Arapahoe County Correction Deed Form

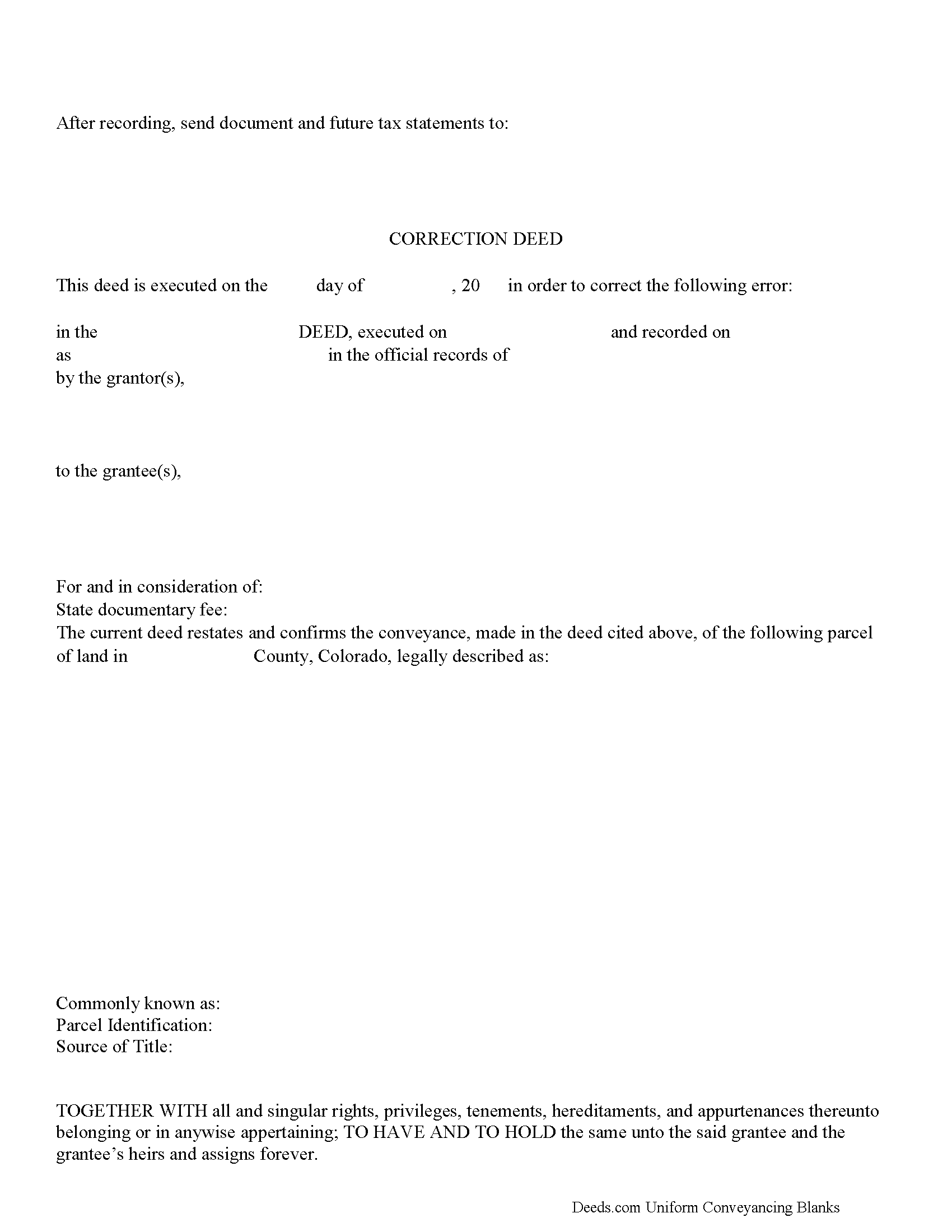

Arapahoe County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

