Fairfield County Trustee Deed Form (Connecticut)

All Fairfield County specific forms and documents listed below are included in your immediate download package:

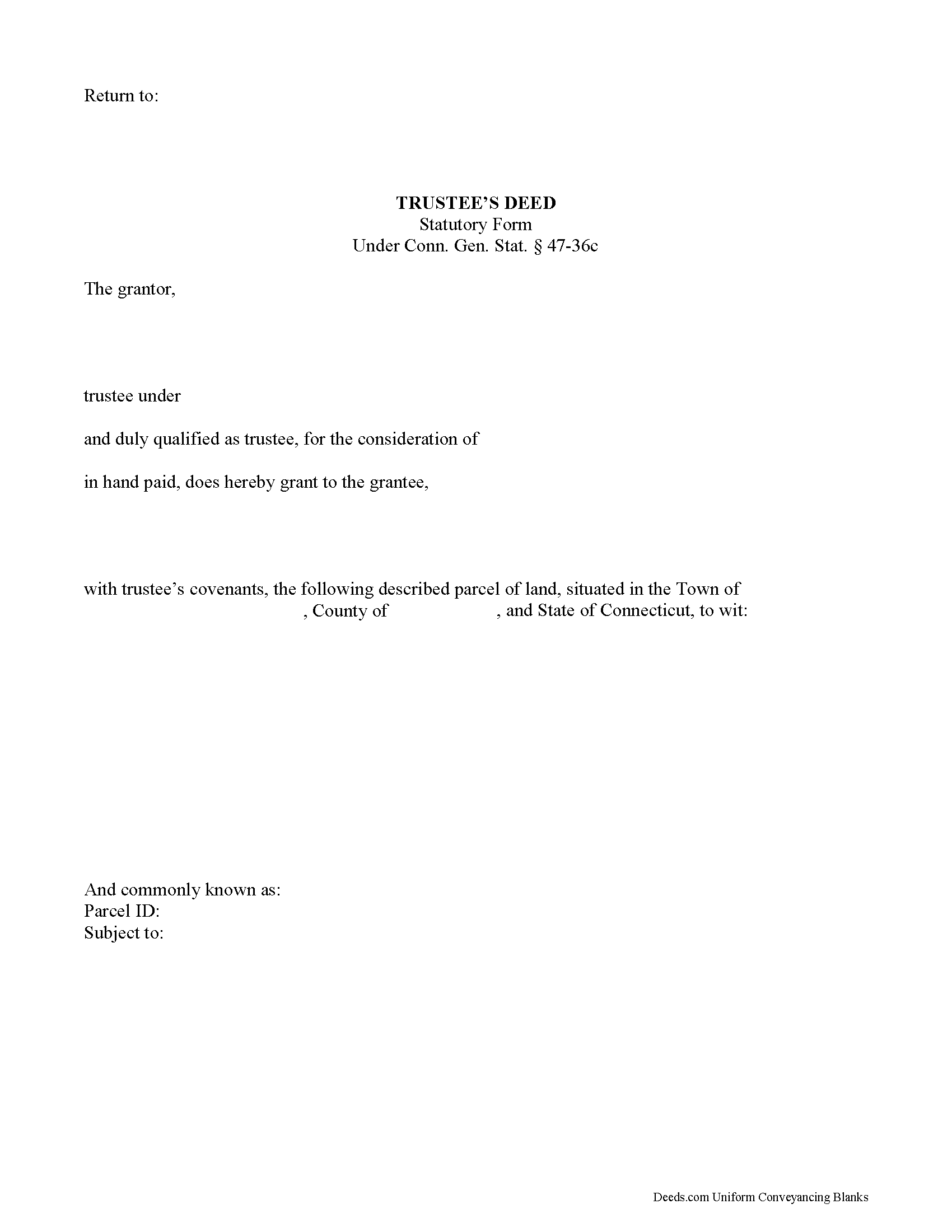

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Fairfield County compliant document last validated/updated 6/20/2025

