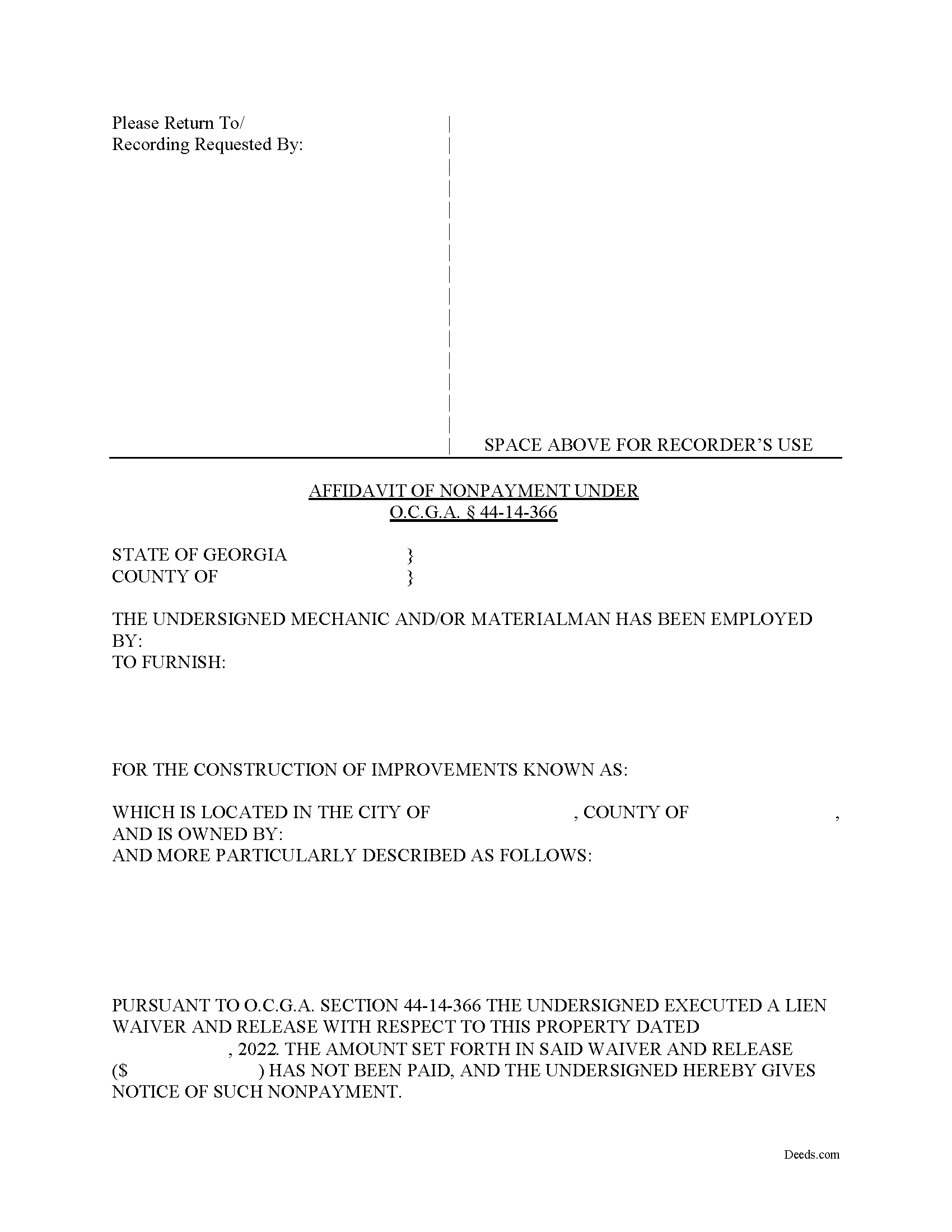

Heard County Affidavit of Non Payment Form

Heard County Affidavit of Non Payment Form

Fill in the blank Affidavit of Non Payment form formatted to comply with all Georgia recording and content requirements.

