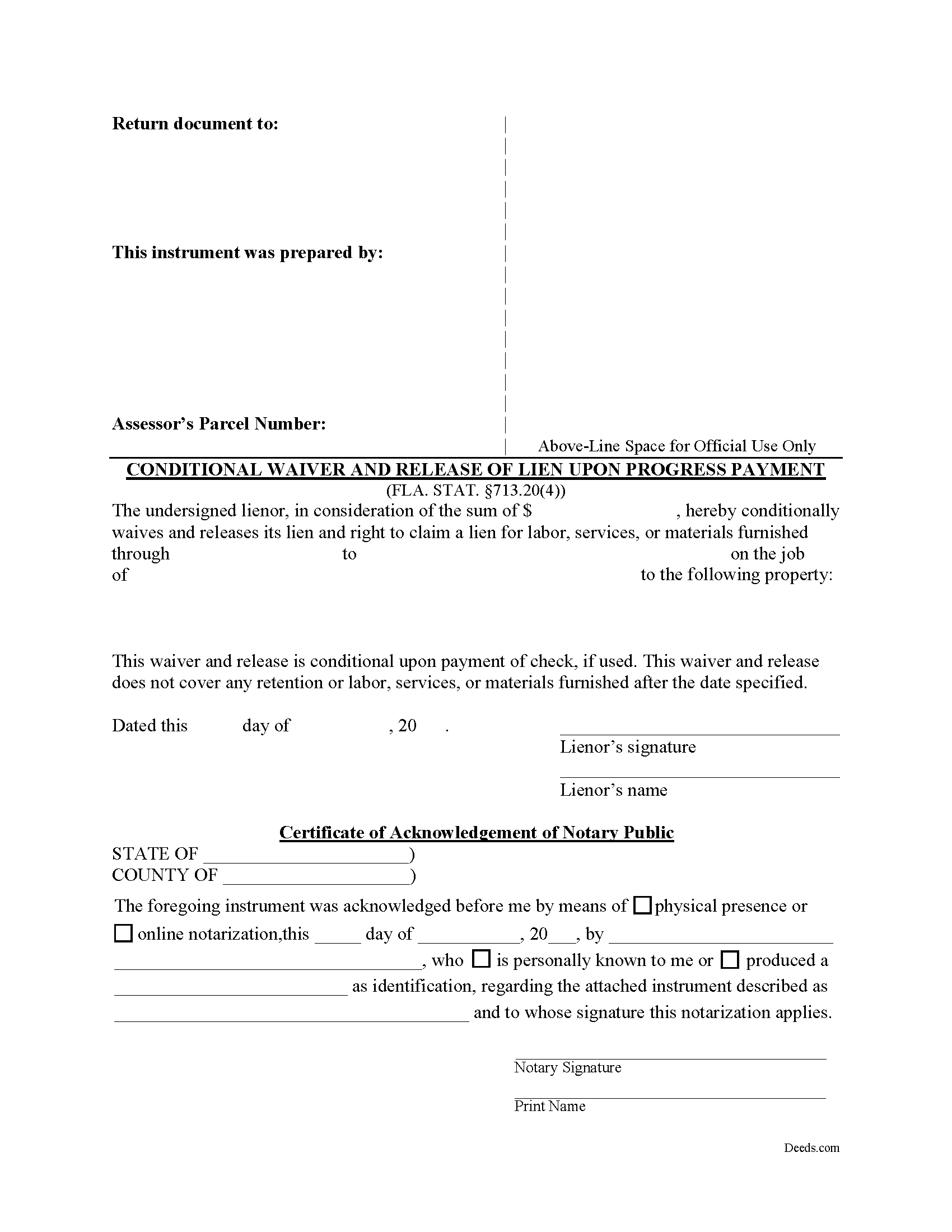

Broward County Conditional Waiver and Release of Lien upon Progress Payment Form

Broward County Conditional Waiver and Release of Lien upon Progress Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

