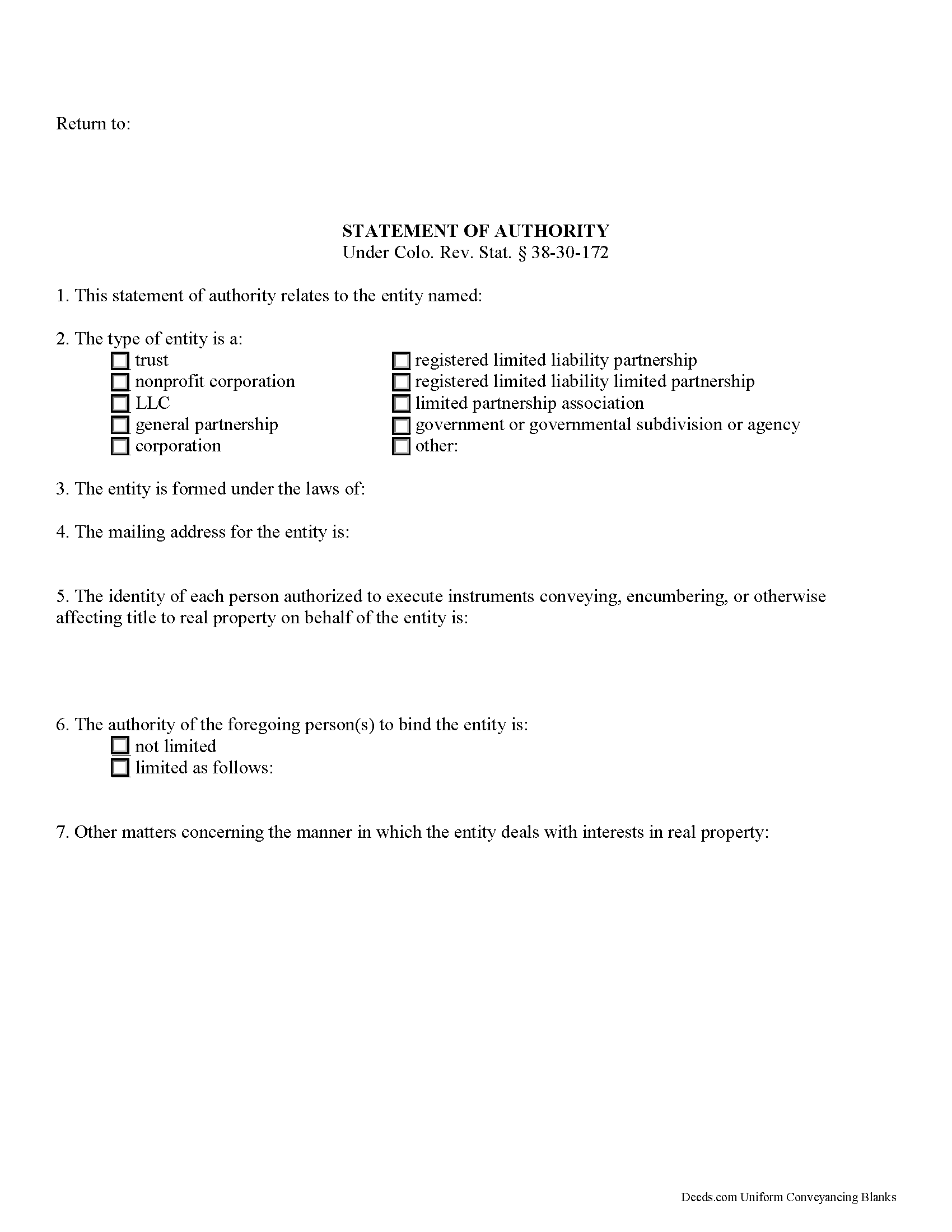

Arapahoe County Statement of Authority Form

Arapahoe County Statement of Authority Form

Fill in the blank form formatted to comply with all recording and content requirements.

