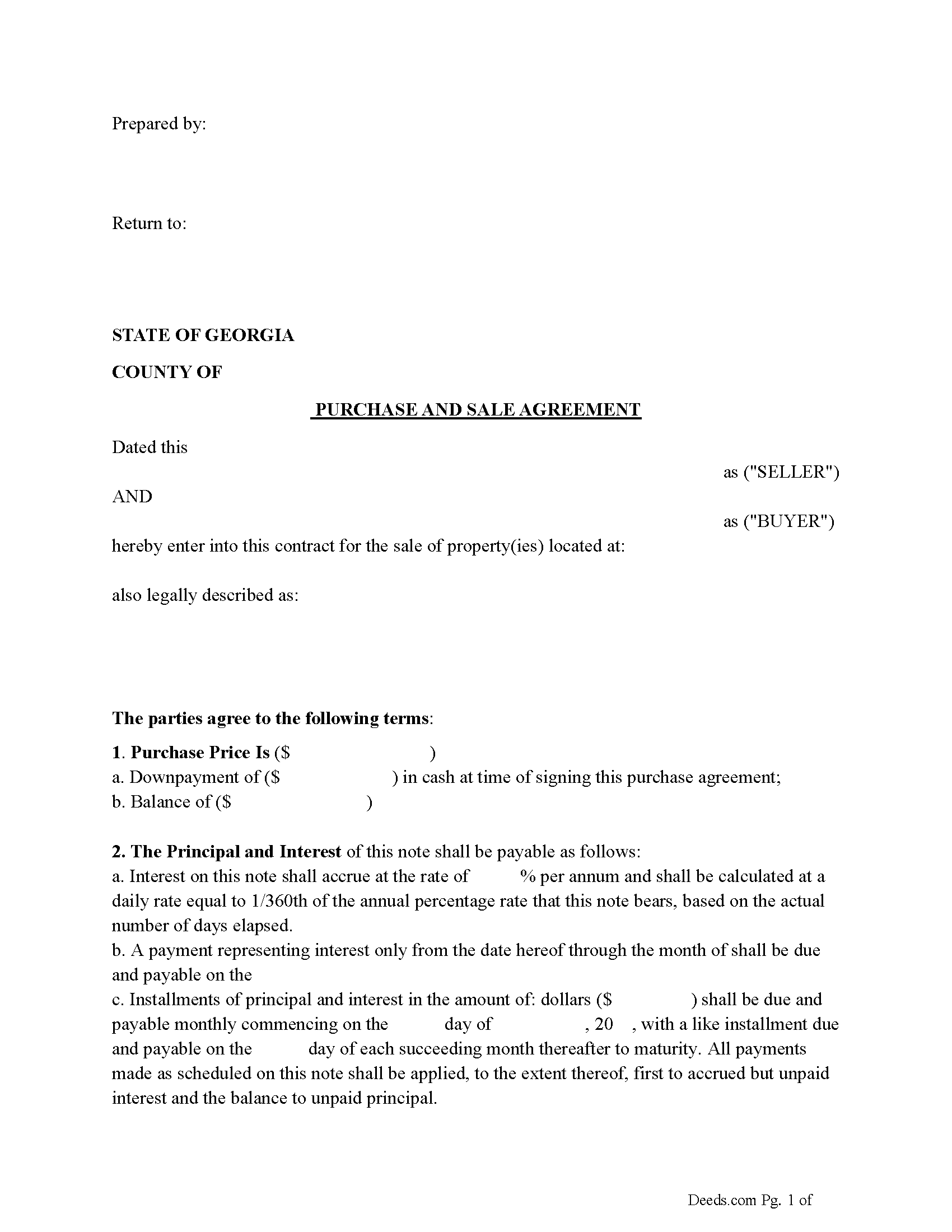

Tift County Purchase and Sale Agreement Form

Tift County Purchase and Sale Agreement Form

Fill in the blank Purchase and Sale Agreement form formatted to comply with all Georgia recording and content requirements.

