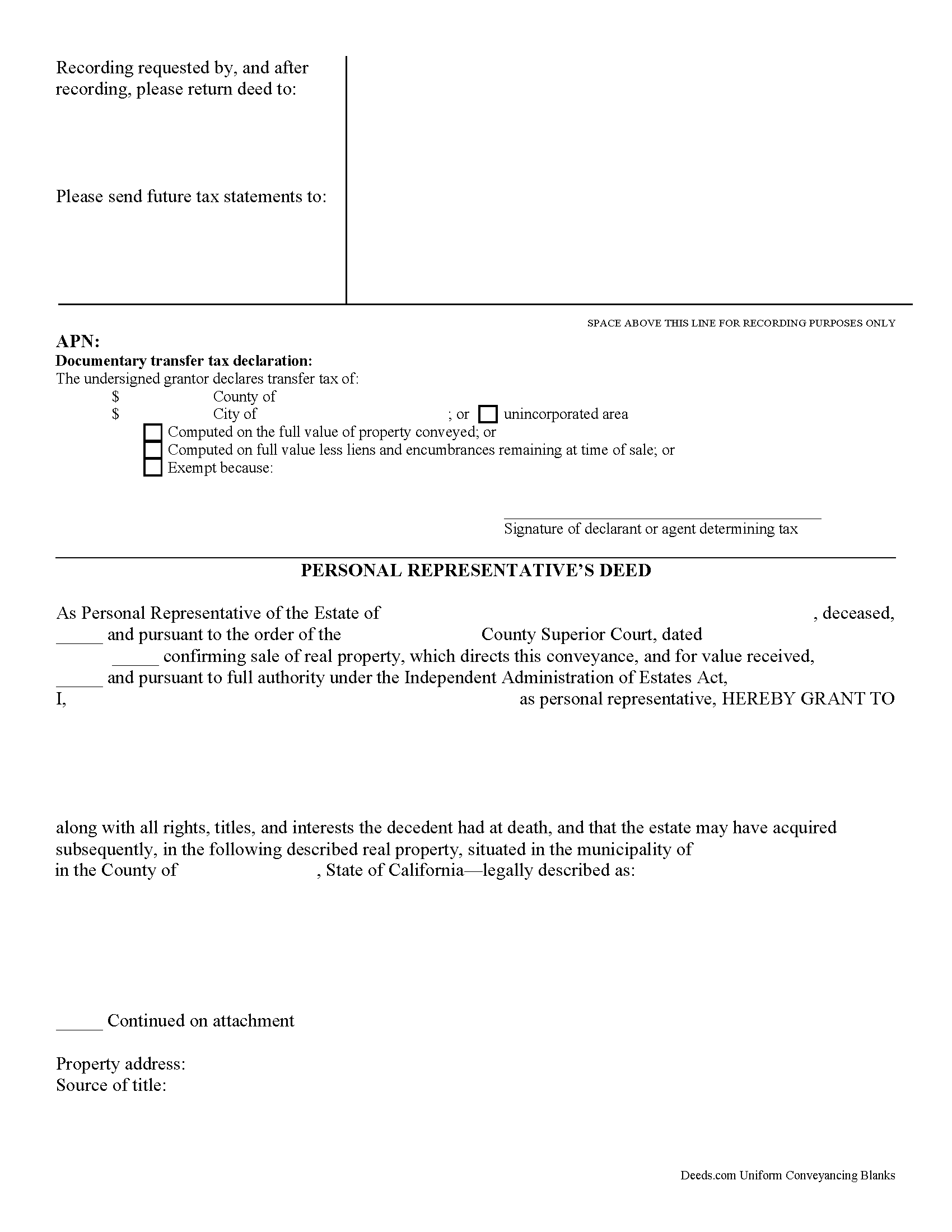

Orange County Personal Representative Deed Form

Orange County Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

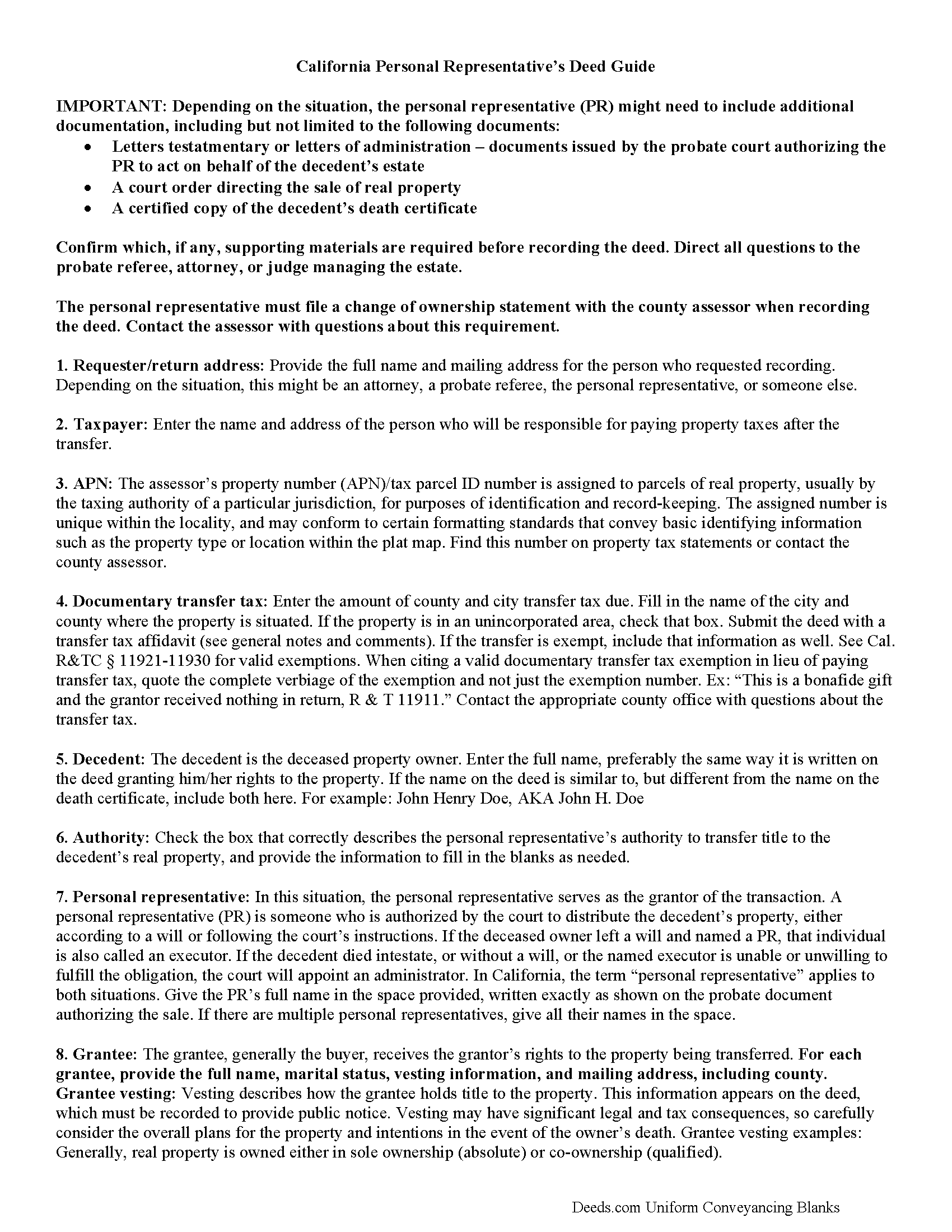

Orange County Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

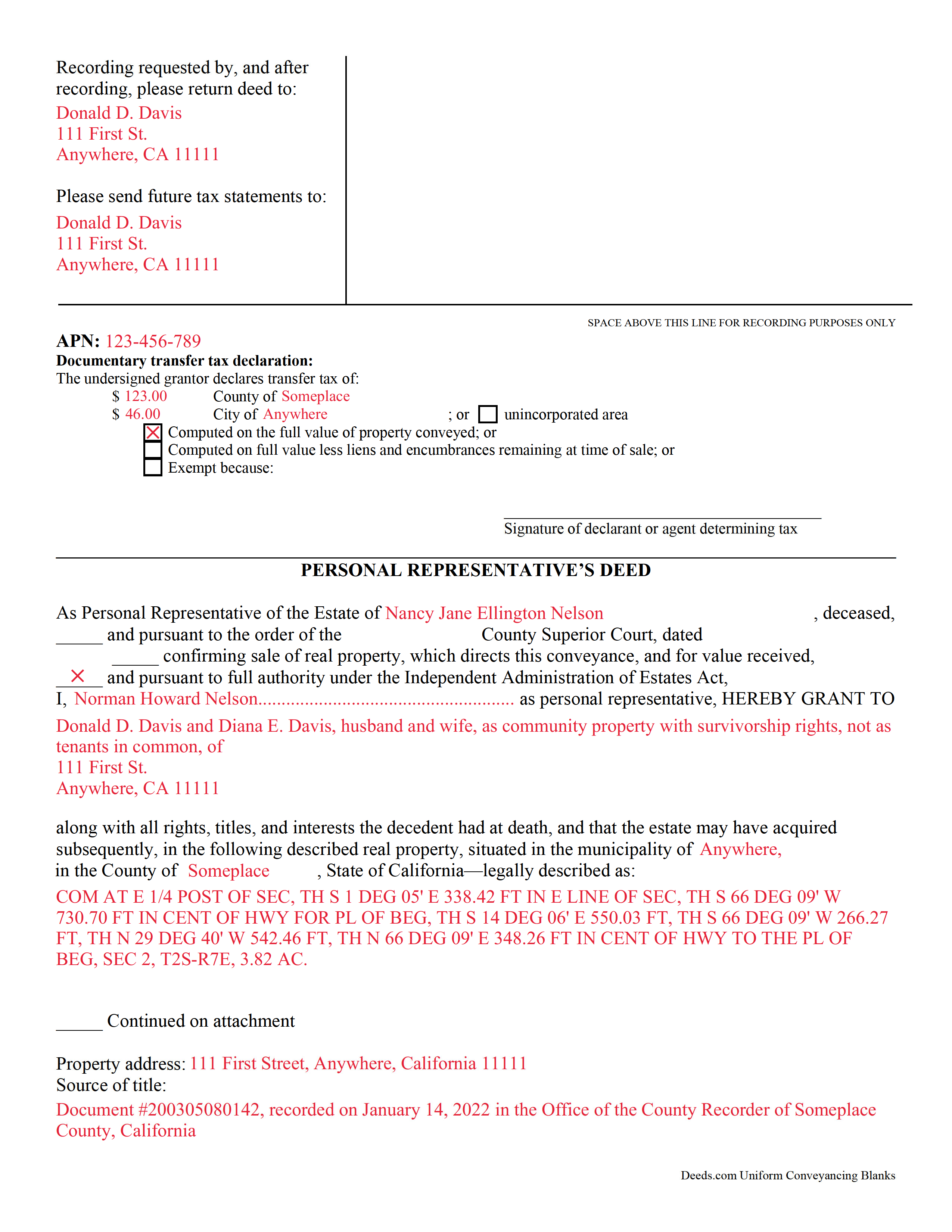

Orange County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Orange County documents included at no extra charge:

Where to Record Your Documents

County Administration South

Santa Ana, California 92701

Hours: 8 a.m. - 4:30 p.m. Monday - Friday

Phone: (714) 834-2500

Old Orange County Courthouse

Santa Ana, California 92701