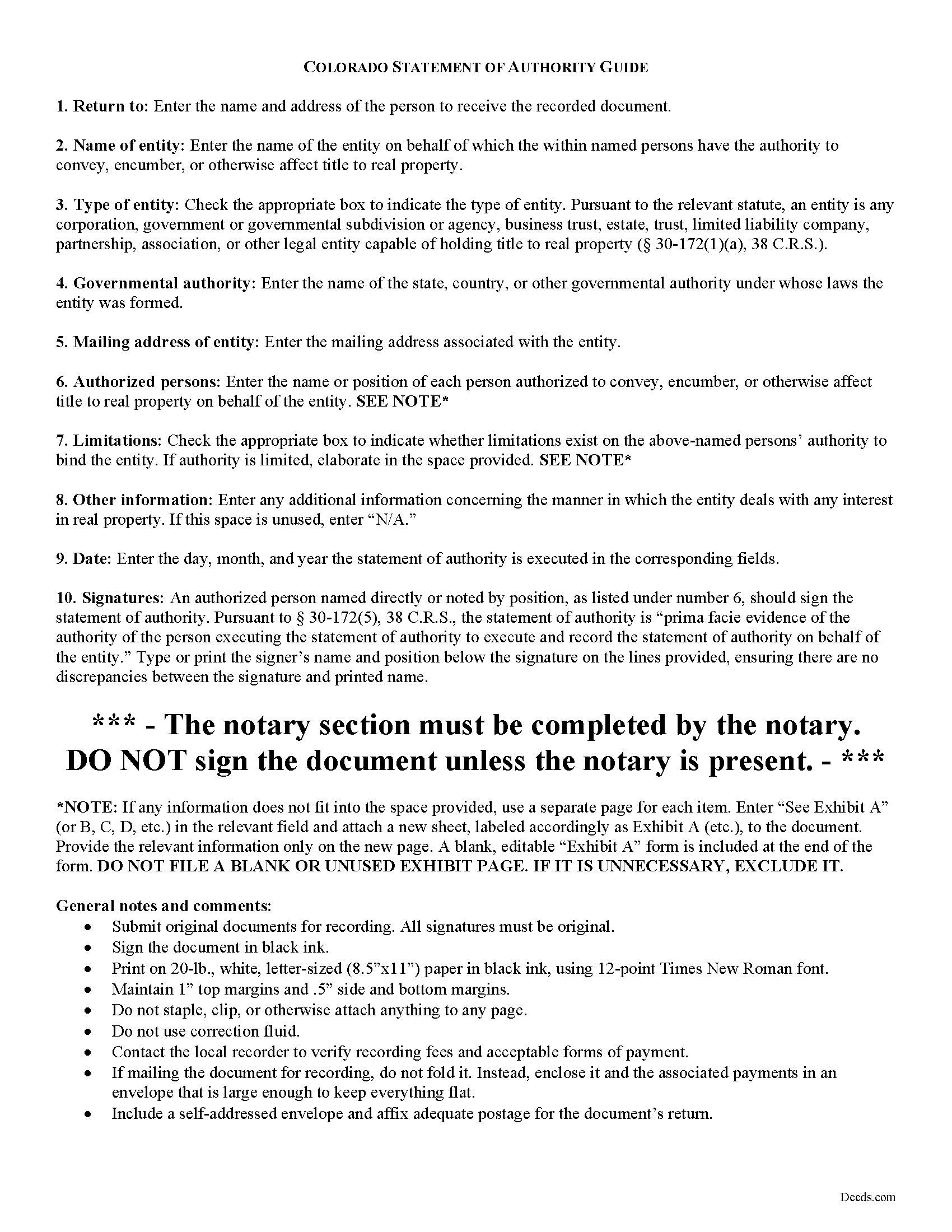

Arapahoe County Statement of Authority Guide

Line by line guide explaining every blank on the form.

