Hartford County Mortgage Deed Form Form (Connecticut)

All Hartford County specific forms and documents listed below are included in your immediate download package:

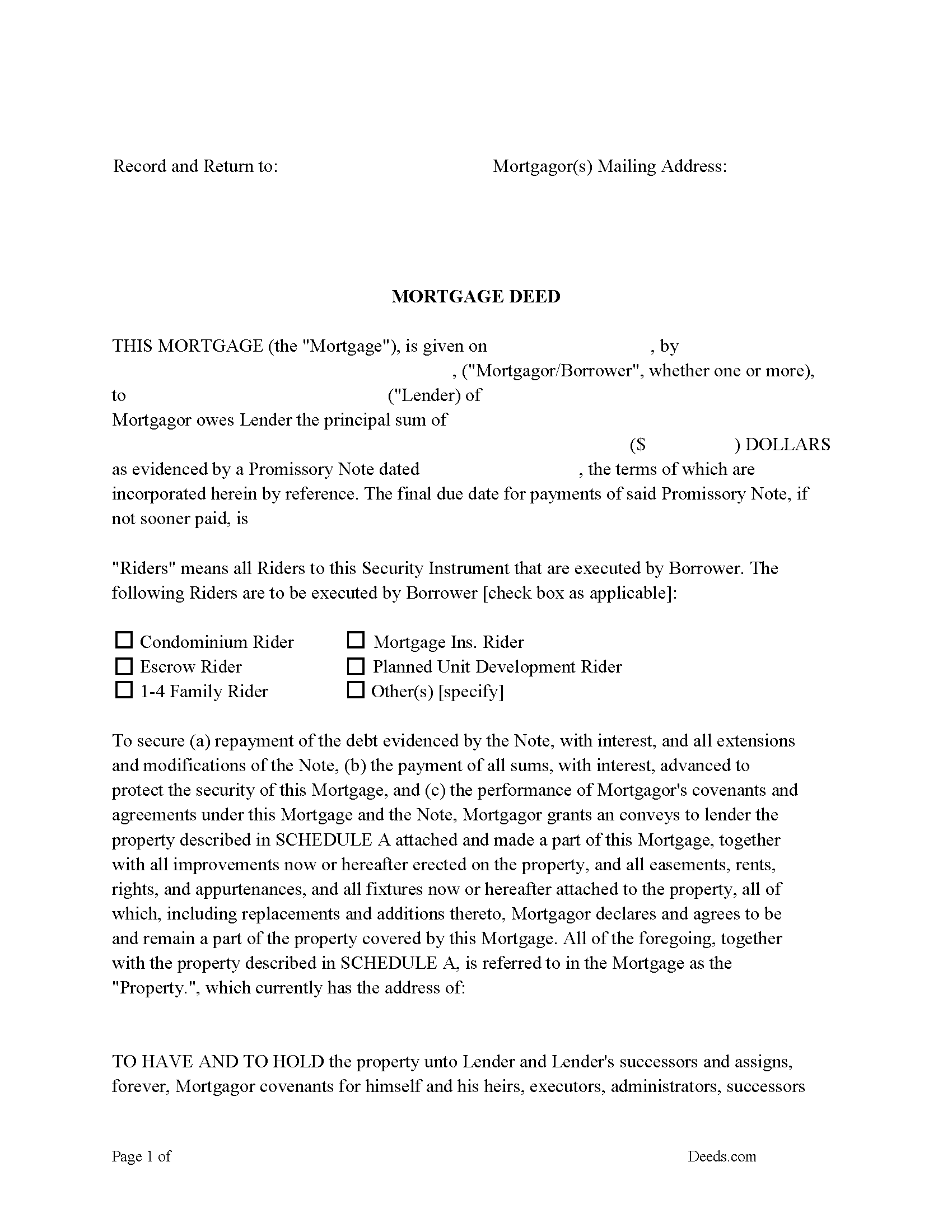

Mortgage Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Hartford County compliant document last validated/updated 7/1/2025