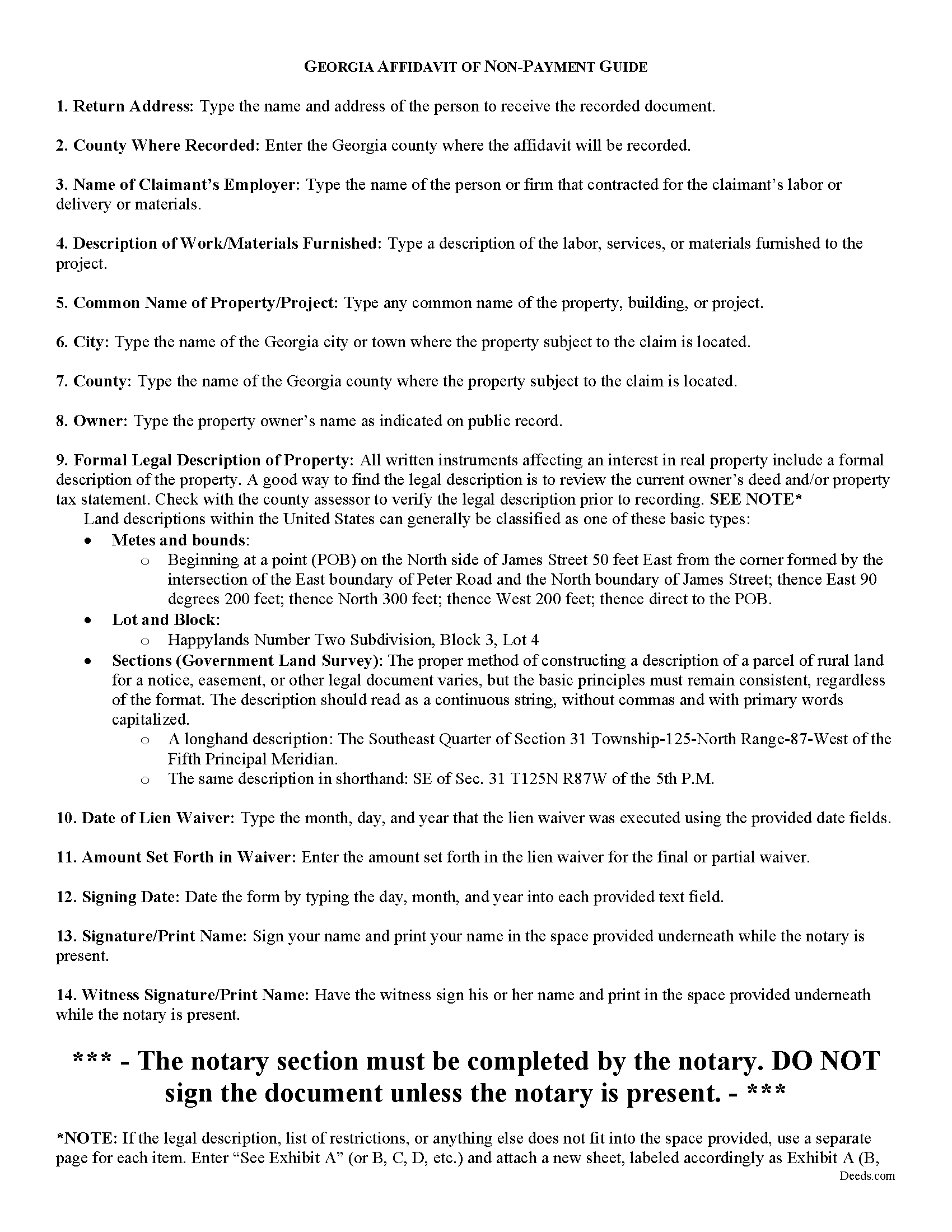

Heard County Affidavit of Non Payment Guide

Line by line guide explaining every blank on the form.

