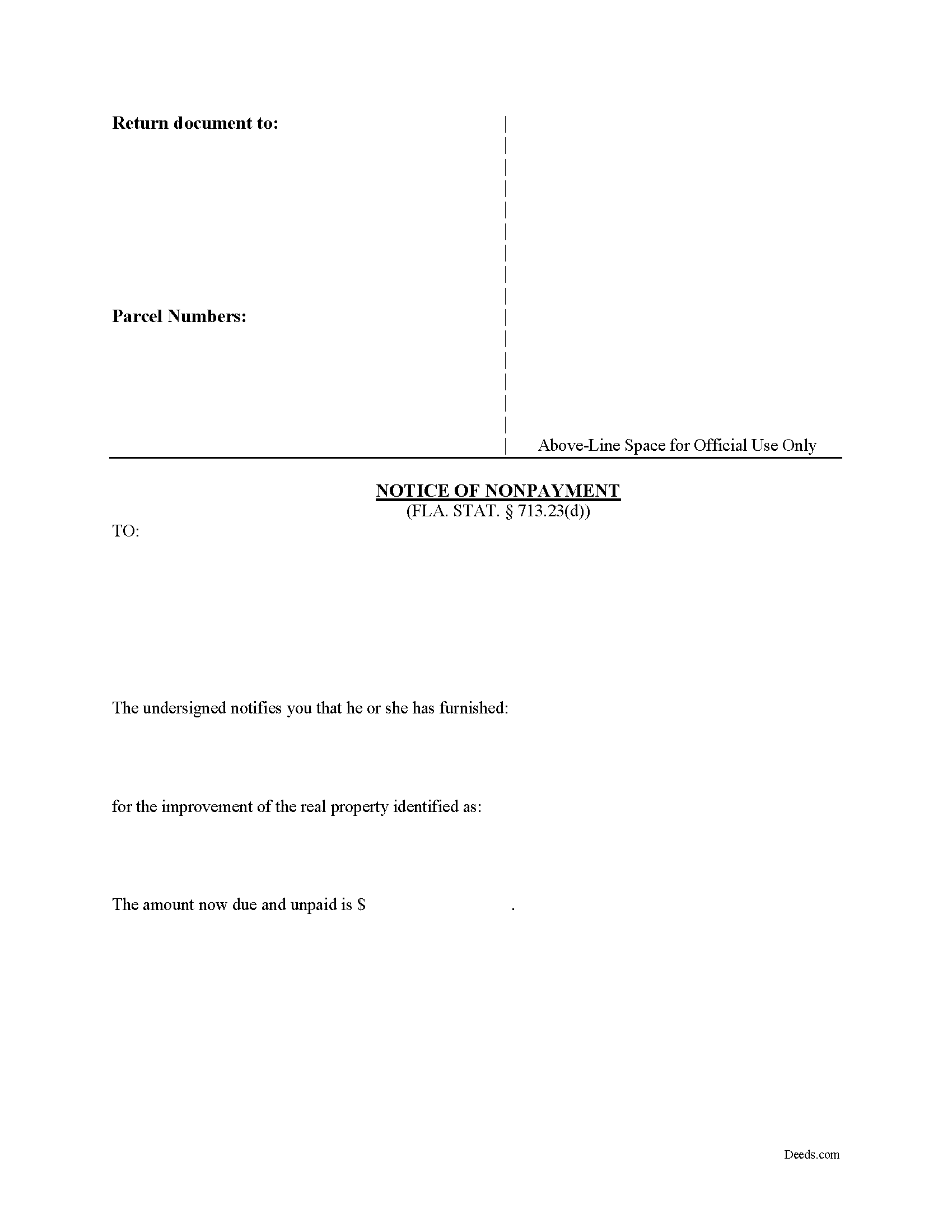

Levy County Notice of Nonpayment Form

Levy County Notice of Nonpayment Form

Fill in the blank form formatted to comply with all recording and content requirements.

