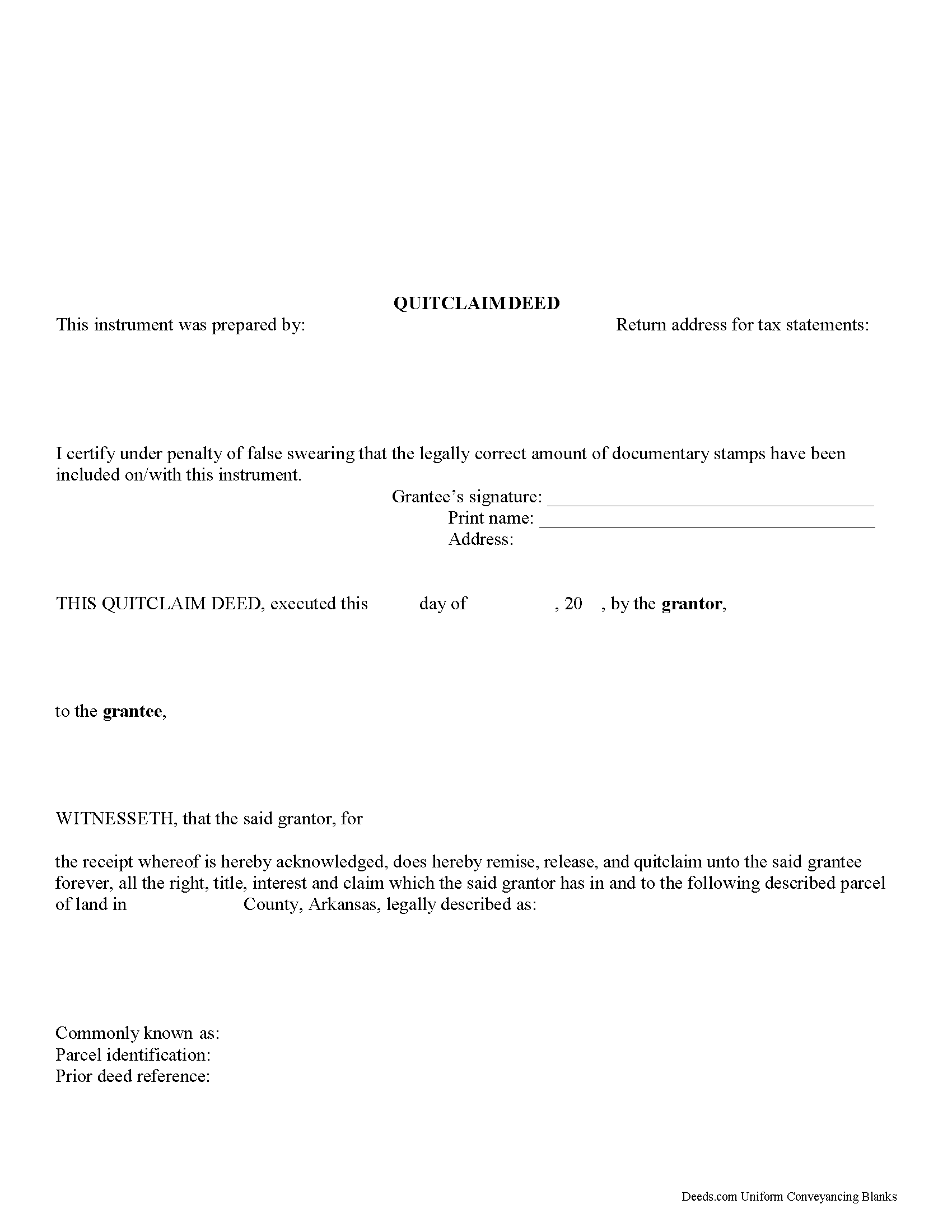

Pope County Quitclaim Deed Form

Pope County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Arkansas recording and content requirements.

