Santa Cruz County Affidavit of Surviving Spouse Form (California)

All Santa Cruz County specific forms and documents listed below are included in your immediate download package:

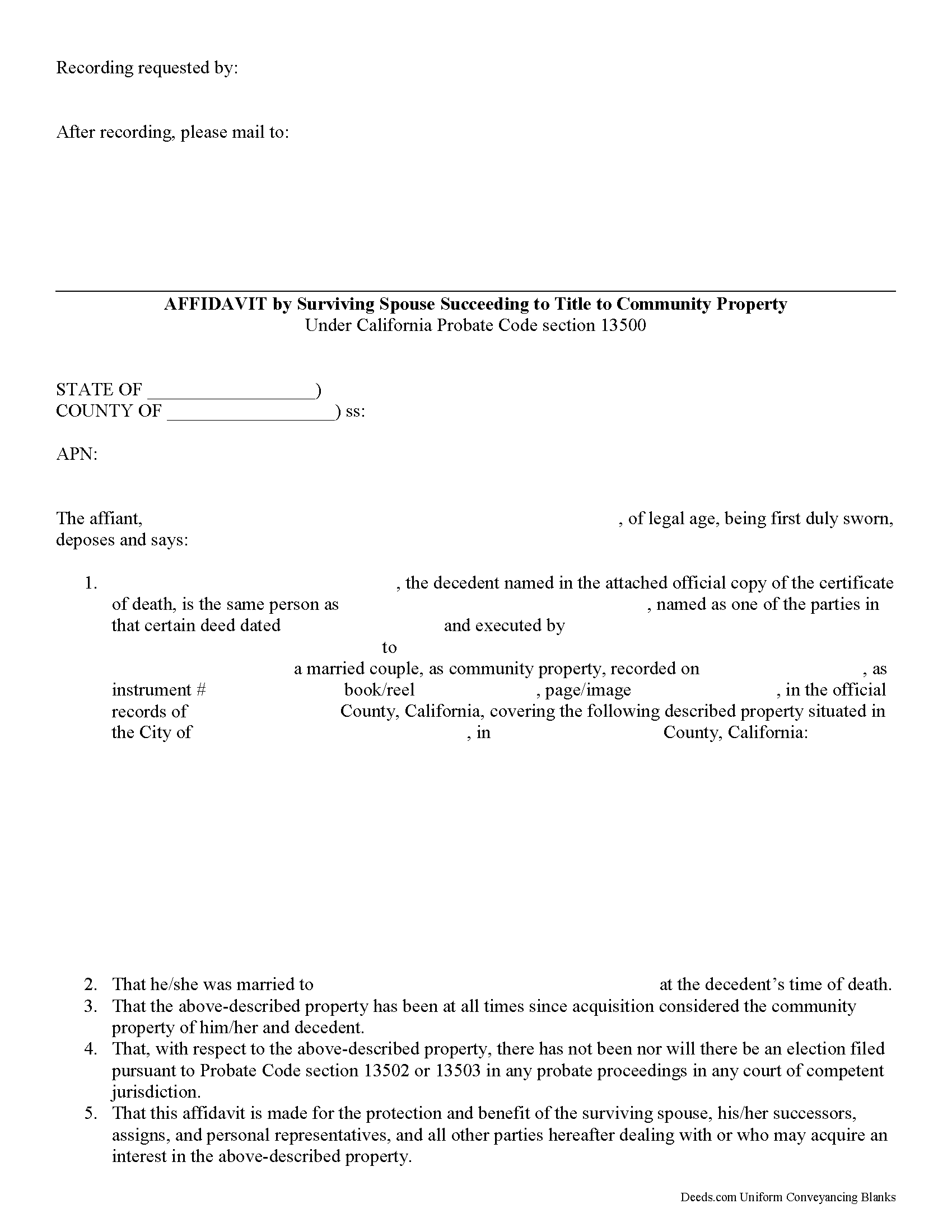

Affidavit of Surviving Spouse Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Santa Cruz County compliant document last validated/updated 7/8/2025