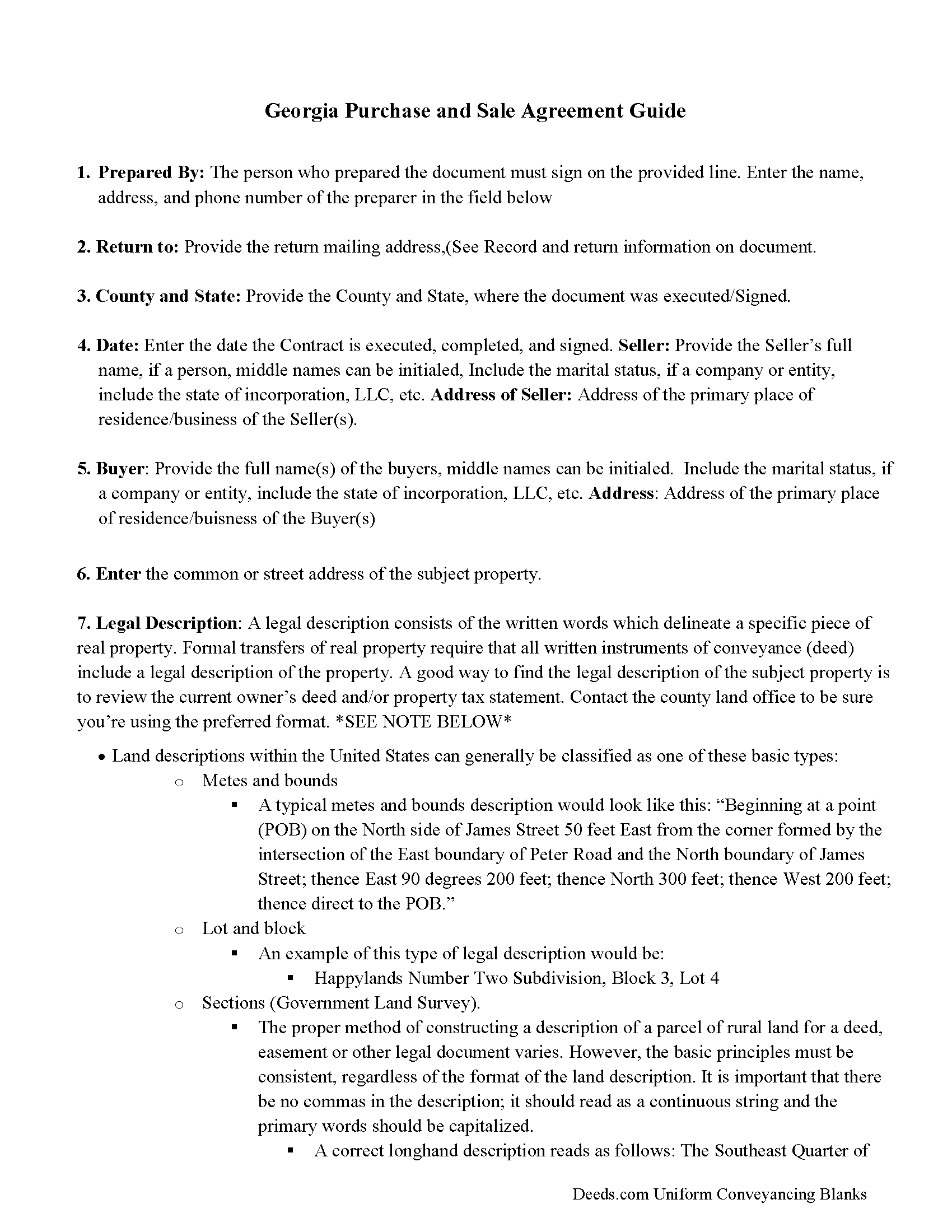

Tift County Purchase and Sale Agreement Guide

Line by line guide explaining every blank on the Purchase and Sale Agreement form.