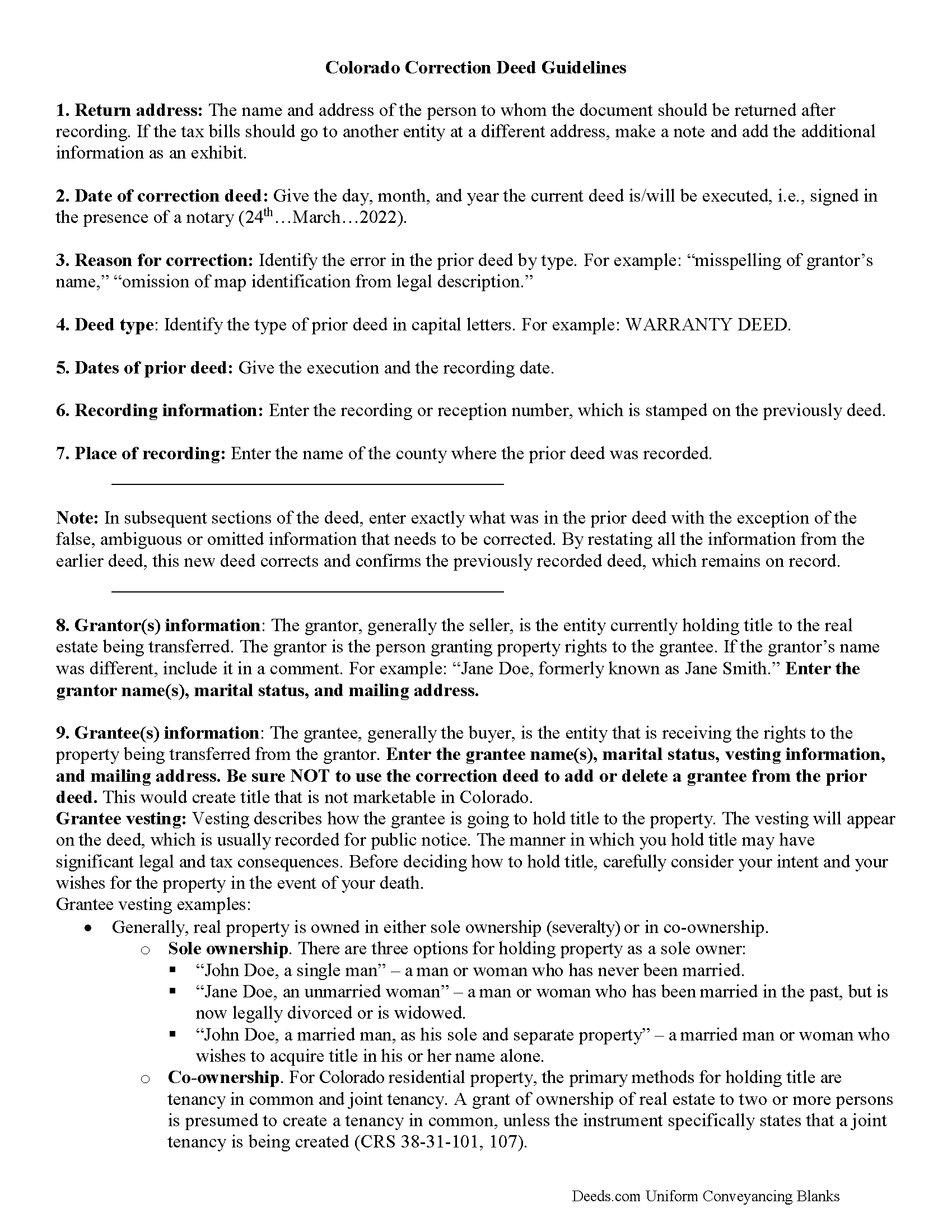

Arapahoe County Correction Deed Guide

Line by line guide explaining every blank on the form.

