Prairie County Beneficiary Deed Revocation Form

Prairie County Beneficiary Deed Revocation Form

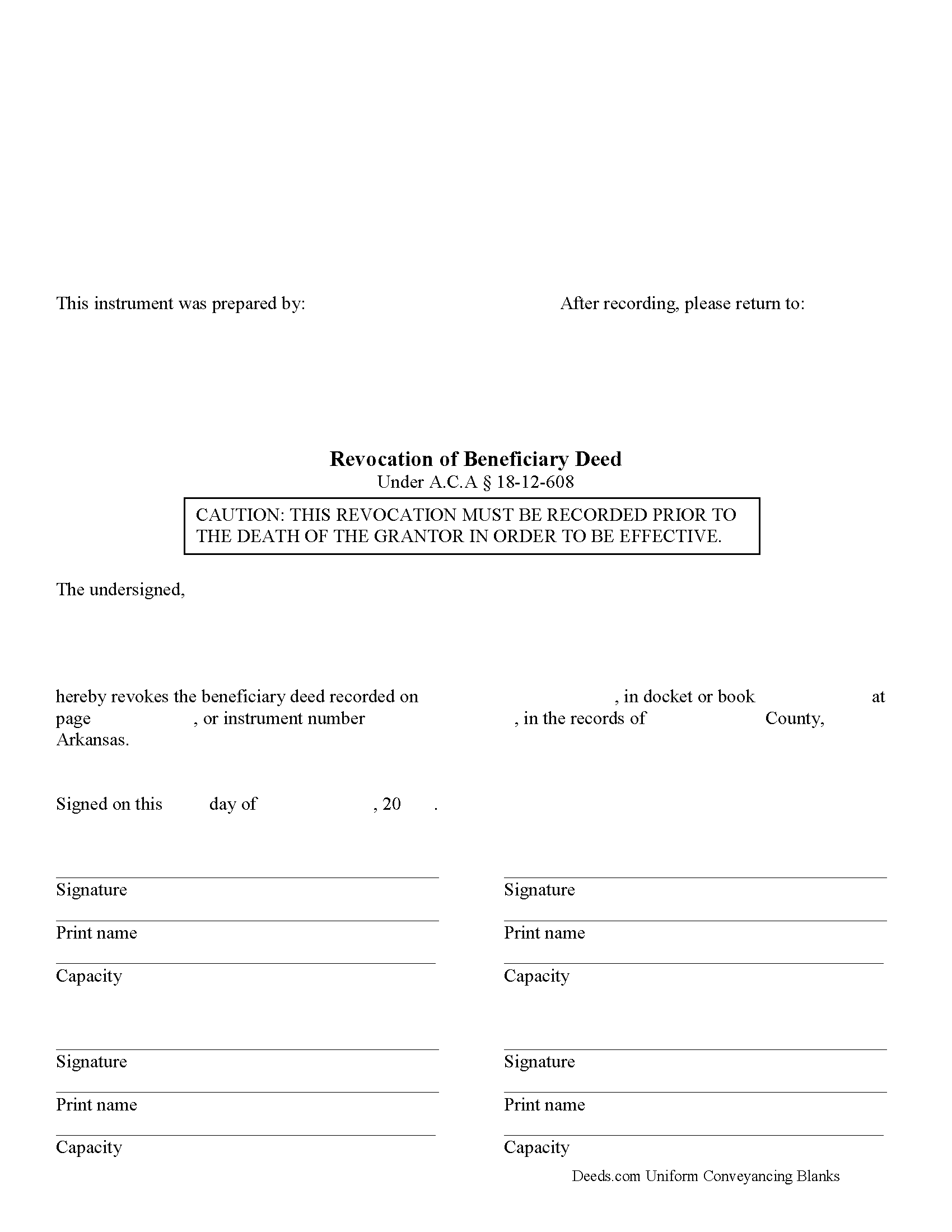

Fill in the blank form formatted to comply with all recording and content requirements.

