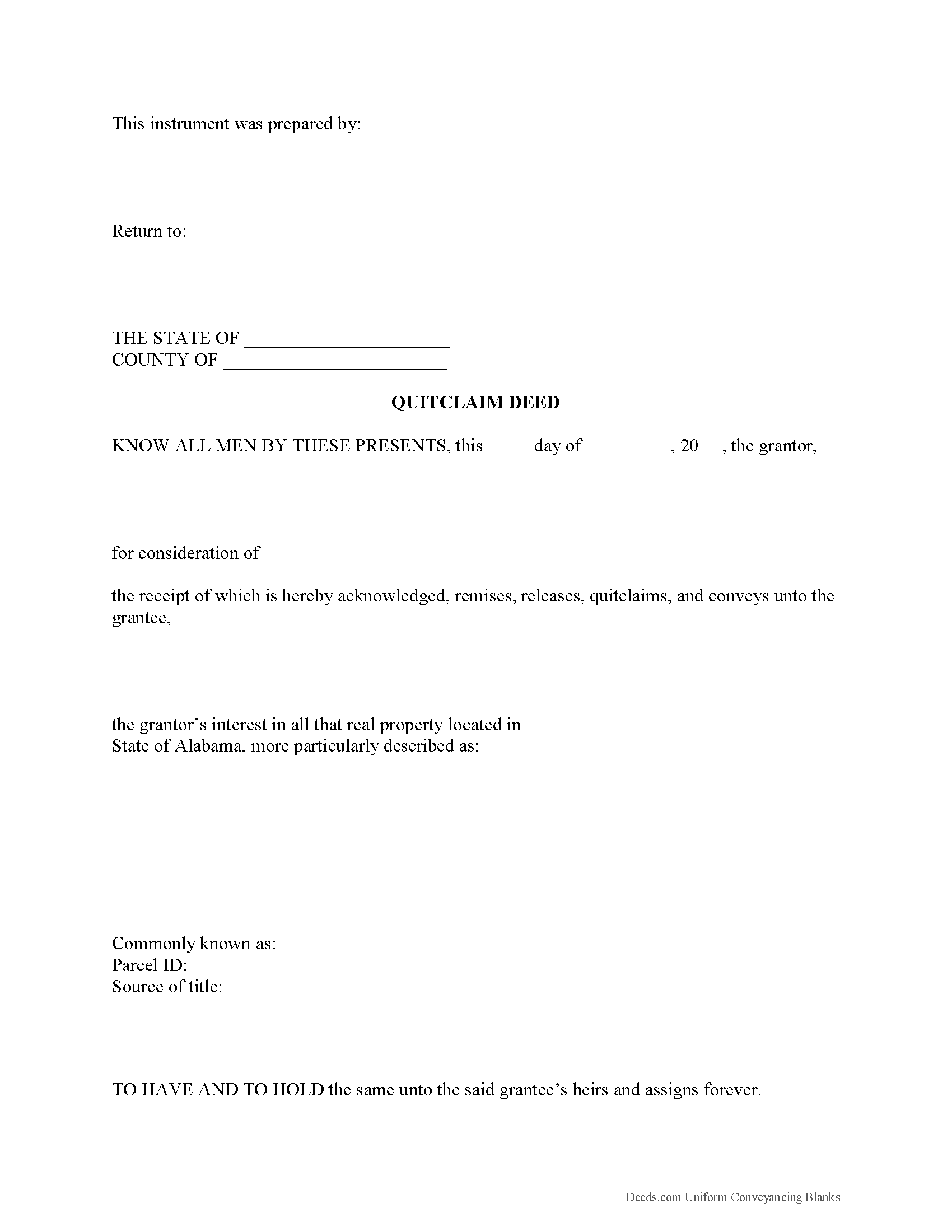

Clay County Quitclaim Deed Form

Clay County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Alabama recording and content requirements.

