Gilchrist County Quitclaim Deed Form

Gilchrist County Quitclaim Deed Form

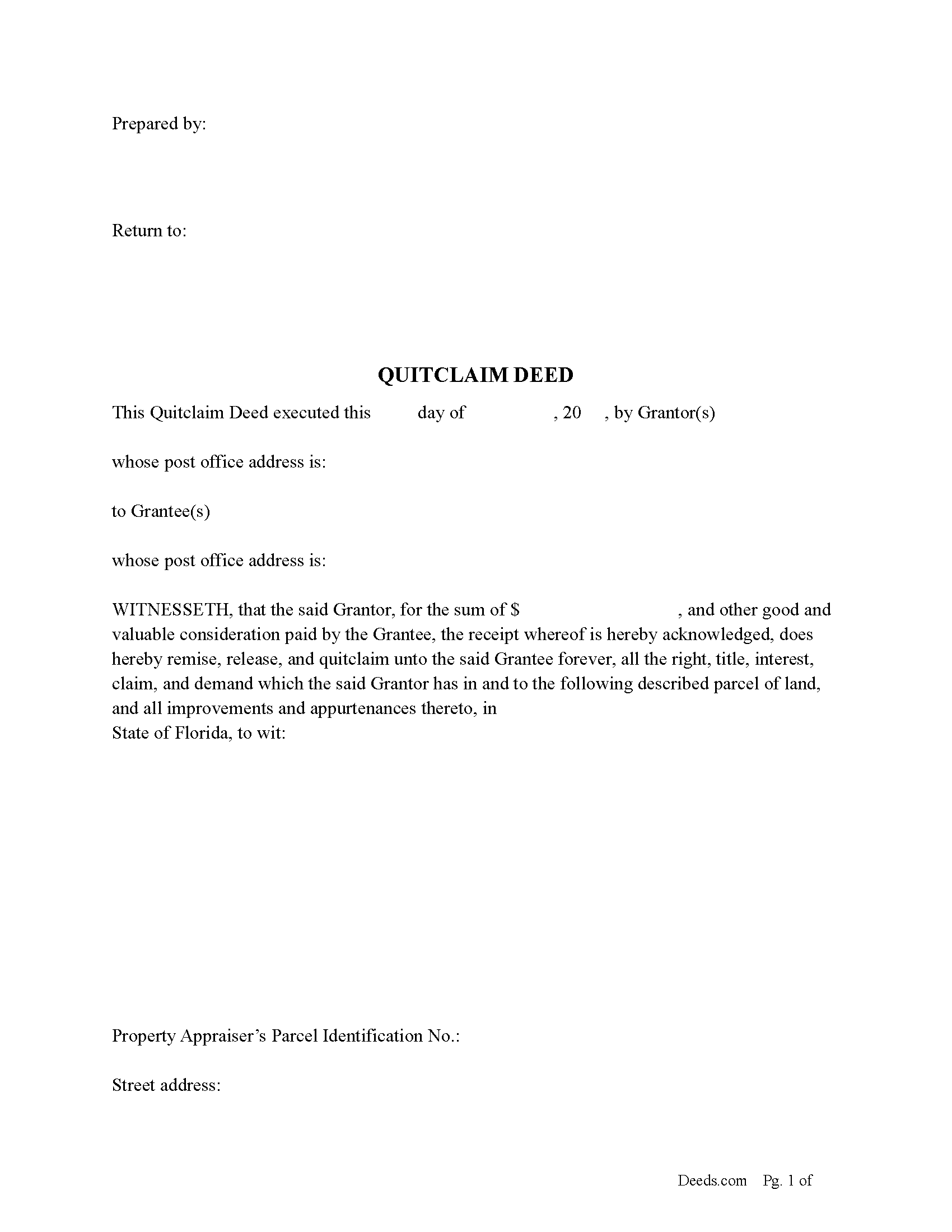

Fill in the blank Quitclaim Deed form formatted to comply with all Florida recording and content requirements.

