Mohave County Correction Deed Form

Mohave County Correction Deed Form

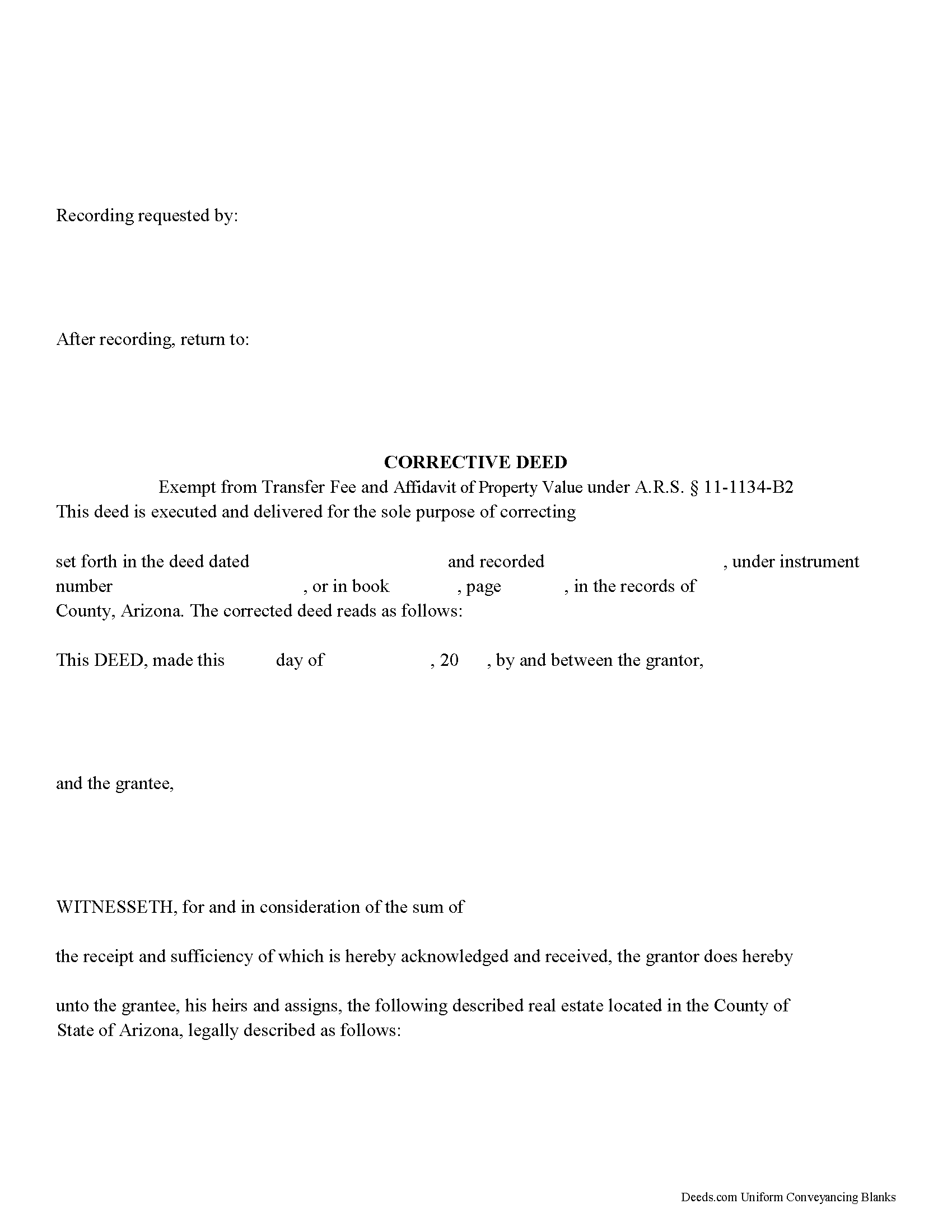

Fill in the blank form formatted to comply with all recording and content requirements.

