Lincoln County Mineral Deed with Quitclaim Covenants Form

Lincoln County Mineral Deed with Quitclaim Covenants Form

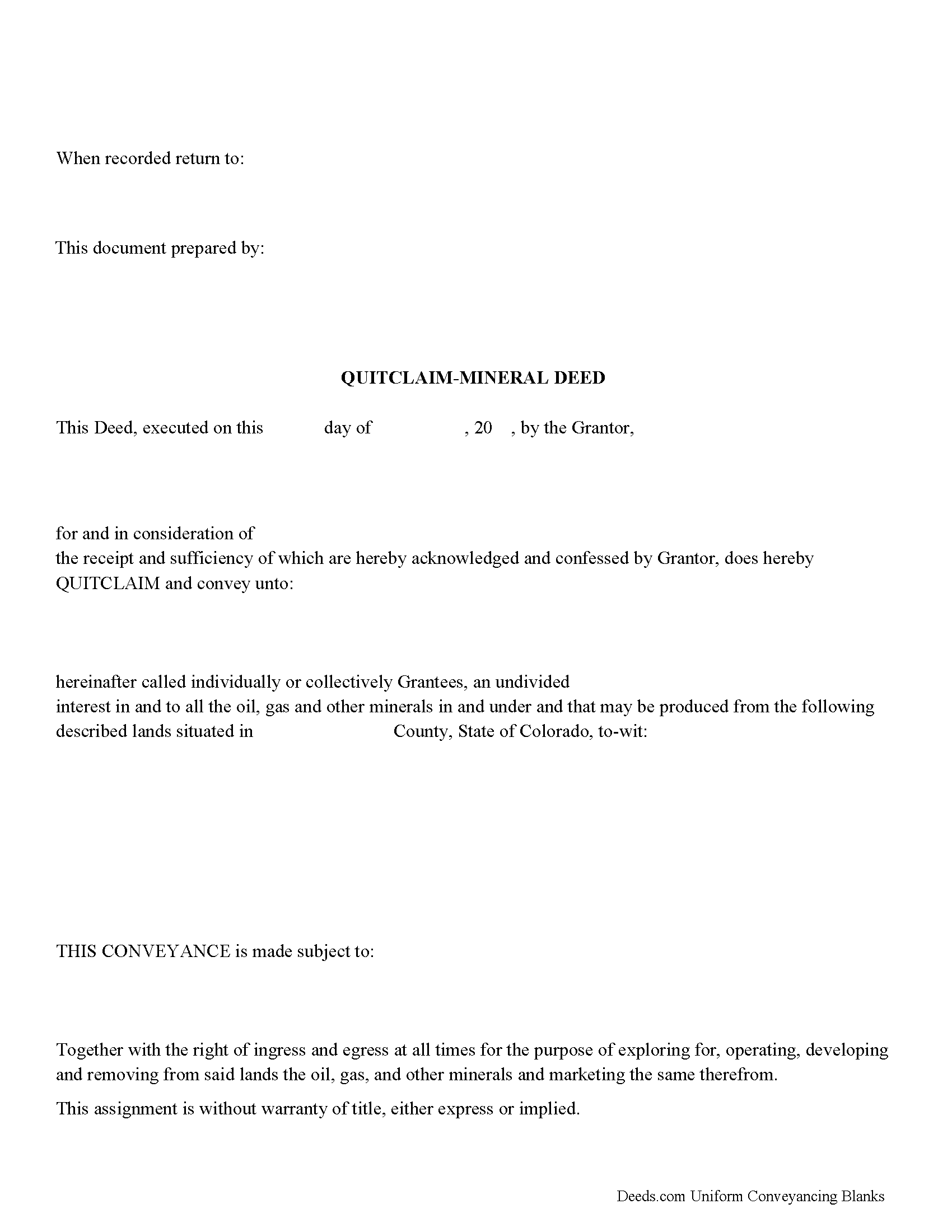

Fill in the blank Mineral Deed with Quitclaim Covenants form formatted to comply with all Colorado recording and content requirements.