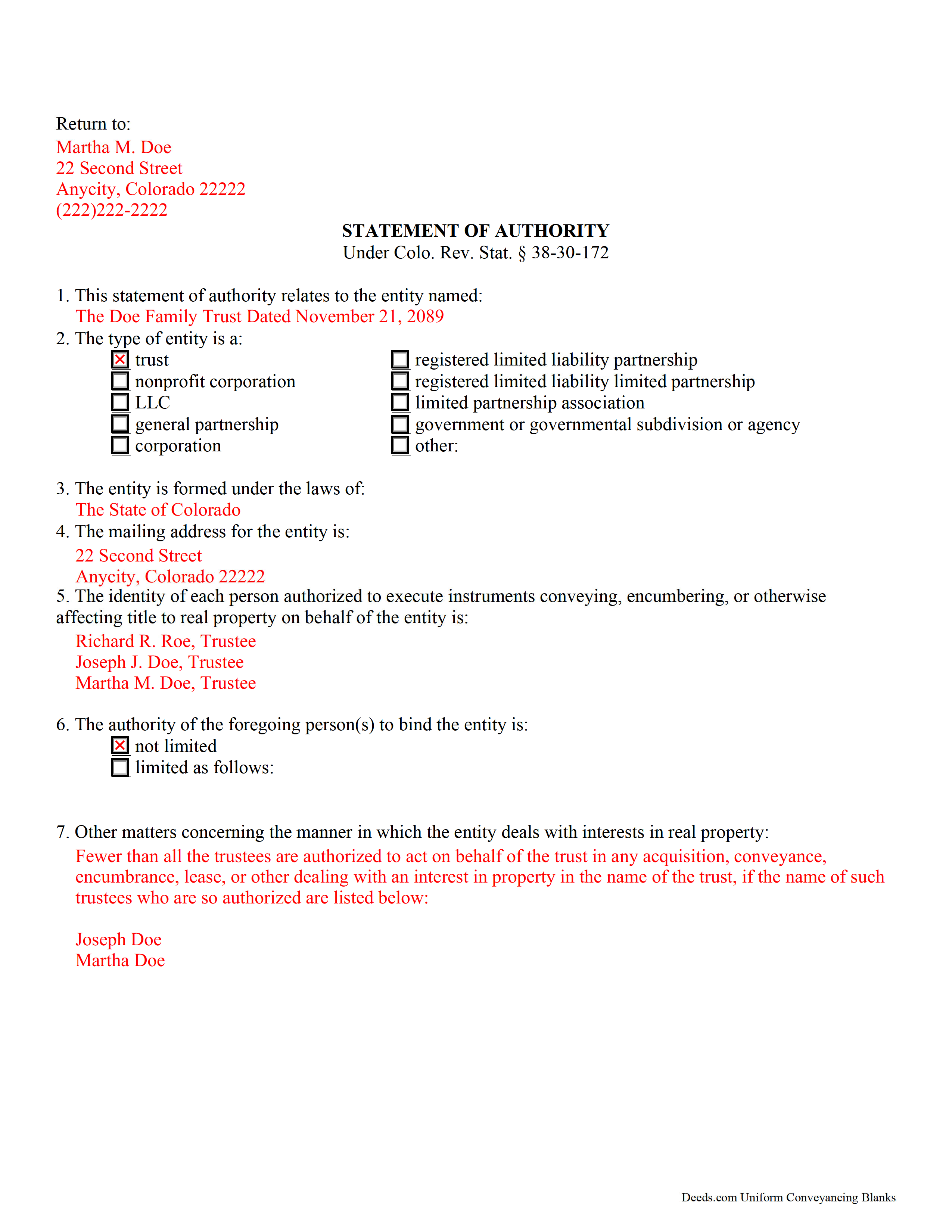

Arapahoe County Completed Example of the Statement of Authority Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Arapahoe County documents included at no extra charge:

Where to Record Your Documents

Arapahoe County Clerk and Recorder

Littleton, Colorado 80120

Hours: 7:00am to 4:00pm M-F

Phone: (303) 795-4520

Recording Tips for Arapahoe County:

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Arapahoe County

Properties in any of these areas use Arapahoe County forms:

- Aurora

- Byers

- Deer Trail

- Denver

- Englewood

- Littleton

Hours, fees, requirements, and more for Arapahoe County

How do I get my forms?

Forms are available for immediate download after payment. The Arapahoe County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Arapahoe County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Arapahoe County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Arapahoe County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Arapahoe County?

Recording fees in Arapahoe County vary. Contact the recorder's office at (303) 795-4520 for current fees.

Questions answered? Let's get started!

A statement of authority is used by a partnership, corporation, government agency, LLC, or other entity who is not an individual to evidence the entity's existence and the identity of the person(s) authorized to act on behalf of the entity [1]. The statement of authority in the State of Colorado is governed by Section 38-30-172 of the Revised Statutes (2016).

