Mohave County Conditional Lien Waiver on Progress Payment Form

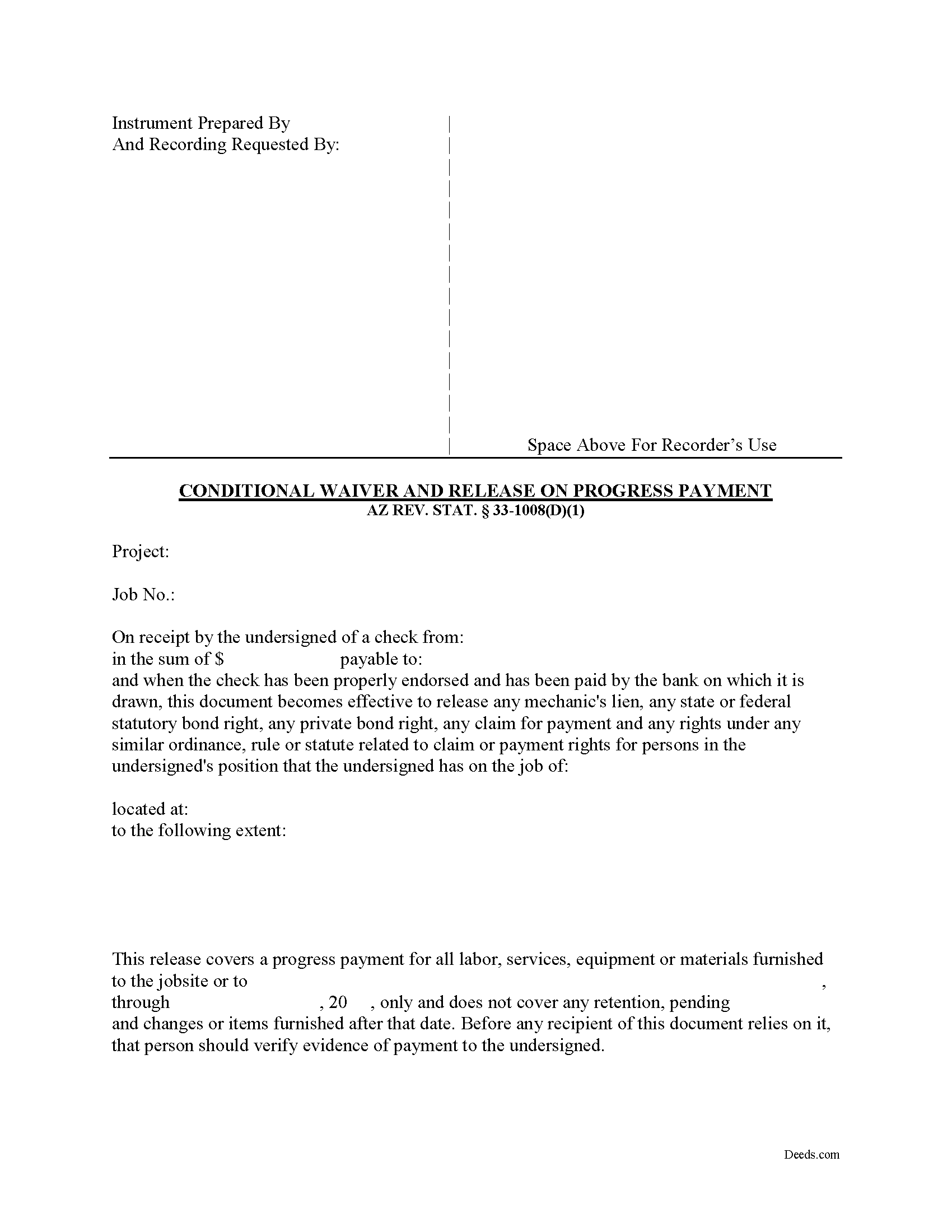

Mohave County Conditional Lien Waiver on Progress Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

