Broward County Notice to Owner Form

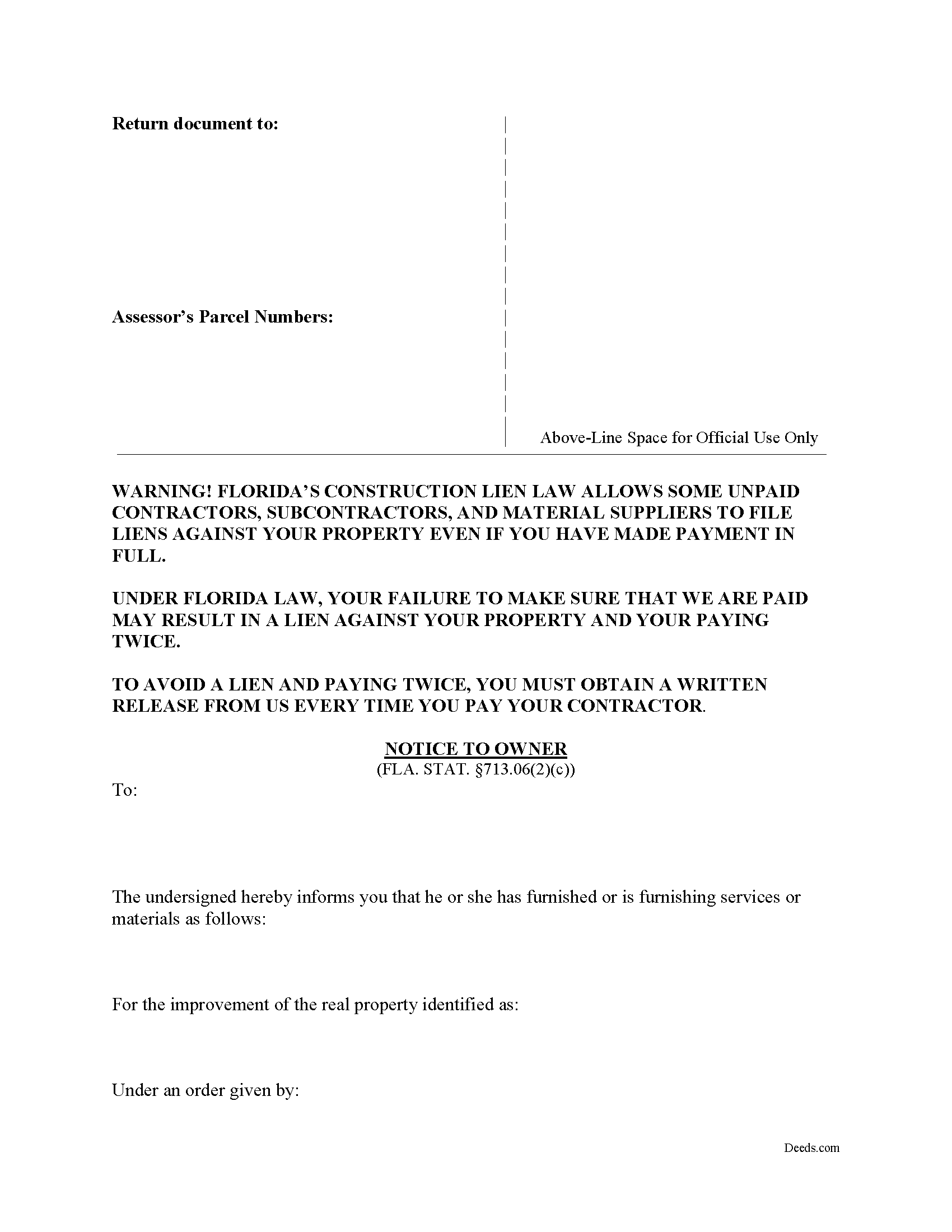

Broward County Notice to Owner Form

Fill in the blank form formatted to comply with all recording and content requirements.

