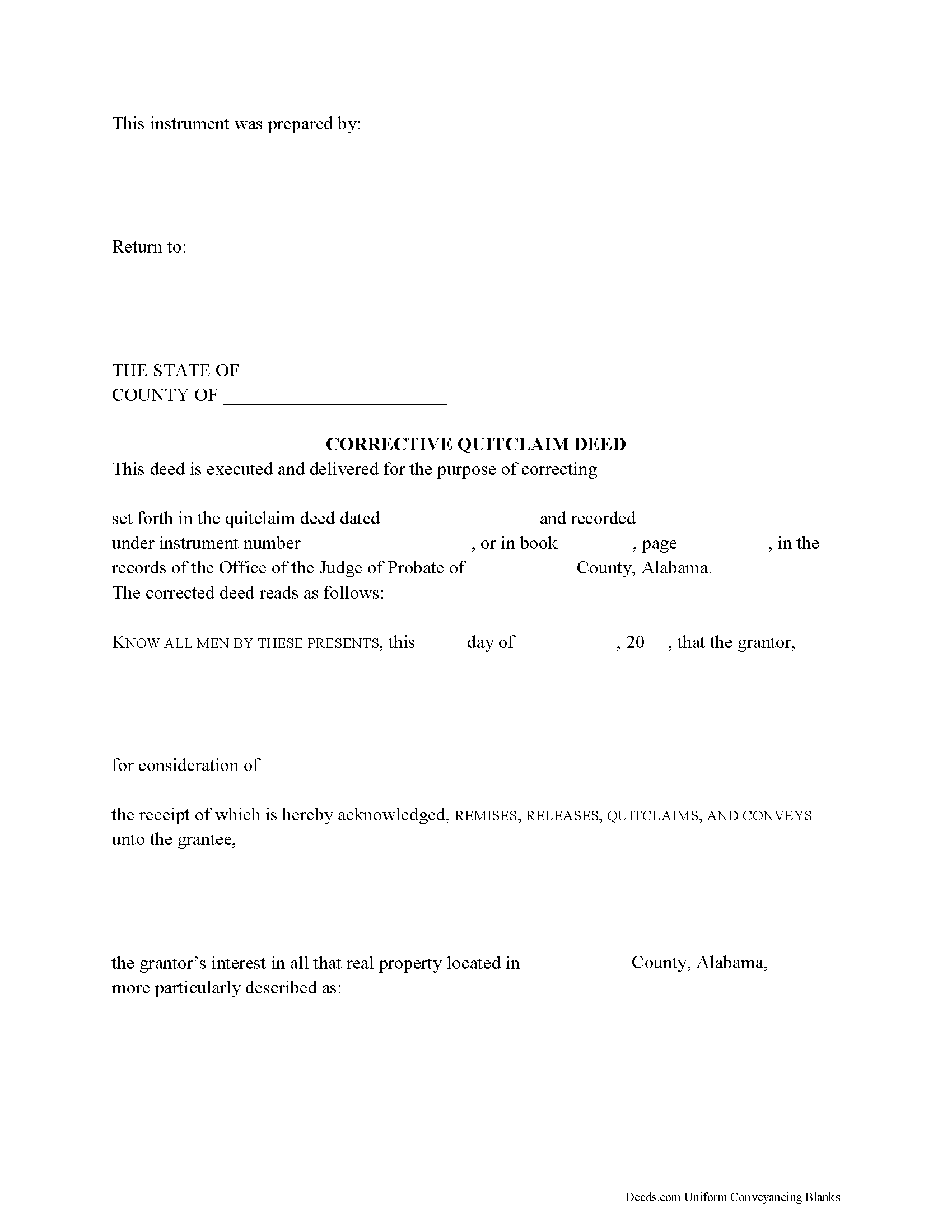

Marshall County Correction Quitclaim Deed Form

Marshall County Correction Quitclaim Deed Form

Fill in the blank Correction Quitclaim Deed form formatted to comply with all Alabama recording and content requirements.