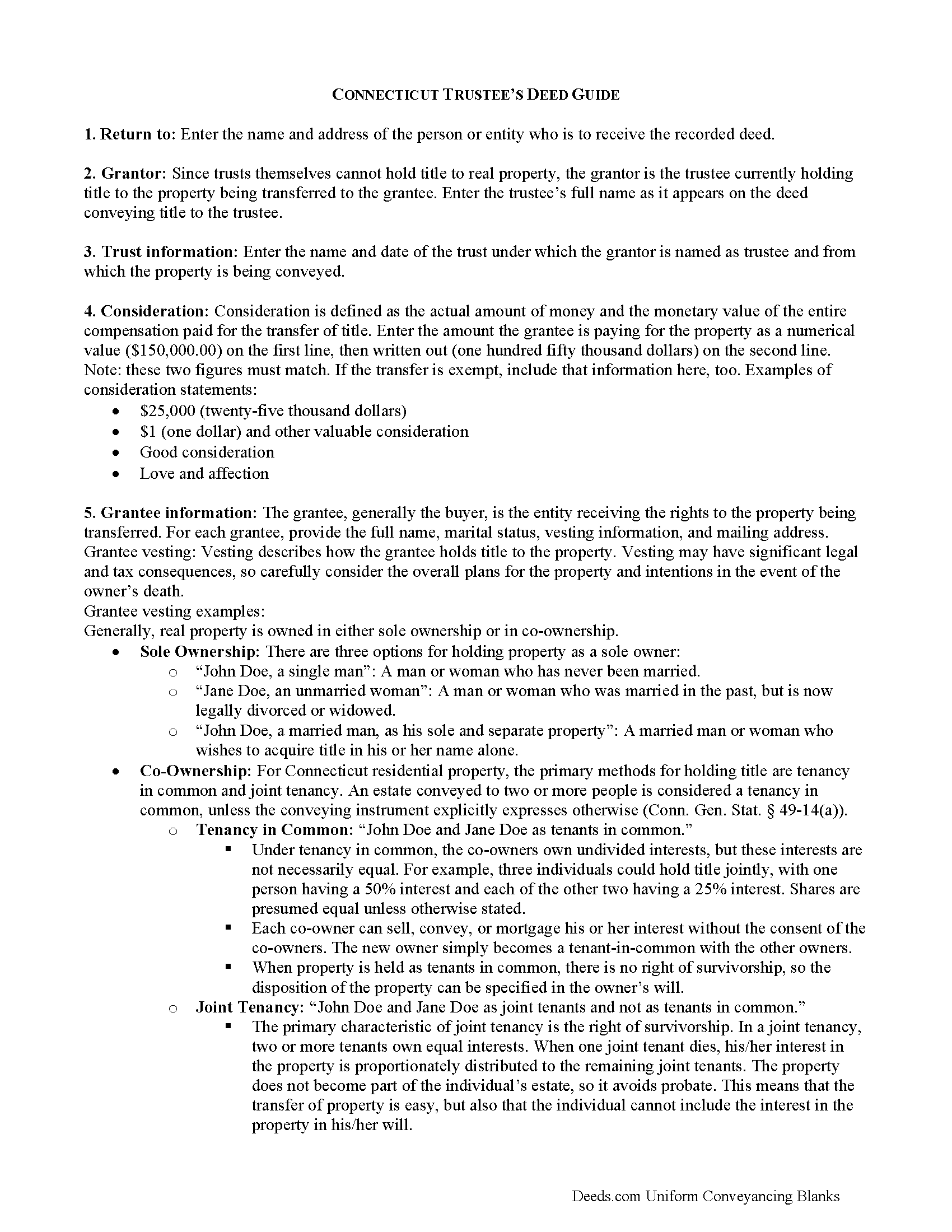

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Fairfield County compliant document last validated/updated 4/28/2025