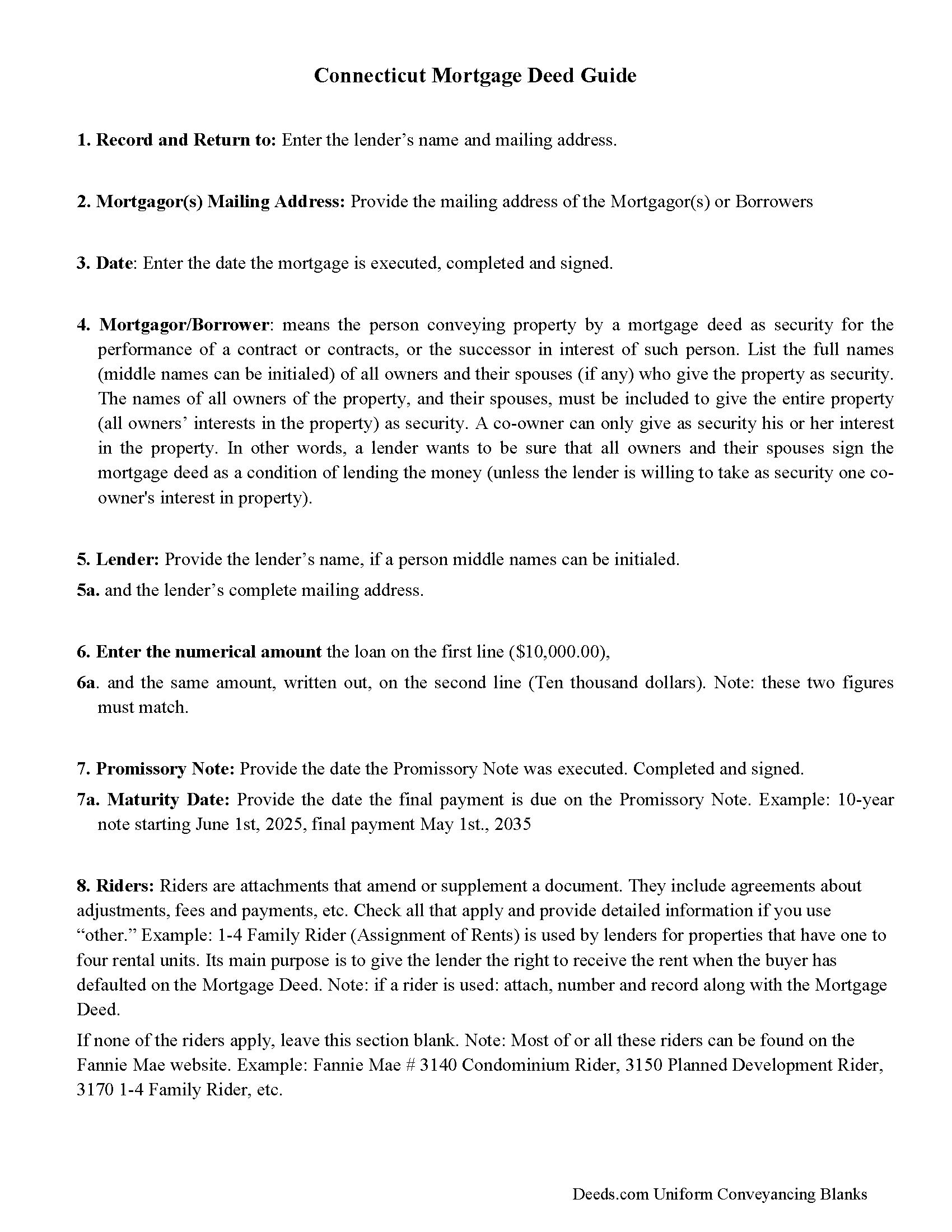

Mortgage Deed Guidelines

Line by line guide explaining every blank on the form.

Included Hartford County compliant document last validated/updated 5/2/2025

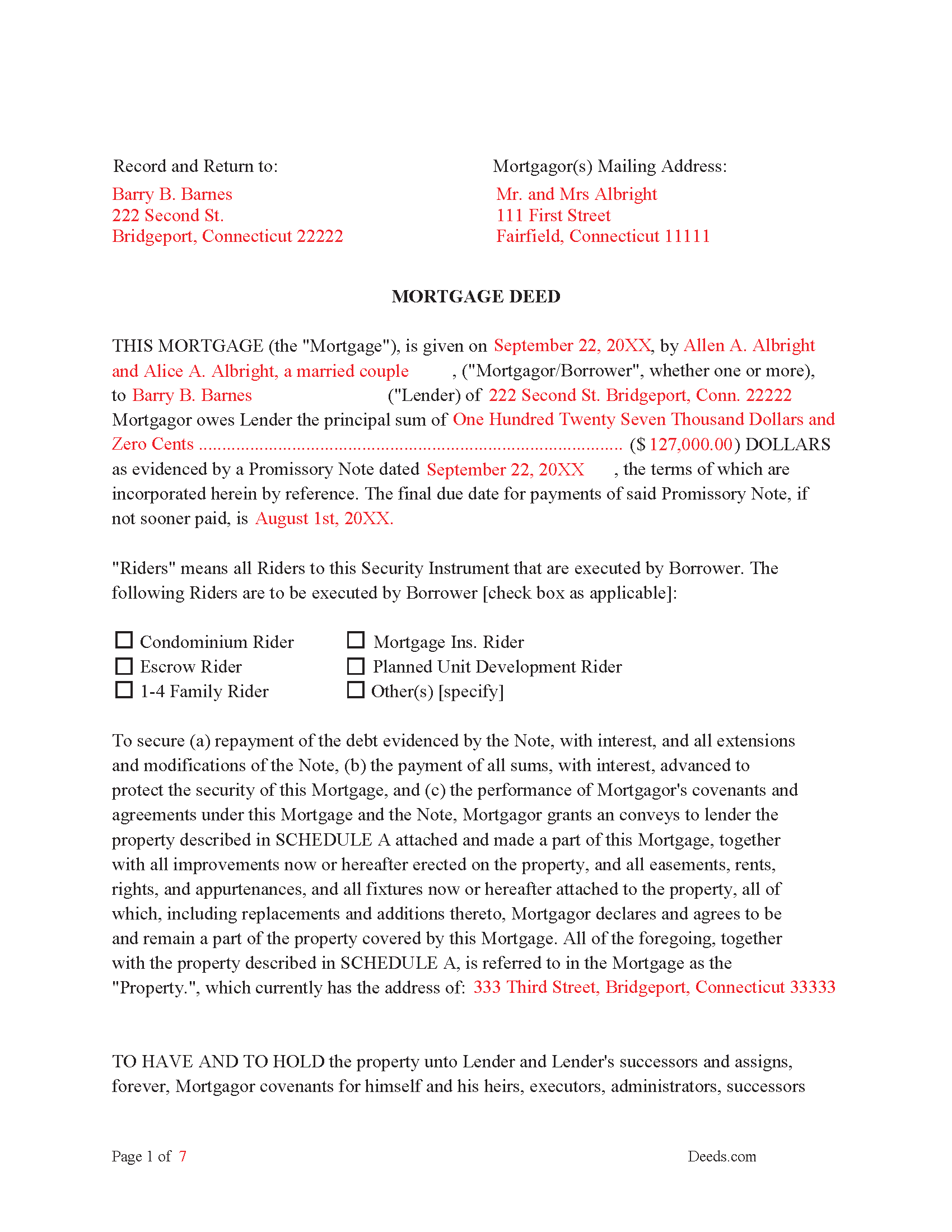

Completed Example of the Mortgage Deed

Example of a properly completed form for reference.

