Imperial County Quitclaim Deed Form (California)

All Imperial County specific forms and documents listed below are included in your immediate download package:

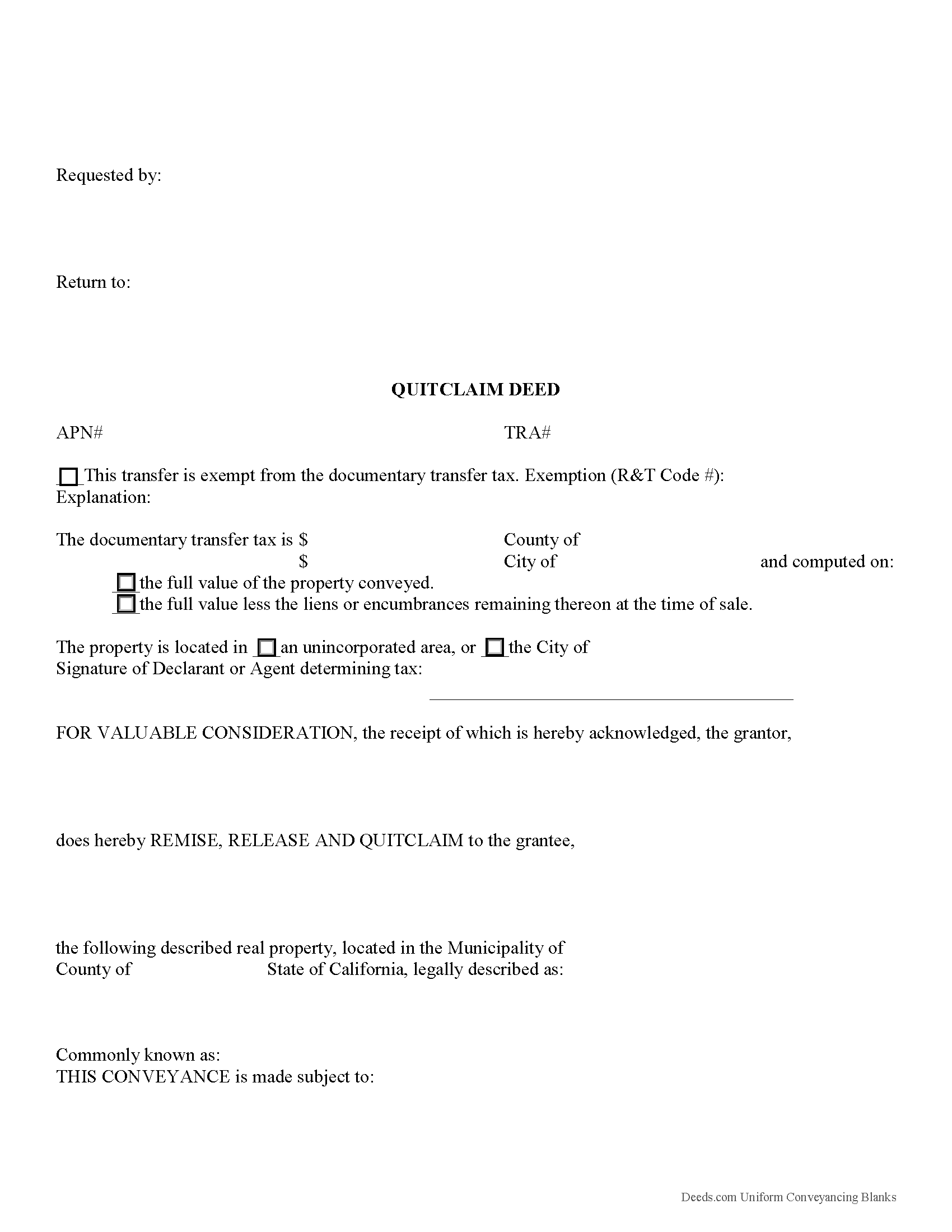

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all California recording and content requirements.