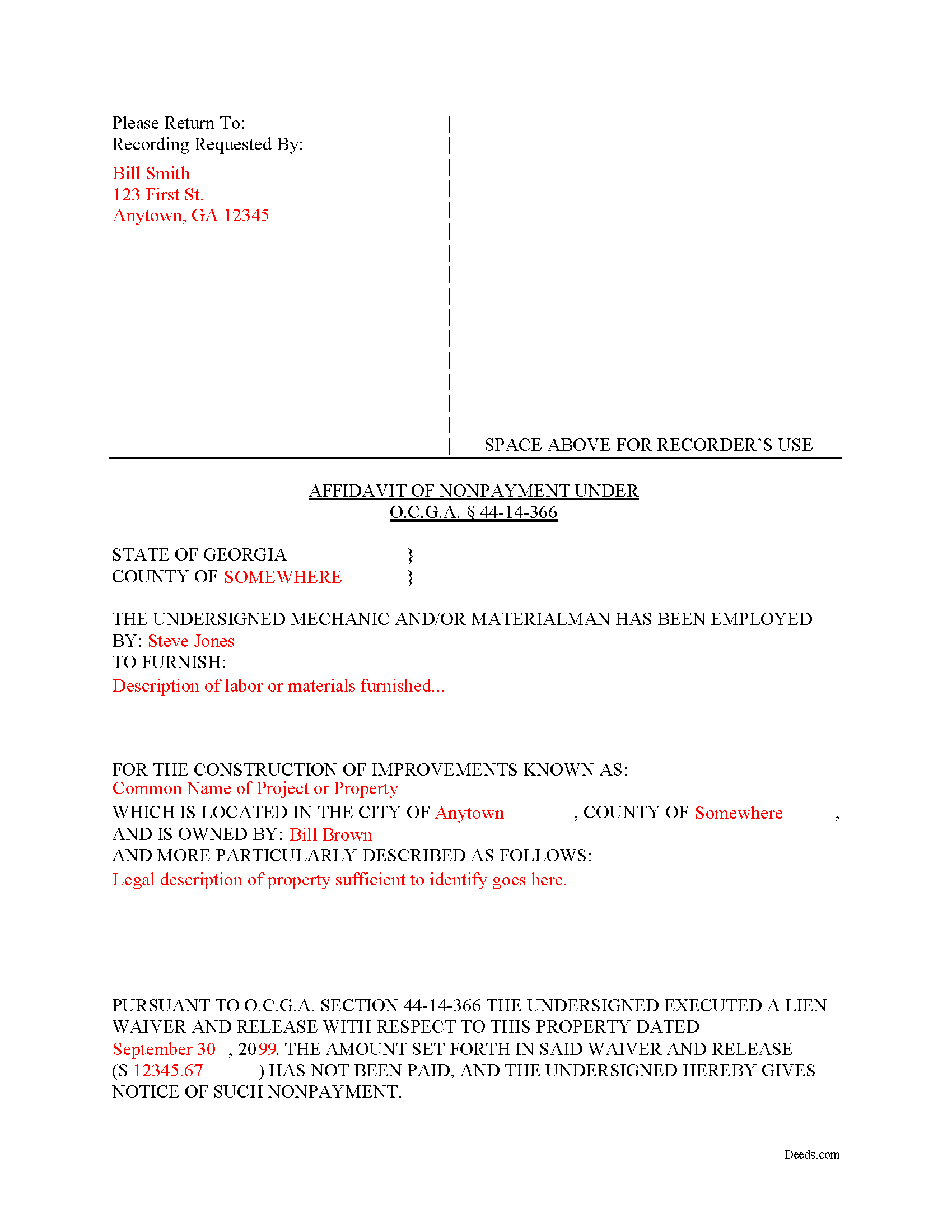

Heard County Completed Example of the Affidavit of Non Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Heard County documents included at no extra charge:

Where to Record Your Documents

Clerk of Superior Court

Franklin, Georgia 30217

Hours: 8:30 to 12:00 & 1:00 to 5:00 M-F

Phone: (706) 675-3301

Recording Tips for Heard County:

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- Leave recording info boxes blank - the office fills these

- Recorded documents become public record - avoid including SSNs

- Have the property address and parcel number ready

Cities and Jurisdictions in Heard County

Properties in any of these areas use Heard County forms:

- Franklin

- Glenn

Hours, fees, requirements, and more for Heard County

How do I get my forms?