Included Hartford County compliant document last validated/updated 6/16/2025

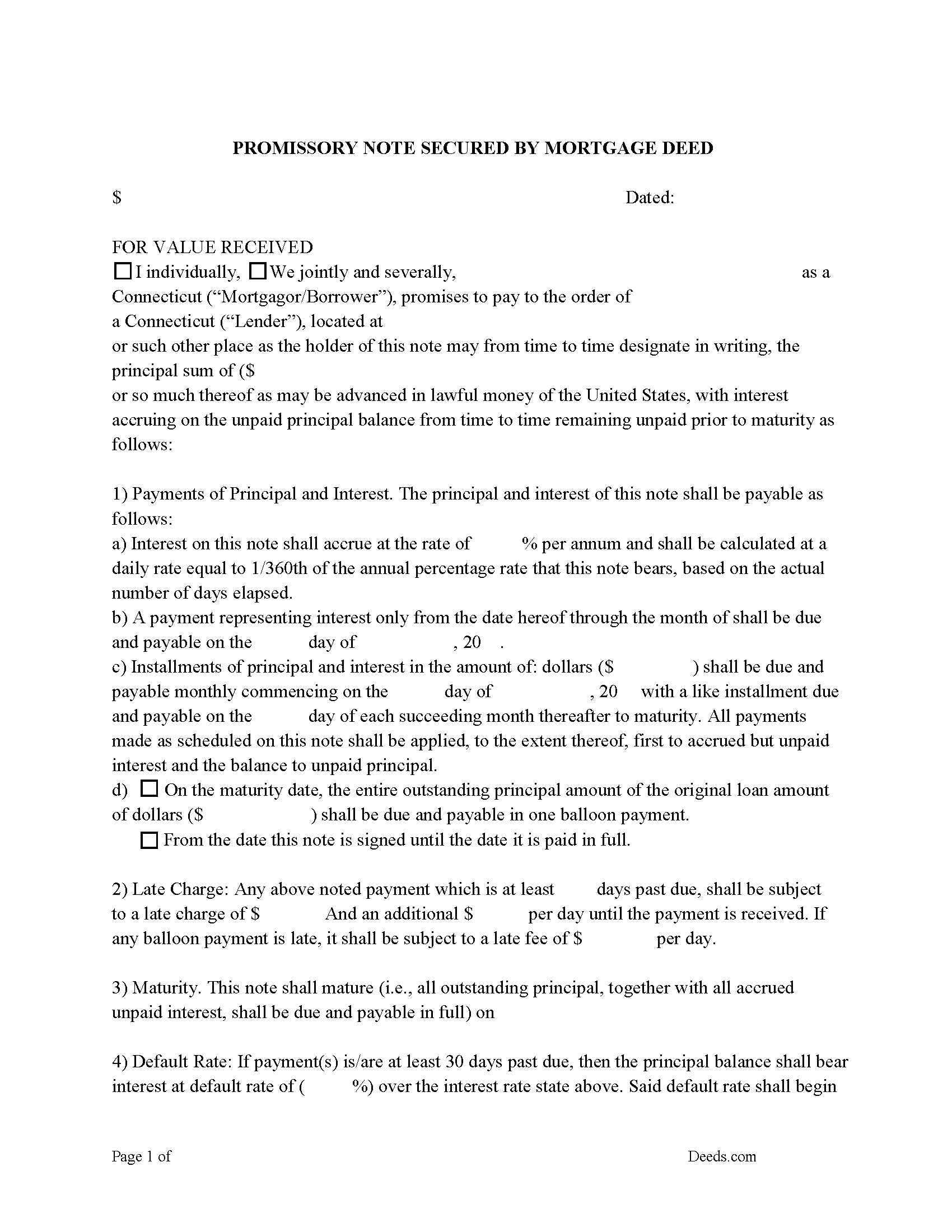

Promissory Note Form

Note that is secured by the Mortgage Deed. Can be used for traditional installments or balloon payment.