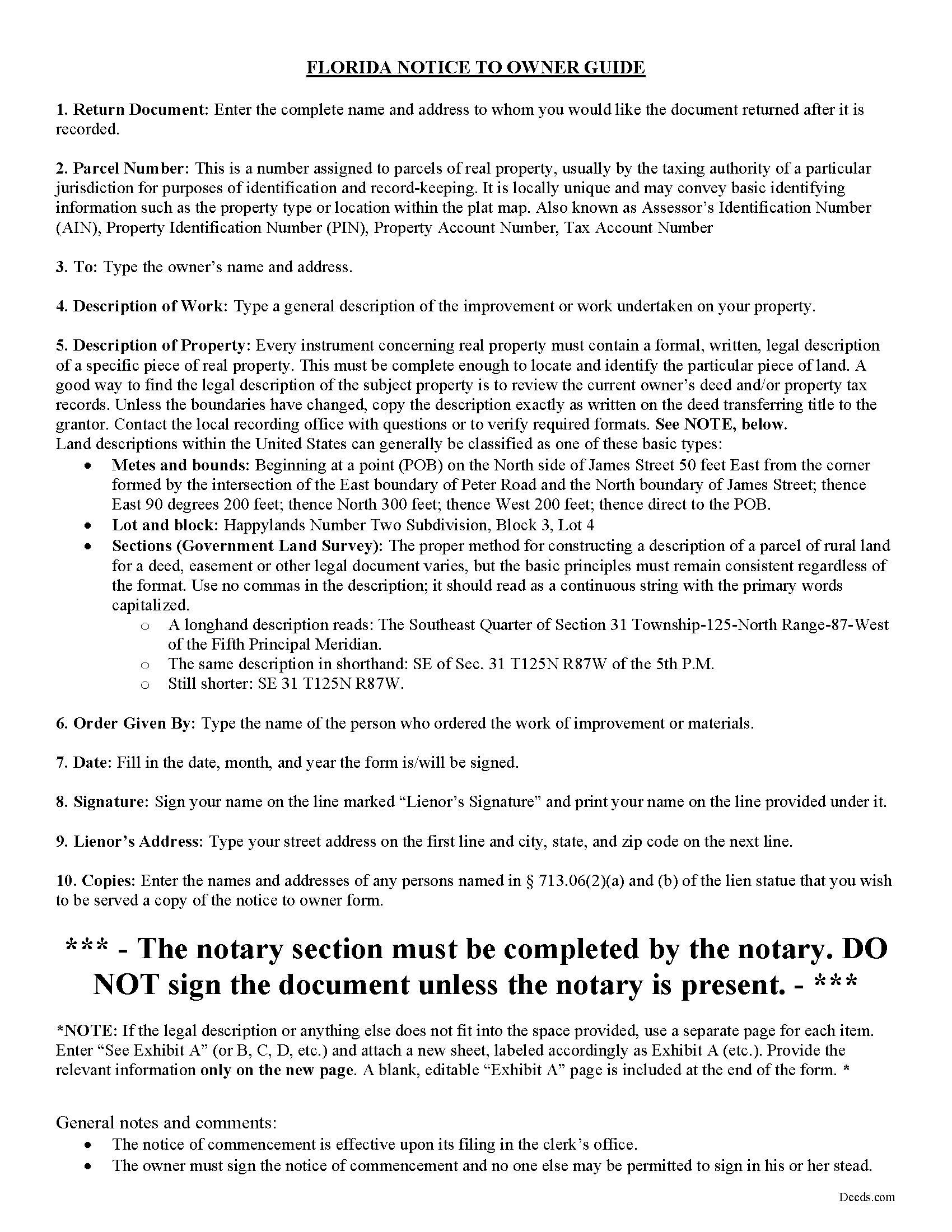

Broward County Notice to Owner Guide

Line by line guide explaining every blank on the form.