Forms are available for immediate download after payment. The Heard County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Heard County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Heard County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Heard County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Heard County?

Recording fees in Heard County vary. Contact the recorder's office at (706) 675-3301 for current fees.

Questions answered? Let's get started!

What happens if a contractor records a lien waiver, but the owner never pays the bill?

Best practices dictate that lien claimants should only grant waivers when payment can be verified. Even so, some claimants still choose to execute a waiver before that time. Unlike many other states, Georgia law provides an avenue for recourse: the Affidavit of Non-Payment. An affidavit of non-payment is a sworn statement filed with the county recorder after a lien waiver has already been filed but no payment was ever received.

When executed, a waiver and release of lien is considered binding against the claimant for all purposes, subject only to payment in full of the amount set forth in the waiver and release. 44-14-366(f)(1). This means if payment is never received, the waiver is considered ineffective. Note that, in order to declare the waiver void, the claimant must file an affidavit of non-payment.

An affidavit of non-payment identifies the parties, the nature of work and materials provided, the location of the improvements, the amount unpaid, and the recording information for the waiver. The affiant/claimant signs the document in front of two witnesses, one of whom must be a notary, then submits the completed affidavit to the same office that recorded the original lien and waiver.

The affidavit must be filed sixty days after the date of the execution of the waiver and release. 44-14-366(f)(2)(C). There's an exception to this requirement if the claimant files their lien claim prior to the expiration of the 60-day period. Id.

This article is offered for informational purposes only and should not be relied upon as the substitute for the advice of an attorney. Please contact an attorney with questions about Affidavits of Non-payment or any other issues related to mechanic's liens in Georgia.

Important: Your property must be located in Heard County to use these forms. Documents should be recorded at the office below.

This Affidavit of Non Payment meets all recording requirements specific to Heard County.

Our Promise

The documents you receive here will meet, or exceed, the Heard County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Heard County Affidavit of Non Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Virginia W.

March 14th, 2021

Easy instructions and a example on how to fill out the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Lowell P.

May 26th, 2020

Exceptionally helpful instruments that are compliant with State law and anticipate various contingencies. Very pleased.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert H.

April 18th, 2020

I am very pleased with your service.

Thank you!

John L B.

November 2nd, 2020

I ordered the Deed package for my state of NJ and the county I needed to prepare the documents. I was able to complete everything that is required to close on an investment property. Fast easy with step by step instructions no matter your situation. Definitely will recommend to family & friends. Save $ instead of paying others to do the same thing you can do yourself.

Thank you for your feedback. We really appreciate it. Have a great day!

JoAnn S.

July 31st, 2021

Easy to process orders.

Thank you!

Donnajean L.

October 9th, 2024

The site is user friendly and uncomplicated.

Thank you!

Marianne F.

September 28th, 2020

This serve was very fast and efficient. I was very pleased at how quickly I received my recorded document.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ajinder M.

June 18th, 2020

wonderful. saved my time and energy. Absolutely love this service. All the best AJ

Thank you!

Nick V.

July 21st, 2020

Turn time was great. Highly recommend.

Thank you!

Pat G.

May 12th, 2020

Found correct form right away, easy to download and print. Thank you!

Thank you!

Holly M.

October 18th, 2019

This was the simplest method of filing a document that I've ever encountered. I've already recommended it my colleagues, and would highly encourage anyone to use it. Fast, easy, simple.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JOANNE W.

November 13th, 2019

Excellent product and so easily obtained. Well worth the price.

Thank you for your feedback. We really appreciate it. Have a great day!

LIDIA M.

February 3rd, 2021

excellent

Thank you!

Margaret S.

March 16th, 2020

Great experience, quick and easy, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Neira S.

January 20th, 2019

No problem with Recorders Office using your document. It is now completed and recorded.

Thank you Neira, have a wonderful day!