Under C.R.S. 38-30-108.5(1), "A trust may acquire, convey, encumber, lease, or otherwise deal with any interest in real ... property in the name of the trust." A statement of authority is recorded alongside a conveyance of interest in real property to a trust; it is executed by the person(s) authorized to hold the title on behalf of the trust -- in this case, the trustee(s).

In addition to listing the name and type of the entity (trust, in this case) and the identity of any persons authorized to execute instruments affecting title to real property on its behalf (trustee), the statement of authority specifies the state, country, or other governmental authority under whose laws it was formed (Colorado) [2]. The document also provides the mailing address of the entity so that the assessor knows where to send tax statements for the property [3].

The statement can also describe limitations, if any, of the trustee's authority to bind the entity; the absence of any listed in the statement of authority serves as prima facie evidence that none exist [4]. The statement may also contain any other matters concerning the manner in which the entity deals with interests in real property.

The statement of authority is signed by the trustee(s) named in the document and acknowledged before a notary public before it is recorded in the county in which the subject real property is situated [5]. Since the document affects an interest in real property, a legal description, including the commonly known address, should be included to distinguish the subject property; use the same legal description on the deed conveying the interest to the trust.

[1] C.R.S. 2-4-401(8)

[2] C.R.S. 38-30-172(2)(b)

[3] http://jeffco.us/assessor/faqs/property-description-department-faqs/what-is-a-statement-of-authority,-and-why-do-you-want-us-to-record-one-/

[4] C.R.S. 38-30-172(5)

[5] C.R.S. 38-30-108.5(2)

(Colorado Statement of Authority Package includes form, guidelines, and completed example)

Important: Your property must be located in Arapahoe County to use these forms. Documents should be recorded at the office below.

This Statement of Authority meets all recording requirements specific to Arapahoe County.

Our Promise

The documents you receive here will meet, or exceed, the Arapahoe County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Arapahoe County Statement of Authority form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Ron D.

June 2nd, 2024

The State form I chose was valid and accurate. However, I found the ability to enter information was inadequate and difficult. Converted the form to a Word document and was then able to enter the information I needed to.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Rita M.

January 12th, 2019

Forget what I just wrote! I found it. Thank You! This is a very convenient service.

That's great to hear Rita, thanks for following up.

Kimberley H.

July 14th, 2021

This was crazy easy to do...such a fantastic service! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Remon W.

January 26th, 2021

Excellent and fast service. I will be using this site as needed in the future.

Thank you Remon, we appreciate you.

Janet B.

July 28th, 2020

Review: Very user friendly and that is very important to me. Quick, easy and clear instructions. I would highly recommend deeds.com for your online filing services.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert S.

January 23rd, 2019

The cost was well worth it. It was very easy to download, fill in the necessary information and then print the deed. I filed my need deed today and everything was complete and accurate because of the example you provided.

Thanks Robert, we appreciate your feedback!

Janet S.

April 7th, 2021

I would've done this years ago if I'd known how easy it was! The plus is it's not expensive either. Thank you deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Winifred T.

May 18th, 2021

ive been looking for this information thank you .

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracy E.

December 19th, 2020

This is so convenient. Thank you.

Thank you!

Lisa P.

March 17th, 2021

Wonderful forms. It's nice that they were formatted perfectly for my county, it's real easy to miss a requirement (margines, font size, and so on) and end up with a rejection or higher recording fee. Good job folks!

Thank you!

John C.

April 14th, 2019

Excellent find (Deeds.com) from a google search, first hit. This was exactly what we were looking for. It also got me to upgrade Adobe to be able to fill in the forms. Will be back for follow up as needed, but I think I got everything we needed in the first downloads. Appreciate a well done site like yours. Thanks John

Thank you for your feedback. We really appreciate it. Have a great day!

Jennie P.

June 25th, 2019

Thank you for the information you sent.

Thank you!

ROSALYN L.

May 31st, 2021

I just now downloaded the forms. So far, so good.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna W.

October 6th, 2022

Answered all of my questions and was very easy to use. I will use Deeds.com to do all of my real estate forms from now on. Thanks.

Thank you!

Kyle K.

May 3rd, 2022

Deeds is extremely helpful and cost effective for small and large businesses. Saves me time to do more valuable tasks.

Thank you for your feedback. We really appreciate it. Have a great day!