Gilchrist County Quitclaim Deed Guide

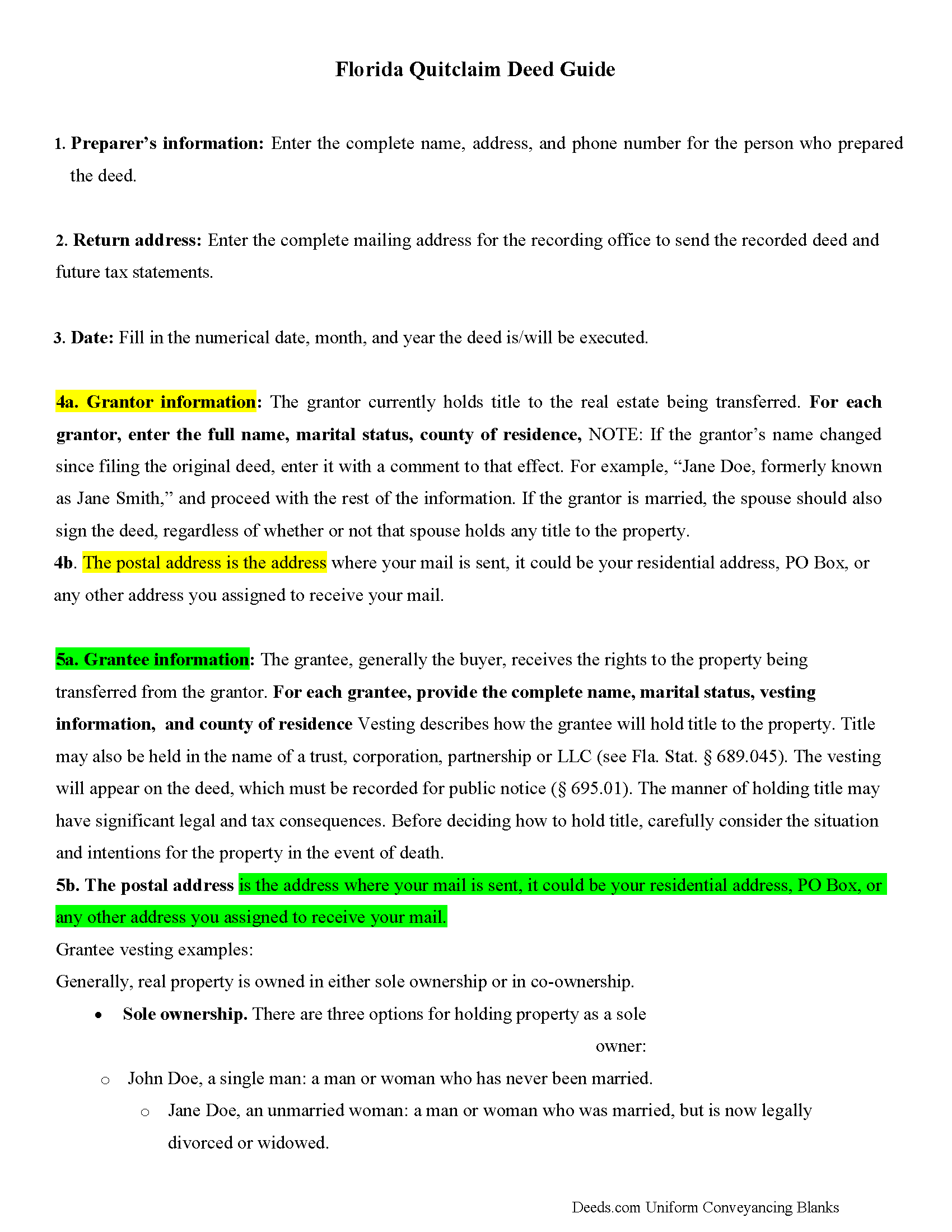

Line by line guide explaining every blank on the Quitclaim Deed form.