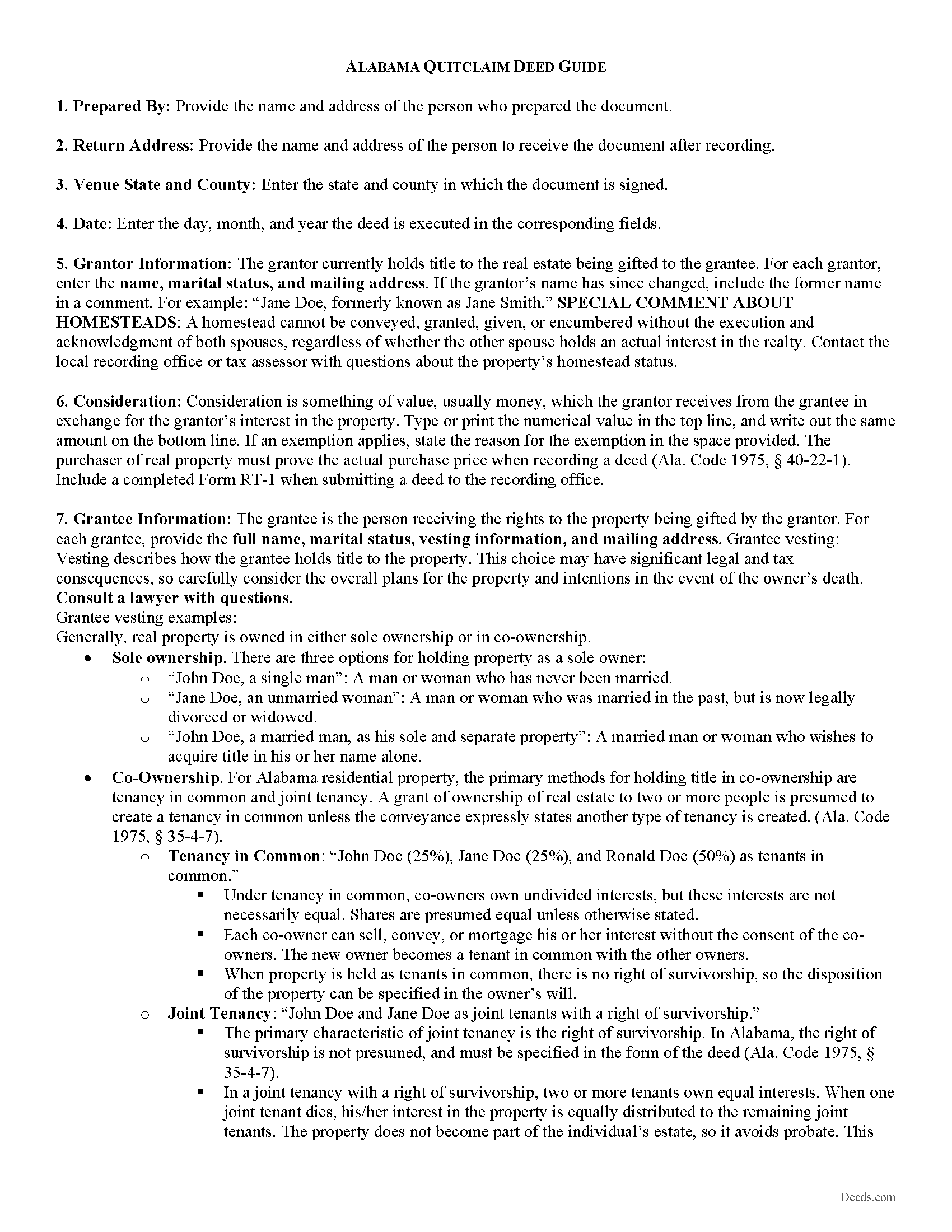

Clay County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

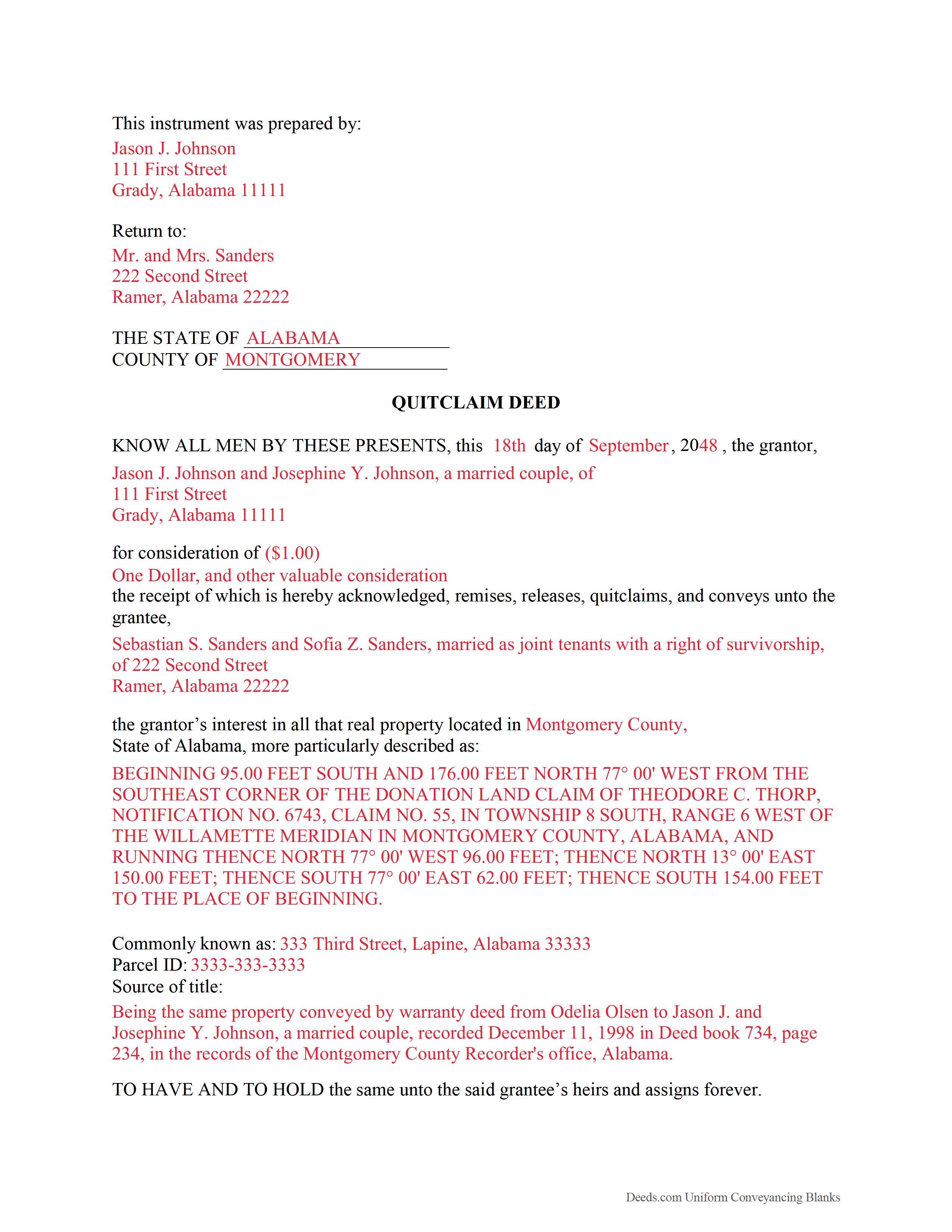

Clay County Completed Example of the Quitclaim Deed Document

Example of a properly completed Alabama Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Alabama and Clay County documents included at no extra charge:

Where to Record Your Documents

Clay County Probate Office

Ashland, Alabama 36251

Hours: 8:30 to 4:00 M-F

Phone: (256) 354-2198

Recording Tips for Clay County:

- Check that your notary's commission hasn't expired

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

- Recorded documents become public record - avoid including SSNs

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Clay County

Properties in any of these areas use Clay County forms:

- Ashland

- Cragford

- Delta

- Hollins

- Lineville

- Millerville

Hours, fees, requirements, and more for Clay County

How do I get my forms?

Forms are available for immediate download after payment. The Clay County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clay County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clay County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clay County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clay County?

Recording fees in Clay County vary. Contact the recorder's office at (256) 354-2198 for current fees.

Questions answered? Let's get started!

Form of the Alabama Quitclaim Deed:

According to Ala. Code 35-4-20, a quitclaim deed must be on a tangible medium, such as paper or parchment. While traditionally handwritten, modern practice includes typed or computer-generated documents, provided they are physically printed.

Signatory Requirements:

The deed must be signed or marked by the grantor or an authorized agent, as required by Ala. Code 35-4-20.

Grantor Information:

Essential details like the grantor's name, address, and marital status must be clearly stated (Ala. Code 35-4-20).

Marriage Considerations:

For properties owned individually by one spouse, only that spouse's signature is necessary. However, if the property is a designated homestead, both spouses must sign, as mandated by Ala. Code 35-4-20.

Homestead and Non-Homestead Provisions:

Transfers of non-homestead properties need a statement clarifying that the property is not the grantor's homestead.

Detailed Property Description:

A full legal description of the property, including references to prior recordings, is required as per Ala. Code 35-4-20.

Grantee Details:

The deed should include the grantee’s name, address, and vesting information.

Deed Preparer Information:

The individual preparing the deed must be identified, including their name and address, as required under Ala. Code 35-4-110 and 35-4-113.

Witness and Acknowledgment:

Notarization or a witness statement is required. If the grantor cannot write, an additional witness is necessary (Ala. Code 35-4-20).