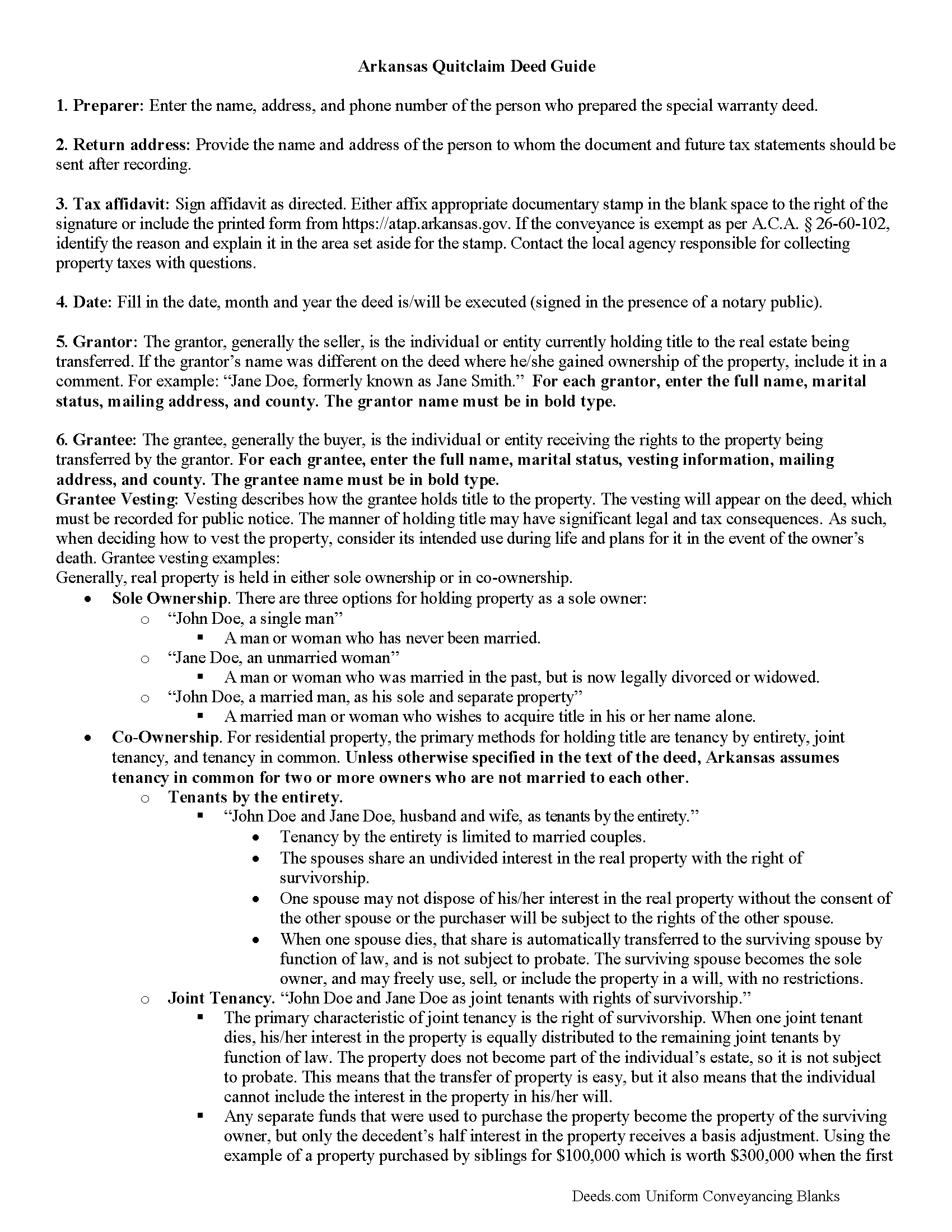

Pope County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

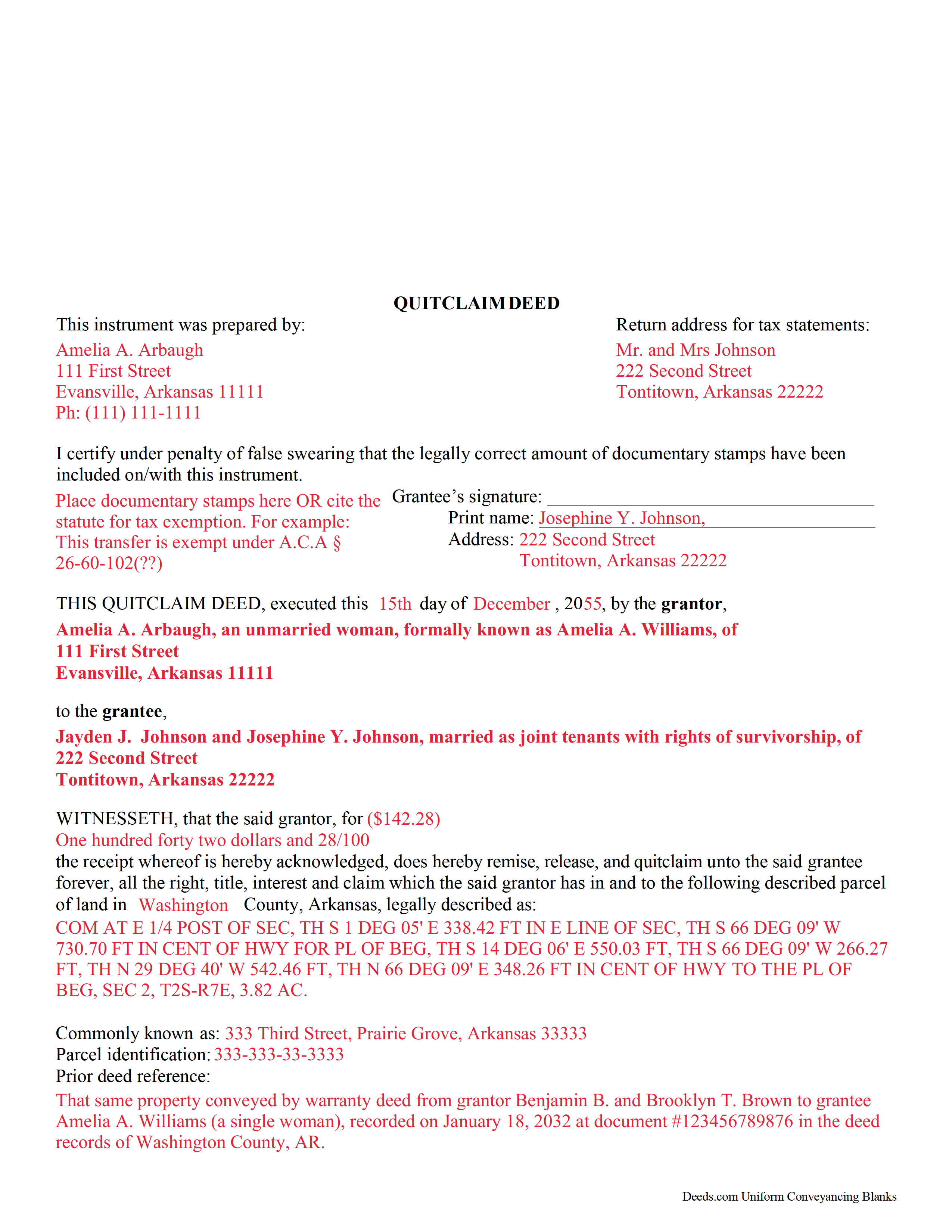

Pope County Completed Example of the Quitclaim Deed Document

Example of a properly completed Arkansas Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Pope County documents included at no extra charge:

Where to Record Your Documents

Pope County Circuit Clerk

Russellville, Arkansas 72801

Hours: 8:00am-4:30pm M-F

Phone: (479) 968-6989

Recording Tips for Pope County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Check that your notary's commission hasn't expired

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Pope County

Properties in any of these areas use Pope County forms:

- Atkins

- Dover

- Hector

- London

- Pottsville

- Russellville

- Tilly

Hours, fees, requirements, and more for Pope County

How do I get my forms?

Forms are available for immediate download after payment. The Pope County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pope County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pope County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pope County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pope County?

Recording fees in Pope County vary. Contact the recorder's office at (479) 968-6989 for current fees.

Questions answered? Let's get started!

A validly executed Arkansas quitclaim deed must meet specific statutory obligations.

Content:

The Arkansas statutes explain that any document conveying rights to real property must be in writing; contain a heading or title describing the purpose and intent of the instrument (in this case Quitclaim Deed) and; provide the name, marital status, address and signature of grantor. While the grantor's marital status is not expressly required, A.C.A. 18-12-403 (2012) states that no instrument conveying the homestead of any married person is valid unless his or her spouse joins in the execution of the instrument, or conveys by separate document, and acknowledges it. If the property conveyed is NOT classified as a homestead, only the grantor must sign unless the spouse is on the original deed as a co-owner.