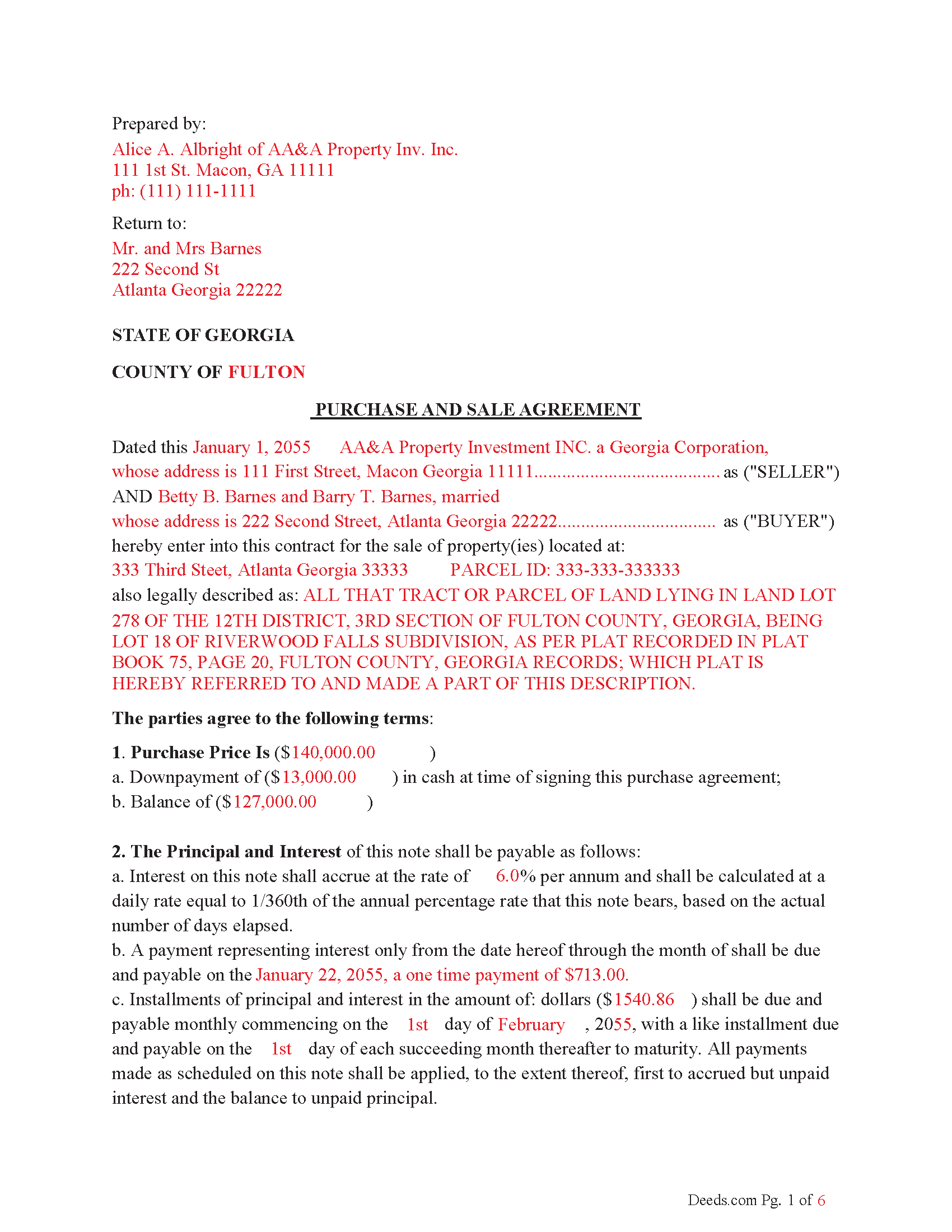

Tift County Completed Example of the Purchase and Sale Agreement Document

Example of a properly completed Georgia Purchase and Sale Agreement document for reference.