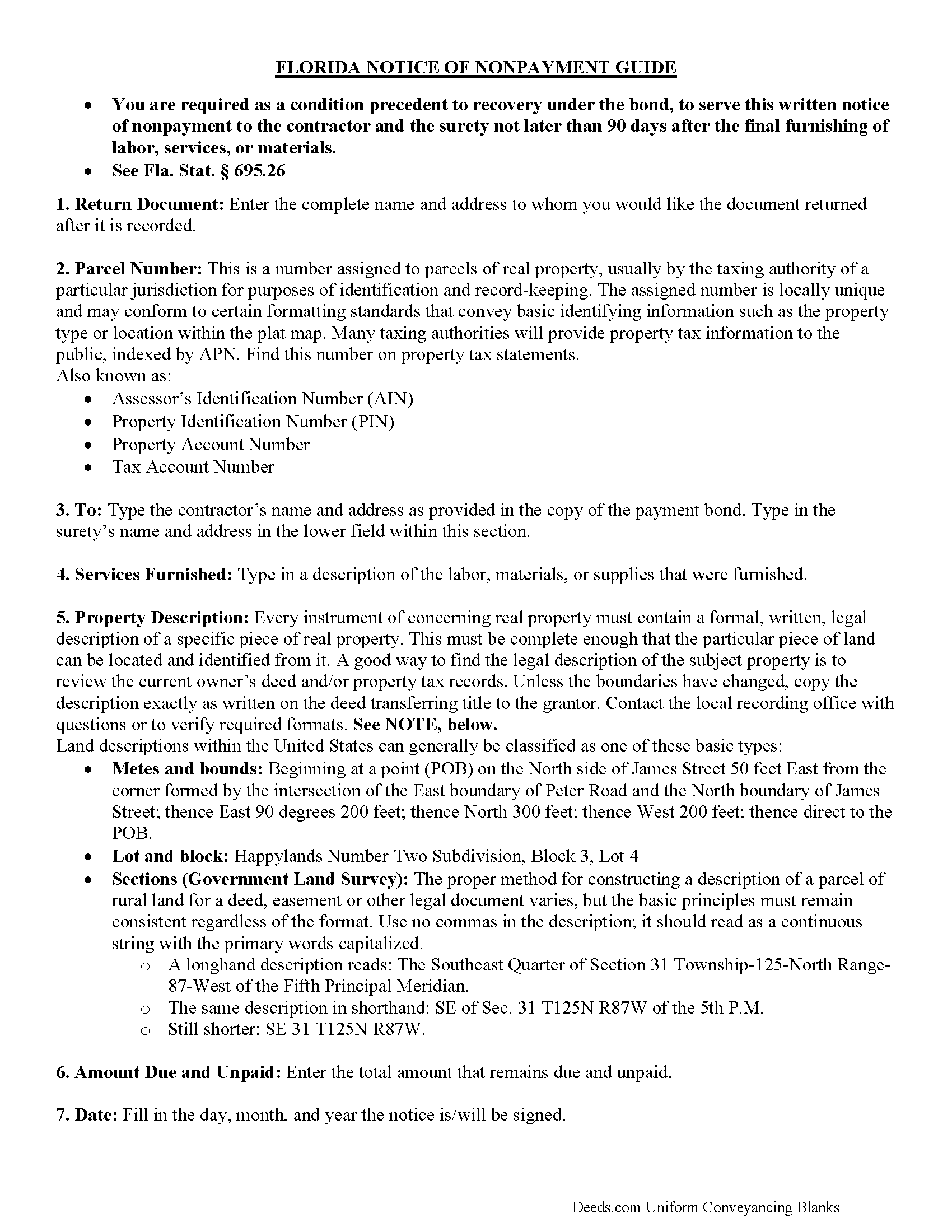

Levy County Notice of Nonpayment Guide

Line by line guide explaining every blank on the form.

