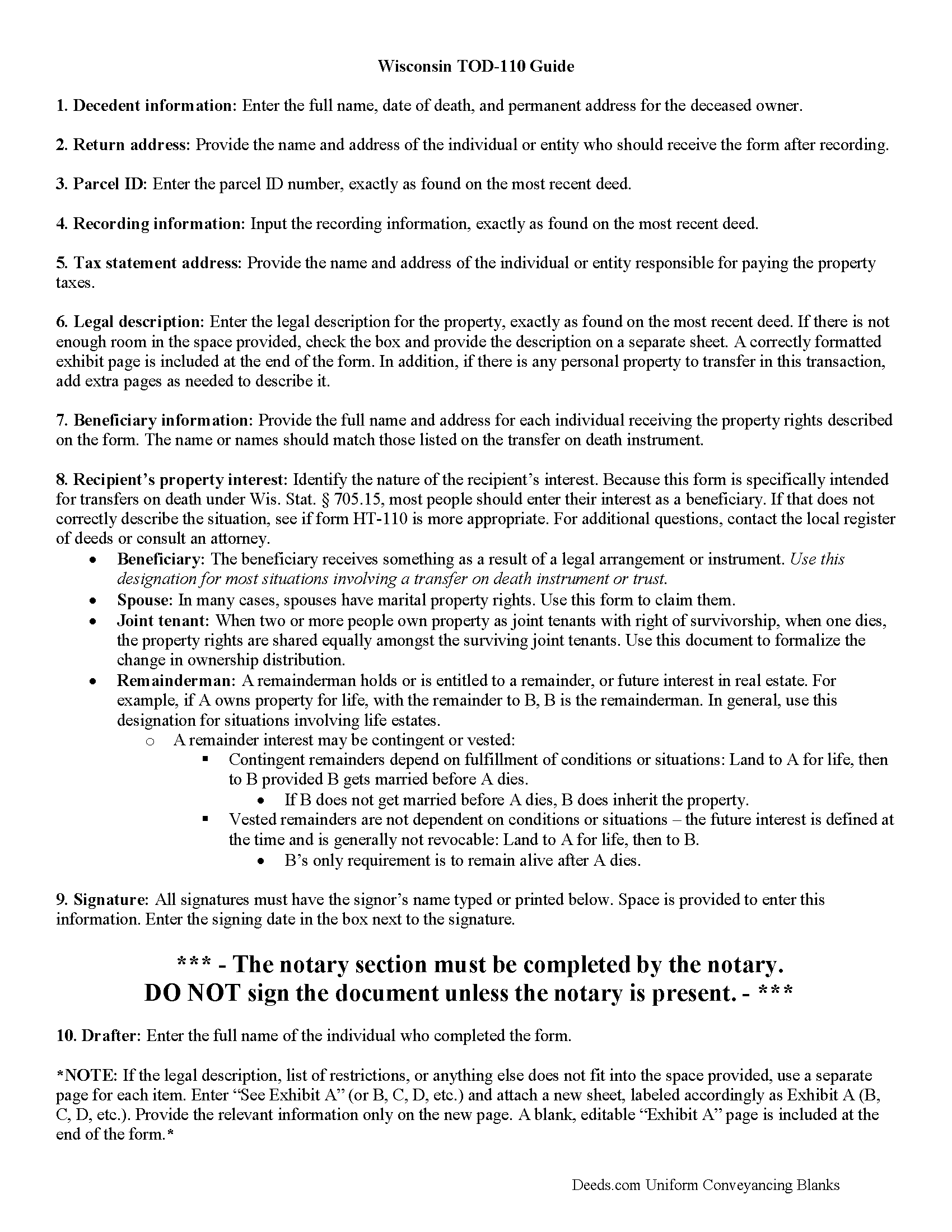

Sawyer County Transfer on Death to Beneficiary Guide

Line by line guide explaining every blank on the form.