Included Imperial County compliant document last validated/updated 11/8/2024

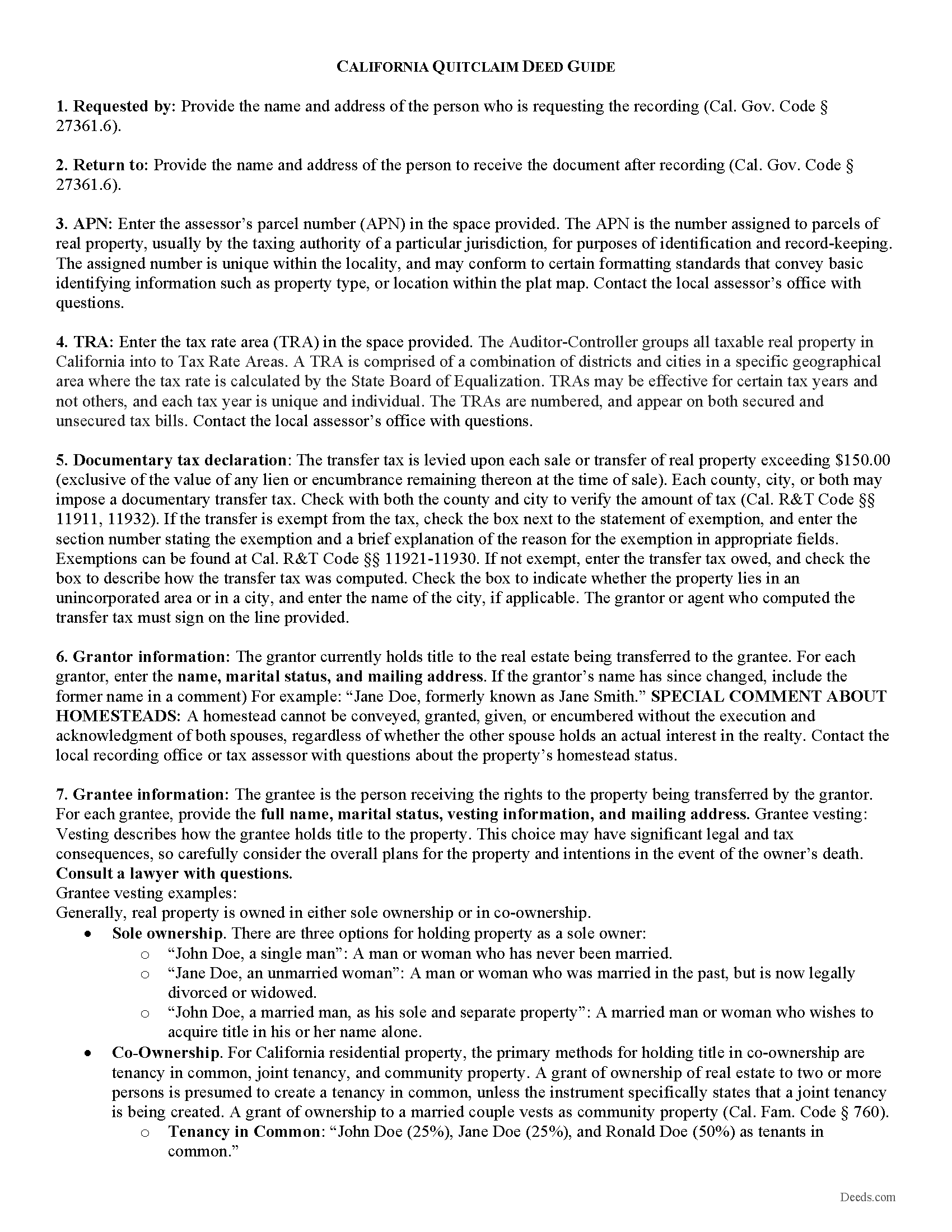

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included Imperial County compliant document last validated/updated 7/4/2025