Hours: Hours: 8 a.m. to 4:30 p.m., Monday - Friday

Phone: (714) 834-2500

South County Branch Office

Santa Ana, California 92653

Hours: Monday through Friday 9:00 am to 4:30 pm / Recording until 4:00pm

Phone: (714) 834-2500

North County Branch Office

Fullerton , California 92832

Hours: Monday through Friday 9:00 am to 4:00 pm

Phone: (714) 834-2500

Recording Tips for Orange County:

- Check that your notary's commission hasn't expired

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Orange County

Properties in any of these areas use Orange County forms:

- Aliso Viejo

- Anaheim

- Atwood

- Brea

- Buena Park

- Capistrano Beach

- Corona Del Mar

- Costa Mesa

- Cypress

- Dana Point

- East Irvine

- El Toro

- Foothill Ranch

- Fountain Valley

- Fullerton

- Garden Grove

- Huntington Beach

- Irvine

- La Habra

- La Palma

- Ladera Ranch

- Laguna Beach

- Laguna Hills

- Laguna Niguel

- Laguna Woods

- Lake Forest

- Los Alamitos

- Midway City

- Mission Viejo

- Newport Beach

- Newport Coast

- Orange

- Placentia

- Rancho Santa Margarita

- San Clemente

- San Juan Capistrano

- Santa Ana

- Seal Beach

- Silverado

- Stanton

- Sunset Beach

- Surfside

- Trabuco Canyon

- Tustin

- Villa Park

- Westminster

- Yorba Linda

Hours, fees, requirements, and more for Orange County

How do I get my forms?