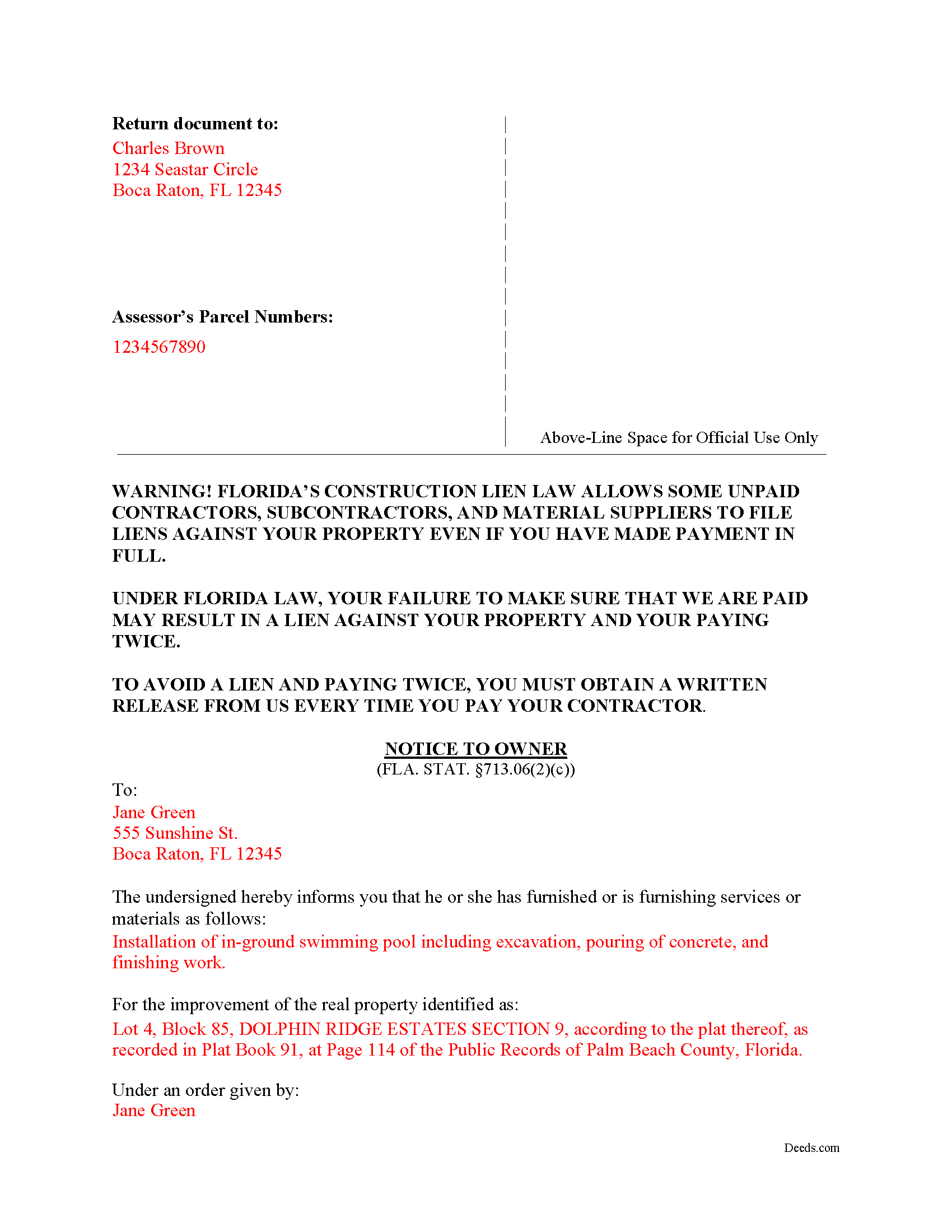

Broward County Completed Example of the Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Broward County documents included at no extra charge:

Where to Record Your Documents

Records, Taxes and Treasury Division

Ft. Lauderdale, Florida 33301-1873

Hours: 7:30am to 5:00pm M-F

Phone: (954) 831-6716 / 954-831-4000

Recording Tips for Broward County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

- Ask about their eRecording option for future transactions

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Broward County

Properties in any of these areas use Broward County forms:

- Coconut Creek

- Dania

- Deerfield Beach

- Fort Lauderdale

- Hallandale

- Hollywood

- Lighthouse Point

- Pembroke Pines

- Pompano Beach

Hours, fees, requirements, and more for Broward County

How do I get my forms?

Forms are available for immediate download after payment. The Broward County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Broward County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Broward County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Broward County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Broward County?