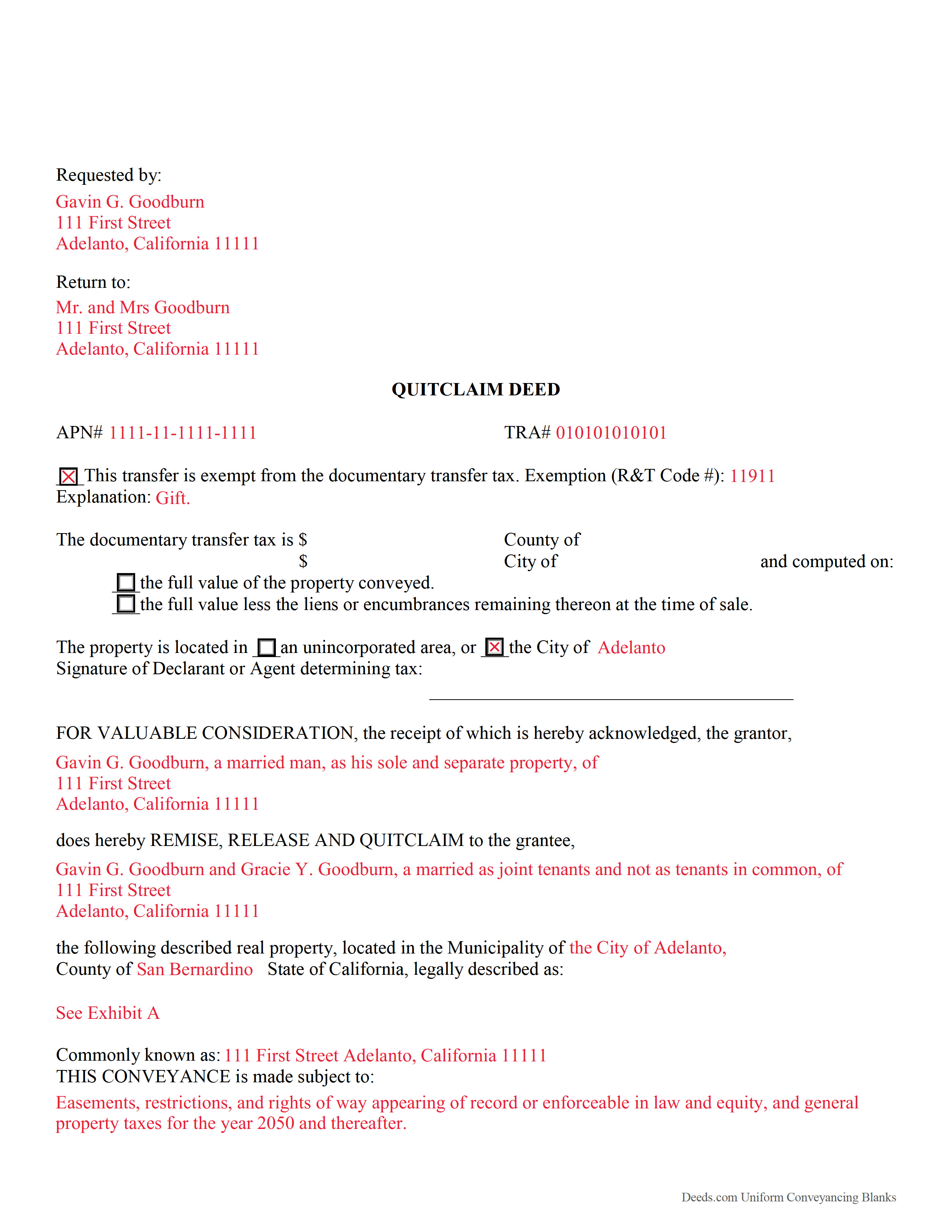

Completed Example of the Quitclaim Deed Document

Example of a properly completed California Quitclaim Deed document for reference.

Included Imperial County compliant document last validated/updated 6/19/2025

The following California and Imperial County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed forms, the subject real estate must be physically located in Imperial County. The executed documents should then be recorded in the following office:

Imperial County Clerk/Recorder

Admin Center - 940 W Main St, Suite 202, El Centro, California 92243-2839

Hours: Monday through Friday 8:00 am to 5:00 pm

Phone: 442-265-1077

Local jurisdictions located in Imperial County include:

- Bard

- Brawley

- Calexico

- Calipatria

- El Centro

- Heber

- Holtville

- Imperial

- Niland

- Ocotillo

- Palo Verde

- Salton City

- Seeley

- Westmorland

- Winterhaven

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Imperial County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Imperial County using our eRecording service.

Are these forms guaranteed to be recordable in Imperial County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Imperial County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Imperial County that you need to transfer you would only need to order our forms once for all of your properties in Imperial County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by California or Imperial County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Imperial County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Quitclaim deeds in California are initially defined by Civ. Code, 1092, 1104-1107, 1113, and further in Gov. Code 27279-27297.7, 27320-27337.