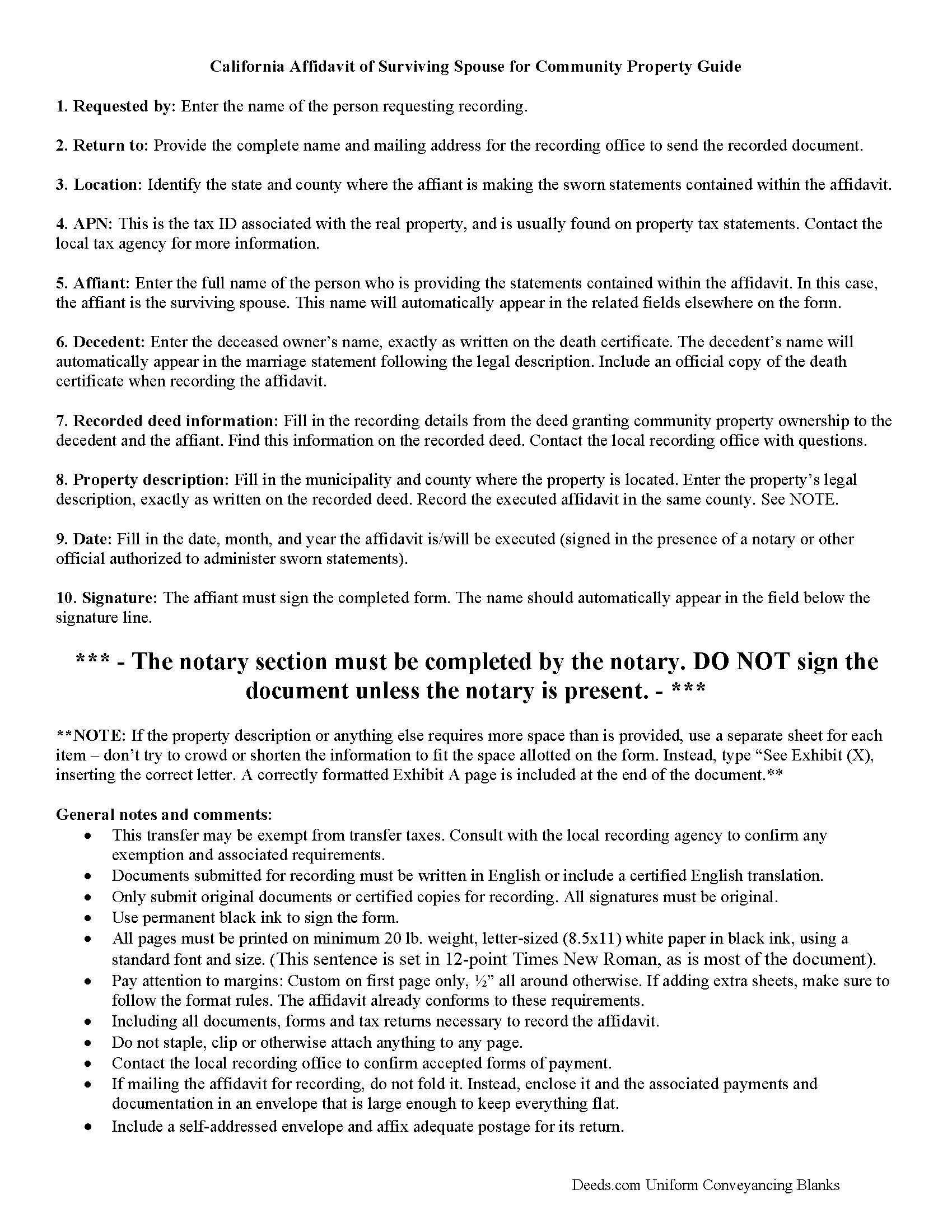

Affidavit of Surviving Spouse Guide

Line by line guide explaining every blank on the form.

