Download Florida Decedent Interest in Homestead Affidavit Legal Forms

Florida Decedent Interest in Homestead Affidavit Overview

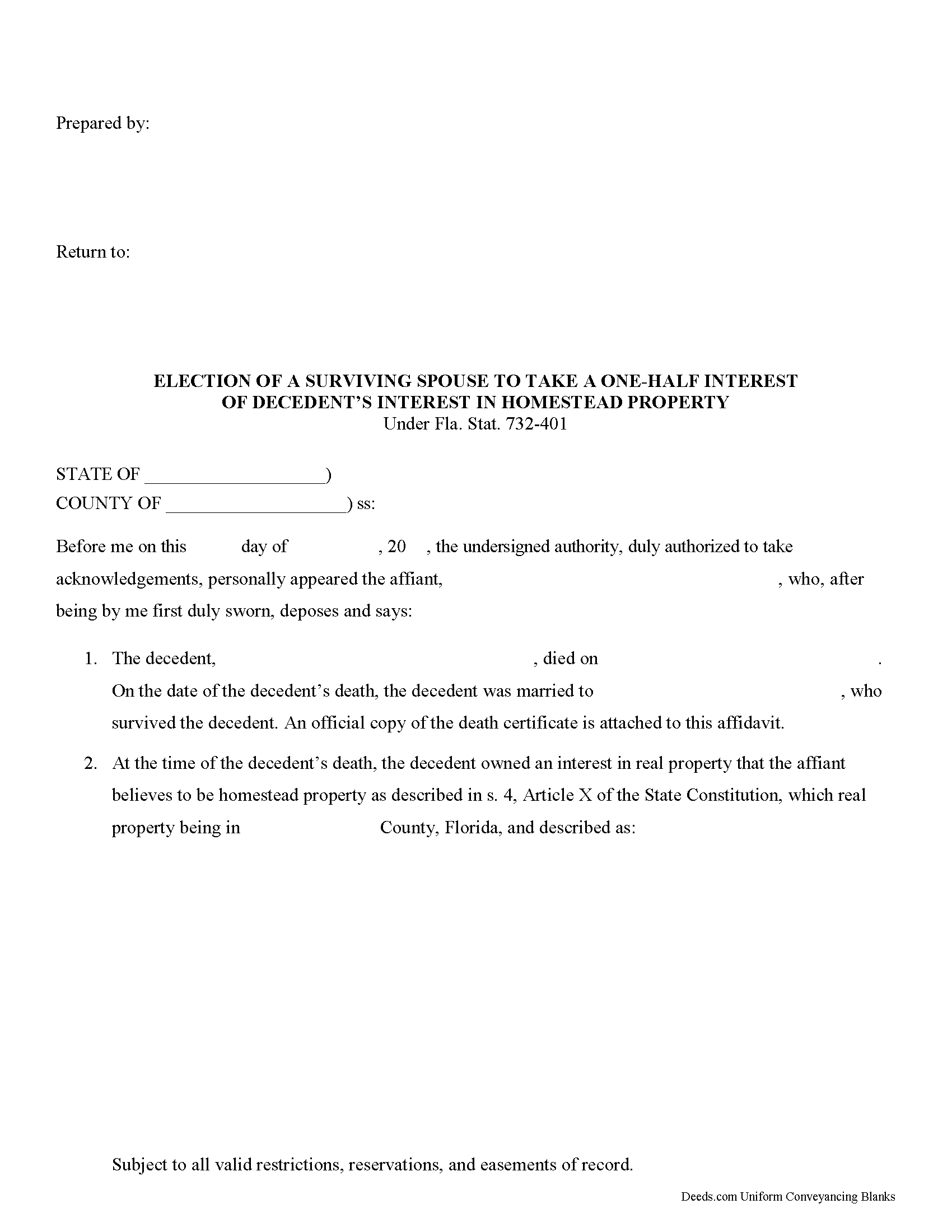

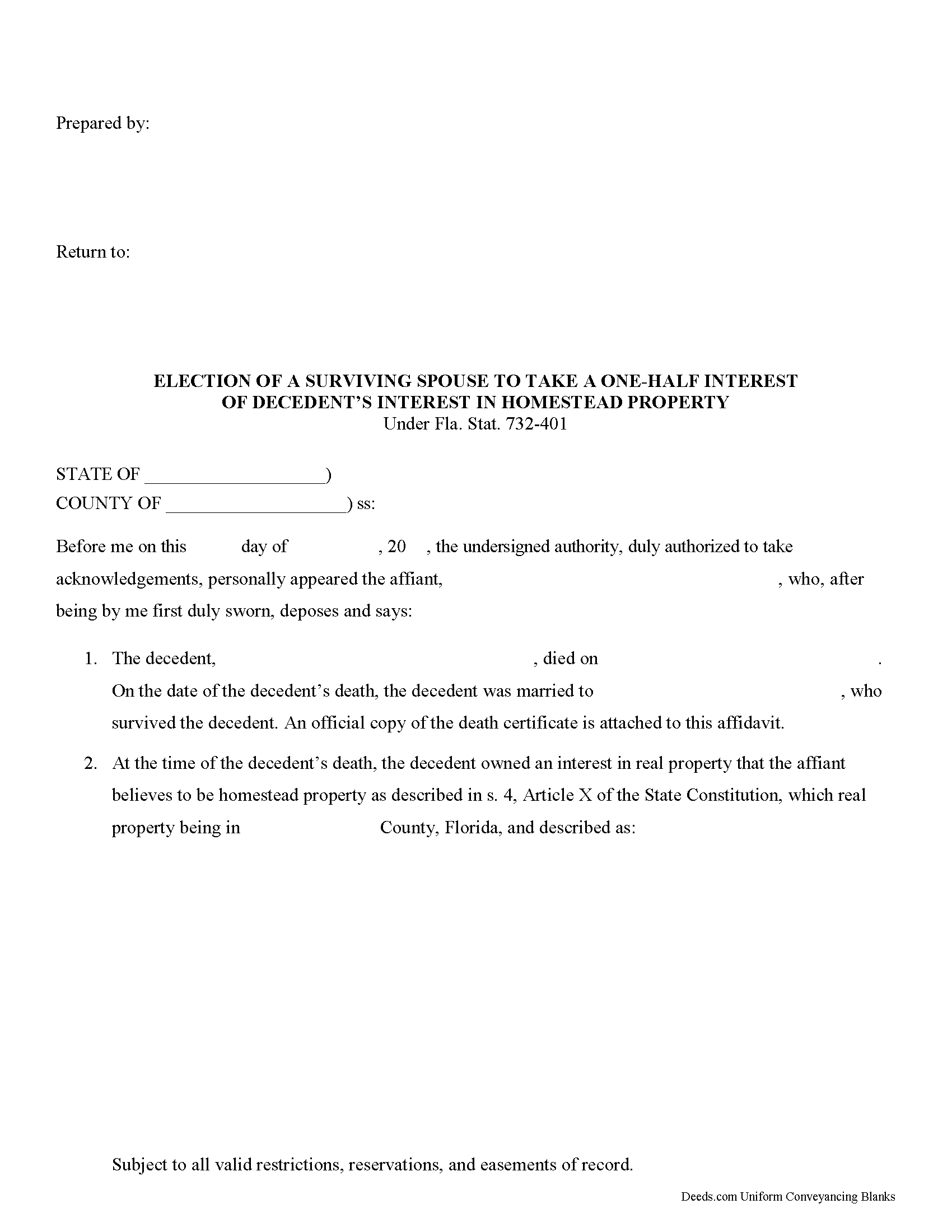

Decedent's interest in homestead affidavit

Under Florida law, real estate that is identified as a homestead but is not included in a deceased owner's will passes to beneficiaries in the same manner as other intestate property. If the decedent is survived by a spouse and one or more descendants, however, the surviving spouse has three main options as set out in section 732.401 of the Florida Statutes:

- take a life estate in the homestead, with a vested remainder to the descendants alive at the time of the decedent's death per stirpes (according to Black's Law Dictionary, 8th ed., "proportionately divided between beneficiaries according to their deceased ancestor's share").

- take an undivided one-half interest in the late spouse's homestead as a tenant in common, with the remaining one-half interest held by any descendants per stirpes.

- disclaim the interest as directed in chapter 739.

When a surviving spouse chooses to take the one-half interest in the property, he/she files a decedent's interest in homestead affidavit. This document allows the spouse to waive the marital rights to a life estate in the property. Instead, the surviving spouse and any descendants hold title as tenants in common. As tenants in common, each party can independently sell his/her interests to the property without notice or joinder from the others.

In most cases, the affidavit must be filed within six months of the decedent's death. The affidavit can be made by the surviving spouse him/herself or, with the court's approval, an attorney in fact or guardian of the property of the surviving spouse. The document is then filed in the county or counties in which the homestead property is located. Once recorded, the surviving spouse's decision is irrevocable.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Product description:

Use this document when the owner of homestead property dies without including the real estate in the will and the surviving spouse elects to forego his/her life estate interest in favor of one-half share and convert his/her interest in a life estate to a tenancy in common with the descendants.

(Florida Decedent Interest in Homestead Package includes form, guidelines, and completed example)