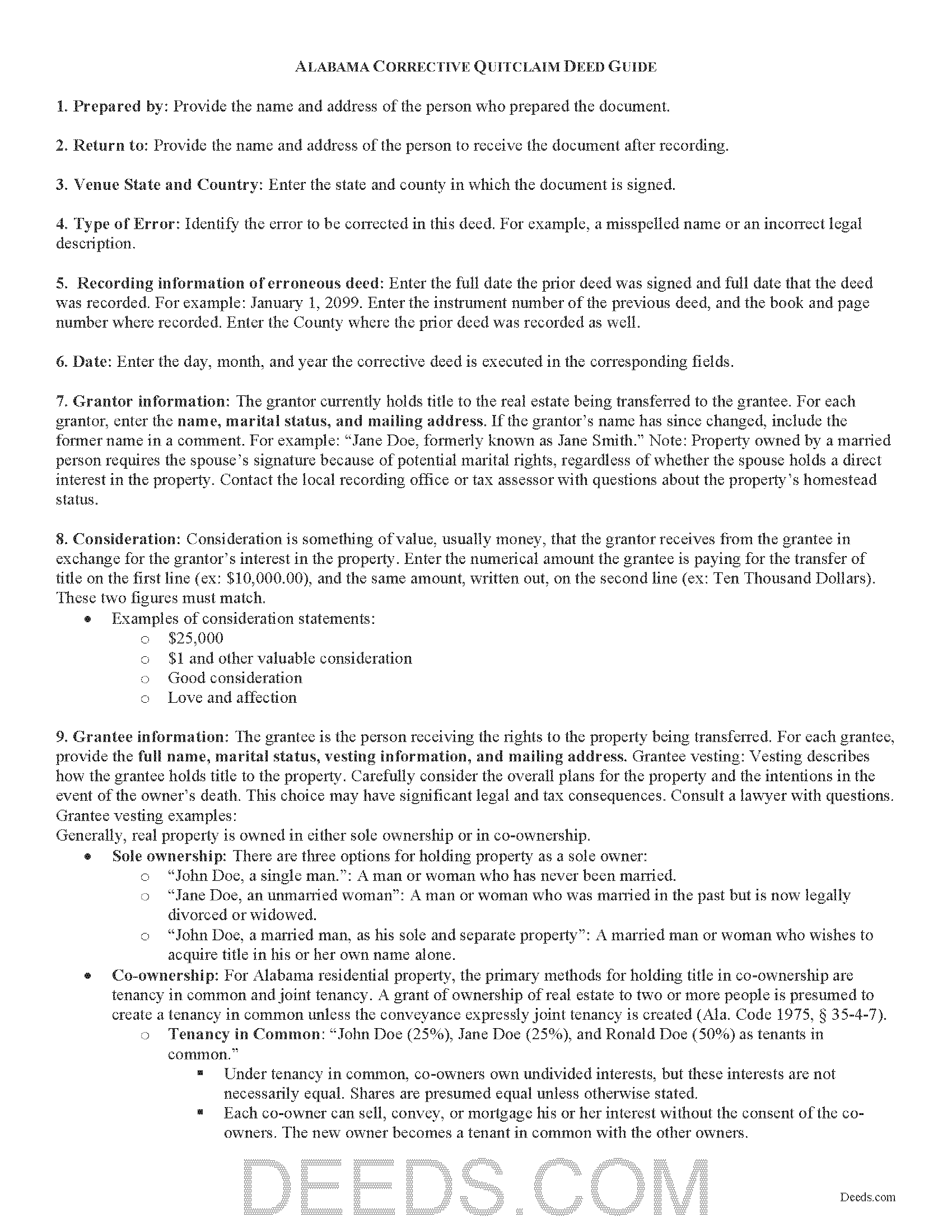

Marshall County Correction Quitclaim Deed Guide

Line by line guide explaining every blank on the Correction Quitclaim Deed form.