Included Santa Cruz County compliant document last validated/updated 4/2/2025

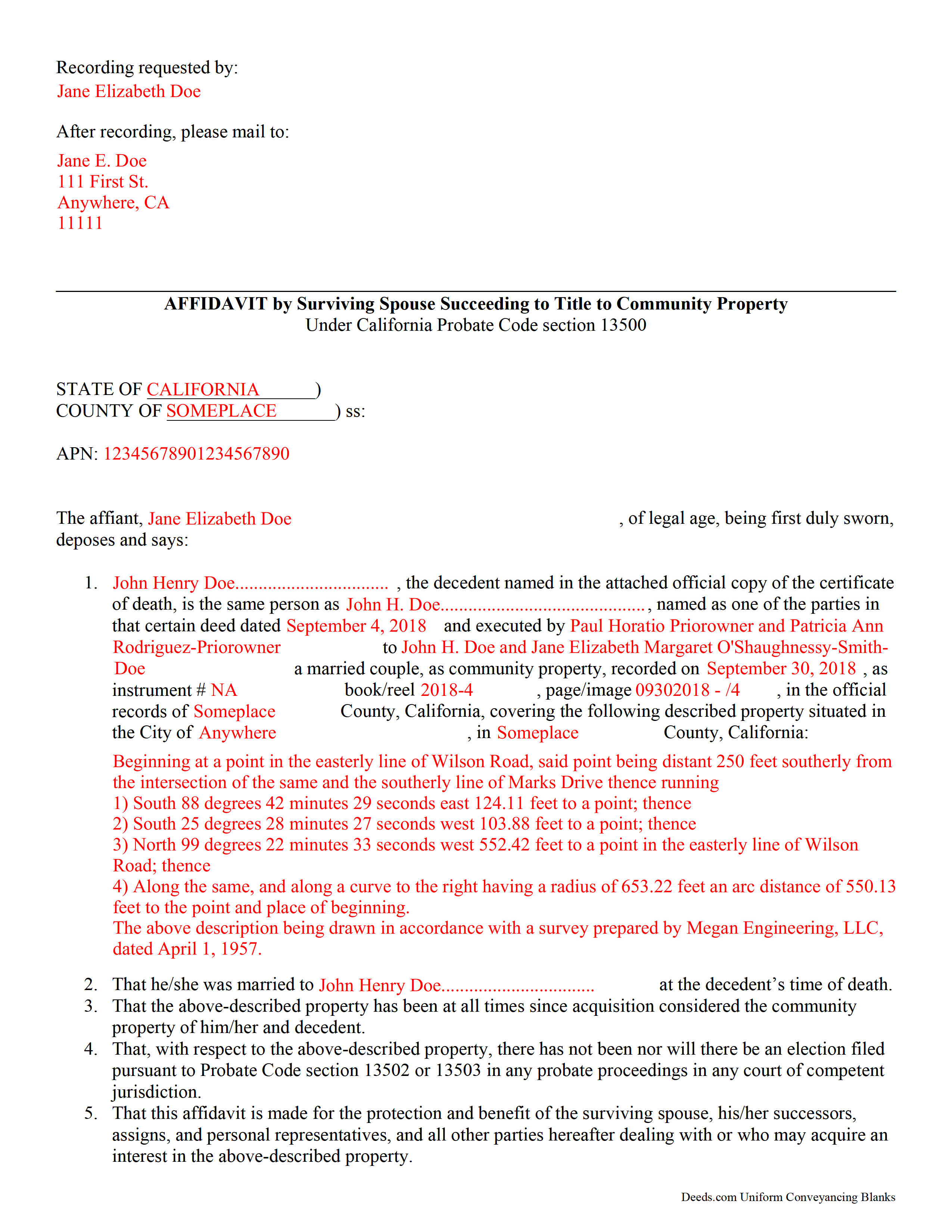

Completed Example of the Affidavit of Surviving Spouse Document

Example of a properly completed form for reference.

Included Santa Cruz County compliant document last validated/updated 4/17/2025

The following California and Santa Cruz County supplemental forms are included as a courtesy with your order:

When using these Affidavit of Surviving Spouse forms, the subject real estate must be physically located in Santa Cruz County. The executed documents should then be recorded in the following office:

County Recorder

701 Ocean St, Rm 230, Santa Cruz, California 95060

Hours: 8:00am to 12:00 and 1:00 to 4:00pm

Phone: (831) 454-2800

Local jurisdictions located in Santa Cruz County include:

- Aptos

- Ben Lomond

- Boulder Creek

- Brookdale

- Capitola

- Davenport

- Felton

- Freedom

- Los Gatos

- Mount Hermon

- Santa Cruz

- Scotts Valley

- Soquel

- Watsonville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Santa Cruz County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Santa Cruz County using our eRecording service.

Are these forms guaranteed to be recordable in Santa Cruz County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Santa Cruz County including margin requirements, content requirements, font and font size requirements.