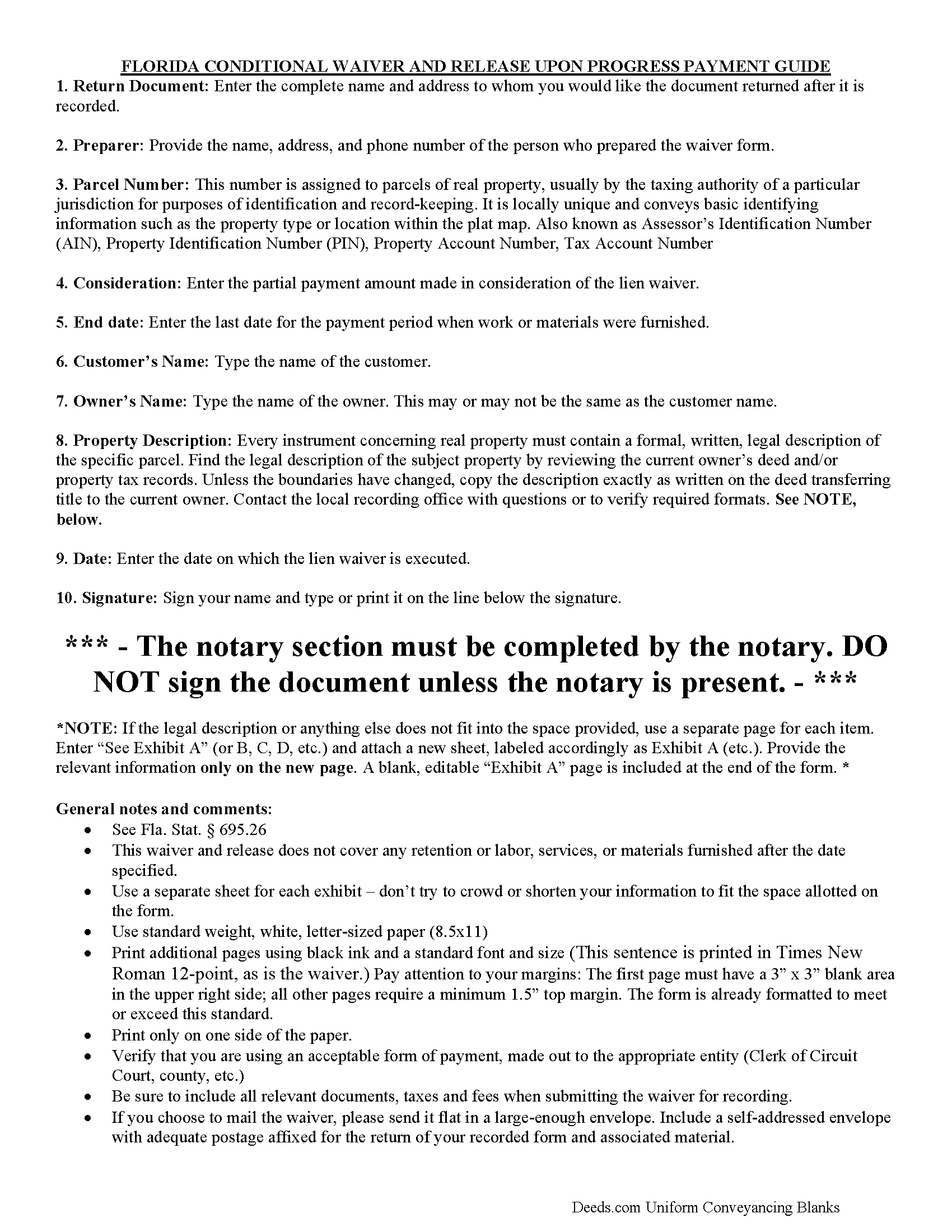

Broward County Conditional Waiver and Release of Lien upon Progress Payment Guide

Line by line guide explaining every blank on the form.