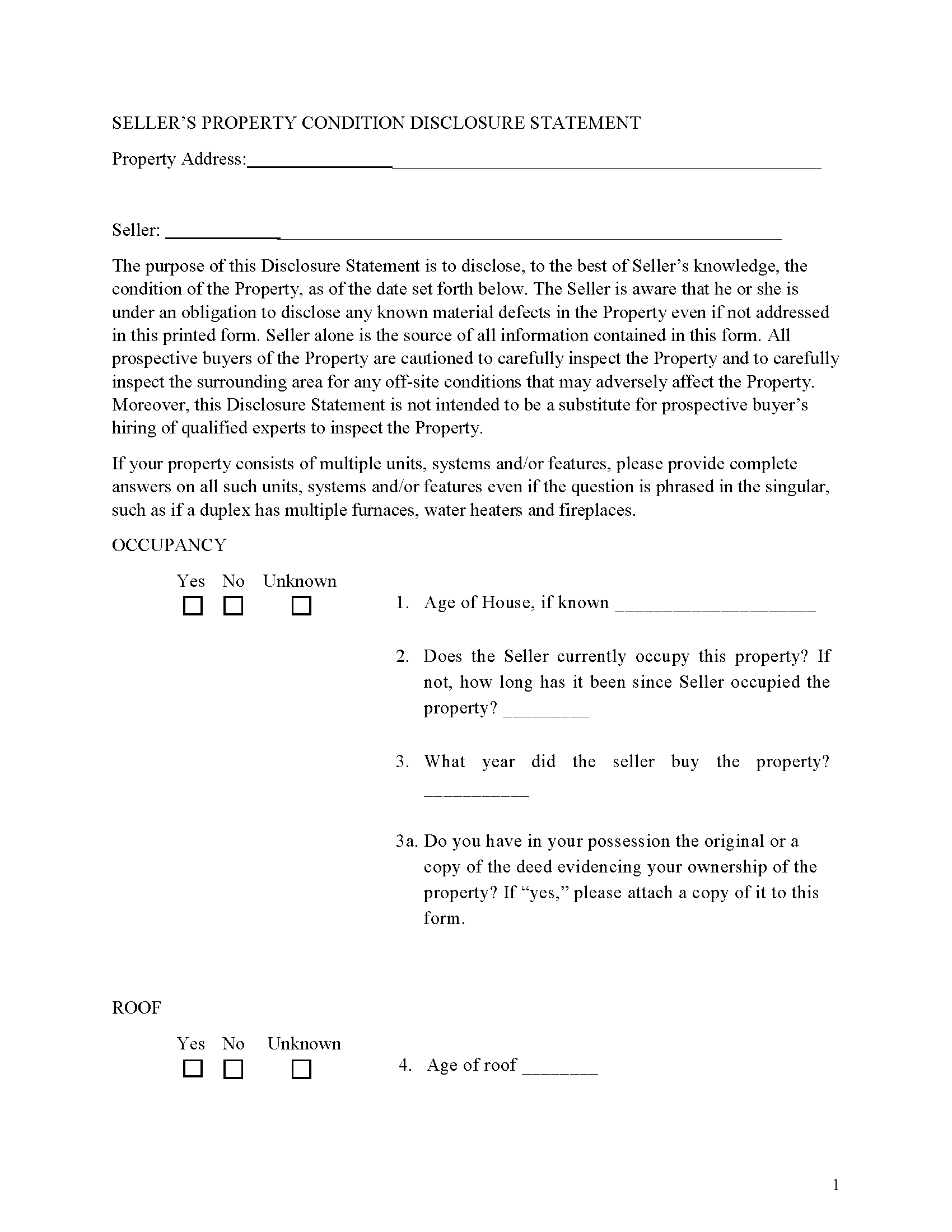

Tift County Sellers Disclosure Form

Discloses known property conditions.