Avoid Implied Warranties:

Due to the nature of quitclaim deeds, words implying warranties like "grant," "bargain," or "sell" should be avoided. Instead, use phrases like "quit claim and convey" or "remise, release, and quit claim" to indicate the transfer of interest without any warranties (Ala. Code 35-4-271).

Recording Requirements:

Mandatory Recording with Probate Judge:

The deed must be recorded with the probate judge in the county where the property is located to ensure legal recognition of the ownership transfer (Ala. Code 35-4-50).

Benefits of Recording:

Recording the deed provides public notice of the change in ownership, protects the rights of the current owner, and maintains an unambiguous chain of title.

Priority in Disputes:

In property ownership disputes, a later owner who has recorded their conveyance generally has legal precedence over an earlier owner with an unrecorded document (Ala. Code 35-4-50).

Consideration Disclosure:

Deed Consideration Clause:

Ala. Code 35-4-34 specifies that the actual consideration (the purchase price or value) does not need to be included in the deed's text.

Real Estate Sales Validation Form Requirement:

Since Ala. Act 2012-494, the actual purchase price or value of the property transfer must be disclosed using the Real Estate Sales Validation Form, in accordance with Ala. Code 40-22-1. The deed cannot be recorded without submitting this form and paying the necessary tax.

County-Specific Stipulations:

Individual counties in Alabama might have specific requirements for quitclaim deeds, including unique formatting, additional information, tax forms, or other documents. Always check with local authorities to ensure full compliance before attempting to record your quitclaim deed.

Important: Your property must be located in Clay County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Clay County.

Our Promise

The documents you receive here will meet, or exceed, the Clay County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clay County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

JOHN L.

November 17th, 2020

Not just good, very good. Very intuitive and very responsive. It just works!

Thank you for your feedback. We really appreciate it. Have a great day!

chris m.

March 10th, 2022

Was warned by attorney that forms from internet have lots of mistakes. But after looking all over, took a chance on here. So far, I am satisfied, and actually happy that I got something that (I believe) meets my state and local requirements. Haven't filed the deed yet, or had to put it into effect, but being able to pick the local area, and have the relevant state law listed on the deed, gives me confidence. Also, got the whole package of possibly relevant forms, and a very good guide how to prep the deed with a sample completed deed - greatly appreciated!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca Q.

January 19th, 2019

Very helpful! Unfortunately, they didn't have what I needed, but they got back to me quickly and didn't charge me anything. Easy to work with.

Thank you for your feedback. We really appreciate it. Have a great day!

Albert j.

June 3rd, 2020

Very easy site to use for a simple minded happy howmowner. Very reasonable fee Quick turn around Good communication

Thank you!

David A.

May 3rd, 2022

Forms were just what I needed. Very well explained and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jami B.

November 6th, 2019

I was blown away by all the information I received for just $19.00!! I am still reading through it. Great job of explaining everything.

Thank you!

nannette b.

October 27th, 2019

got what I needed quick and easy thank you!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Ronnie W T.

September 16th, 2022

Very fast and efficient as soon as we paid for the document, it was downloaded to us immediately.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas J.

March 3rd, 2021

I'm pleased with the service

Thank you!

jennifer e.

September 1st, 2020

EXCELLENT, PROMPT SERVICE. I will definitely use again .HIGHLY RECOMMEND.

Thank you for your feedback. We really appreciate it. Have a great day!

Betty J W.

May 31st, 2022

Was Totally Amazed, it was so easy to follow the example and I am 75 years old. I took my paper work in and it passed with flying colors. Thank-You So much saved me $665.00. BJW

Thank you!

JOHNNY M.

September 28th, 2019

The information provided is quite thorough.I recommend this Site to anyone, in need of Material for Quit Claim Deeds.

Thank you!

Carol F.

May 22nd, 2019

Instructions were easy to follow and it was reasonable

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn W.

April 25th, 2022

The Mineral Deed transfer form was pretty good. Could have used more info in the guide about where to find legal property descriptions and source of title. Also more space on the pdf for entering return addresses - there was room for only one; I needed three. I will be sending the form to the County Courthouse soon. I hope it works.

Thank you for your feedback. We really appreciate it. Have a great day!

DAVID K.

April 5th, 2019

Good so far could use more examples for each section of info. needed. ex. (parcel and alt.ID info where to find and etc. #2 more examples. If it was not for the red print examples helping to fill the form out I could have downloaded free forms, the examples are what made me choose your form !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!