Included Hartford County compliant document last validated/updated 5/22/2025

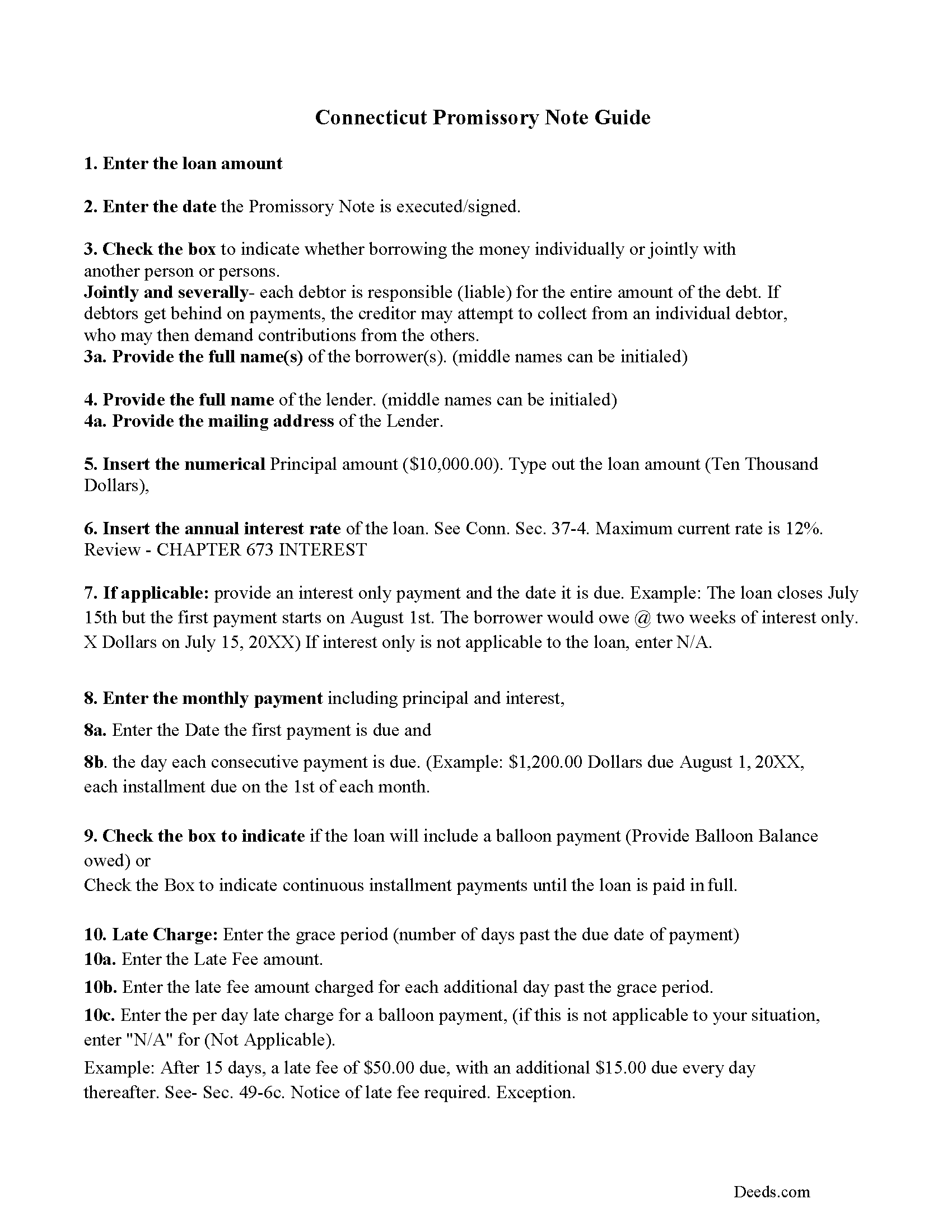

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Hartford County compliant document last validated/updated 7/9/2025