Can the Affidavit of Surviving Spouse forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Santa Cruz County that you need to transfer you would only need to order our forms once for all of your properties in Santa Cruz County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by California or Santa Cruz County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Santa Cruz County Affidavit of Surviving Spouse forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Transferring California Community Property to the Surviving Spouse

Section 100(a) of the California Probate Code states that when a married person dies, one-half of the couple's community property belongs to the surviving spouse and the other half stays in the decedent's name, ostensibly for probate distribution. For transfers occurring after July 1, 2001, California property owners gained the option to hold title as community property with the right of survivorship. By vesting this way, the remaining spouse acquires the deceased spouse's portion of the shared property without the need for probate (Cal Civ Code 682.1(a)).

The surviving spouse files an affidavit (a statement of facts, made under oath), along with an official copy of the death certificate, at the recording office for the county where the property is located. The content may vary depending on the circumstances, but it generally contains the names of both spouses, a formal legal description of the shared real estate, and the recording information for the deed transferring ownership to the couple, confirming their intention to hold title as community property. Note that the right of survivorship is not automatic with community property -- it must be written on the face of the deed. To alleviate any questions about the survivorship status, consider including an official copy of the recorded deed.

The affidavit should also confirm, among other things, that the co-owners were married when the decedent died, that there are no probate actions related to the property, and that the surviving spouse is submitting the affidavit to ensure clear title. A clear title is important because it makes future transactions involving the real estate less complicated.

Each case is unique, so contact an attorney with specific questions or for complex situations.

(California Affidavit of Surviving Spouse Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Santa Cruz County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Santa Cruz County Affidavit of Surviving Spouse form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Rosie M.

March 13th, 2025

I found exactly what I was looking for, and the documents are a complete package. Great service!

Thank you, Rosie! We're so glad you found exactly what you needed and that the documents met your expectations. We appreciate your kind words and your support! If you ever need anything else, we're here to help.

Robert D.

March 7th, 2019

These forms made it so easy to update the property deed and the instructions and sample filled out form were most helpful. You might want to add some brief information on when or why to use the Acknowledgment in Individual Capacity notary form. In my case the notary was required to use it but also filled in the brief notarize section on the Affidavit as well. She said the one on the Affidavit had some value because it showed she had witnessed the my signature. But this was only after I suggested both be filled in as she initially thought to just strike through it and just use the Acknowledgment in Individual Capacity form.

Thank you for your feedback. We really appreciate it. Have a great day!

Christopher G.

August 20th, 2020

thank you - your service is awesome - i sent documents to the county - after 2 plus weeks they returned them with 'errors' - i went to your site - signed up - uploaded documents and submitted in less than 3 minutes - had it approved by the county in under 12 hours - THANK YOU - great service!!!!

Thank you Christopher, glad we could help. Have a great day!

Charles H.

December 8th, 2020

Website is user-friendly and very helpful, butI will have to wait until I submit my documents to the Clerk of Court to see if they are acceptable.

Thank you for your feedback. We really appreciate it. Have a great day!

George Y.

June 24th, 2021

Thought it was great, no issues. Very convenient especially dealing with difficult municipalities and a post COVID world. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Jayar L.

May 23rd, 2024

I just completed my first deed filing and I’m very happy with the experience. The deeds staff was extremely supportive and helpful in guiding me through the learning curve of being my first filing without legal assistance. They saved me a ton in legal fees.

Thank you for the kind words Jayar. Glad we were able to help.

DENISE E.

February 25th, 2021

I just submitted a beneficiary deed and it was accepted immediate and then recorded the next day! I like that I receive email messages notifying me of the process. The process was super easy and seamless. It's saved me so much time that I did not have to drive to downtown Phoenix to have this document record it. I love Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Fred D.

August 31st, 2022

At first glance, explanations and guidance to fill out the grant deed seems quite direct and no too difficult. I did not see any reference to a mortgagee which I believe needs to be incorporated in a boundary line adjustment (BLA), though not sure

I'll do the actual filling out the form in the next couple of weeks and will be in a better position for a more complete review.

Thank you for your feedback. We really appreciate it. Have a great day!

Amanda W.

August 18th, 2020

Very helpful.

Thank you!

Jenny E.

March 21st, 2021

I thought the website was good. But once I paid the money and downloaded the papers I needed for Grays Harbor. I had to end up calling a escrow company that we had worked with only to find out that they work with a slightly different version. The escrow company was kind enough to email me the version Grays Harbor recommends and uses. There is a chance I could use theses in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Martha D.

June 5th, 2019

Excellent website. I found exactly what I was looking for!

Thank you!

Madline J.

June 25th, 2020

amazing job!!

Thank you!