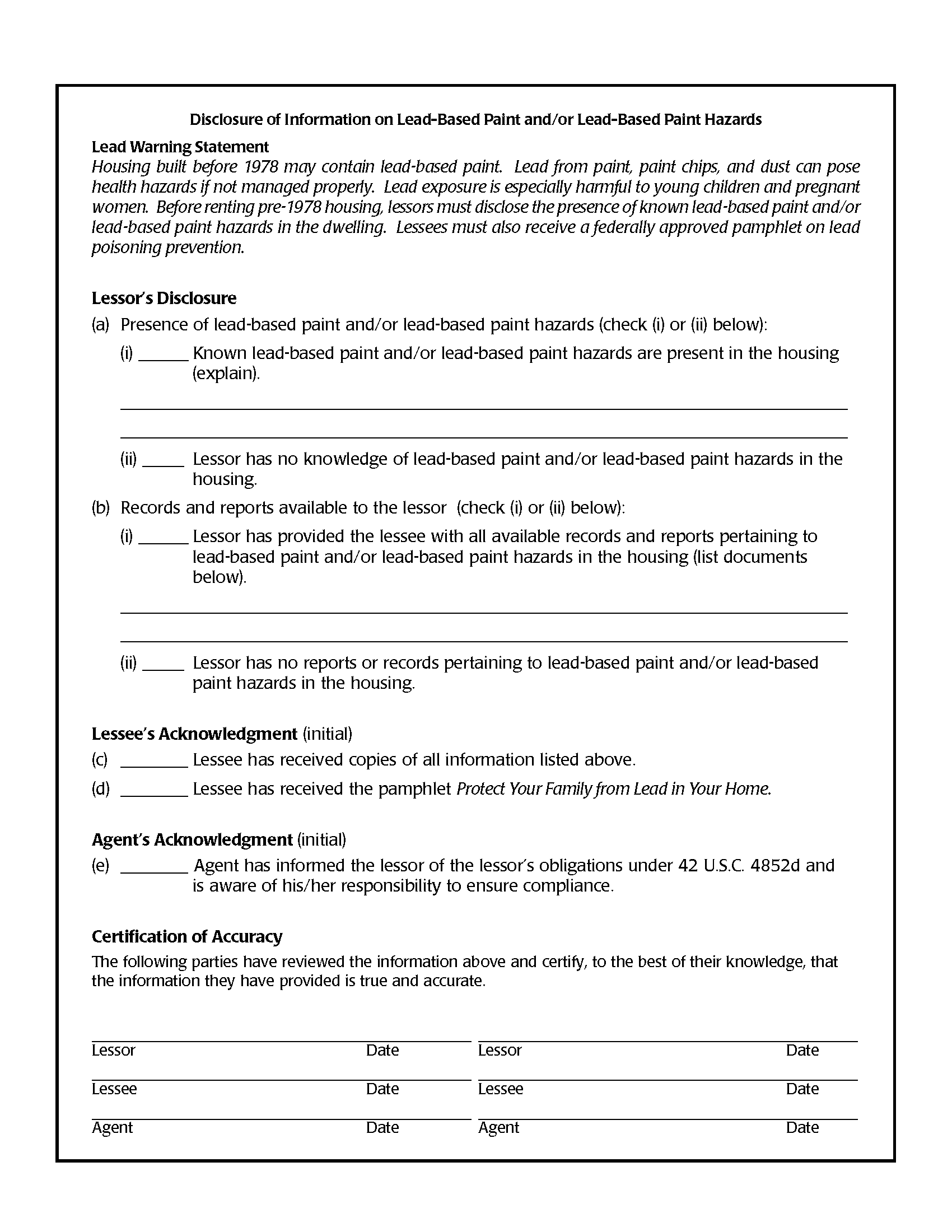

Tift County Lead Based Paint Disclosure Form

Required for residential property built before 1978

All 5 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Tift County documents included at no extra charge:

Where to Record Your Documents

Clerk of Superior Court

Tifton, Georgia 31794 / 31793

Hours: 8:00 to 5:00 M-F

Phone: (229) 386-7810 & 7816

Recording Tips for Tift County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Tift County

Properties in any of these areas use Tift County forms:

- Brookfield

- Chula

- Omega

- Tifton

- Ty Ty

Hours, fees, requirements, and more for Tift County

How do I get my forms?

Forms are available for immediate download after payment. The Tift County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Tift County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Tift County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Tift County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Tift County?

Recording fees in Tift County vary. Contact the recorder's office at (229) 386-7810 & 7816 for current fees.

Questions answered? Let's get started!

1. Seller Financing Purchase and Sale Agreement

• Purpose: A Purchase and Sale Agreement (sometimes referred to a Land Cotract) with seller financing outlines the terms of the sale of the property and specifies that the seller will provide financing to the buyer. It functions as a contract between the buyer and seller that details the sale price, terms of financing (interest rate, payment schedule), contingencies, and other aspects of the transaction.

• Parties: This agreement involves the buyer and seller.

To protect both parties. The title company shall serve as the escrow agent for the closing of this transaction. All documents and funds necessary to the completion of the transaction shall be placed in escrow five days prior to the closing. This agreement is to serve as escrow instructions for the closing of this transaction; the escrow agent may attach standard Conditions of Acceptance, insofar as the same is not inconsistent with the terms of this agreement. Seller shall pay out of the purchase price through escrow: (a) all costs associated with preparation of the deed; (b) all fees for filing the deed; (c) any amounts due Buyer by reason of prorations; and (d) one-half of the escrow fee. Buyer shall pay: (a) one-half of the escrow fee; (b) the cost of the title search; (c) the premium for the title commitment and the owner's fee policy of insurance; (d) any prorations due Seller; (e) all fees associated with the preparation and filing of Buyers mortgage; and (f) the real estate transfer tax.

title shall transfer to Buyer upon the expiration of the installment payment period, or thirty days after Seller's receipt that the balance of the purchase price has been deposited in escrow, whichever is earlier, or at such other time as the parties may agree in writing. The closing date may be extended or shortened upon written agreement of the parties

Finance: Traditional Finance with installments or with a balloon payment apply.