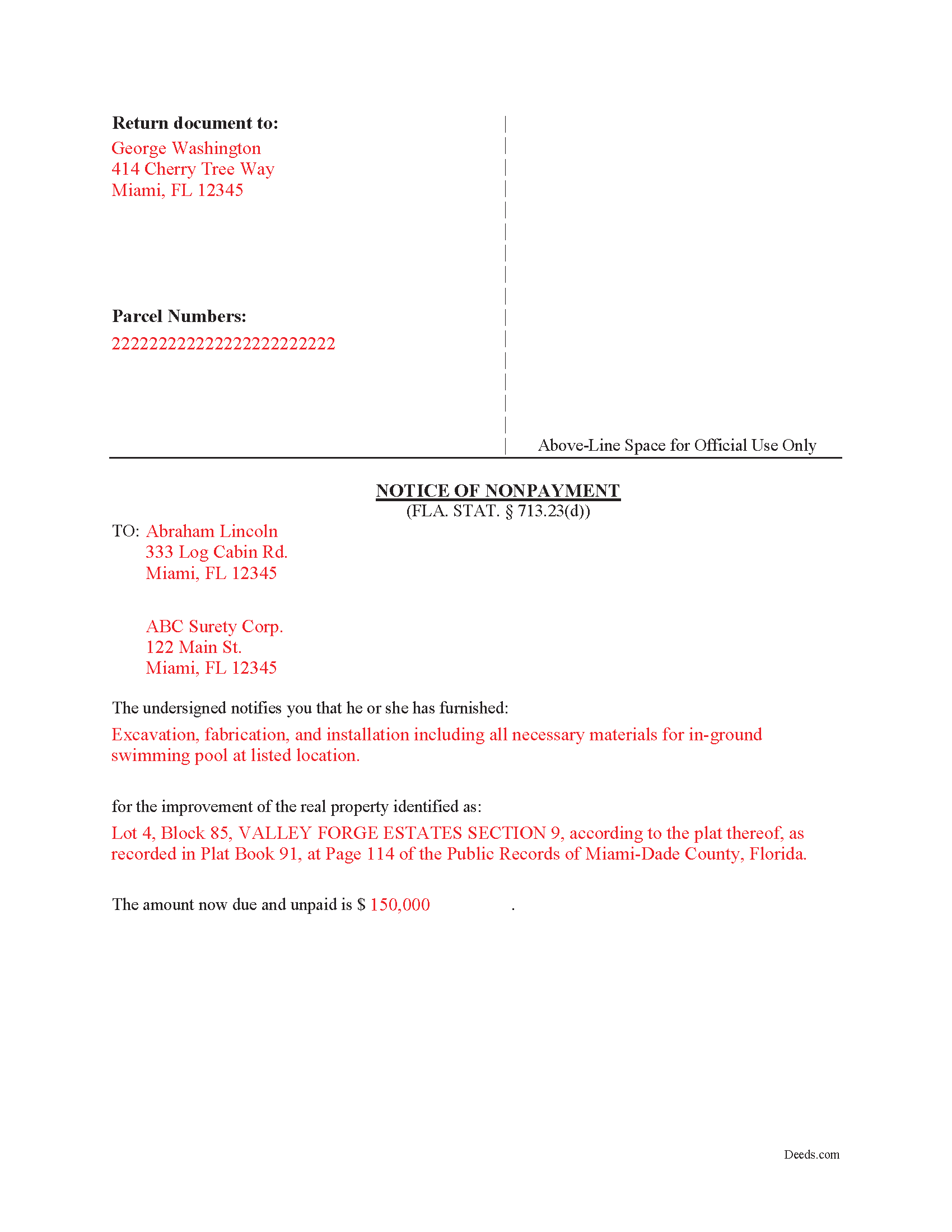

Levy County Completed Example of the Notice of Nonpayment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Levy County documents included at no extra charge:

Where to Record Your Documents

Clerk of Circuit Court - Levy County Courthouse

Bronson, Florida 32621

Hours: 8:30am to 4:30pm M-F

Phone: (352) 486-5266

Recording Tips for Levy County:

- Verify all names are spelled correctly before recording

- Avoid the last business day of the month when possible

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Levy County

Properties in any of these areas use Levy County forms:

- Bronson

- Cedar Key

- Chiefland

- Gulf Hammock

- Inglis

- Morriston

- Otter Creek

- Williston

- Yankeetown

Hours, fees, requirements, and more for Levy County

How do I get my forms?

