Download California Affidavit of Surviving Spouse Legal Forms

California Affidavit of Surviving Spouse Overview

Transferring California Community Property to the Surviving Spouse

Section 100(a) of the California Probate Code states that when a married person dies, one-half of the couple's community property belongs to the surviving spouse and the other half stays in the decedent's name, ostensibly for probate distribution. For transfers occurring after July 1, 2001, California property owners gained the option to hold title as community property with the right of survivorship. By vesting this way, the remaining spouse acquires the deceased spouse's portion of the shared property without the need for probate (Cal Civ Code 682.1(a)).

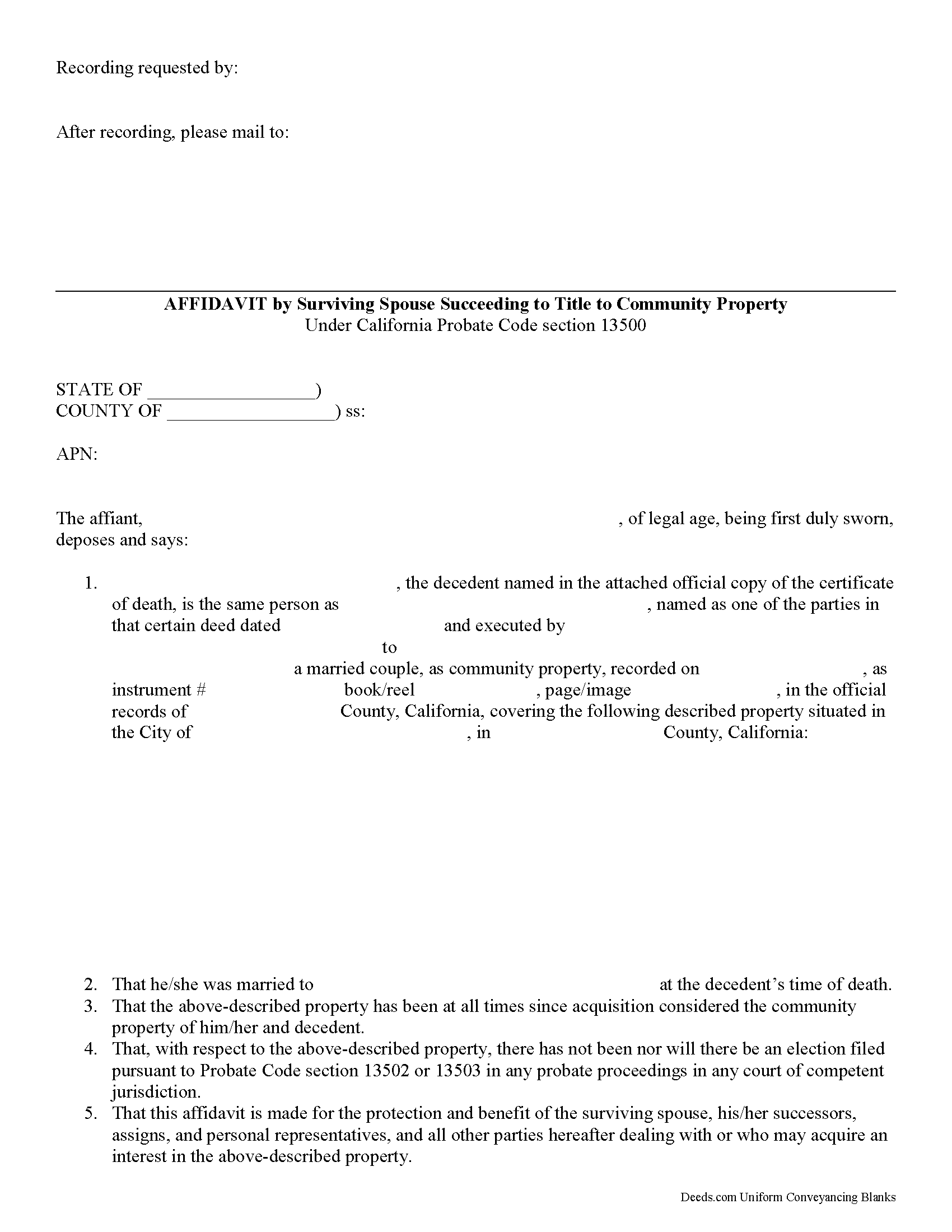

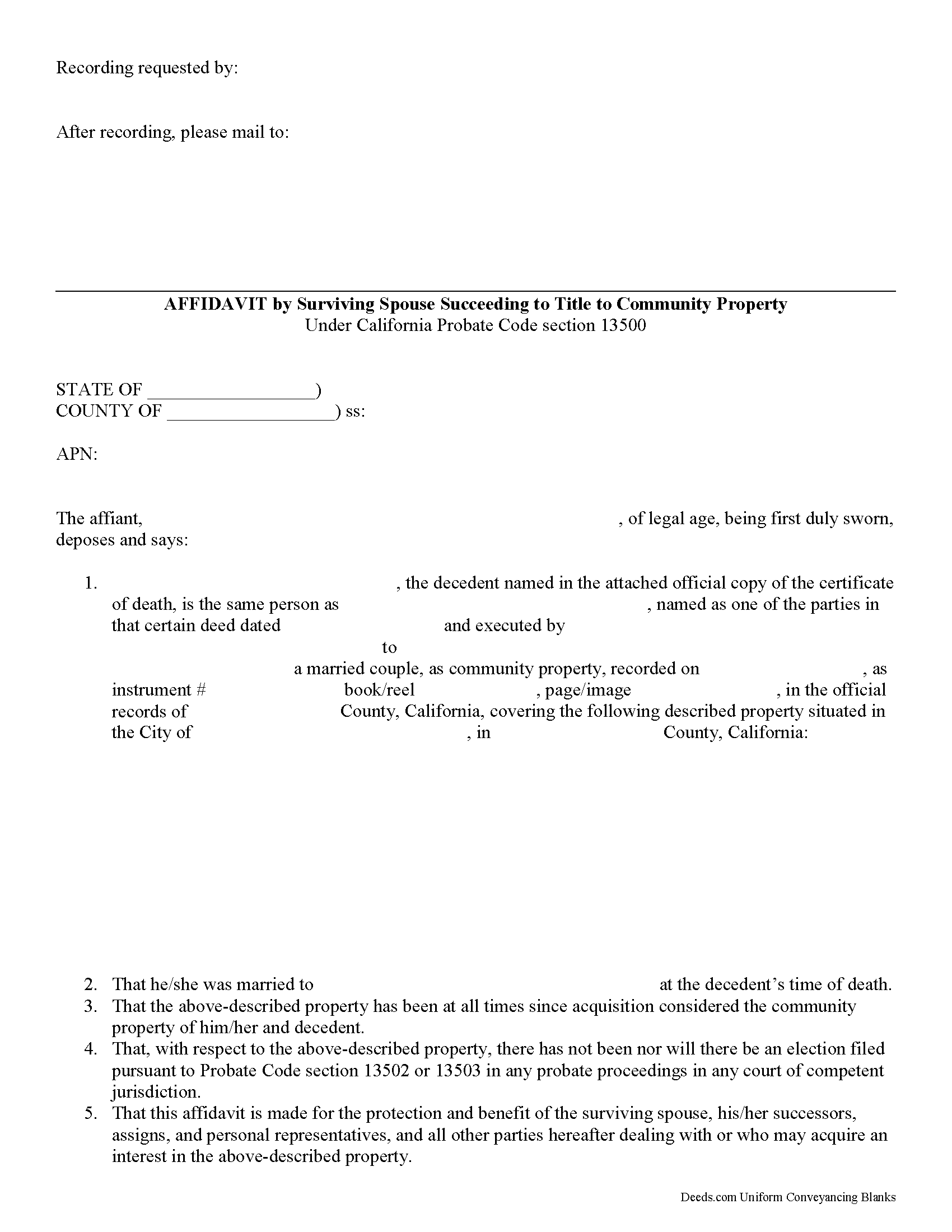

The surviving spouse files an affidavit (a statement of facts, made under oath), along with an official copy of the death certificate, at the recording office for the county where the property is located. The content may vary depending on the circumstances, but it generally contains the names of both spouses, a formal legal description of the shared real estate, and the recording information for the deed transferring ownership to the couple, confirming their intention to hold title as community property. Note that the right of survivorship is not automatic with community property -- it must be written on the face of the deed. To alleviate any questions about the survivorship status, consider including an official copy of the recorded deed.

The affidavit should also confirm, among other things, that the co-owners were married when the decedent died, that there are no probate actions related to the property, and that the surviving spouse is submitting the affidavit to ensure clear title. A clear title is important because it makes future transactions involving the real estate less complicated.

Each case is unique, so contact an attorney with specific questions or for complex situations.

(California Affidavit of Surviving Spouse Package includes form, guidelines, and completed example)