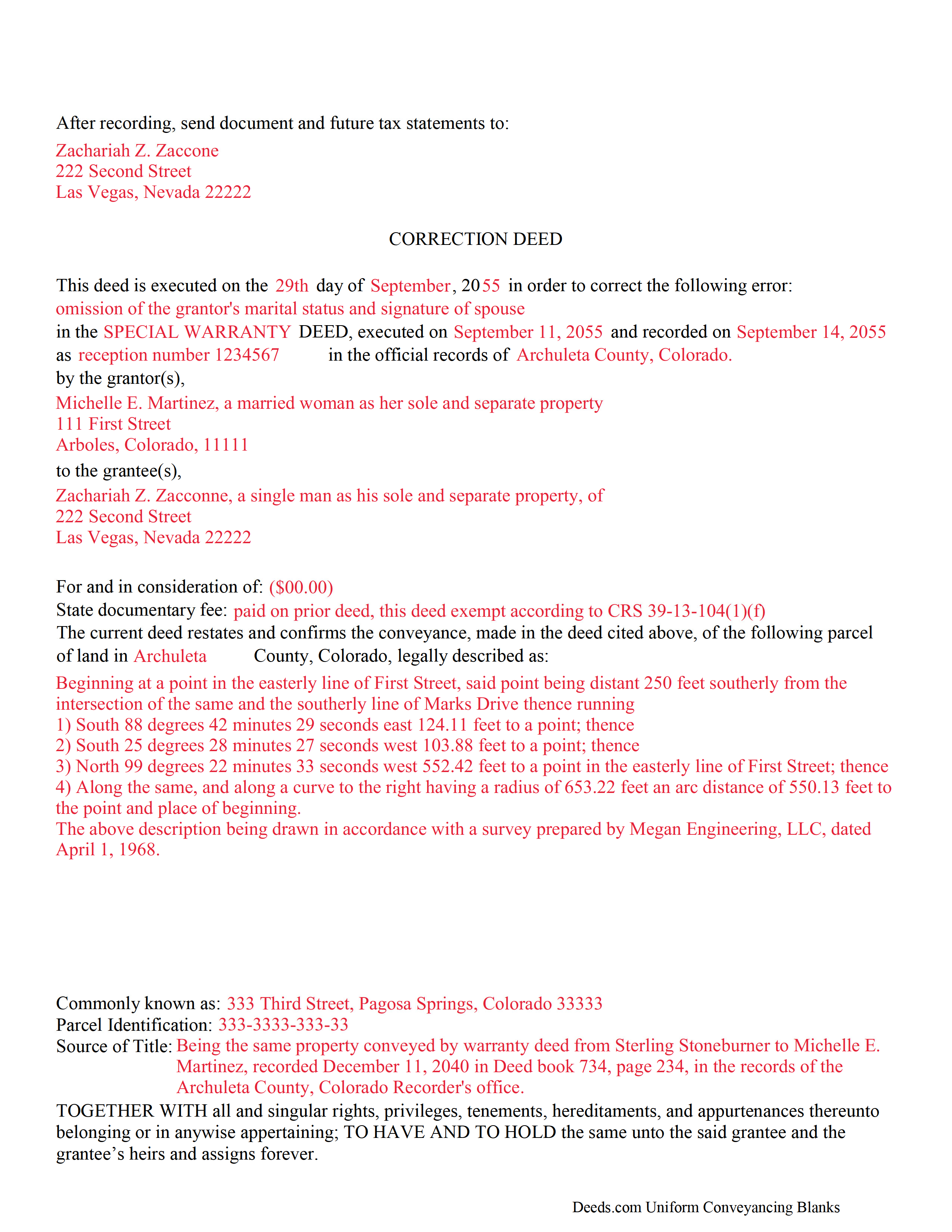

Arapahoe County Completed Example of the Correction

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Arapahoe County documents included at no extra charge:

Where to Record Your Documents

Arapahoe County Clerk and Recorder

Littleton, Colorado 80120

Hours: 7:00am to 4:00pm M-F

Phone: (303) 795-4520

Recording Tips for Arapahoe County:

- Bring your driver's license or state-issued photo ID

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Arapahoe County

Properties in any of these areas use Arapahoe County forms:

- Aurora

- Byers

- Deer Trail

- Denver

- Englewood

- Littleton

Hours, fees, requirements, and more for Arapahoe County

How do I get my forms?