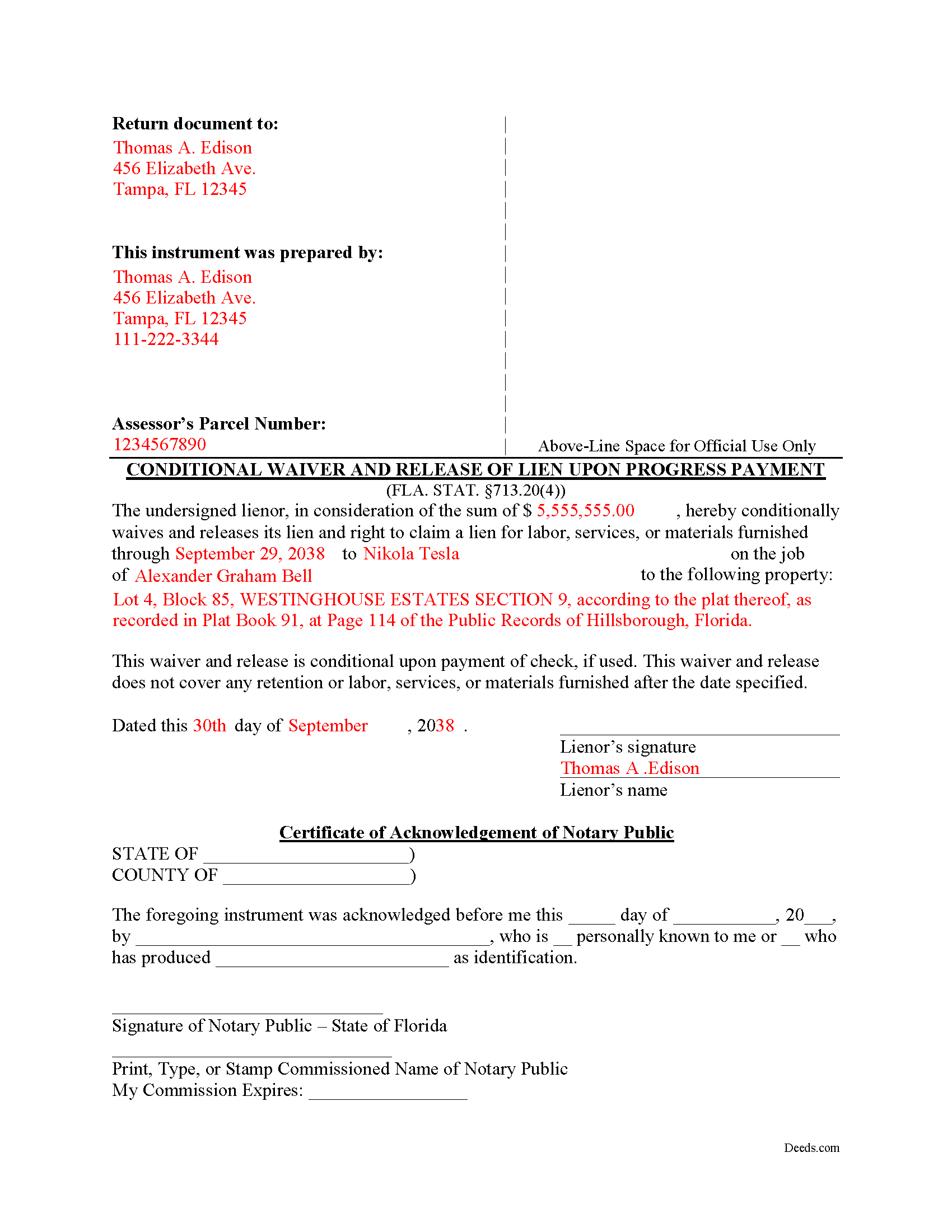

Broward County Completed Example of the Conditional Waiver and Release of Lien upon Progress Payment Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Broward County documents included at no extra charge:

Where to Record Your Documents

Records, Taxes and Treasury Division

Ft. Lauderdale, Florida 33301-1873

Hours: 7:30am to 5:00pm M-F

Phone: (954) 831-6716 / 954-831-4000

Recording Tips for Broward County:

- Check that your notary's commission hasn't expired

- Recorded documents become public record - avoid including SSNs

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Broward County

Properties in any of these areas use Broward County forms:

- Coconut Creek

- Dania

- Deerfield Beach

- Fort Lauderdale

- Hallandale

- Hollywood

- Lighthouse Point

- Pembroke Pines

- Pompano Beach

Hours, fees, requirements, and more for Broward County

How do I get my forms?