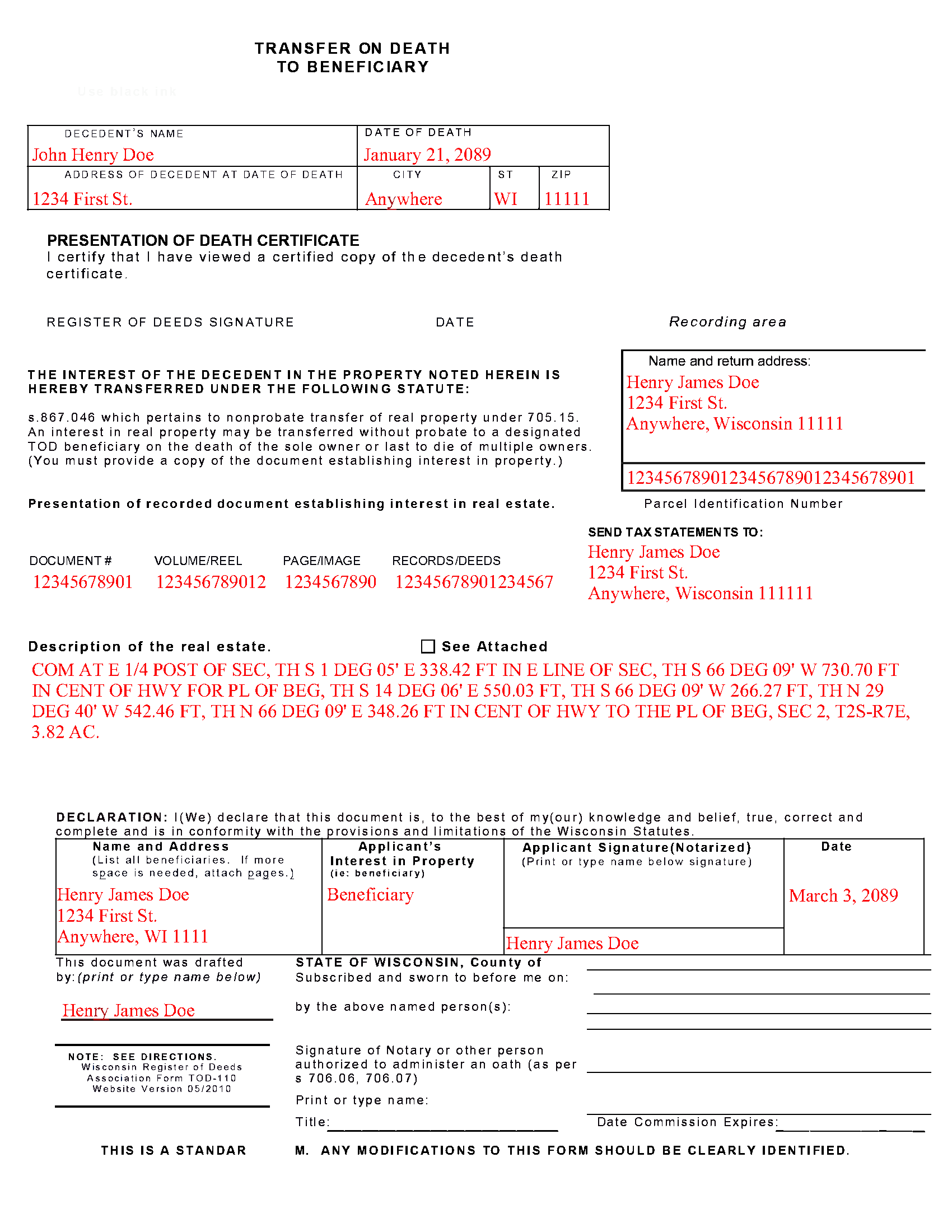

Sawyer County Completed Example of the Transfer on Death to Beneficiary Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Sawyer County documents included at no extra charge:

Where to Record Your Documents

Sawyer County Register of Deeds

Hayward, Wisconsin 54843-6584

Hours: Monday - Friday 8:00 am - 4:00 pm

Phone: (715) 634-4867

Recording Tips for Sawyer County:

- Documents must be on 8.5 x 11 inch white paper

- Request a receipt showing your recording numbers

- Leave recording info boxes blank - the office fills these

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Sawyer County

Properties in any of these areas use Sawyer County forms:

- Couderay

- Edgewater

- Exeland

- Hayward

- Ojibwa

- Radisson

- Stone Lake

- Winter

Hours, fees, requirements, and more for Sawyer County

How do I get my forms?