Forms are available for immediate download after payment. The Arapahoe County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Arapahoe County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Arapahoe County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Arapahoe County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Arapahoe County?

Recording fees in Arapahoe County vary. Contact the recorder's office at (303) 795-4520 for current fees.

Questions answered? Let's get started!

Use this deed form to make minor corrections in a previously recorded warranty, special warranty or quitclaim deed.

In Colorado, a previously recorded deed can be corrected by recording a second deed, called a correction or corrective deed. The sole purpose of such a document is to prevent potential title flaws, which may create problems when the current owner attempts to sell the property. The correction deed does not convey title but confirms the prior conveyance. For the most part it reiterates the prior deed verbatim, except for the corrected item and the consideration.

The errors usually adjusted by a corrective deed are minor omissions or typographical mistakes, sometimes called scrivener's errors. Among those are misspelled names, omitted or wrong middle initial, a minor error in the property description, or an omitted execution date, or a faulty acknowledgment. However, certain types of changes cannot be achieved by using a correction deed. For example: the addition or omission of a grantee; changing the manner in which title is held to/from "joint tenants with rights of survivorship"; making material changes to the legal description; or deleting a portion of the originally transferred property. As far as changes to the legal description are concerned, use a correction deed only if a portion of the property was left out of the original conveyance.

The correction deed must be executed from the original grantor to the original grantee and state that its purpose is to correct a specific error, identified by type. It references the prior deed by date(s) and recording/reception number, as well as county of recording. A correction deed generally is exempt from state documentary fee (CRS 39-13-104(1)(f), which is calculated based on the consideration stated in the deed. Thus, many counties advise to enter $0 as consideration and to state the exemption on the correction deed (CRS 39-13-104(2)).

(Colorado Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Arapahoe County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Arapahoe County.

Our Promise

The documents you receive here will meet, or exceed, the Arapahoe County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Arapahoe County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Susan N.

December 1st, 2019

Hope to get form printed out Ok.

Thank you!

Robert T.

September 23rd, 2019

Very quick thank you.

Thank you!

R Rodney H.

January 29th, 2019

Excellent service--I got just the information I needed quickly and reasonably priced. I am glad to know of this service for future needs, as an individual, in this sector. Cheers, RRH

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dallas S.

July 19th, 2023

Very easy

Thank you!

Daniel N.

June 28th, 2024

Deeds.com provided the document template and instructions I needed, right when I needed them. I was able to navigate through an unfamiliar process with exactly the support I needed at an affordable and fair price. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David M.

January 13th, 2023

Outstanding products and interface. DCM, IL Attorney

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

sandra f.

December 9th, 2020

excellent transaction...very informative prior to purchase..

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roberto S.

October 9th, 2024

Everything great thank you

Thank you for your positive words! We’re thrilled to hear about your experience.

Terri E.

October 6th, 2023

Quick Accurate experience will recommend this service to my friends

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LINDA J M.

November 18th, 2019

NO PROBLEMS. I LIKE THE DEED DOCUMENT AND INSTRUCTIONS. MADE IT EASY.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brennan H.

October 4th, 2023

I had worked for a couple of months sending things back and forth to the county and still had no success. I decided to use deeds.com and it was all done in a few hours. Such a relief! While I find this to be wrong and the county should work with property owners as well as they work with third parties, I was still grateful for this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Jan O.

April 22nd, 2021

This was so easy and just what I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Shane J.

December 5th, 2024

I use deeds.com for all of my document filing needs. The amount of time and money saved on making trips to the auditor's office is well worth the nominal fee that is charged. I highly recommend deeds.com!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Deirdre M.

July 11th, 2022

Thank for you guidance to amend & correct & recover my home with evidence you provide in Dead Fraud. I'll keep you updated.

Thank you!

ROBERT H.

January 11th, 2019

No review provided.

Thank you!