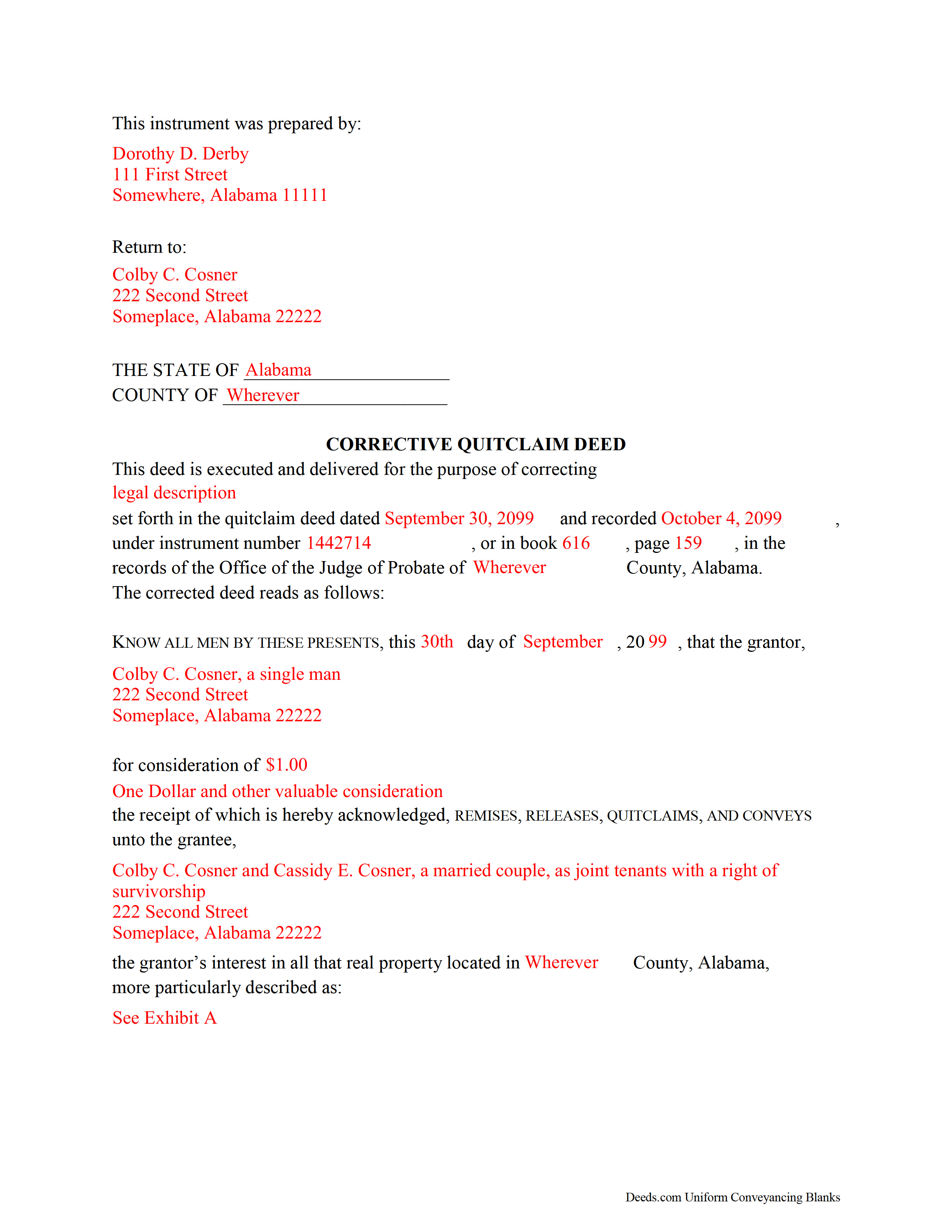

Marshall County Completed Example of the Correction Quitclaim Deed Document

Example of a properly completed Alabama Correction Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Alabama and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Probate Judge

Guntersville, Alabama 35976

Hours: 8:00am to 4:30pm M-F

Phone: (256) 571-7767 x208

Recording Tips for Marshall County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Albertville

- Arab

- Boaz

- Douglas

- Grant

- Guntersville

- Horton

- Union Grove

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (256) 571-7767 x208 for current fees.