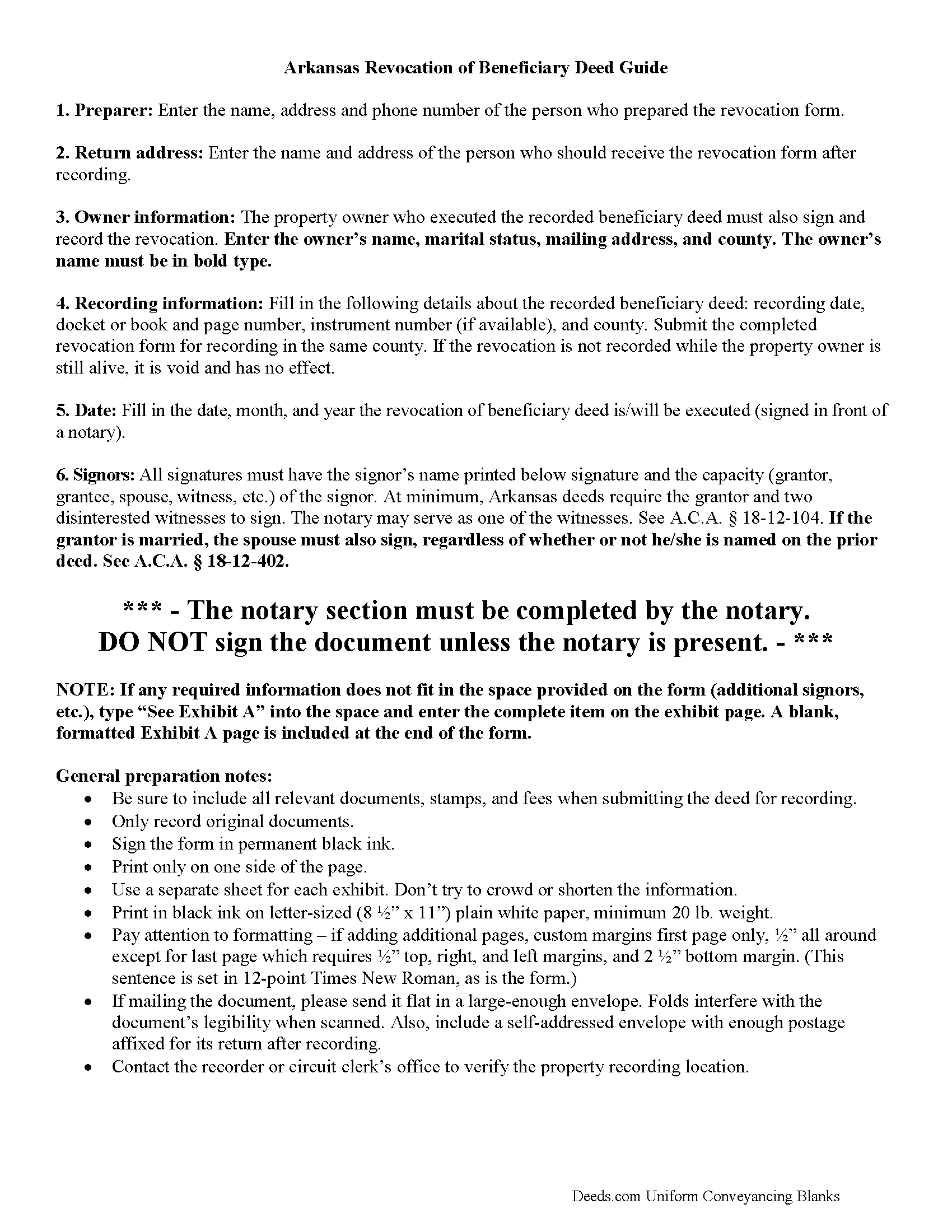

Prairie County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

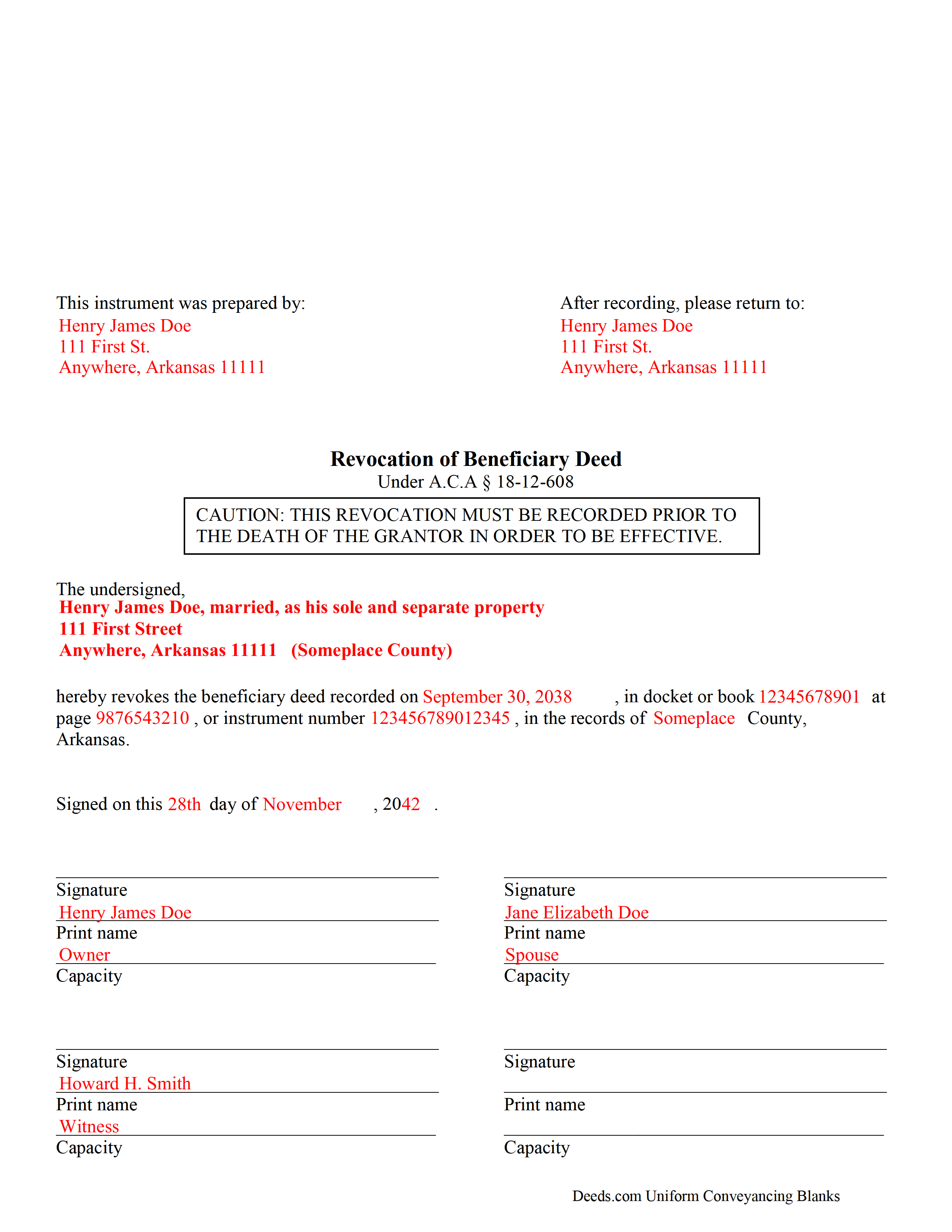

Prairie County Completed Example of the Beneficiary Deed Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Prairie County documents included at no extra charge:

Where to Record Your Documents

Circuit and County Clerk

Des Arc, Arkansas 72040

Hours: 8:00am to 4:30pm M-F

Phone: (870) 256-4434

Recording Tips for Prairie County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Prairie County

Properties in any of these areas use Prairie County forms:

- Biscoe

- De Valls Bluff

- Des Arc

- Hazen

- Hickory Plains

- Ulm

Hours, fees, requirements, and more for Prairie County

How do I get my forms?

Forms are available for immediate download after payment. The Prairie County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Prairie County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Prairie County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Prairie County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Prairie County?

Recording fees in Prairie County vary. Contact the recorder's office at (870) 256-4434 for current fees.

Questions answered? Let's get started!

Revoking a Beneficiary Deed in Arkansas

Beneficiary deeds in Arkansas are governed by A.S.A. 18-12-608. This statute also includes information about revoking an executed and recorded beneficiary deed.