Mohave County Correction Deed Guide

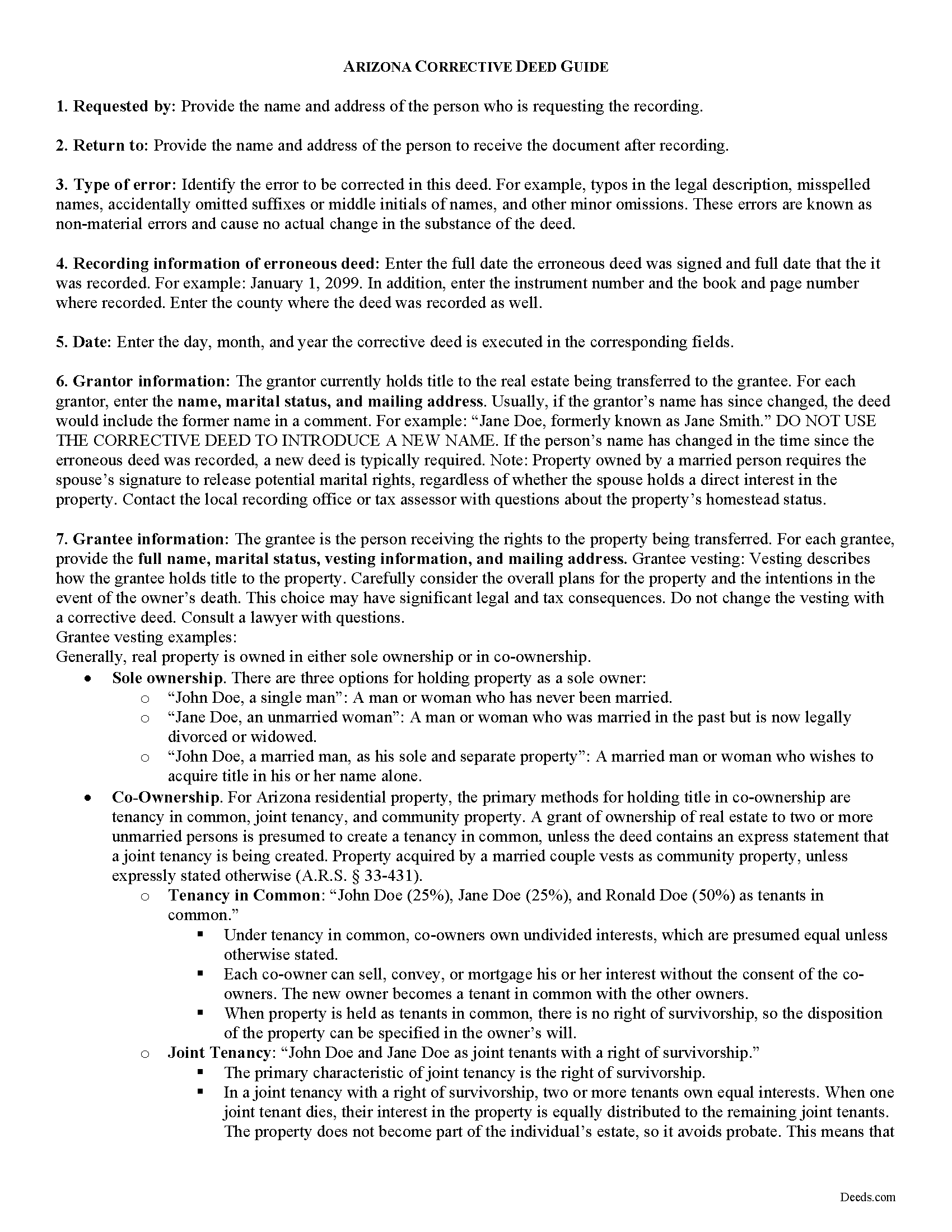

Line by line guide explaining every blank on the form.