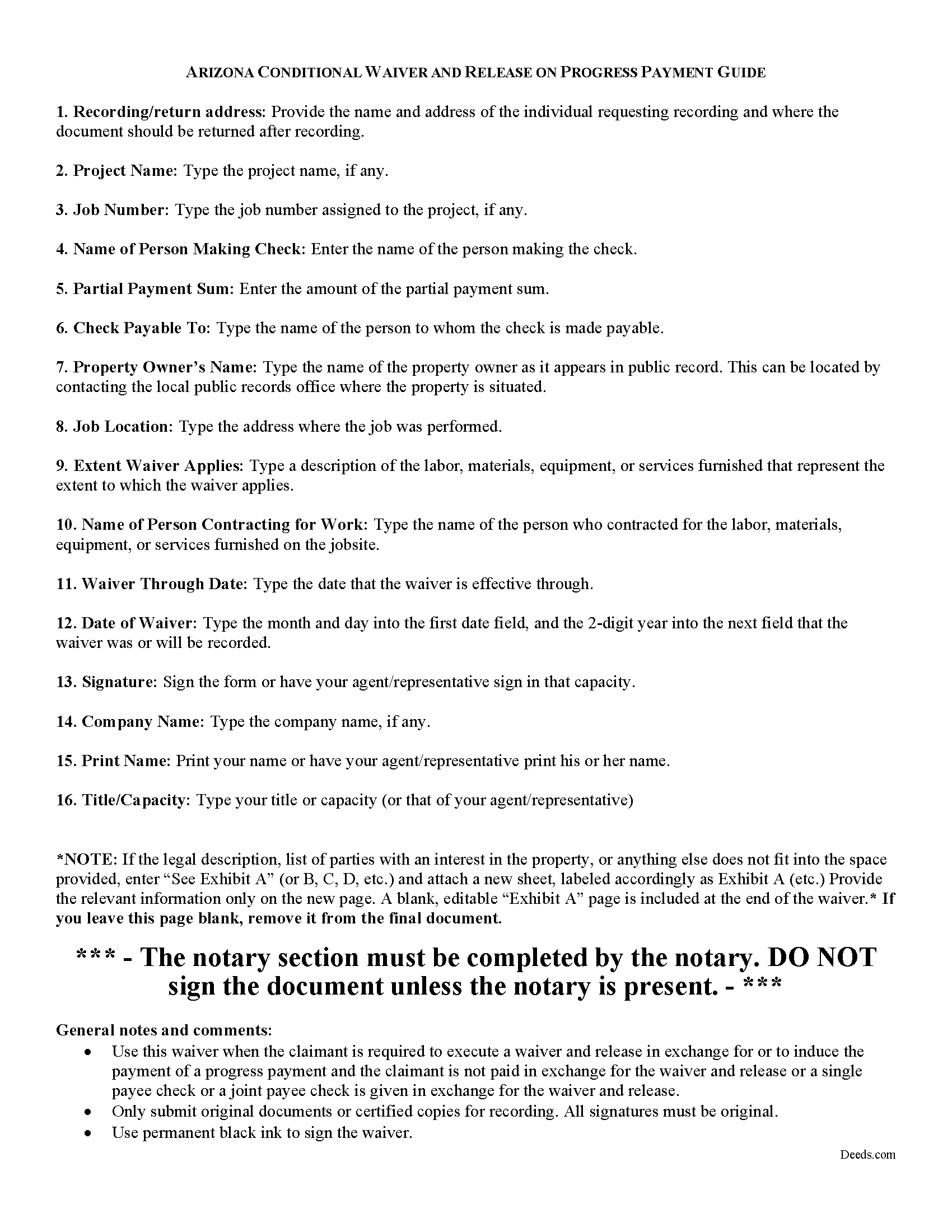

Mohave County Conditional Lien Waiver on Progress Payment Guide

Line by line guide explaining every blank on the form.