Recording fees in Broward County vary. Contact the recorder's office at (954) 831-6716 / 954-831-4000 for current fees.

Questions answered? Let's get started!

A statutory Notice to Owner (NTO) form, under section 713.06 of the Florida Revised Statutes, is a fairly simple document. Sent to an owner by any lienor (subcontractor, sub-subcontractor or material supplier without a direct contract between the two parties), this document informs the owner that the lienor has or will commence the supply of labor, services, or materials for the purpose of improving their real property. The NTO is a first step in securing a mechanics lien on the property.

Florida's lien statute requires lienors as defined at 713.01(18-20) to serve the owner with a NTO form, even if the claimant is not a direct party to a contract with the owner. The lien law sets forth the required contents of the NTO, which must include the lien claimant's name and address, a description of the property, and a description of the services or materials furnished. The claimant must serve the owner either before commencement of the work or furnishing of materials, or within 45 days of such furnishing. Failure to serve the NTO in accordance with the lien statute renders associated liens invalid.

The NTO should be served on the owner in accordance with service methods prescribed under Florida law. The easiest (and least expensive) method is to use certified mail. Other acceptable methods include personal service and posting the notice at the jobsite as a final alternative.

Each case is unique, so contact an attorney with specific questions or for complex situations involving a Notice to Owner or other issue related to Florida's Construction Lien Law.

Important: Your property must be located in Broward County to use these forms. Documents should be recorded at the office below.

This Notice to Owner meets all recording requirements specific to Broward County.

Our Promise

The documents you receive here will meet, or exceed, the Broward County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Broward County Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Patricia J.

September 17th, 2020

Easy quick process to download at a reasonable price. Some good info provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sarah H.

December 11th, 2020

Very helpful and great price

Thank you!

William S.

August 5th, 2020

Assuming that the downloads went without a hitch, the system was easy to follow and execute.

Thank you!

Dennis K.

June 9th, 2020

Easily downloaded and filled out form for quit claim deed was approved as soon as i dropped it off.

Thank you for your feedback. We really appreciate it. Have a great day!

John Z.

November 5th, 2021

Very easy to use. Straight forward. Am glad I found the tools to process an important document of property ownership. Thanks much. Will recommend to friends and family.

Thank you!

Debora A.

May 23rd, 2023

Website easy to use and explanations available

Thank you!

Martine S.

July 29th, 2020

Very easy process and was recorded in a prompt manner. We will be using your services again in the future for sure.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth R.

April 20th, 2023

It was easy to download and save the Revocation of Beneficiary of Deed form. The example and instructions helped a lot. When I went to file with the county clerk's office, she read through it carefully and said "perfect" when she was through. Thank you for making it so easy!

Thank you!

Z. L.

October 20th, 2021

I appreciate a service that can reach any county in Texas to file deed distribution deeds. It is convenient, time and money saving for our clients and takes the headache out of estate administration. Thanks.

Thank you!

wendell s.

September 25th, 2020

The forms were everything promised. The guide was very helpful and made the process painless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert S B.

May 22nd, 2019

I would not have ordered this form had I realised how limited the fields are for details. There is no room for elaboration of terms. The language only allows one grantor and one grantee, and the gender and quantity default construction is a poor choice. Be basic, but leave room for more.

Thank you for your feedback. We really appreciate it. Have a great day!

willie B.

May 21st, 2019

I love how you can get information you need online great program ,outstanding just love it....

Thank you!

Pamela P.

April 10th, 2021

Access to all the necessary forms was easy. The detailed guide very helpful for ensuring a customer can fill out the documents accurately.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin M.

November 22nd, 2019

Thank you for your services...Attny office quoted a very large fee for the "TOD DEED" process, so this is very helpful that I am able to take care of this myself. If I would have researched your link sooner, I could have saved my Dad a lot of money for the "SURVIVORSHIP DEED". Thanks again & have a wonderful day:)

Thank you for your feedback. We really appreciate it. Have a great day!

Sara S.

January 8th, 2021

Deed.com was very user friendly, made recording convenient and fast responses. I do recommend.

Thank you for your feedback. We really appreciate it. Have a great day!