Avoid using the terms "grant, bargain, and sell," because they contain an express covenant of warranty to the grantee. Including a warranty changes the nature of the deed from a simple quit claim. See A.C.A. 18-12-102 (2012).

The quit claim deed must also contain the name, address, and vesting decision (how title will be held) of the grantee and a description and address of the land being transferred.

As per A.C.A. 18-12-104 (2012), all documents conveying real estate must be executed before two disinterested witnesses, one of whom may be the notary or other official acknowledging the grantor's signature.

Recording:

A.C.A. 14-15-402 (2012) itemizes the formatting requirements for Arkansas quit claim deeds. Use only letter-sized paper (8" x 11") allowing a 2" margin at the top right of the first page, " margin on the right, left and bottom, and all around on other pages except for the last, which should have a 2" margin at the bottom. If the document does not follow these guidelines, it may not be accepted for recording or it might incur non-standard document fees.

A.C.A. 14-15-404 (2012) discusses the effect of recording instruments changing property ownership. The act of recording a deed enters it into the public record. This preserves the continuous chain of title, allowing future prospective owners to review the property's ownership history. Therefore, if a bona fide purchaser (one who buys something for value without notice of title defects) records a deed for property that has been previously conveyed to someone who never recorded the deed, the later purchaser retains ownership because there was no public notice of the earlier transfer. In short, record the quit claim deed as soon as possible after it's executed.

Be aware that counties often require unique formatting, additional information, tax forms, or other documents before the quit claim deed may qualify for recording.

(Arkansas Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Pope County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Pope County.

Our Promise

The documents you receive here will meet, or exceed, the Pope County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pope County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Maribel I.

September 15th, 2022

It would be helpful to be able to edit verbiage on the form. I was preparing a Deed of Distribution; therefore, there was no consideration paid. I had to type the language into a Word document instead.

Thank you for your feedback. We really appreciate it. Have a great day!

Jane H.

February 5th, 2019

So far, so good!

Thank you Jane. Have a great day!

Carol H.

December 22nd, 2021

Great help Quite useful

Thank you!

Elaine E. W.

February 13th, 2021

Your product package was thorough and I am the one who does not know how to use or begin to be interactive with a computer. I wish I had learned long ago....ok your directions appear to be clear but when you are not familiar to the words.....it can and is difficult.....I downloaded the forms and completed them by hand/pen.....I just hope it will be acceptable to the recorder....Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Zunika B.

December 18th, 2020

Was quick and easy compared to visiting downtown where the recorders office is closed or just the thought of mailing important documents and waiting until someone hopefully reaches back out to you. All responses were timely and process was easy. No complaints.

Thank you!

Alain L.

June 15th, 2021

deeds.com was able to turnaround my document in a matter of hours. I was also surprised at how easy their website was to navigate, considering other websites that offered the same service were so convoluted. Thank you again for the quick turnaround.

Thank you!

REBECCA B.

May 8th, 2023

Documents arrived instantly. Performed exactly as stated. Will use website again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

TEDDY Y.

January 29th, 2022

this experience was made possible with the ease of using your service thank you

Thank you!

Dana H.

September 8th, 2021

Thanks for making this process a seamless one! I love Deeds.com and will recommend it to others!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael R.

August 25th, 2025

A suggestion: Include instructions on how to add your spouse to the deed, rather than transferring completely to a third party

Thank you for your thoughtful feedback. Adding a spouse to a deed is a common need, and suggestions like yours help us identify where additional guidance would be useful. We’ll take this into consideration as we continue improving our resources.

Laura J.

April 6th, 2021

Very satisfied. Highly recommend!

Thank you!

Coralis M.

September 2nd, 2021

Fast, efficient and professional service! Thanks

Thank you!

Evelyn A.

October 30th, 2021

Was easy to use. Just didnt find what i needed

Thank you for your feedback. We really appreciate it. Have a great day!

Elvira N.

January 6th, 2021

Very useful, it even includes a guide on filling out the deed form!

Thank you!

Johnny B.

December 24th, 2019

This site was a breeze using.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!