Leon County Certificate of Trust Form

Leon County Certificate of Trust Form

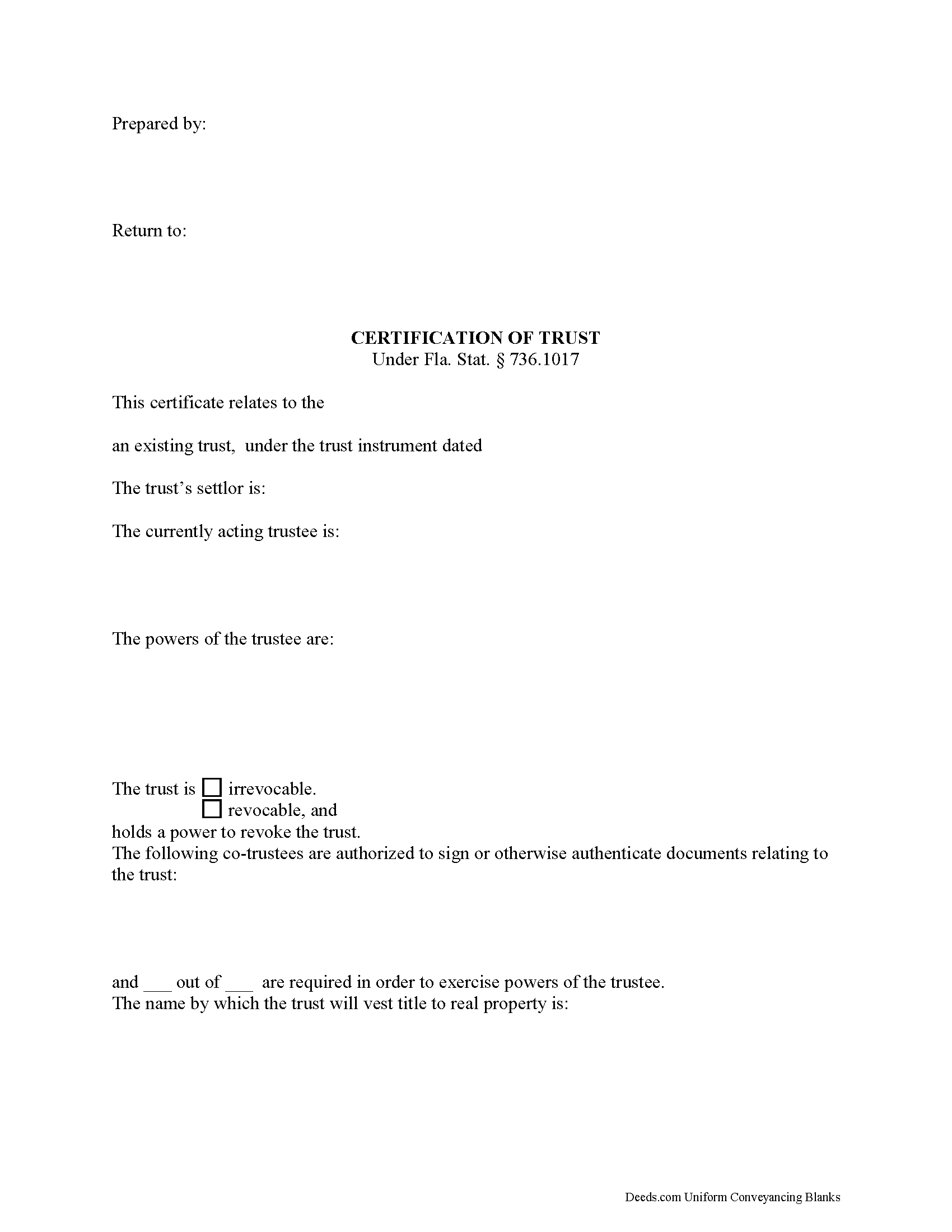

Fill in the blank Certificate of Trust form formatted to comply with all Florida recording and content requirements.