Forms are available for immediate download after payment. The Levy County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Levy County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Levy County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Levy County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Levy County?

Recording fees in Levy County vary. Contact the recorder's office at (352) 486-5266 for current fees.

Questions answered? Let's get started!

What is a Notice of Nonpayment?

Codified at FLA. STAT. 713.23(d), the Notice of Nonpayment form is used to provide the contractor or surety with notice that the lienor has furnished certain labor, services or materials for improvement of real property and to notify each party of the amount that remains due and unpaid.

After the completion (or termination) of the furnishing of labor or materials on a bonded project for which you are still owed payment, you should complete and record this form. The Notice is like a lien but instead of attaching to the subject property, it attaches to the payment bond.

To recover an outstanding balance under the bond, the lienor must serve the contractor with a notice of nonpayment in addition to a notice to contractor form. The lienor must serve this written notice no later than 90 days after the final furnishing of labor, services, or materials. Remember that the time for serving the written notice of nonpayment is ONLY measured from the last day that the lienor furnishes labor, services, or materials. Id.

A valid notice of nonpayment form must include both the contractor's and surety's name and address, a description of the labor or materials furnished, a property description, and the amount owed and unpaid.

Each case is unique, so contact an attorney with specific questions or for complex situations relating to a notice of nonpayment or other issues with Florida mechanic's liens.

Important: Your property must be located in Levy County to use these forms. Documents should be recorded at the office below.

This Notice of Nonpayment meets all recording requirements specific to Levy County.

Our Promise

The documents you receive here will meet, or exceed, the Levy County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Levy County Notice of Nonpayment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Robert S.

June 10th, 2022

Thank you! You are so awesome. Its amazing to be able to get everything together in a download packet. You make it so easy for the user.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andrew M.

January 21st, 2024

Awesome service, I don’t know how much it saved me but I know it was a lot cheaper than going to a lawyer.

We are delighted to have been of service. Thank you for the positive review!

Carl R.

August 26th, 2020

Wonderful forms even for an simpleton like me. Thank goodness there are people that actually know what they are doing.

Thanks for the kind words Carl.

Dagmar R.

April 28th, 2021

Great Service, very helpful and knowledgeable.

Thank you for your feedback. We really appreciate it. Have a great day!

Amy S.

May 4th, 2023

Fast and easy access.

Thank you!

James A.

June 11th, 2019

As advertised.

Thank you!

Michael R.

September 15th, 2019

This was just TOO easy to do and use!! Thank you so much for your service!

Thank you!

Joseph I.

July 27th, 2021

Your instructions and sample are geared towards businesses. It would have been helpful to have included some for us individuals as married couples as well. I also recall one or two spelling errors on the form that I could not fix, and the instructions seem to be for a prior form. This particular registry also required a stamped self-addressed envelope for return of documents. Hey, you asked! Overall, pleased.

Thank you for your feedback. We really appreciate it. Have a great day!

Roger J.

December 3rd, 2020

I found the service easy to use and very helpful.

Thank you!

Randy R.

May 16th, 2019

Thank you So far everything worked great. Got my downloads so I'm off and running. I hope the rest of the paperwork goes this easy.

Thank you Randy, we appreciate your feedback.

patricia l.

February 16th, 2019

found this site very easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Terralynn J.

July 18th, 2019

I was very pleased to find ONLINE, Deed Revision Document(s) and their explanation. I ordered these document Forms, downloaded them and Printed them. Now, I will be able to fill them out in the privacy of my home. Instructions were also included, how to file this new Deed, after I complete it and have it Notarized. This has saved me time and emotional stress following the death of my husband. THANK YOU.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David J.

March 27th, 2020

Very easy to use and saved a lot of time

Thank you!

Faith D.

April 26th, 2023

That was really nice to use! Just don't have a computer but will go get copies. Thank you for being there.

Thank you!

Christine B.

April 16th, 2021

The site was easy to navigate.

Thank you!