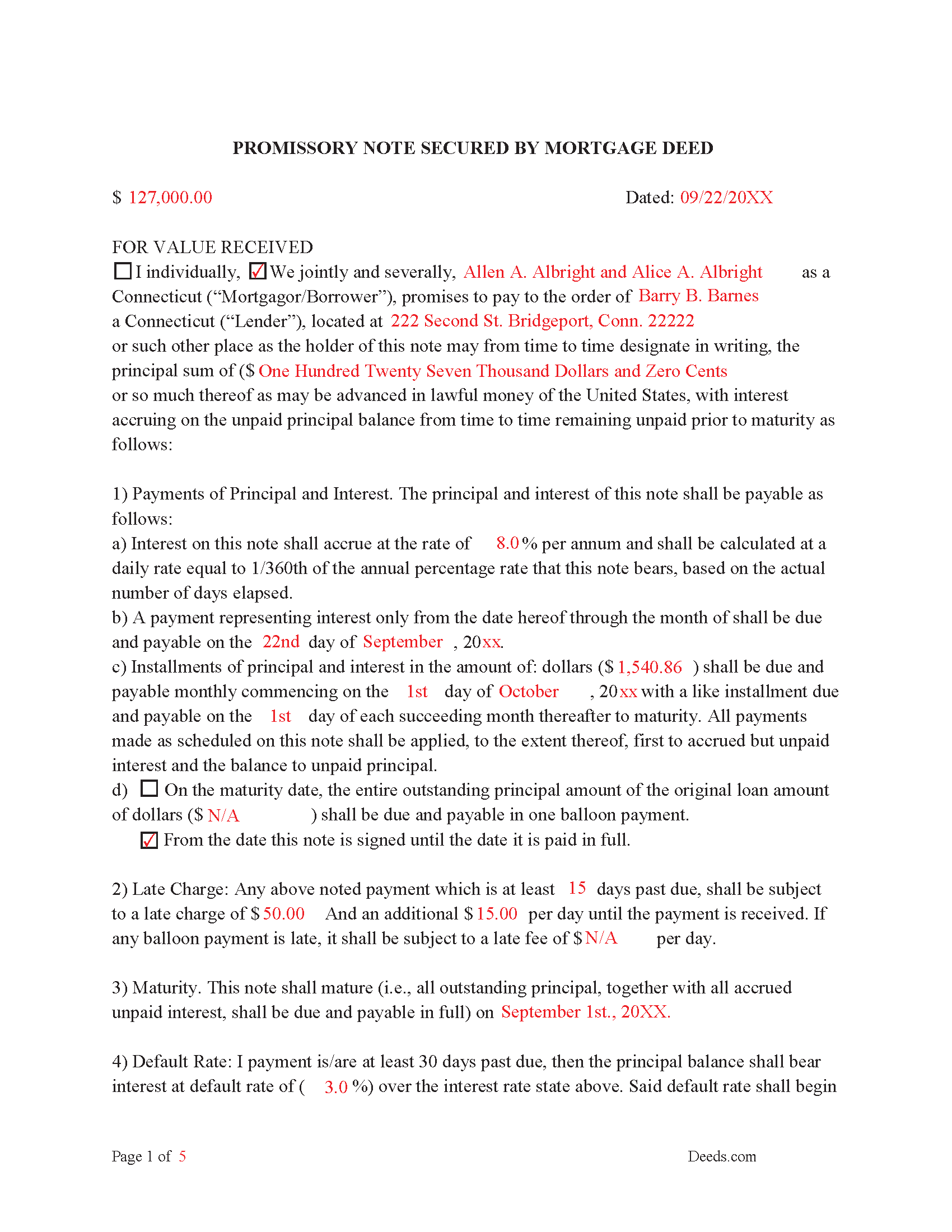

Completed Example of the Promissory Note

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

Included Hartford County compliant document last validated/updated 7/11/2025

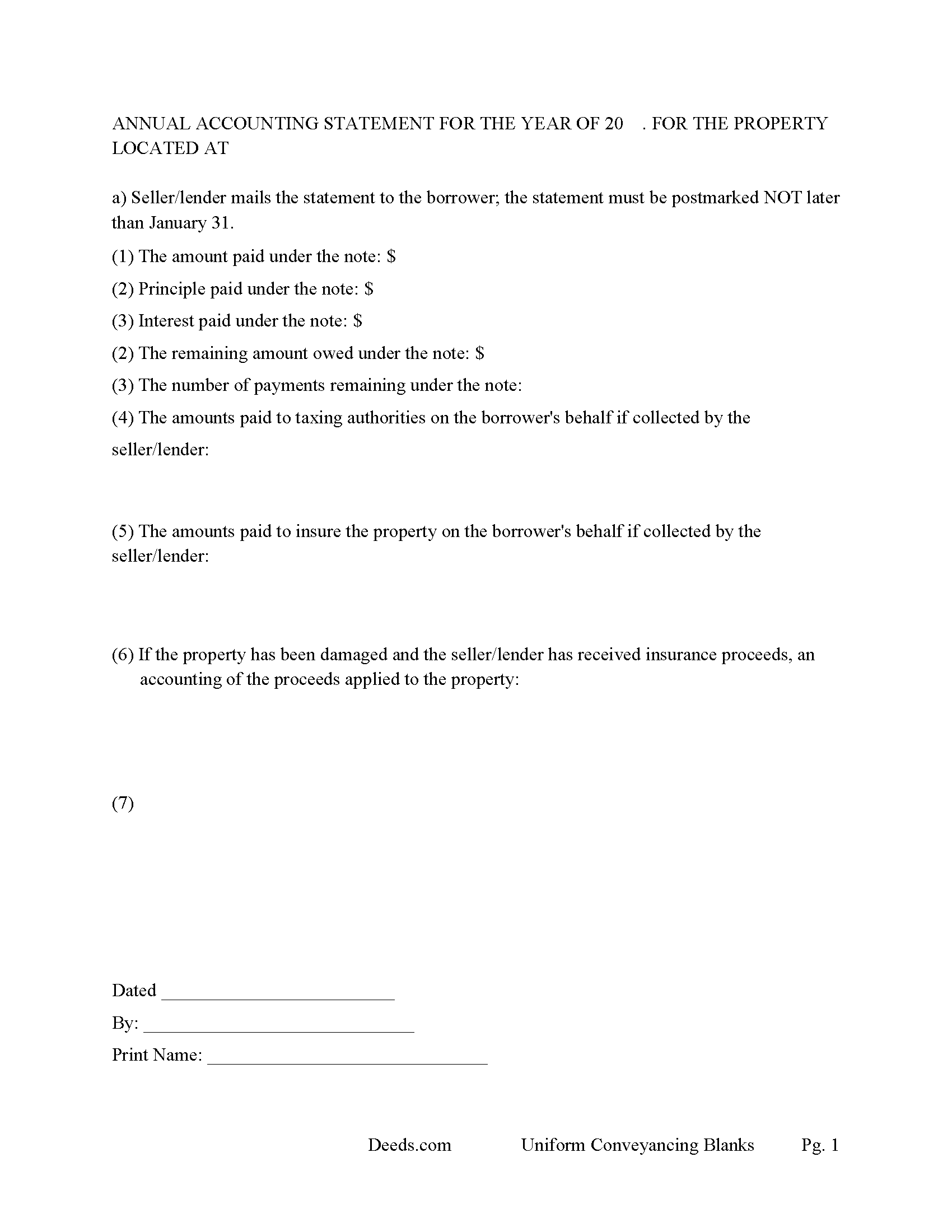

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included Hartford County compliant document last validated/updated 3/6/2025

The following Connecticut and Hartford County supplemental forms are included as a courtesy with your order:

When using these Mortgage Deed Form forms, the subject real estate must be physically located in Hartford County. The executed documents should then be recorded in one of the following offices:

Avon Town Clerk

60 West Main St, Avon, Connecticut 06001

Hours: Mon-Fri 8:30 to 4:30; Summer: Mon-Thu 8:00 to 4:45 & Fri 8:00 to 12:30

Phone: (860) 409-4311

Berlin Town Clerk

Town Hall - 240 Kensington Rd, Berlin, Connecticut 06037

Hours: Mon-Wed 8:30 to 4:30; Thu 8:30 to 7:00; Fri 8:30 to 1:00

Phone: (860) 828-7036

Bloomfield Town Clerk

800 Bloomfield Ave, Bloomfield, Connecticut 06002

Hours: Mon-Fri 9:00 to 5:00

Phone: (860) 769-3507

Bristol City Clerk

City Hall - 111 N Main St, Bristol, Connecticut 06010

Hours: Mon-Fri 8:30 to 5:00

Phone: (860) 584-6200

Burlington Town Clerk

Town Hall - 200 Spielman Hwy, Burlington, Connecticut 06013

Hours: Mon-Thu 8:00 to 4:00; Fri 8:00 to 12:30

Phone: (860) 673-6789 Ext 2

Canton Town Clerk

4 Market St / PO Box 168, Collinsville, Connecticut 06022

Hours: Mon, Tue, Thu 8:15 to 4:30; Wed 8:15 to 6:45; Fri 8:15 to 12:00

Phone: (860) 693-7870

East Granby Town Clerk

9 Center St / PO Box TC, East Granby, Connecticut 06026

Hours: Mon-Thu 8:00 to 12:00 & 1:00 to 4:00; Fri 8:00 to 1:00

Phone: (860) 653-6528

East Hartford Town Clerk

Town Hall - 740 Main St, 1st Floor, East Hartford, Connecticut 06108

Hours: Mon-Fri 8:30 to 4:30

Phone: (860) 291-7230

East Windsor Town Clerk

11 Rye St, Broad Brook, Connecticut 06016-0213

Hours: Mon-Wed 8:30 to 4:30; Thu 8:30 to 7:00; Friday 8:30 to 1:00

Phone: (860) 292-8255

Enfield Town Clerk

820 Enfield St, Enfield, Connecticut 06082

Hours: Mon-Fri 9:00 to 5:00

Phone: (860) 253-6440

Farmington Town Clerk

Town Hall - 1 Monteith Dr, Farmington, Connecticut 06032

Hours: Mon-Fri 8:30 to 4:30 / Recording until 4:15

Phone: (860) 675-2380

Glastonbury Town Clerk

2155 Main St / PO Box 6523, Glastonbury, Connecticut 06033-6523

Hours: Mon-Fri 8:00 to 4:30

Phone: (860) 652-7616

Granby Town Clerk

15 North Granby Rd, Granby, Connecticut 06035

Hours: Mon, Tue, Wed 8:00 to 4:00; Thu 8:00 to 6:30; Fri 8:00 to 12:30

Phone: (860) 844-5308

Hartford Town and City Clerk

550 Main St, Hartford, Connecticut 06103

Hours: Mon-Fri 8:15 to 4:45

Phone: (860) 757-9749

Hartland Town Clerk

Town Hall - 22 South Rd, East Hartland, Connecticut 06027

Hours: Mon-Wed 10:00 to 12:00 & 1:00 to 4:00

Phone: (860) 653-0285

Manchester Town Clerk

Town Hall - 41 Center St, Manchester, Connecticut 06045-0191

Hours: Mon-Fri 8:30 to 5:00 / Recording until 4:45

Phone: (860) 647-3037

Marlborough Town Clerk

26 North Main St / PO Box 29, Marlborough, Connecticut 06447

Hours: Call for hours

Phone: (860) 295-6206

New Britain Town Clerk

27 West Main St, Rm 109, New Britain, Connecticut 06051

Hours: Mon-Fri 8:15 to 3:45 / last Thu of month until 6:45

Phone: (860) 826-3347 & 3349

Newington Town Clerk

131 Cedar St , Newington, Connecticut 06111

Hours: Mon-Fri 8:30 to 4:30

Phone: (860) 665-8545

Plainville Town Clerk

Municipal Center - 1 Central Square, Plainville, Connecticut 06062

Hours: Mon, Tue, Wed 8:00 to 4:00; Thu 8:00 to 7:00; Fri 8:00 to 12:00

Phone: (860) 793-0221 Ext 246, 247, 248

Rocky Hill Town Clerk

761 Old Main St, Rocky Hill, Connecticut 06067

Hours: Mon-Fri 8:30 to 4:30

Phone: (860) 258-2705

Simsbury Town Clerk

Town Hall - 933 Hopmeadow St / PO Box 495, Simsbury, Connecticut 06070

Hours: Mon 8:30 to 7:00; Tue-Thu: 8:30 to 4:30; Fri 8:30 to 1:00

Phone: (860) 658-3243

Southington Town Clerk

Town Hall - 75 Main St / PO Box 152, Southington, Connecticut 06489

Hours: Mon-Wed & Fri 8:30 to 4:30; Thu 8:30 to 7:00

Phone: (860) 276-6211

South Windsor Town Clerk

1540 Sullivan Ave, South Windsor, Connecticut 06074

Hours: Mon-Fri 8:00 to 4:30

Phone: (860) 644-2511 Ext 226 & 227

Suffield Town Clerk

83 Mountain Rd, Suffield, Connecticut 06078

Hours: Mon-Thu 8:00 to 4:30; Fri: 8:00 to 1:00 / Recording until 4:00 and 12:30 respectively

Phone: (860) 668-3880

West Hartford Town Clerk

Town Hall - 50 South Main St, Rm 313, West Hartford, Connecticut 06107

Hours: Mon & Wed 8:30 to 4:30; Tue 7:30 to 4:30; Thu 8:30 to 7:00; Fri 8:30 to 12:00 / Recording until 15 mins before closing

Phone: (860) 561-7430

Wethersfield Town Clerk

505 Silas Deane Hwy, Wethersfield, Connecticut 06109

Hours: Mon-Fri 8:00 to 4:30

Phone: (860) 721-2880

Windsor Town Clerk

275 Broad St, Windsor, Connecticut 06095

Hours: Mon-Fri 8:00 to 5:00

Phone: (860) 285-1902

Windsor Locks Town Clerk

50 Church St, Windsor Locks, Connecticut 06096

Hours: Mon-Wed 8:00 to 4:00; Thu 8:00 to 6:00; Fri 8:00 to 1:00

Phone: (860) 627-1441 Ext 312

Local jurisdictions located in Hartford County include:

- Avon

- Berlin

- Bloomfield

- Bristol

- Broad Brook

- Burlington

- Canton

- Canton Center

- Collinsville

- East Berlin

- East Glastonbury

- East Granby

- East Hartford

- East Hartland

- East Windsor

- East Windsor Hill

- Enfield

- Farmington

- Glastonbury

- Granby

- Hartford

- Manchester

- Marion

- Marlborough

- Milldale

- New Britain

- Newington

- North Canton

- North Granby

- Plainville

- Plantsville

- Poquonock

- Rocky Hill

- Simsbury

- South Glastonbury

- South Windsor

- Southington

- Suffield

- Tariffville

- Unionville

- Weatogue

- West Granby

- West Hartford

- West Hartland

- West Simsbury

- West Suffield

- Wethersfield

- Windsor

- Windsor Locks

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Hartford County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Hartford County using our eRecording service.

Are these forms guaranteed to be recordable in Hartford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hartford County including margin requirements, content requirements, font and font size requirements.

Can the Mortgage Deed Form forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Hartford County that you need to transfer you would only need to order our forms once for all of your properties in Hartford County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Connecticut or Hartford County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Hartford County Mortgage Deed Form forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

This is a Connecticut Mortgage Deed given to secure a debt on real property. This form can be used to finance a house, rental property (up to 4 units) or Condominium. This form secures repayment of a debt, with interest. evidenced by a Promissory Note. A Mortgage Deed with strong default clauses can be beneficial when selling and/or financing a property.

MORTGAGOR also known as BORROWER(S), WARRANTS AND COVENANTS AS FOLLOWS:

1. PROMISE TO PAY. Borrower shall pay the indebtedness evidenced by the Note and secured by this Mortgage.

2. CHARGES, LIENS, ESCROW. Borrower shall promptly pay all taxes, assessments, fines, impositions and other charges against the Property.

3. HAZARD INSURANCE AND CONDEMNATION. Borrower shall insure the Property against loss by fire, and such other hazards as Lender may require and in such amounts.

4. CONDOMINIUMS, PLANNED UNIT DEVELOPMENTS, COMMON INTEREST COMMUNITIES. If this Mortgage is on a unit in a condominium, a planned unit development or any common interest community (as that term is defined in Section 47-202(7) of the Connecticut General Statutes

5. PRESERVATION AND MAINTENANCE OF PROPERTY. Borrower shall maintain the property in good condition and repair

6. ASSIGNMENT OF RENTS. To further secure the indebtedness secured hereby, Borrower hereby assigns, transfers and sets over to Lender all of the rents and profits now due or which may hereafter become due from the Property.

7. INSPECTION. Lender may make or cause to be made reasonable entries upon and inspection of the Property.

8. FORBEARANCE BY LENDER NOT A WAIVER.

9. COMPLIANCE WITH REGULATIONS. Mortgagor has obtained all permits and approvals

10. ALTERATION OR DEMOLITION. No building or other improvement on the Property shall be structurally altered, removed or demolished without Lender's prior written consent.

11. LEASE RATIFICATION. Borrower shall furnish Lender at any time, upon demand, with a lease ratification and estoppel agreement as to any lease affecting the Property,

12. REMEDIES CUMULATIVE. Each remedy provided in this Mortgage is distinct from and cumulative with any other right or remedy hereunder, or afforded by law or equity, and may be exercised concurrently, independently or successively.

13. SUCCESSORS AND ASSIGNS; CAPTIONS. The covenants and agreements contained in this Mortgage shall bind, and the rights under this Mortgage shall inure to, Mortgagor's and Lender's respective heirs, executors, administrators, successors and assigns.

14. NOTICE. Any notice provided for in this Mortgage shall be deemed to have been given to Mortgagor or to Lender when given in the manner designated herein.

15. GOVERNING LAW; SEVERABILITY. This mortgage shall be governed by the laws of the State of Connecticut.

16. MODIFICATION OR EXTENSION. Lender reserves the right, together with Mortgagor, to amend or modify in any way the terms of this Mortgage and to extend the term hereof or time for making any payment hereunder, all without the consent of any subsequent encumbrancer.

17. ACCELERATION; REMEDIES. All sums secured by this Mortgage shall immediately become due and payable, at Lender's option, without necessity for demand or notice, if: (a) any installment or payment required under this Mortgage or the Note is not paid when due; (b) Mortgagor shall convey any interest in the Property or be deprived of the same by process or operation of law; (c) Mortgagor or any accommodation maker, endorser or guarantor of the Note (1) becomes generally unable to pay its debts as they become due, (2) admits its inability to pay its debts as they become due, (3) makes a general assignment for the benefit of its creditors, (4) files or becomes the subject of a petition in bankruptcy, for an arrangement with its creditors or for reorganization under any federal or state bankruptcy or other insolvency law, or (5) files or becomes the subject of a petition for the appointment of a receiver, custodian, trustee or liquidator of the party or of all or substantially all of its assets under any federal or state bankruptcy or other insolvency law; (d) Mortgagor or any accommodation maker, endorser or guarantor of the Note shall fail to perform any other covenant or agreement contained in this Mortgage, the Note or any guaranty securing the Note; or (e) Mortgagor shall fail to perform for a period of ten (10) days any covenant or agreement contained in any other mortgage securing the Property. If Lender declares all sums secured by this Mortgage immediately due and payable, Lender may invoke any remedies permitted by applicable law.