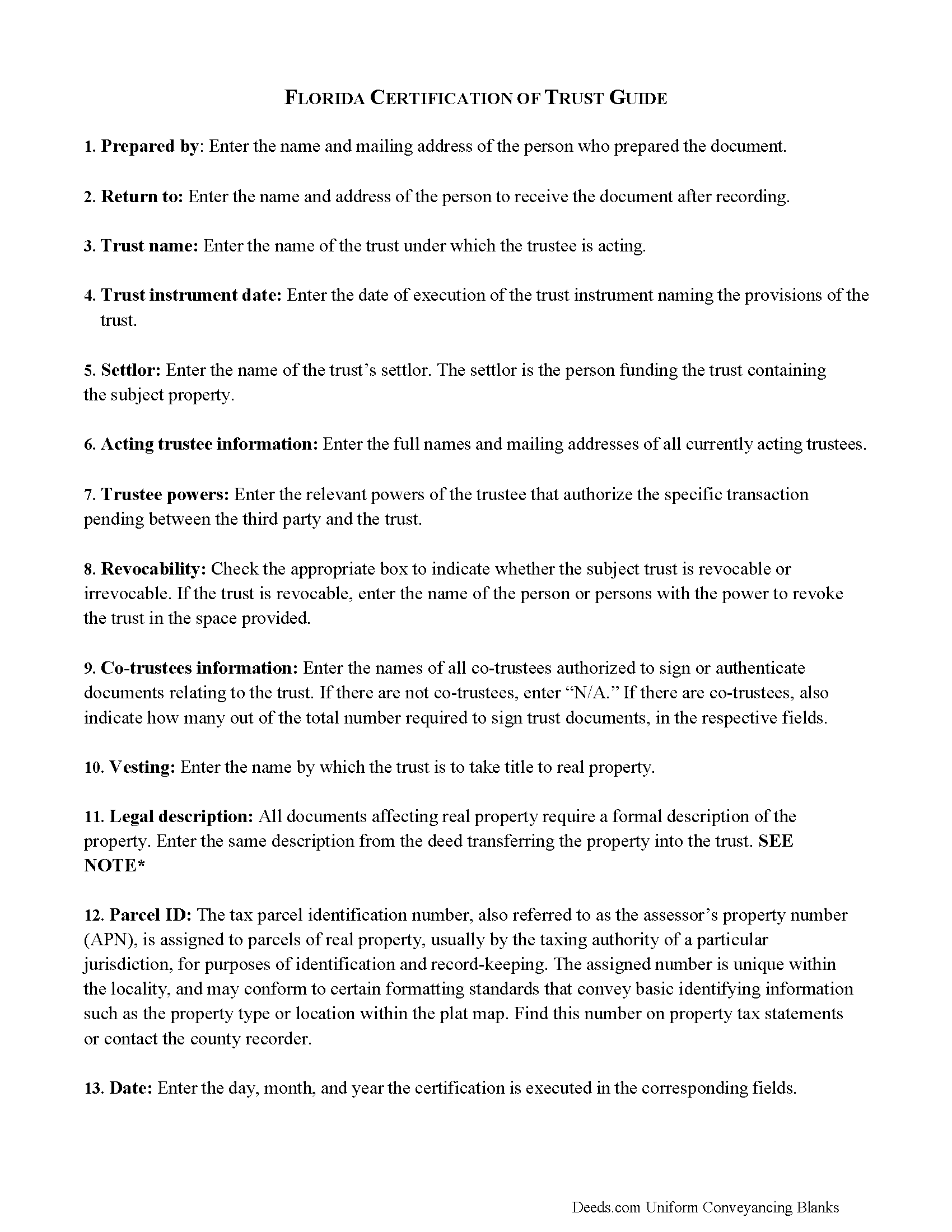

Leon County Certificate of Trust Guide

Line by line guide explaining every blank on the Certificate of Trust form.