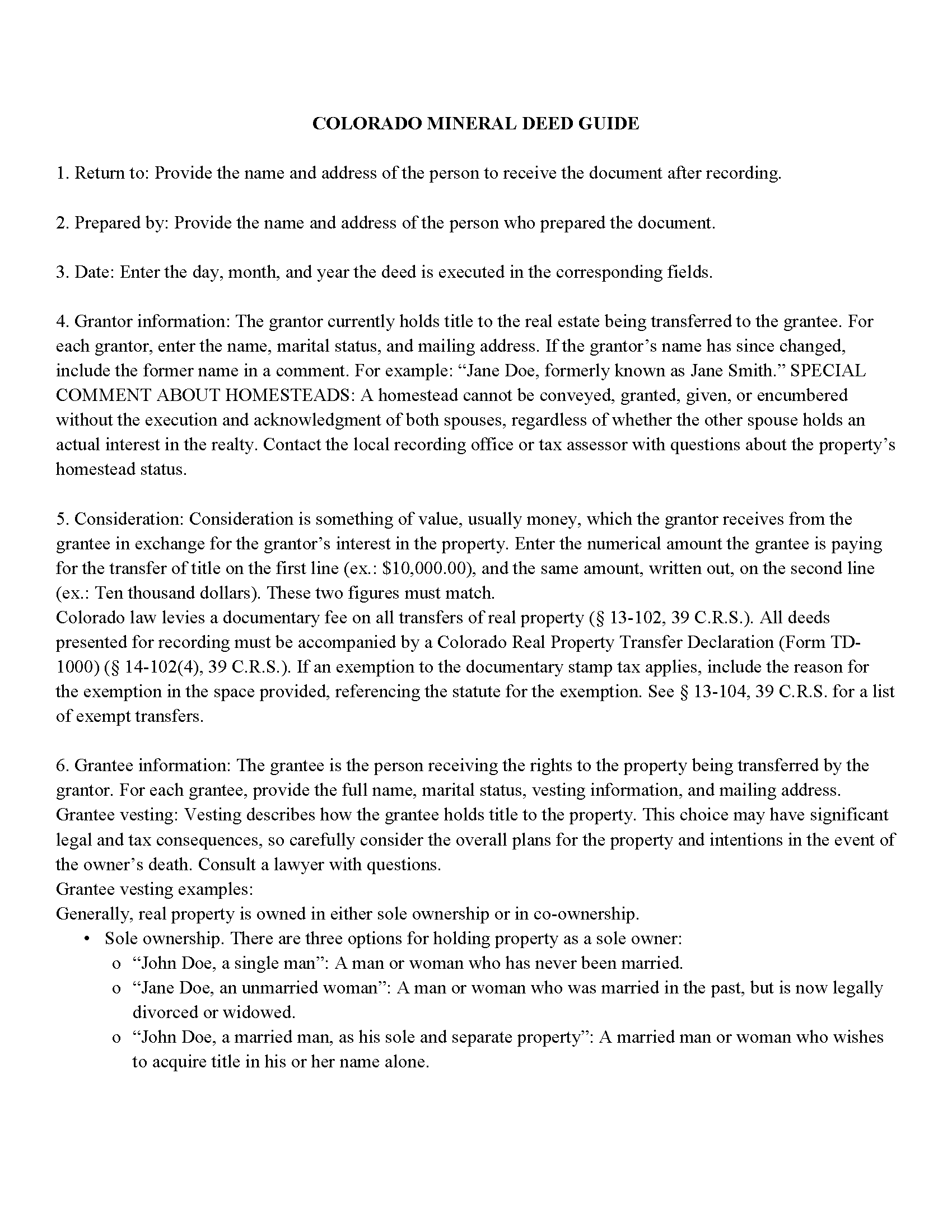

Lincoln County Mineral Deed with Quitclaim Covenants Guide

Line by line guide explaining every blank on the Mineral Deed with Quitclaim Covenants form.