18. PAYMENTS AND PROCEEDS. Any payment made with respect to the Note and any amount received by Lender may be applied by Lender to accrued interest,

Fully formatted for recording.

PROMISSORY NOTE SECURED BY MORTGAGE DEED

Promissory Note guided by Connecticut Law, includes the option of accepting installment loan payments or a balloon payment, Balloon payments are often used to cash out when selling and financing a property. Example: 3 years of payments, followed by a balloon payment of $$$. Late payments and default rates are charged to protect Lender(s). The Borrower in this note has the option of paying the loan off early, with no penalty, if so desired.

FOR VALUE RECEIVED

A Connecticut ("Mortgagor/Borrower"), promises to pay a Connecticut ("Lender"), located at YYYYY or such other place as the holder of this note may from time to time designate in writing, the principal sum of ($ $$$$$) or so much thereof as may be advanced in lawful money of the United States, with interest accruing on the unpaid principal balance from time to time remaining unpaid prior to maturity as follows:

1) Payments of Principal and Interest. The principal and interest of this note shall be payable as follows:

2) Late Charge: Any above noted payment which is at least XX days past due, shall be subject to:

3) Maturity. This note shall mature (i.e., all outstanding principal, together with all accrued interest:

4) Default Rate: I payment is/are at least 30 days past due, then the principal balance shall bear

5) This Note shall be secured by a Mortgage Deed to real property commonly known as:

6) Failure to pay this Note or any of the Additional Obligations at maturity, or the failure of

7) Prepayment. Borrower shall have the right to prepay, without penalty, all or part of the unpaid balance of this Note

8) Default. If any of the following events of default occur, this Note and any other obligations of the Borrower to the Lender, shall become due immediately, without demand or notice:

a)the failure of the Borrower to pay the principal and any accrued interest when due;

b)the filing of bankruptcy proceedings involving the Borrower as a debtor;

c)the application for the appointment of a receiver for the Borrower;

d)the making of a general assignment for the benefit of the Borrower's creditors;

e)the insolvency of the Borrower;

f)a misrepresentation by the Borrower to the Lender for the purpose of obtaining or extending credit.

9)In addition, the Borrower shall be in default if there is a sale, transfer, assignment, or any other disposition of any real estate pledged as collateral for the payment of this Note, or if there is a default in any security agreement which secures this Note.

10) All payments due under this Note shall be paid when due,

11) In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee

12) The obligations of Borrower to Lender under this Note and the Additional Obligations herein remain in full force and effect until Lender has received payment in full of all obligations. The

13) Borrowers agree that the interest rate contracted for includes the interest rate set forth herein and any other charges, fees, costs and expenses incidental to this transaction paid by Borrowers to the extent the same are deemed interest under applicable law. If, for any circumstance

14) In case of renewal or extension of this Note, at any or times, all of the provisions of the Loan Documents shall remain in full force and effect as security for the payment of the renewed or extended Note and for the performance of the obligations of Borrower under the Loan Documents.

15) Governing Law: Lender; Joint and Several Obligation. This Note will be governed by the laws of the State of Connecticut. The Borrower agrees to pay this Note as written to the order of the Lender as defined above.

16) Service of Process. BORROWER HEREBY CONSENTS TO THE JURISDICTION OF

ANY STATE OR FEDERAL COURT LOCATED WITHIN CONNECTICUT, AND

17) Waiver of Jury Trial. BORROWER HEREBY WAIVES TRIAL BY JURY IN ANY SUIT,

Our Promise

The documents you receive here will meet, or exceed, the Hartford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hartford County Mortgage Deed Form form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas D.

July 10th, 2019

The site is fine with one exception. About half the pdf files I downloaded were corrupted. I could not open them or view their contents. Fortunately, the link continued to work, so after I discovered this, I downloaded the corrupted files again, and they now seem fine. I do not know if my computer or the website caused this odd problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Earnest K.

January 8th, 2025

I used the "personal representative's deed." There were a few errors, after I went to record it at the county recorder's office. For #7, it should've stated "The estate of Joe Schmoe, hereby grants Mr. Personal Representative....." instead of, "I Mr. Personal Representative, as personal representative, hereby grant to personal representative...." rnrnThe person at the recorder's office said you cannot state "you are granting property to yourself."rnrnJust fix that, and everything else is fine.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Monica D. N.

April 8th, 2019

The Web site is very intuitive, organized well and forms are easily found. The instructions provided are very helpful. Value in terms of price is very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nicole M.

June 3rd, 2020

This is my very first use with your company. I submitted my package and within the hour you had responded with an Invoice for me to pay so you could proceed with my recording. So far I am very impressed! Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Erik G.

January 12th, 2022

Great...

Thank you!

John M.

May 14th, 2022

I found just what I needed at a very good price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Keyuna C.

April 25th, 2020

Speedy process, they provided me with the exact documents that I needed.

Thank you!

Thomas J.

March 3rd, 2021

I'm pleased with the service

Thank you!

Jeff R.

December 4th, 2020

Great company. I had some issues with what I had prepared on my end but my contact at Deeds.com helped me with modifying the documents and submitted them successfully. Thanks for going the extra mile

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela W.

April 11th, 2019

Signing up was easy and the form was amazing. The ability to type on it (I am on a MAC) was beyond my expectations, the ability to save a blank, save my two documents, save the instructions and sample was excellent. The documents are in the mail and we are hopefully they will be approved. Blessings,

Thank you for your feedback. We really appreciate it. Have a great day!

Jon G.

June 26th, 2021

Excellent service and professionalism

Thank you!

Rosanne E.

October 8th, 2020

Excellent response and all went well with downloading documents. Thank you for offering this important service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!