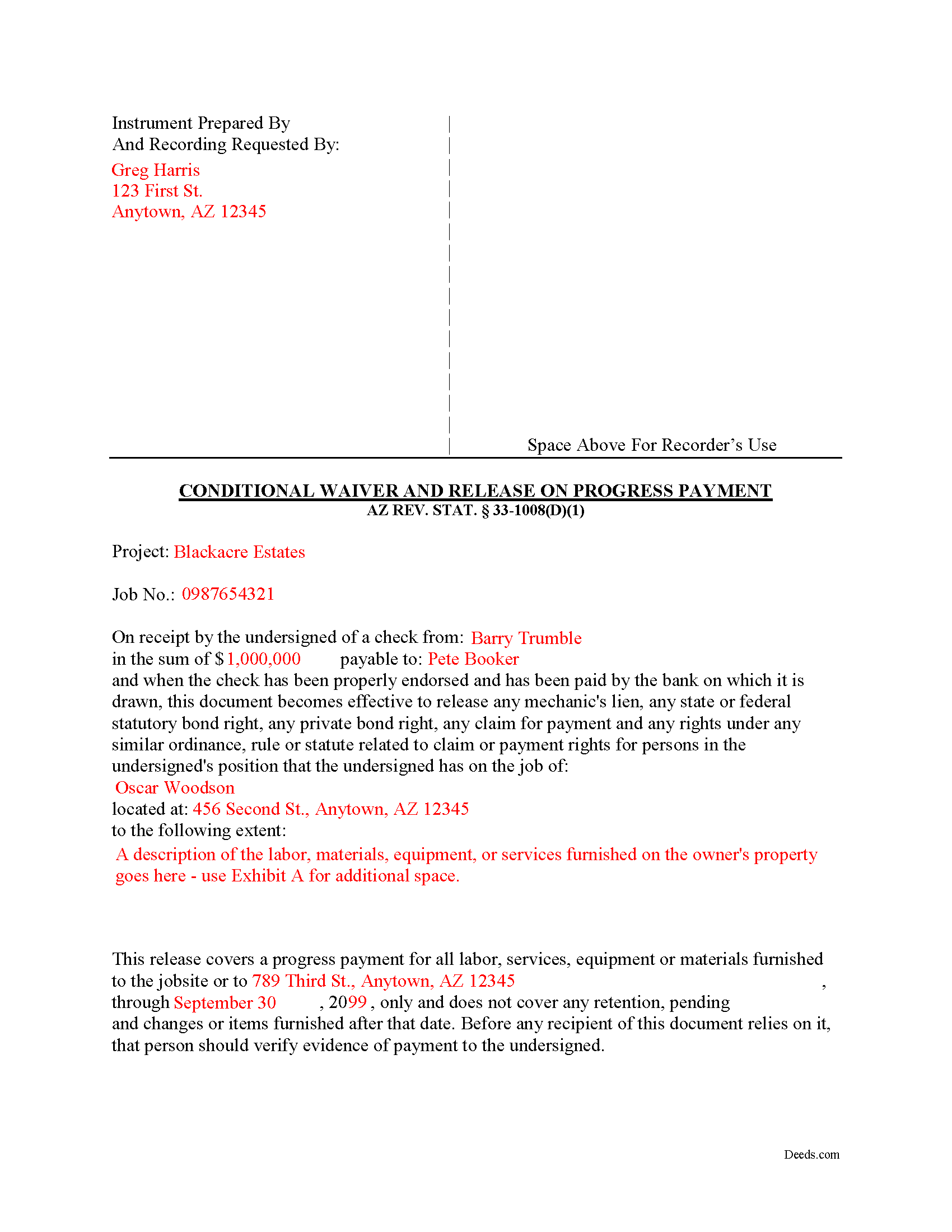

Mohave County Completed Example of the Unconditional Lien Waiver on Progress Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Mohave County documents included at no extra charge:

Where to Record Your Documents

County Recorder

Kingman, Arizona 86401 / 86402

Hours: Monday thru Friday 9:00 am until 5:00 pm

Phone: 928-753-0701

Recording Tips for Mohave County:

- Bring your driver's license or state-issued photo ID

- Recording fees may differ from what's posted online - verify current rates

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Mohave County

Properties in any of these areas use Mohave County forms:

- Bullhead City

- Chloride

- Colorado City

- Dolan Springs

- Fort Mohave

- Golden Valley

- Hackberry

- Hualapai

- Kingman

- Lake Havasu City

- Littlefield

- Meadview

- Mohave Valley

- Oatman

- Peach Springs

- Temple Bar Marina

- Topock

- Valentine

- Wikieup

- Willow Beach

- Yucca

Hours, fees, requirements, and more for Mohave County

How do I get my forms?

Forms are available for immediate download after payment. The Mohave County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mohave County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mohave County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mohave County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mohave County?

Recording fees in Mohave County vary. Contact the recorder's office at 928-753-0701 for current fees.

Questions answered? Let's get started!

Arizona Conditional Lien Waiver on Progress Payment

Lien waivers are part of the mechanic's lien process. The waiver is a document from a contractor, subcontractor, materials supplier or other party to the construction project (the claimant) acknowledging receipt of payment and waiving any future lien rights to the owner's property. Lien waivers are governed under Arizona Revised Statute 33-1008.