Mohave County Completed Example of a Correction Deed Document

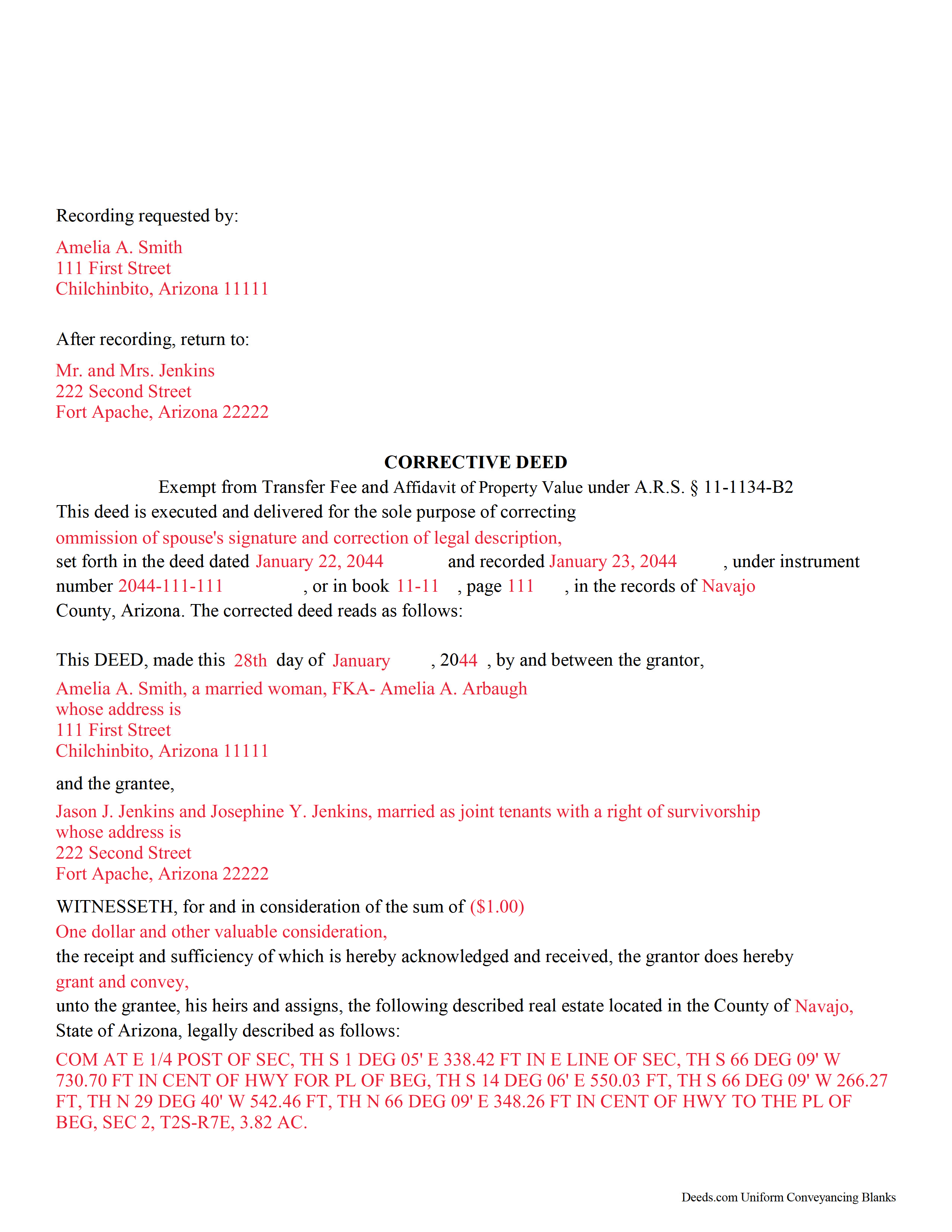

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Mohave County documents included at no extra charge:

Where to Record Your Documents

County Recorder

Kingman, Arizona 86401 / 86402

Hours: Monday thru Friday 9:00 am until 5:00 pm

Phone: 928-753-0701

Recording Tips for Mohave County:

- Ensure all signatures are in blue or black ink

- Request a receipt showing your recording numbers

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Mohave County

Properties in any of these areas use Mohave County forms:

- Bullhead City

- Chloride

- Colorado City

- Dolan Springs

- Fort Mohave

- Golden Valley

- Hackberry

- Hualapai

- Kingman

- Lake Havasu City

- Littlefield

- Meadview

- Mohave Valley

- Oatman

- Peach Springs

- Temple Bar Marina

- Topock

- Valentine

- Wikieup

- Willow Beach

- Yucca

Hours, fees, requirements, and more for Mohave County

How do I get my forms?