Forms are available for immediate download after payment. The Broward County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Broward County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Broward County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Broward County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Broward County?

Recording fees in Broward County vary. Contact the recorder's office at (954) 831-6716 / 954-831-4000 for current fees.

Questions answered? Let's get started!

Lien waivers or releases are used to surrender the right to a lien, either in full or in part depending on what type of lien release form is used. Florida's Construction Lien Law authorizes statutory waivers at 713.20 Fla. Stat. (2016).

Under 713.20(4), lienors may waive, on condition of payment, part of a lien they already delivered against the owner's interest in the improved property. Such a release contains information about the lienor, the customer, the property owner, the property description, the payment amount, and a date to mark the end of the work period covered by the waiver.

Each case is unique, so contact an attorney with specific questions or any other issues related to Florida Construction Liens.

Important: Your property must be located in Broward County to use these forms. Documents should be recorded at the office below.

This Conditional Waiver and Release of Lien upon Progress Payment meets all recording requirements specific to Broward County.

Our Promise

The documents you receive here will meet, or exceed, the Broward County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Broward County Conditional Waiver and Release of Lien upon Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Willie P.

May 13th, 2020

Your service was excellent

Thank you for your feedback. We really appreciate it. Have a great day!

William B.

May 29th, 2021

The website works just as described. I couldn't ask for anything more helpful in drafting an easement and all at a very reasonable price. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Kathleen M.

December 29th, 2023

I am very happy with this service

Your kind words have brightened our teams day! Thank you for the positive feedback.

Rebecca M.

May 3rd, 2025

EASY DOWNLOAD AND PRINT AND / OR SAVE TO YOU PC WHICH SHOULD BE DONE BEFORE FILLING OUT. AFTER I actually use them I'll let you know if its all good, Thanks

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Paula B.

August 8th, 2019

I'm transferring a property into a trust and ordered the QuitClaim Deed. Everything was pretty straight forward and user friendly. However, the Additional Information/Instructions for the Preliminary Change of Ownership Report skips from Section "I" to "M" and does not address "K". It would have been very helpful to have an explanation of the difference between the three options in that section. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen U.

December 5th, 2020

This is another great deal that has come out of the quarantine for covid. Saved me hours and days of time. and provides a way to file deeds that really isn't done effectively anyway else. It was also very inexpensive that you would not expect. I didn't even have to leave home.

Thank you for your feedback. We really appreciate it. Have a great day!

Darius M.

June 27th, 2020

I receive the specific legal forms that I needed as well as a guide on how to fill out the form. Very pleased. I saved $300.00 in lawyers fees by filling out the Quickclaim deed myself.

Thank you for your feedback. We really appreciate it. Have a great day!

shelley m.

March 5th, 2019

I thought the service was good

Thank you Shelley. Have a fantastic day!

Richard G.

August 28th, 2022

I was not able to add more linea to the deed and add up to four people and their addresses. The document should be able to be expanded.

Thank you for your feedback. We really appreciate it. Have a great day!

JAMES M.

July 17th, 2023

The forms are just what I needed! Easy to navigate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody P.

March 26th, 2021

Great service continues! Thanks again!

Thank you!

Jason B.

January 15th, 2022

You saved me $275.00 perfect! Thank you!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy P.

February 2nd, 2019

Straightforward, easy to navigate, saves time and gas = a real value for the price!

Thank you for your feedback. We really appreciate it. Have a great day!

Carl S.

February 29th, 2020

Five Stars!

Thank you!

Pat K.

December 31st, 2018

It has been very easy. Like that the recording is so fast.

Thank you for your feedback. We really appreciate it. Have a great day!