Content:

Each document submitted for recording should have the title near the top of the first page (Gov. Code 27324). Include the name and address of the individual requesting recording as well as a name and return address for use after the quitclaim deed is recorded. Provide the name and address of the individual or entity to receive tax bills at the bottom of the first page. (Gov. Code 27321.5, 27361.6). In addition, every quit claim deed must contain the name and address of everyone with an ownership interest in the property. Be certain to present the names in exactly the same way they're found on the prior deed. If there are any unrecorded changes, provide the original and new names like this: Jane Doe, formerly known as Jane Smith. See Gov. Code 27288.1.

Any document which modifies, releases, or cancels the provisions of a previously recorded document shall state the recorder identification number or the book and page of the document being modified, released, or canceled. (Gov. Code 27361.6). Additionally, Gov. Code 27280.5 requires that the names of parties required to be indexed appearing in any instrument, paper, or notice presented for recordation should be legibly typed or printed near the signature. The names of all persons executing or witnessing a document shall be legibly signed or shall be typed or printed to the side of or below the signature.

While not specifically discussed in the statutes, a valid quit claim deed should also include, at minimum, a complete legal description of the property and the name, address, and vesting choice of the grantee.

Recording:

Note that Gov. Code 27293 requires that quit claim deeds in languages other than English are not suitable for recording. Civ. Code 1169 states that quit claim deeds must be recorded by the County Recorder of the county in which the conveyed real estate is situated.

Civ. Code 1213-1214 discuss California's recording statute, which is classified as "race-notice." Basically, the first bona fide purchaser....will prevail over an earlier purchaser who failed to record the conveyance. So, despite Civ. Code 1217, which states that "an unrecorded instrument is valid as between the parties thereto and those who have notice thereof," just because the parties on the quit claim deed know about it, their knowledge does NOT constitute constructive notice to the public. Therefore, RECORD THE QUIT CLAIM DEED as soon as possible after executing it. This protects the interests of all parties.

Gov. Code 27361.6 formalizes some formatting requirements: The top right 2 " X 5" corner is reserved for the Recorder's use only. The top left 2 " X 3 " corner is reserved for the name of the person requesting recording and a return name and address. The title of the document must appear on the first page immediately below the space reserved for the Recorder.

(California Quitclaim Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Imperial County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Imperial County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Don B.

November 2nd, 2020

This was my first experience with Deeds. Web site instructions are detailed and easy to understand. This was a smooth process. Highly recommend to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Lynne Z.

April 22nd, 2022

not enough room for legal description. Wouldn't allow me to enter widow status in owner box. Not clear who to send it to so I printed it out and will ask the notary who I use for recording it.

Thank you!

Lynda D S.

November 2nd, 2022

Sorry, I did not see that I was in the wrong review and just sent a review of a "product" I ordered online.

As for Deeds.com I was very happy with the process and speed of getting the forms.

I have used this site before.

Highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn G.

January 15th, 2023

This information was extremely helpful and needed. The price is so worth it also.

Thank you!

Paul D.

July 24th, 2019

Easy to use! The forms were perfect and everything was explained well! Will use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly H.

February 13th, 2019

Thanks!!

Thank you!

Cathy W.

December 18th, 2021

Easy to use and fee is reasonable.

Thank you!

Harry W B.

January 11th, 2021

This is a very valuable resource. It was user friendly and made transfer happen in a day!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tonni L.

June 15th, 2021

Quick and easy with great instructions and accurate documents. I plan to make this site a part of our financial planning. Highly recommend. Saved big by this DIY process.

TL

Thank you for your feedback. We really appreciate it. Have a great day!

Oldemar T.

June 7th, 2020

Messaging system should reach customer email. It took me a couple of days to find out the processor had messaged me. A customer notification should be implemented for every message left in the account.

Thank you!

Gary F.

October 6th, 2021

5 star review. Was able to order and download what I wanted in just a few minutes without any glitches.

Thank you for your feedback. We really appreciate it. Have a great day!

Billie W.

April 23rd, 2021

Excellent way to do this kind of transaction.

Thank you!