Default: In the event that the Buyer fails to make any installment payment when due under this Agreement, or fails to perform any of the other covenants or obligations required by this Agreement, and such default continues for a period of thirty (30) days after written notice of default has been given to the Buyer by the Seller, the Seller may declare the entire remaining unpaid balance of the purchase price immediately due and payable, and the Seller shall have the right to foreclose upon the property under the Power of Sale contained herein, subject to the provisions outlined.

Power of Sale - No Court Involvement: The foreclosure is completed without the need for court intervention unless the borrower files a lawsuit to challenge the foreclosure.

Timeframe: Non-judicial foreclosures in Georgia can be relatively quick, typically taking 30 to 60 days from the time of default to the foreclosure sale.

Use this form for the sale of residential, rental, condominiums, vacant land and planned unit developments.

For use in Georgia only.

Important: Your property must be located in Tift County to use these forms. Documents should be recorded at the office below.

This Purchase and Sale Agreement meets all recording requirements specific to Tift County.

Our Promise

The documents you receive here will meet, or exceed, the Tift County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Tift County Purchase and Sale Agreement form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Daniel A.

April 25th, 2022

First time using Deeds.com. Downloaded the PDF forms for creating an Illinois Mortgage and Promissory Note. Filled them out, saved them, and printed them out. Going to send them to my Title Company for closing on a property. Save a bunch of money on not have to pay lawyer fees for creating the same legal documents that Deeds.com provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Victoria L.

February 25th, 2019

This is a fantastic website and financial savings to many. Being able to download and complete the document I needed vs having my attorney complete saved me $800. I would highly recommend this website.

Thank you for the kind words Victoria. Have a great day!

Pedro M.

December 12th, 2023

Fast and professional service.

Thank you for your positive words! We’re thrilled to hear about your experience.

George S.

September 16th, 2021

Excellent product- very easy to use. Will use again...

Thank you for your feedback. We really appreciate it. Have a great day!

Marites T.

April 6th, 2023

Extremely helpful team of professionals who are patient when you need to get things filed correctly. Very small price for the comfort of knowing your DOCUMENTS are FILED with you local Recorder's Office. Some of the filings, if they are correctly formatted are already uploaded and official within a few hours. Here's the ALTERNATIVE you may encounter. For Example: King County Recorder's Office moved which means most filings are backed up 7-10 days if you DROP your filing in a BOX with your CHECK or MAIL IT. Neither is a great option, since they have no WALK IN HOURS.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jane N.

March 7th, 2019

This worked. Saved me a trip to get a copy of a deed. Cost less than the parking fee. Very convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Gail M.

October 27th, 2022

Great website. Once submit payment documents are immediately emailed, easy to print and clear format. Will definitely use again!

Thank you for your feedback. We really appreciate it. Have a great day!

Giuseppina M.

October 24th, 2024

Fast, reliable excellent service

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

srikanth n.

January 14th, 2020

why not word format??

Good question. There are many reasons, we'll touch on a few. For the end user (you) Adobe Reader is free, Word is not. PDF is the portable document standard, Word is a decent word processor. A portable document format (PDF) maintains document formatting such as margins and font size which is very important to legal documents, Word does not. Have a wonderful day.

William Q.

September 30th, 2020

The website and information is fine. The proof in the pudding, of course, is whether the forms I used now will provide the results I want if the changes are challenged at some future date.

Thank you for your feedback. We really appreciate it. Have a great day!

Regina G.

May 18th, 2022

Very good customer service. Would recommend them highly.

Thank you!

COURTNEY K.

August 7th, 2020

I could not be happier with this service! It was so easy and fast!

Thank you!

Martha G.

January 7th, 2020

Well-designed site. Incredibly easy to find what I needed, very reasonable cost.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna M.

November 22nd, 2021

Appreciated the ability to not only download the form but the instruction's AND a sample.

Thank you for your feedback. We really appreciate it. Have a great day!

Muhamed H.

February 3rd, 2022

Nice!

Thank you!