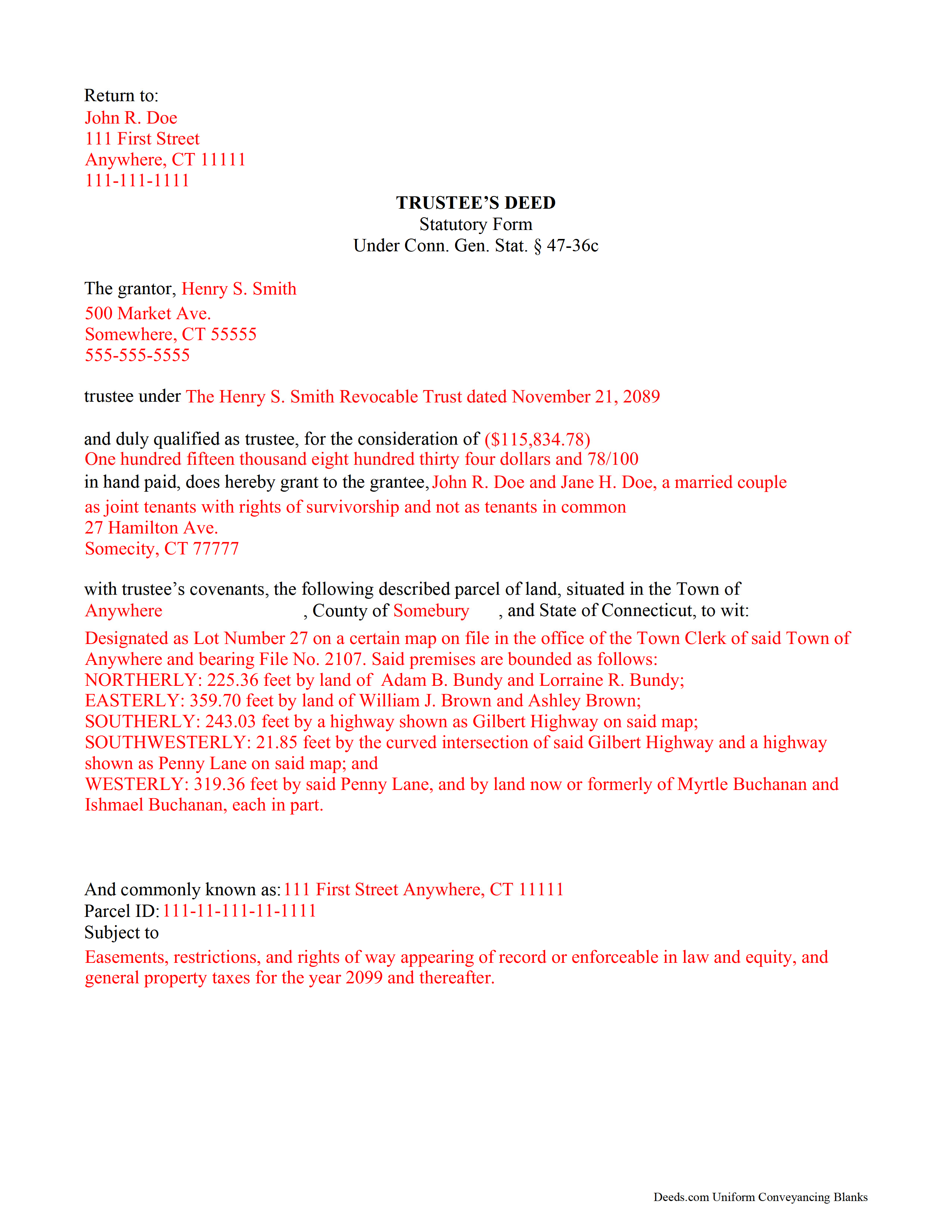

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Fairfield County compliant document last validated/updated 2/25/2025

The following Connecticut and Fairfield County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Fairfield County. The executed documents should then be recorded in one of the following offices:

Bethel Town Clerk

Municipal Center - 1 School St, Bethel, Connecticut 06801

Hours: 8:30 to 4:30 Mon-Fri

Phone: (203) 794-8505 or 8506

Bridgeport Town Clerk

City Hall - 45 Lyon Terrace, Rm 122, Bridgeport, Connecticut 06604

Hours: 9:00am to 4:00 pm Mon-Thu; Fri until noon

Phone: (203) 576-7208

Brookfield Town Clerk

Town Hall - 100 Pocono Rd, Rm 115 / PO Box 5106, Brookfield, Connecticut 06804

Hours: Mon-Fri 8:00am to 4:00pm. Thu until 6:00pm

Phone: (203) 775-7313

Danbury Town Clerk

155 Deer Hill Ave, Danbury, Connecticut 06810

Hours: Mon - Wed 7:30am - 6:00pm; Thu 7:30am - 6:30pm

Phone: 203-797-4531

Darien Town Clerk

Town Hall - 2 Renshaw Rd, Rm 101, Darien, Connecticut 06820

Hours: Monday - Friday 8:30am to 4:30pm

Phone: (203) 656-7307

Easton Town Clerk

225 Center Rd, Easton, Connecticut 06612

Hours: Monday through Friday 8:30 to 1:00 & 2:00 to 4:30 / Recording until 4:00

Phone: (203) 268-6291 x133

Fairfield Town Clerk

Old Town Hall - 611 Old Post Rd, Fairfield, Connecticut 06824

Hours: 8:30 to 4:30 M-F

Phone: (203) 256-3090

Greenwich Town Clerk

Town Hall - 101 Field Point Rd, 1st floor, Greenwich, Connecticut 06830

Hours: 8:00 to 4:00 M-F

Phone: (203) 622-7897

Monroe Town Clerk

7 Fan Hill Rd, Monroe, Connecticut 06468

Hours: Mon-Thu 8:00 to 4:00; Fri until 1:00

Phone: (203) 452-2811

New Canaan Town Clerk

Town Hall - 77 Main St, 1st floor / PO Box 447, New Canaan , Connecticut 06840

Hours: 8:30 a.m. - 4:00 p.m. M-F

Phone: (203) 594-3070

New Fairfield Town Clerk

4 Brush Hill Rd, New Fairfield, Connecticut 06812

Hours: 8:30am to 5:00pm; Friday until 12:00pm

Phone: (203) 312-5616

Newtown Town Clerk

Municipal Center - 3 Primrose St, Newtown, Connecticut 06470

Hours: Monday - Friday 8:00 AM to 4:30 PM

Phone: (203) 270-4210

City of Norwalk Town Clerk

Norwalk City Hall - 125 East Ave, Rm 102, Norwalk, Connecticut 06851

Hours: 8:30 to 4:30 M-F / Recording until 4:15

Phone: (203) 854-7747

City of Shelton City/Town Clerk

City Hall - 54 Hill St, 1st floor, Shelton, Connecticut 06484

Hours: Monday - Friday 8 AM - 5:30 PM

Phone: (203) 924-1555 x1503

Sherman Town Clerk

Mallory Town Hall - 9 Rt 39 North / PO Box 39, Sherman, Connecticut 06784

Hours: Tue to Fri 9:00-12:00 & 1:00-4:00; Sat 9:00-12:00

Phone: (860) 354-5281

City of Stamford Town Clerk

Gov Center - 888 Washington Blvd, Stamford, Connecticut 06901

Hours: 8:00 a.m. - 3:30 p.m.

Phone: (203) 977-4054

Stratford Town Clerk

2725 Main St, Rm 106, Stratford, Connecticut 06615

Hours: Monday through Friday 8:00am to 4:00pm

Phone: (203) 385-4020

Redding Town Clerk

Town Hall - 100 Hill Rd / PO Box 1028, Redding, Connecticut 06875

Hours: Mon-Wed 8:30 to 5:30; Thu 8:30 to 6:00; Fri closed

Phone: (203) 938-2377

Ridgefield Town Clerk

Town Hall - 400 Main St, Ridgefield, Connecticut 06877

Hours: 8:30 to 4:30 Monday-Friday

Phone: (203) 431-2783

Trumbull Town Clerk

Town Hall - 5866 Main St, 1st floor, Trumbull, Connecticut 06611

Hours: Mon-Fri 9:00 to 5:00 / Recording until 4:30

Phone: (203) 452-5035

Weston Town Clerk

Town Hall - 56 Norfield Rd, Weston, Connecticut 06883

Hours: 9:00am to 4:30 pm Monday - Friday

Phone: (203) 222-2616

Westport Town Clerk

110 Myrtle Ave, Rm 105, Westport , Connecticut 06880

Hours: 8:30 to 4:30 Monday through Friday

Phone: (203) 341-1110

Wilton Town Clerk

Town Hall - 238 Danbury Rd, Wilton, Connecticut 06897

Hours: 8:30 to 4:30 M-F

Phone: (203) 563-0106

Local jurisdictions located in Fairfield County include:

- Bethel

- Botsford

- Bridgeport

- Brookfield

- Cos Cob

- Danbury

- Darien

- Easton

- Fairfield

- Georgetown

- Greens Farms

- Greenwich

- Hawleyville

- Monroe

- New Canaan

- New Fairfield

- Newtown

- Norwalk

- Old Greenwich

- Redding

- Redding Center

- Redding Ridge

- Ridgefield

- Riverside

- Sandy Hook

- Shelton

- Sherman

- Southport

- Stamford

- Stevenson

- Stratford

- Trumbull

- Weston

- Westport

- Wilton

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Fairfield County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Fairfield County using our eRecording service.