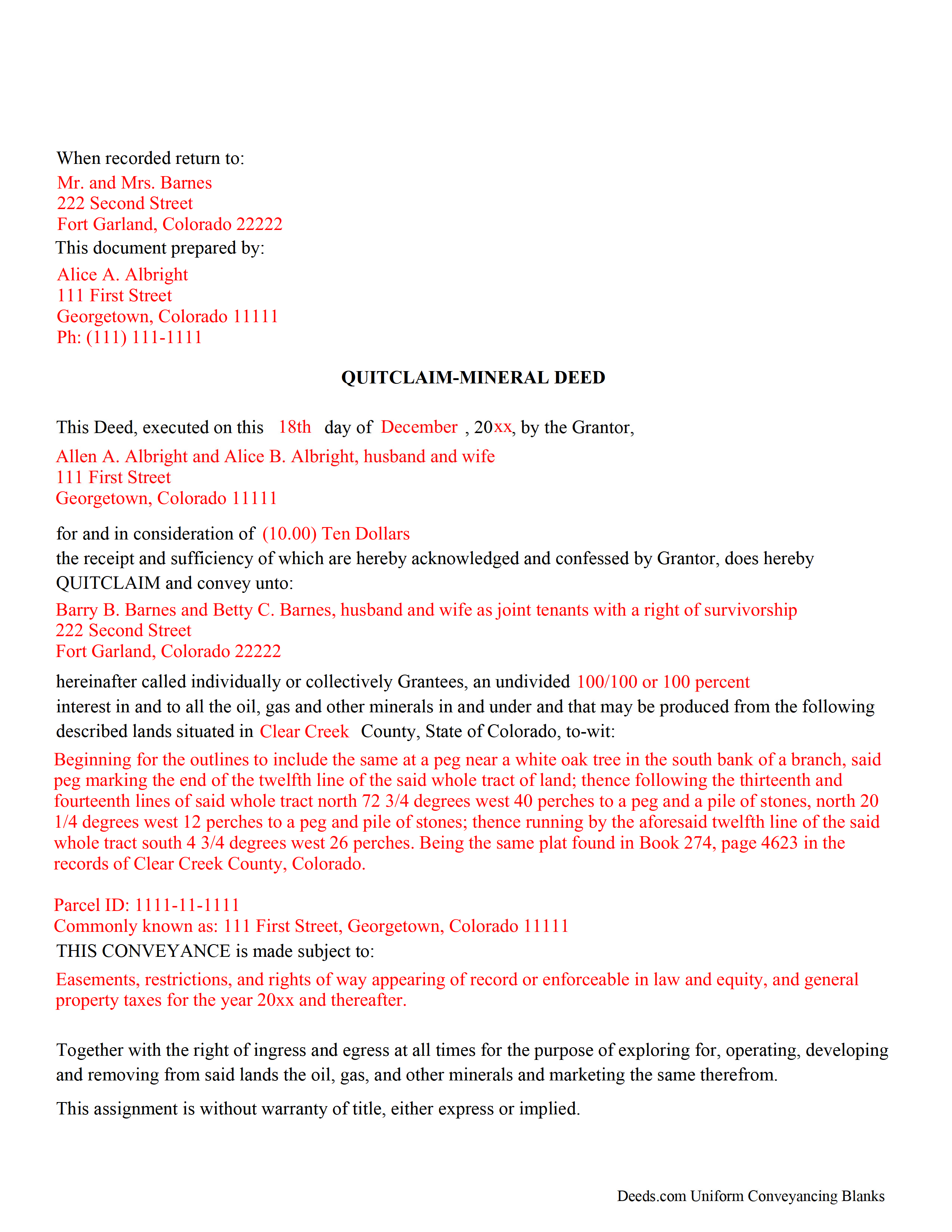

Lincoln County Completed Example of the Mineral Deed with Quitclaim Covenants Document

Example of a properly completed Colorado Mineral Deed with Quitclaim Covenants document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Clerk and Recorder

Hugo, Colorado 80821

Hours: 8:00 to 4:30 Monday-Friday

Phone: (719) 743-2444

Recording Tips for Lincoln County:

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Arriba

- Genoa

- Hugo

- Karval

- Limon

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (719) 743-2444 for current fees.

Questions answered? Let's get started!

In Colorado, a Mineral Quitclaim Deed is used to transfer oil, gas, and mineral rights from the grantor to the grantee. It is a form of property transfer, not a lease agreement (CO Rev Stat § 38-30-113).

Transfer Details: The deed includes the transfer of a variety of mineral rights, such as oil, gas, and other minerals, without exceptions or reservations. The grantor specifies the percentage of mineral rights the grantee receives.