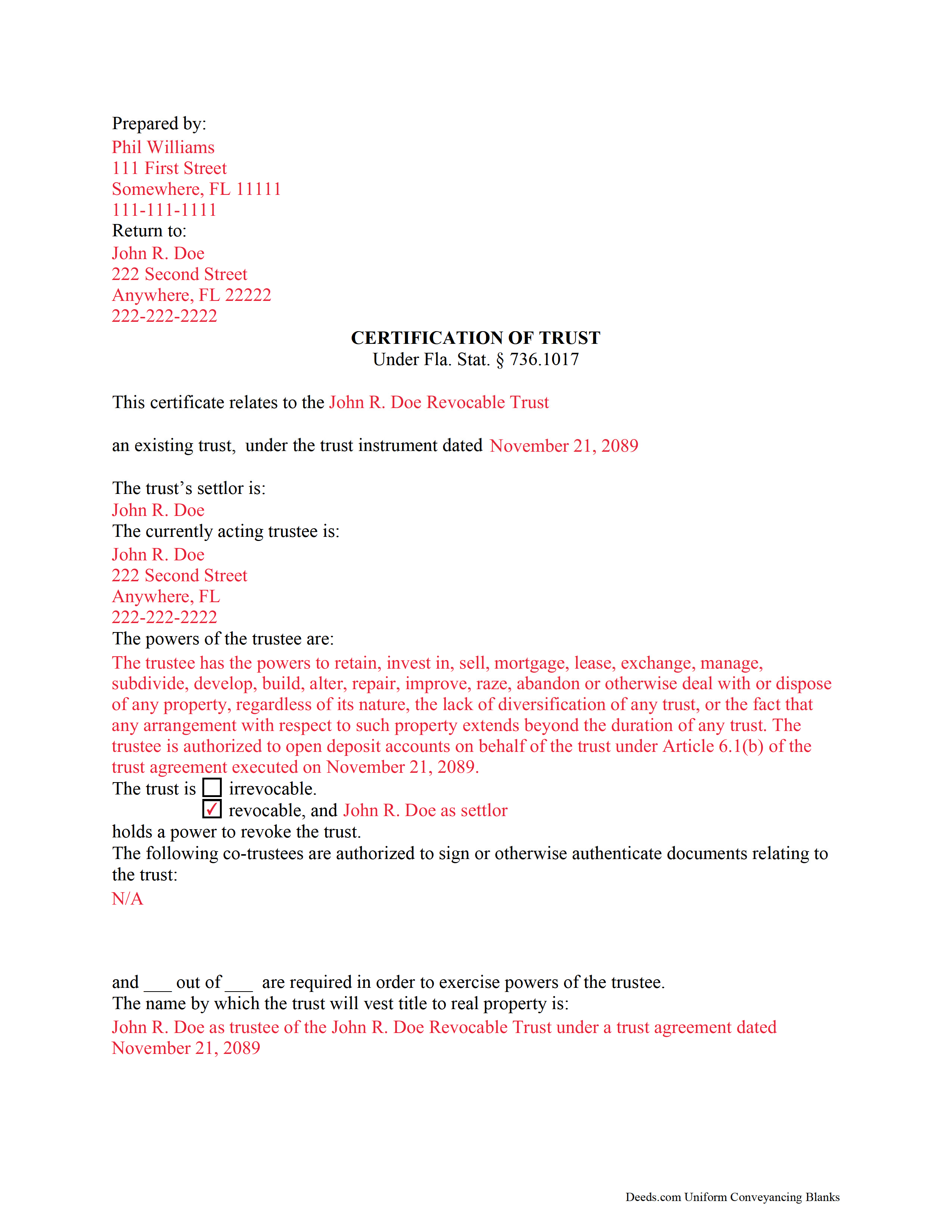

Leon County Completed Example of the Certificate of Trust Document

Example of a properly completed Florida Certificate of Trust document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Leon County documents included at no extra charge:

Where to Record Your Documents

County Courthouse / Courts Dept. and Official Records

Tallahassee, Florida 32301

Hours: 8:00am - 4:30pm M-F

Phone: (850) 577-4030

Northeast Branch

Tallahassee, Florida 32312

Hours: 8:00am - 5:00pm M-F

Phone: (850) 577-4030

Recording Tips for Leon County:

- Both spouses typically need to sign if property is jointly owned

- Mornings typically have shorter wait times than afternoons

- Have the property address and parcel number ready

Cities and Jurisdictions in Leon County

Properties in any of these areas use Leon County forms:

- Tallahassee

- Woodville

Hours, fees, requirements, and more for Leon County

How do I get my forms?

Forms are available for immediate download after payment. The Leon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Leon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Leon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Leon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Leon County?

Recording fees in Leon County vary. Contact the recorder's office at (850) 577-4030 for current fees.

Questions answered? Let's get started!