Forms are available for immediate download after payment. The Orange County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Orange County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Orange County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Orange County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Orange County?

Recording fees in Orange County vary. Contact the recorder's office at (714) 834-2500 for current fees.

Questions answered? Let's get started!

Personal representative's deeds are used to transfer real property from both testate (with a will) and intestate (without a will) estates. These documents provide essential information about the specific probate estate and related property transfer in one document.

When a person dies, the probate court authorizes someone to take responsibility for distributing the remaining assets according to the instructions set out in the decedent's will (if one exists), while also following state and local laws. This person is often known as an executor or an administrator of the estate. California, however, identifies the individual who accepts that fiduciary duty as a personal representative (PR).

One common task involves transferring title on the decedent's real estate. Deeds used for this purpose must meet the same state and local requirements as warranty or quitclaim deeds. They also include other details, such as facts about the deceased property owner, the probate case, and anything else deemed necessary by the situation. In addition, the PR must file a PCOR with the county assessor's office when recording the completed deed.

Note that these deeds may need to be recorded with the probate court as well as the county recording office. Consult with the legal professional involved in managing the specific probate case to ensure that all recording and notice requirements are met.

See California Probate Code, Division 7. Administration of Estates of Decedents for more information. Remember that each case is unique, so contact an attorney with specific questions or for complex circumstances.

(California Personal Representative Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Orange County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Orange County.

Our Promise

The documents you receive here will meet, or exceed, the Orange County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Orange County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Barbara M.

November 21st, 2020

We love this service - so easy to use and quick. It is the second time we have used Deeds.com, in two different states. Wonderful service!

Thank you for your feedback. We really appreciate it. Have a great day!

Ryan P.

October 6th, 2020

It was a pleasant surprise to find out how easy the site was to use! Clear directions! very user friendly!

Thank you!

Lana B.

August 25th, 2019

Was very helpful!

Thank you!

harry S.

March 3rd, 2022

Just created account. Very easily done. have not recorded anything yet. Hope to do so soon.

Thank you for your feedback. We really appreciate it. Have a great day!

Gina I.

June 14th, 2021

Found the forms I needed with no problem and easy to fill out thanks to the guide that is with it. Big help!

Thank you for your feedback. We really appreciate it. Have a great day!

PAUL B.

August 18th, 2023

Very fast and efficient reply

Thank you!

Roy K.

February 15th, 2019

Just what we were looking for. Very easy to fill out. Thanks

Thank you Roy. We appreciate your feedback.

Marlene B.

February 21st, 2024

I appreciated the fact that the forms were by Texas County and I knew I had the right form. The form were fairly easy to complete. I had trouble completing the form because the property description was long and kept disappearing and I had to re-type. It would also have helped it I could have saved and not had to start over every time.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Chris B.

March 3rd, 2023

Accurate information and easy to use website.

Thank you for your feedback. We really appreciate it. Have a great day!

Estelle R.

May 25th, 2022

Easy to download. Hopefully easy to fill in. Just wish there was wording for a Beneficiary Deed for moving real estate property owned by a married couple to their Trust upon death of last Trustee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Victoria S.

March 13th, 2021

Deed.com is AMAZING! I only had about 2 weeks to get my quit claim deed recorded by my county office before my refinace due date approached. When I uploaded my quit claim to Deed.com I got it electronically recored by county register's office in "24 hours"!!! Deed.com is quick and efficient and I will dedinitely be using Deed.com again if I ever need a document recorded again.

Thank you for your feedback. We really appreciate it. Have a great day!

Munir S.

August 2nd, 2024

Good service. Easy to use, responsive, fast, and fairly priced. First time user, will continue to use it for future needs. Recommend.

Thank you for your positive words! We’re thrilled to hear about your experience.

Robert B.

August 14th, 2021

The forms were easy to download and fill.

Thank you!

Alana G.

March 26th, 2021

I was very pleased. It was the form I needed. I was getting discouraged by companies that wanted me to sign up for monthly payments just to get the one form I needed. I prefer your system of paying for what I get. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Janice T.

September 14th, 2020

The downloads were a great help in understanding of both what a Warranty Deed was and how to follow the steps as well as filling out the forms.

Thank you for your feedback. We really appreciate it. Have a great day!