Forms are available for immediate download after payment. The Sawyer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sawyer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sawyer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sawyer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sawyer County?

Recording fees in Sawyer County vary. Contact the recorder's office at (715) 634-4867 for current fees.

Questions answered? Let's get started!

Transfer to Beneficiary -- TOD-110

Completing the Change of Property Rights from a Wisconsin Transfer on Death Deed

When a grantor/owner of real estate under a Wisconsin transfer on death deed dies, the named beneficiary or beneficiaries gain the rights to the property by function of law. Even though this transfer is, in theory, automatic, the best way to ensure accurate and up-to-date ownership records is to file a completed and notarized transfer on death to beneficiary form TOD-110 with the register of deeds for the county where the land is located. By recording this document, the new owner formalizes the transfer and provides public notice of the new status.

(Wisconsin TOD to Beneficiary Package includes form, guidelines, and completed example)

Important: Your property must be located in Sawyer County to use these forms. Documents should be recorded at the office below.

This Transfer on Death to Beneficiary meets all recording requirements specific to Sawyer County.

Our Promise

The documents you receive here will meet, or exceed, the Sawyer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sawyer County Transfer on Death to Beneficiary form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4591 Reviews )

Gretchen B.

June 22nd, 2021

I wanna give more stars because the required information is there, but the character spacing is disjointed on the first page, rendering a gap-filled, awkward-looking document. Also, the opening parenthesis for the first field on the first page is on the wrong line and is backwards, which sets the wrong tone especially since it's the first thing you have to fill out.

Thank you for your feedback. We really appreciate it. Have a great day!

Amie S.

January 8th, 2019

The forms that I downloaded from Deeds were perfect for what I needed. I even checked with a lawyer to see if the papers would work and she said yes.

Thanks Amie, have a great day!

David D.

February 11th, 2019

Quick, easy, thorough, reasonable price. Much better than trying to contact a paralegal (who do not usually respond quickly, it seems)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary N.

January 13th, 2021

Very easy to use.

Thank you Mary.

Hope A.

June 4th, 2021

Great Website and layout!! so easy!

Thank you!

Jane D.

February 5th, 2021

Very easy to navigate and we get exactly what we need, when we need it! Also, they keep Tra k of previous purchases, so you don't have to repurchase! It's great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard E.

January 3rd, 2019

Very easy. I copied each doc separately. Is there a way to copy the all docs at once into a folder? Thanks for being there. Rich

Thank you for the feedback Richard. Currently there is no way to download all of the documents at once but we'll definitely look into it. Have a great day!

Lori S.

April 19th, 2022

The documents I created on deeds com turned out beautiful and very professional looking. The example they gave along with the instruction booklet made it very easy t create a professional looking document for our land Sale. I was very pleased with how easy it was and would recommend it to anyone needing professional documents without having to go thru an attorney or title company. I was very impressed!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jenine E.

April 4th, 2021

The information seems complete and accurate. The form was easy to use and save. I'll let you know if we encounter problems getting the deed processed.

Thank you for your feedback. We really appreciate it. Have a great day!

KAREN I.

May 14th, 2024

it worked. fantastic. thanks!

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

James M.

November 23rd, 2020

Clear and easy instructions! Prompt notices of steps and status. Great job! I wish all counties in all states were this easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis T.

November 23rd, 2019

I liked the service very much. The form I ordered wasn't provided by the local government agency and I couldn't find it on the internet. I liked that the form came with easy to follow, line by line, instructions and a sample. I also appreciated that I wasn't forced to take on a trial membership to keep me on the hook. I would definitely use this service again in the future!

Thank you for your feedback. We really appreciate it. Have a great day!

Maria Lucy A.

August 5th, 2020

Very good service. Directions were easy to follow to obtain the document I needed.

Thank you!

Bonnie C.

July 28th, 2021

Easy and convenient. Was nice to have just a one time charge without a so-called anual fee/membership. Will use again if needed. May update review after "all is said and done."

Thank you!

DARRYL B.

June 16th, 2020

Professional and convenient.

Thank you for your feedback. We really appreciate it. Have a great day!