Governed by the Florida Trust Code under Fla. Stat. 736.1017, any trustee may execute and sign a certification of trust in lieu of furnishing a trust instrument (Fla. Stat. 736.1017(2)). The document is proof of a trust's existence, as well as the trustee's authority to act on behalf of the trust.

Lending institutions or other parties might ask for a certification of trust before processing a request, such as opening an account in the trust's name or transferring assets into or out of the trust. The certification contains only the information about the trust needed for the specific pending transaction, and the identities of those having a beneficial interest in the trust remain confidential; trust documents are usually unrecorded and therefore not a matter of public record.

A recipient can request excerpts of the trust instrument concerning the appointment of the trustee and the trustee's powers, as well as excerpts of relevant amendments, but may rely upon information presented in the certificate as fact.

The requirements for a valid certification of trust include the trust's name and date of the trust instrument; the settlor's name; the acting trustee's name; and the trustee's powers relevant to the situation. In addition, the certificate states whether the trust is irrevocable or revocable, and who has the power to revoke the trust in the case of the latter. If the transaction involves real estate, include the legal description of the subject property or properties.

If the trust has more than one acting trustee, the certificate shows who is authorized to sign documents relating to the trust, and how many are required to sign. The certificate also confirms the name by which the trustee, as representative of the trust, is to take title to trust assets.

Finally, the certificate requires a statement that the trust has not been modified in any way that would invalidate any information presented within.

The executing trustee signs the certificate in the presence of a notary public and two witnesses, as per Fla. Stat. 117.05. If the document is being recorded, submit it in the county in which the subject real property is located.

(Florida Certificate of Trust Package includes form, guidelines, and completed example)

Contact a lawyer with any questions regarding certifications of trust or trust law in the State of Florida, as each situation is unique.

Important: Your property must be located in Leon County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust meets all recording requirements specific to Leon County.

Our Promise

The documents you receive here will meet, or exceed, the Leon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Leon County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Maura M.

January 15th, 2020

Easy user friendly website

Thank you!

Joan S.

May 21st, 2020

Thanks for providing this service. We had searched for weeks for the correct documents. It might help clients to find you soon if the banks and mortgage companies can refer clients to you. They require the forms but offer no direct source to obtain them. You are 5 star in every way.

Thank you!

Katherine N.

May 22nd, 2019

Very easy to understand and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jayne J.

May 21st, 2025

We have used this service two times and now going for third. Would recommend. So glad this service is available.

Thank you for your positive words! We’re thrilled to hear about your experience.

Theresa M.

August 12th, 2023

Simple and quick service!!

Thank you!

Dawn L.

May 26th, 2022

Not totally satisfied as unable to edit as needed on signature page of the deed. I want to be able to date the document and don't want the verbage "signed, sealed and delivered in the presence of" to appear and cannot remove it. The notary will make his or her own statement below as to the date executed.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary B.

December 1st, 2021

Great job, Deeds.com! I'm a retired lawyer, and I'm liking what I see. Well done.

Thank you!

Joanne D.

May 14th, 2020

Loved your easy to follow instructions along with the paperwork forms that I was looking for. Would highly suggest this service to everyone. You should share this platform with other counties!! Extremely helpful

Thank you!

Lana J.

March 4th, 2022

Very easy to use and the forms were perfectly formatted. Great value and service!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steve R.

April 28th, 2023

Quick, clean, easy. A hat trick.

Thank you!

Kenny H.

January 14th, 2020

The forms are extremely helpful. They could use some updating. Promissory note "...in the form of cash, check or money order." is a bit outdated. My note is with my son and we have an automatic bank transfer set up for payments. He could Venmo me. There are many other options and likely to be more changes in the future, so I know this is difficult to maintain.

Thank you for your feedback. We really appreciate it. Have a great day!

Lutalo O.

December 26th, 2019

Great tool for finding the best real estate forms!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Traci R.

November 21st, 2019

I was disappointed in the form received. The language was not clear and for the price, one would think we would receive a Word version rather than a PDF.

Sorry to hear of your struggle Traci. We have canceled your order and payment. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Jeffrey W.

April 29th, 2020

One of the most user-friendly services I have used. HIGHLY reccomended.

Thank you!

James B.

May 6th, 2019

All required forms readily available at fair price. Easy to create account. Immediately acquired documents upon order.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!