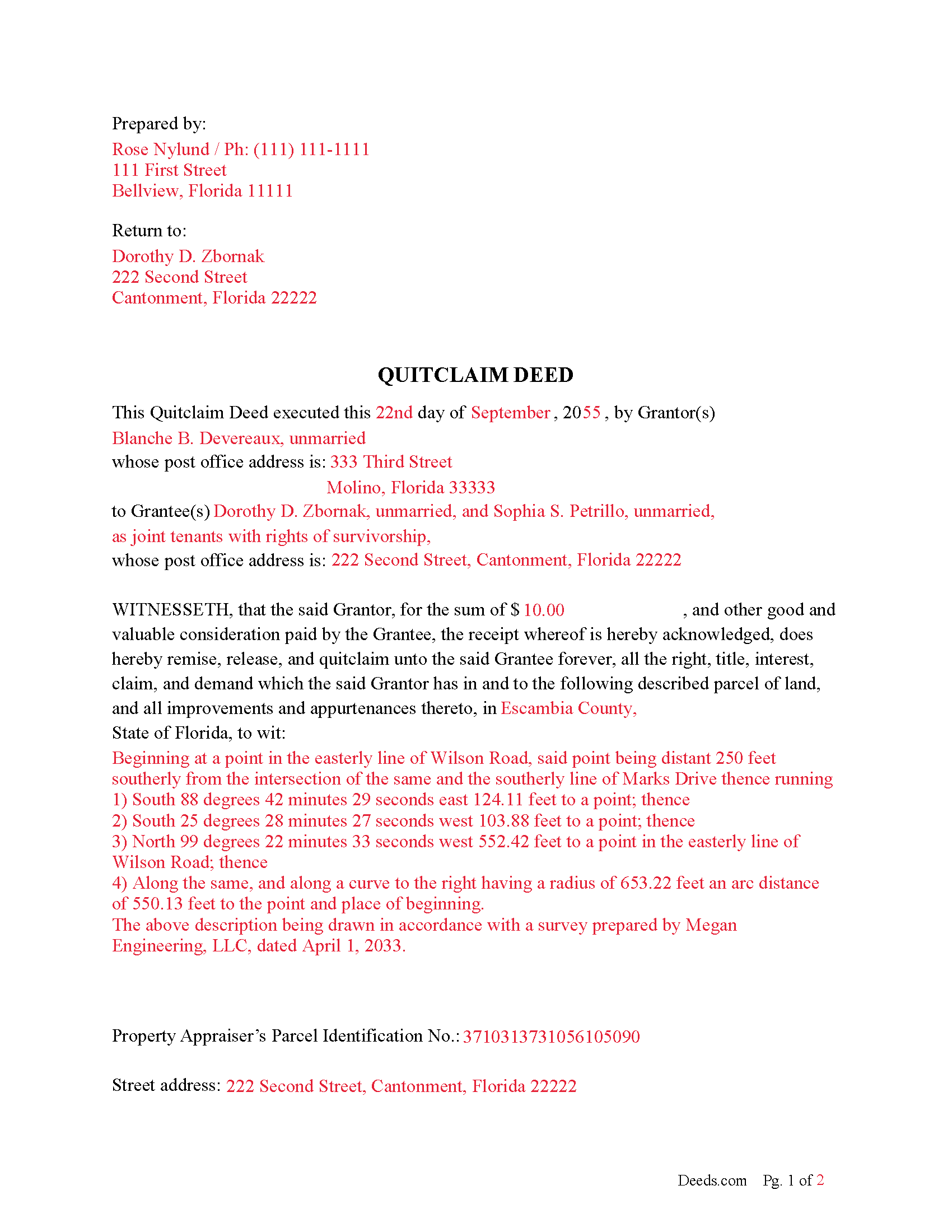

Gilchrist County Completed Example of the Quitclaim Deed Document

Example of a properly completed Florida Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Gilchrist County documents included at no extra charge:

Where to Record Your Documents

Gilchrist County Clerk of Court

Trenton, Florida 32693

Hours: 8:30 a.m.- 5:00 p.m

Phone: (352) 463-3170

Recording Tips for Gilchrist County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Gilchrist County

Properties in any of these areas use Gilchrist County forms:

- Bell

- Trenton

Hours, fees, requirements, and more for Gilchrist County

How do I get my forms?

Forms are available for immediate download after payment. The Gilchrist County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Gilchrist County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gilchrist County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Gilchrist County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Gilchrist County?

Recording fees in Gilchrist County vary. Contact the recorder's office at (352) 463-3170 for current fees.

Questions answered? Let's get started!

Florida statutory requirements for quit claim deed form content:

F. S. 689.01 presents the basic rules for conveying real property in Florida. Although quitclaim deeds are not specifically defined in the Florida Statutes, the correct language, modifications, and content work together to create an instrument that legally transfer ownership of land.