Section 18-12-608 (d)(1) states that a beneficiary deed "may be revoked at any time by the owner or, if there is more than one (1) owner, by any of the owners who executed the beneficiary deed." Why is this flexibility important? Well, life is uncertain and circumstances change. The original beneficiary may no longer be an appropriate recipient of the real property. Perhaps the beneficiary knows about the transfer, but is unable or unwilling to accept it. Instead of disclaiming the gift when the owner dies, thus forcing the property back into the estate for probate, the owner has the option to revoke the beneficiary deed and designate someone else to receive it.

Regardless of the reason, to revoke a beneficiary deed, the owner must execute a document setting forth the revocation and then record it, DURING HIS/HER LIFE, in the county where the property is situated. This should be the same county where the beneficiary deed was recorded earlier.

The owner may also simply sell the property outright, thereby extinguishing any remaining interest in it and leaving nothing to transfer at death. Or, he/she may execute and record another beneficiary deed, naming someone else to receive the real estate. This method is effective because "the recorded beneficiary deed that is last signed before the owner's death is the effective beneficiary deed, regardless of the sequence of recording." ( 18-12-608(e))

Even though there are several options available to revoke or change a recorded beneficiary deed, recording a revocation is the most efficient way to ensure the owner's wishes are carried out. A revocation discontinues the potential future interest described in the beneficiary deed, which then frees the real estate for whatever the owner wishes to do with it next. This is also important because it helps maintain a clear chain of title, which will make later sales or mortgages of the property less complicated.

Note: as with beneficiary deeds, any changes or revocations must be executed and recorded while the owner is alive.

(Arkansas Beneficiary Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Prairie County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Prairie County.

Our Promise

The documents you receive here will meet, or exceed, the Prairie County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Prairie County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Roger S.

August 19th, 2020

status was canceled. said i needed to record directly. would be 5 stars if it worked.

Sorry for the inconvenience Roger. Unfortunately, not all jurisdictions in the country have progressed to the point of being able to accept all document types for e-recording.

Cindy N.

August 2nd, 2024

Our home was in only my husband’s name and as we are getting older, it was time to add my name to the Deed to avoid potential issues in the future. Our experience with Deeds.com was wonderful. The website is user friendly, instructions written in layman’s terms, straightforward and easy to follow. Very reasonably priced. I highly recommend using Deeds.com.

Thank you for the kind words Cindy. We appreciate you. Have an amazing day!

Deb D.

January 31st, 2019

Excellent website - easy to use, and found exactly the form I needed right away. Highly recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

deborah k.

April 7th, 2022

was very easy to fill out the directions were very helpful

Thank you!

Terrance S.

April 6th, 2020

I'd say 5 stars. Thank you.

Thank you!

Beverly H.

February 13th, 2019

Thanks!!

Thank you!

Anne-Marie B.

December 30th, 2020

This was the first time I have ever e-recorded a document. The process was smooth and simple. I loved being informed at each step along the way. I am glad I chose deeds.com and plan to use them in the future for all my electronic recording of legal documents.

Thank you!

Christine D.

November 3rd, 2021

Very easy to use and very fast. I was very happy with your service and will definitely use it again in the future!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert K.

June 13th, 2021

Very user friendly - I found the affidavit I needed right away together with the guide to filling it out.

Thank you!

Terry S.

March 23rd, 2022

Worked well for us except for not being able to edit. Got it completed and recorded with the county clerk! Having the instructions and example made it easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Wayne R.

February 22nd, 2021

Couldn't believe how simple it was to do such a very important family support task and the price was right! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra M.

November 17th, 2019

The forms were easy to use but there was a software issue that made it impossible to get the county name to appear on the form in the correct place. It made the deed look a little sloppy

Thank you!

Coralis M.

September 2nd, 2021

Fast, efficient and professional service! Thanks

Thank you!

ROBERT K.

April 12th, 2021

It was so easy to obtain the necessary documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Dana Y.

October 22nd, 2019

Purchased and used the quitclaim form. I have no complaints with any aspect. The forms, instructions, and example all came together to make the process very easy.

Thank you Dana. Have a great day!