Rights and Access: The grantee is granted rights to access the land for activities like mining, drilling, exploration, operation, and development of these minerals, including their storage, handling, transportation, and marketing.

No Title Warranty: The grantor quitclaims the mineral rights without any warranty of title, either express or implied, meaning the grantee accepts the title as it is, including any discrepancies (§ 38-30-116).

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer property. Resolution often involves the holder(s) of the mineral rights, quit-claiming any rights he/she/they have or might have in the subject property.

Legal Requirements and Recording: The deed must include the name, address, and county of both the grantor and grantee, consideration paid, a formal legal description of the property, the assessor's ID number (if available), and an acknowledged signature of the grantor (C.R.S. 38-30-113, 114, 116; C.R.S. 38-35-122).

Recording Process: According to C.R.S. 38-35-109, after execution, the quitclaim deed must be recorded in the office of the county clerk where the land is situated. Colorado follows a "race-notice" recording statute, meaning the first bona fide grantee to record the deed generally retains the rights to the property.

Permanent Impact and Legal Advice: The use of a quitclaim deed can have lasting implications on property rights. It is advisable for individuals to seek legal counsel to fully understand the document's implications before executing it.

(Colorado Mineral Deed with Quitclaim Package includes form, guidelines, and completed example)

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Mineral Deed with Quitclaim Covenants meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Mineral Deed with Quitclaim Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Willie P.

May 13th, 2020

Your service was excellent

Thank you for your feedback. We really appreciate it. Have a great day!

Chris B.

March 3rd, 2023

Accurate information and easy to use website.

Thank you for your feedback. We really appreciate it. Have a great day!

Zachary F.

February 1st, 2022

I am a lawyer and purchased a specialized type of deed for a special scenario. The product received was functional, but not great. Wording is slightly clunky and the form layout was not convenient for making a professional final product. The wording also didn't contemplate a remote-state probate, which is a common scenario. Something about the PDF prevented me from doing cut and paste, so I had to do OCR to get the relevant text for inserting in my existing draft deed. Finally, while the site claims it is customized for the exact state and county, it does not appear to be well-customized for that purpose and I had to use other language (not sourced from the deeds.com document) to meet local norms.

Thank you for your feedback. We really appreciate it. Have a great day!

Jacqueline G.

July 29th, 2021

I'm 84 and not all that smart when it comes to what a Lawyer usually helps you with, but I took a chance to see if I could do this. Walla, I was able to do it. I was helping my son who had a stroke a few years ago and the transaction went well. Thank you.

Thank you for your feedback Jacqueline. We appreciate you.

Oldemar T.

June 7th, 2020

Messaging system should reach customer email. It took me a couple of days to find out the processor had messaged me. A customer notification should be implemented for every message left in the account.

Thank you!

Esfir K.

October 3rd, 2022

I had to call 3 times, two calls were hanged up on me. Thank you to 3rd representative, who helped me with my question. Unfortunately, I do not know her name. She was very patient, kind, professional. I am very thankful for her help.

Thank you!

Diane D.

July 2nd, 2020

Document site was very easy to access and pull up what I needed.

Thank you!

Carol M.

March 14th, 2019

worked very well

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth N.

April 3rd, 2019

I love how easy it is to understand and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Giustino C.

May 27th, 2020

I am pleased with this electronic service in making a time sensitive deed transfer since very few options exist currently with the Covid 19 Crisis. This was the only rapid and available option to record the deed transfer and the fee was reasonable. I was able to upload my notarized and executed document and had a record number as well as the official document within 24 hours. It was simple and easy to use. Thank you deeds.com!!

Thank you Giustino, glad we could help.

Darren D.

December 29th, 2019

Easy-peasy to find, download and use the forms!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sylvia H.

December 22nd, 2023

Deeds.com really made the process of completing and submitting the Lien application easy. Thank you, and I will be using you whenever I need a real estate document that you carry.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JAMSHEAD T.

December 13th, 2020

An excellent service. Exactly what one would hope for in the 21st century.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard B.

May 27th, 2022

Had trouble filling in the forms not very user friendly. The text always had to be manipulated to look in the best place. Could not easily move existing text to look more professional with the text being inserted.

Thank you for your feedback. We really appreciate it. Have a great day!

Cheryl S.

April 30th, 2021

quick response

Thank you!