All quitclaim deeds must be in writing and be signed by the grantor in the presence of two witnesses. In addition to these details, F. S. 689.02 presents the form for a warranty deed. It includes requirements for the date of conveyance; the names, addresses, and counties of both parties (grantor and grantee); the amount of consideration (usually money); and a complete legal description of the property. The statutory form also requests the property appraiser's parcel ID, which should be included if possible, and the grantee's social security number, which may be omitted on documents submitted for recordation and entry into the public record. This basic form also includes warranty covenants, however, which must be deleted and/or changed where appropriate because quit claim deeds do not contain any warranty protection for the grantee.

If the real estate described in the quitclaim deed is a homestead, F. S. 689.111 explains that if the grantor is married, both spouses must sign the conveyance whether both have ownership of the property or not.

Recording:

F. S. 695.26 provides the requirements for recording instruments affecting real property:

* Each signature must have the signor's name typed or printed beneath the signature, and each signor's complete mailing address must be in the body of the quit claim deed. In most cases, the addresses are included with the grantor/grantee information.

* Quit claim deeds must contain the name and mailing address of the individual who prepared the document.

* Each witness's signature must have the signor's name typed or printed beneath the signature.

* The quit claim deed must be acknowledged by a notary public or other official authorized to take acknowledgements and administer oaths.

* Specific format: 3" x 3" space at the top right of the first page, 1" around the sides and bottom, 1" x 3" at the top right of all other pages with 1" around the sides and bottom.

Florida follows a "notice" recording statute. F. S. 695.01 asserts that conveyances of real property, including quit claim deeds, must be formally recorded according to law, thereby providing notice to the public of a change in ownership of the parcel of land. This means that if the grantor conveys the same property to another bona fide purchaser (buyer of the land for value, usually money), and the earlier deed is not recorded, the later grantee will generally retain ownership.

Recording quit claim deeds or other instruments that formalize a change in ownership of property preserves the chain of title (sequence of owners), which simplifies future conveyances. F. S. 695.11 states that instruments submitted for recording to the clerk of circuit court's office are considered to be recorded at the time they are filed. Each document receives a unique, sequential, official register number to identify the order of submission; lower numbers have priority over higher numbers in the same series.

F. S. 695.01 goes on to explain that grantees by quit claim are considered "bona fide purchasers without notice within the meaning of the recording acts." This is because quit claim deeds contain no warranties of title. Regardless, the best way to protect the interests of all parties is to record the deed as soon as possible after its execution.

(Florida Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Gilchrist County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Gilchrist County.

Our Promise

The documents you receive here will meet, or exceed, the Gilchrist County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gilchrist County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Mary L.

March 25th, 2023

Super easy, fast recording time. 100% recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer A.

May 20th, 2020

Great site

Thank you!

Gretchen D.

January 7th, 2019

Quick and easy process to get the documents, and helpful to see the example filled out.

Thank you for your feedback Gretchen, we really appreciate it. Have a great day!

Veronica G.

November 11th, 2020

Excellent service A+

Thank you!

Linda W.

January 22nd, 2021

Fast service. From the time I sent my Quit Claim Deed to deeds.com, and six hours later my deed was recorded. It was painless, great convenience.

Thank you!

Dianne M.

June 30th, 2023

I find the resources on this website so helpful. The service is outstanding. Thank you.

Thank you!

Seth T.

January 8th, 2019

THE BEST WEBSITE I HAVE EVER SEEN FOR LEGAL DOCUMENTS!!! THANKS

Thanks Seth, we appreciate your feedback.

Chelsie F.

April 3rd, 2020

Super customer service and communication! Fast service and more informative than expected! Can't say thanks enough.

Thank you!

Melody P.

January 29th, 2021

Thanks again for such expedient and excellent service!

Thank you!

Scott s.

September 2nd, 2022

Information requested was provided and time to reply was quick!

Thank you!

Don M.

September 9th, 2021

I find the site very difficult to nagitagte.

Sorry to hear that Don, we’ll try harder.

Barbara C.

February 27th, 2020

Excellent site; easy to use

Thank you!

Rodney S.

October 7th, 2021

Good service; thank you.

Thank you!

James K.

January 12th, 2023

Gave me exactly what i needed

Thank you for your feedback. We really appreciate it. Have a great day!

Wanda B.

July 22nd, 2022

Great prompt and efficient service!

Thank you for your feedback. We really appreciate it. Have a great day!