Forms are available for immediate download after payment. The Mohave County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mohave County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mohave County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mohave County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mohave County?

Recording fees in Mohave County vary. Contact the recorder's office at 928-753-0701 for current fees.

Questions answered? Let's get started!

What happens when there is an error in your deed? What can you do to fix it? One option may be filing a corrective deed.

A corrective deed is an instrument used to correct a small error in a deed that has been recorded at an earlier date. Corrections can only be made to non-material errors, causing no actual change in the substance of the deed. Common mistakes include typographical errors in the legal description, misspelled names, accidentally omitted suffixes or middle initials, etc.

Major, or material, changes to the substance of the deed have a legal effect in how property is titled, and therefore require a new deed. Adding or removing a grantee, for example, or significant changes to the legal description, may all require a new deed of conveyance. When in doubt about the gravity of an error and whether a correction deed is the appropriate vehicle to address it, consult with a lawyer.

On the corrective deed, give the recording information from the previously filed document, then identify which section contains the error. Provide the correct details in the body of the deed. The corrective deed states the nature of the error and recites the date and recording information of the erroneous deed.

For the corrective deed to be valid, all parties who signed the erroneous deed must sign the corrective deed in the presence of a notarial official. If the grantor is married, Arizona requires that both spouses sign the deed (A.R.S. 33-452). Finally, the form must meet all state and local standards for recorded documents. Submit the completed corrective deed to the local recording office.

Most transfers of real property are subject to a transfer tax and must be accompanied by an Affidavit of Property Value. However, corrective deeds are exempt from both because the property has already been transferred (A.R.S. 11-1133, 11-1134).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about corrective deeds or any other issues related to real property in Arizona.

(Arizona Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Mohave County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Mohave County.

Our Promise

The documents you receive here will meet, or exceed, the Mohave County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mohave County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

LEVELL H.

April 20th, 2021

I was very pleased with the ease in use of the forms. I suggest making sure the sample copy is totally aligned with the exact same parts. I was a little confused about the portion "Subject to.." It was easy to make corrections, additions, etc because the page remained open, and I didn't have to re=open the forms continuously.

Thank you!

Charles B.

April 5th, 2020

KVH really went above and beyond to help me try to find what I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

bruce t.

May 16th, 2022

Much good information provided. Forms easy to use. Price is a bargain.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary S.

January 9th, 2022

Easy to use. Very helpful

Thank you!

David H.

June 8th, 2020

Exceeded expectations; bundle included not only the form but also detailed instructions and definitions and a completed "John Doe" example.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LETICIA N.

August 23rd, 2022

I AM VERY PLEASED WITH YOUR WEBSITE. EASY AND I WAS GIVEN A SAMPLE OF THE FORM AND INSTRUCTIONS. I AM VERY PLEASED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Quinlyn H.

August 4th, 2020

They didn't have what I was looking for so they refunded my money immediately. Very easy to work with!

Thank you!

Juanita G.

June 2nd, 2023

This was so easy to use, quick turnaround and I will continue to use this service. Thank you!

Thanks you Juanita for taking the time to leave your feedback. We really appreciate it. Have a fantastic day!

Roger W.

August 3rd, 2020

worked very good or me

Thank you Roger, have a great day!

Cheryl B.

November 20th, 2021

Seems easy enough, may have downloaded forms I don't need, however I'm hoping that these are the only I'll need. Did a lot of research and Deeds.com looks to be the best for anything you need. I am very happy at finally being able to find the forms I was looking for so easily. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Danny W.

August 13th, 2020

download complete..I am happy with results. Correct document for the state and my application, and it was a simple transaction.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gene L.

August 5th, 2020

Worked perfect. Thanks.

Thank you!

Ted C.

May 7th, 2021

Everything was straight forward. I think I was able to accomplish my objective.

Thank you!

Lana J.

March 4th, 2022

Very easy to use and the forms were perfectly formatted. Great value and service!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DARRYL B.

June 16th, 2020

Professional and convenient.

Thank you for your feedback. We really appreciate it. Have a great day!