In Arizona, lien waivers require strict compliance with the statute and any document purported to waive a lien must follow the statutory format. AZ REV. STAT. 33-1008(A). Any contract or other form attempting to waive lien rights is void as a matter of law. Id. Additionally, lien waivers filed in the state require evidence of actual payment when the waiver is conditioned on receipt of payment. Id.

There are two classifications of lien waivers: conditional and unconditional. Within either class, there are subcategories of "partial" and "final" waivers. A conditional waiver is effective only when payment is received, usually verified by a check clearing the bank. So, a conditional waiver given after a progress payment releases the claimant's right to lien, up to a specified date, but only after the check used to pay clears the bank.

The waiver must contain details identifying the job/project, the amount and type of payment, including the name of the person who wrote any checks, the property owner, the location and a description of the work, relevant dates, and the claimant's signature. 33-1008(D)(1).

This article is provided for informational purposes only and should not be relied on as a substitute for the advice of an attorney. Please contact an Arizona attorney with questions about mechanic's lien waivers.

Important: Your property must be located in Mohave County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver on Progress Payment meets all recording requirements specific to Mohave County.

Our Promise

The documents you receive here will meet, or exceed, the Mohave County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mohave County Conditional Lien Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

CHERYL G.

April 11th, 2022

After my county rejected a deed from another company, I researched better and purchased my Lady Bird Deed from Deeds.com. Very simple, received everything immediately. Printed out sample and guide sheets and filled out my deed. Very thorough and easy to understand. All the additional forms were awesome. And the best part is, my county recorded my deed this morning! WooHoo! Very happy customer! Thank you!

Glad to hear! Thanks for taking the time to leave your review. We appreciate you. Have a great day.

EVE A.

October 31st, 2022

Site was easy to navigate. I found the lien discharge form I was looking for immediately and the download and completion was simple. Thank you for having a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

July 27th, 2021

Appreciate the help with DC's non-intuitive forms. Superb service.

Thank you!

Tiffany Dawn J.

September 28th, 2019

Would be nice to have a better description on how to complete the forms if it is separated couple and one is signing the deed over to the other. I am still unsure how it should be worded. Disappointed that the guide didn't have better explanations.

Thank you for your feedback. We really appreciate it. Have a great day!

Gina G.

April 17th, 2024

This service is fantastic! Took a few tries to scan the document correctly, but their patience and quick turn around made this a far better experience than going to the County myself.

We are delighted to have been of service. Thank you for the positive review!

James J.

December 27th, 2019

Downloaded and used the Ladybird Warranty Deed for a county in Florida with no issues. Cost for the download and subsequent recording fee of the deed totaled less than $40. No reason to pay hundreds. I assume the subsequent transfer upon death will go smoothly, but I of course, will never know. The "example" of a completed form was very beneficial. Also, get a copy of the current deed and make sure legal description of real estate is exactly the same on the new deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Lou H.

April 27th, 2019

5 stars.

Thank you!

Dennis B.

June 19th, 2019

It was easy to download the necessary "Death of Joint Tenant" forms. These easy to use interactive forms are made to comply with the laws specific to your state.

Thank you!

Rita M.

January 12th, 2019

Forget what I just wrote! I found it. Thank You! This is a very convenient service.

That's great to hear Rita, thanks for following up.

Roxanne B.

December 16th, 2020

This is an excellent service during a pandemic! Recording documents can be challenging with changing hours and rules. Yesterday I was able to file an important document from the comfort of my home.

Thank you for your feedback. We really appreciate it. Have a great day!

Tracy E.

December 19th, 2020

This is so convenient. Thank you.

Thank you!

chungming a.

March 30th, 2019

easy to use website.

Thank you!

Michael W.

November 16th, 2021

So far the web site and the tools are a pleasure to use. The price is reasonable. If only getting rid of this timeshare in Mashpee Massachusetts (that I have owned for over thirty years) was this easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pouya N.

November 6th, 2020

THEY ARE AWSOME. MAKE IT REALLY EASY AND EFFICIENT TO WORK. THANK YOU

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Georgiana I.

January 25th, 2020

The deed itself was easy. I did notice that although the website says that the deed would exempt the house from probate, the deed clearly states that it might not. I hope that "might " is the operative word here.

Thank you for your feedback. We really appreciate it. Have a great day!