Questions answered? Let's get started!

Corrective Quitclaim Deeds in Alabama

What happens when there is an error in your deed? What can you do to fix it? One option may be filing a corrective deed.

A corrective deed is an instrument used to correct a small error in a deed that has been recorded at an earlier date. Note that corrective deeds cannot change the nature of the transfer, so make sure to use the same type of document. For example, to correct a recorded quitclaim deed, use a corrective quitclaim deed.

Corrections can only be made to non-material errors, causing no actual change in the substance, or facts, of the deed. Common minor errors include misspelled names or missing information, such as marital status, or a mistake transcribing courses and distances in the legal description of the property. Material changes to the substance of the deed have a legal effect in how property is titled, and therefore require a new deed.

On the corrective deed, give the recording information from the previously filed document, then identify which section contains the error. Provide the correct details in the body of the deed. The corrective deed states the nature of the error and recites the date and recording information of the erroneous deed.

The deed must meet the state and local formatting standards as for recorded documents, and must also be acknowledged before any of the officers listed in (Ala. Code 1975, 35-4-24). For the corrective deed to be valid, all parties who signed the prior deed must sign the corrective deed in the presence of a notarial official. The execution of a deed must be attested by at least one witness in Alabama (Ala. Code 1975, 35-4-20). If the grantor is married, Alabama requires that both spouses sign the deed (Ala. Code 1975, 6-10-3).

Most transfers of real property are subject to a privilege or license tax, but re-recording corrected deeds is exempt under Ala. Code 1975, 40-22-1, so there is no need for a Real Estate Sales Validation Form (Form RT-1).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about corrective quitclaim deeds or any other issues related to transferring real property in Alabama.

(Alabama Correction Quitclaim Package includes form, guidelines, and completed example)

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Correction Quitclaim Deed meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Correction Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Thi W.

May 3rd, 2019

Absolutely the easiest and fastest service ever!!! staff very helpful.

Thank you!

James M.

January 3rd, 2023

It would be helpful to have a joint tenant example.

Thank you!

Karen B.

January 13th, 2020

Completed although having the sample really helped. Now to file.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert A.

June 9th, 2021

First timer with Deeds.com - excellent experience. I am a lawyer and do not record often. Did not have to pay membership- fast and easy upload of documents- fast response - fast recording time from county recorder- very legible documents- very reasonable price. I give 6 stars out of 5!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael L.

April 26th, 2025

Quick and Easy. Much appreciated!

Thank you for your feedback. We really appreciate it. Have a great day!

Charles B.

November 20th, 2023

The support received was far above expectations.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Larry H.

March 29th, 2019

Wow! So easy and such a cost savings. Thanks

Thanks Larry, we appreciate your feedback.

Robert K.

August 1st, 2020

I used your TOD document to deed my home to my daughter. Your sample document was very helpful. I had to do it a few times but finally got it right. I didn't check but It was surely cheaper than a lawyer fee.

Thank you for your feedback. We really appreciate it. Have a great day!

James N.

December 14th, 2018

The purchasing process was very slick and my credit card was charged IMMEDIATELY. The deliver went well as the link was provided immediately. However I asked a question via the "Contact Us" link and days later I get a survey but no reply. I may have been directed to the wrong forms via my County and I wanted to confirm that...but still no answer. What would that deserve as a rating???

Also, your history on our site shows no messages sent via our contact us page.

Jenny B.

October 30th, 2019

Thank you! Will use you again in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Halilat S.

April 2nd, 2021

Excellent communications. Well done guys!

Thank you for your feedback. We really appreciate it. Have a great day!

Michelle N.

June 28th, 2023

I was very pleased with the service I received. I sent a Quit Claim deed to be filed and received a response the next morning that it was complete.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth K.

April 19th, 2020

Really great experience. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin M.

May 13th, 2020

Maricopa County Recorders office directed to use Deeds.com for all forms, etc. Easily found the Warranty Deed form, instructions & sample form I was looking for.

Thank you!

Jon I.

May 27th, 2020

I liked the information I download. Just what I was looking for.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!