Are these forms guaranteed to be recordable in Fairfield County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fairfield County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Fairfield County that you need to transfer you would only need to order our forms once for all of your properties in Fairfield County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Connecticut or Fairfield County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Fairfield County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The trustee's deed is a statutory conveyance under Section 47-36c of the Connecticut Statutes. Unlike other forms of conveyance, it is named for the person executing the deed rather than the type of deed it is.

Used in trust administration, the trustee's deed conveys real property out of a trust. Since trusts cannot legally hold title to property in Connecticut, the trustee holds title to real property as a representative of the trust. The trustee must be authorized by the trust instrument to hold the position of trustee and to act on the trust's behalf.

A basic trustee's deed will name the trust's original trustee as the grantor and vest title in the name of a grantee. Sometimes, the grantor appears as a successor trustee if the original trustee is unavailable, due to death, for example. Documentation evidencing the change in trustee must be recorded in the town's land records.

When correctly executed, the trustee's deed grants title in fee simple to the grantee with the following trustee's covenants, pursuant to Sec. 47-36s of the Statutes: (1) the trustee is duly qualified to act as trustee, (2) the trustee has full power and authority as trustee to bargain and sell the described premises in manner and form as set forth, and (3) the trustee and the trustee's successors shall warrant and defend the granted premises against all claims and demands of any person claiming by, from or under the trustee. Sometimes, a third party may request a declaration or certification of trust as proof of trustee's authority to transfer title.

As with all documents affecting real property, the trustee's deed should contain a legal description of the subject parcel. All trustees must sign the deed in the presence of a notary for a valid transfer. Two witness signatures are required (Conn. Gen. Stat. 47-5(a)(4)). In Connecticut, land records are recorded in the individual town where the property is located, and not at the county level.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Our Promise

The documents you receive here will meet, or exceed, the Fairfield County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fairfield County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Gene J.

September 6th, 2019

Easy to pay for, hard to download. A zip file containing all the forms would be a great addition.

Your warning under the Review box needs help: see

Your review may displayed publicly so please do not include any personal information.

Thank you for your feedback. We really appreciate it. Have a great day!

TIFFANY B.

April 24th, 2024

THIS SERVICE IS AMAZING! IT SAVES ME SO MUCH TIME!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Barbara A.

January 27th, 2023

Much easier than going to the courthouse!

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret C.

February 9th, 2021

I recieved my document in a reasonable amount of time. I thought being a member i would be able to look up more than 1 document but it keeps asking me for more money. I requested help, asking if I need to pay for each document but have not yet been answered. I appreciate the fact I got 1 document I needed quickly.

Thank you!

Jo Anne M.

June 2nd, 2020

good I think

Thank you!

Barbara Y.

December 14th, 2020

I found your instructions and sample for completing a quit-claim deed in Arizona to be simple and easy to follow with one exception. The website to use in order to determine the code for the reason for exemption of fees was incorrect, as a result of which I had to contact the County Recorder to obtain that information.

Thank you for your feedback. We really appreciate it. Have a great day!

sheila m.

August 26th, 2019

Very happy with the forms. Ease of use and price were points for high marks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gwen N.

September 16th, 2021

Easy to use

Thank you!

Suzanne W.

July 10th, 2020

Excellent service, knowledgeable, and quick responses. I'll be using this service again for any future filing needs. WAY better than going to the filing office in person!

Thank you so much for the kind words Suzanne, glad we could help.

Angela A.

May 12th, 2022

The forms, instructions and example of the completed Interspousal Transfer Deed was very helpful. I was able to complete all necessary forms quickly and bring them to the County Recorder's Office for filing with no problems. It was a great relief, and I didn't even need to hire an attorney. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan K.

February 16th, 2019

Very helpful; information included on the form explanations about Colorado laws in regards to beneficiary deeds helped us understand the issues involved.

Thank you for your feedback. We really appreciate it. Have a great day!

HEATHER M.

September 27th, 2024

The guide I needed was very easy to understand and the template was easy to complete. I had a property attorney review the deed before I had it registered and she was impressed. She said she couldn't have written it better herself! Definitely worth the money instead of paying high dollar attorney fees for a simple task.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!