Rabun County Trustee Deed Form

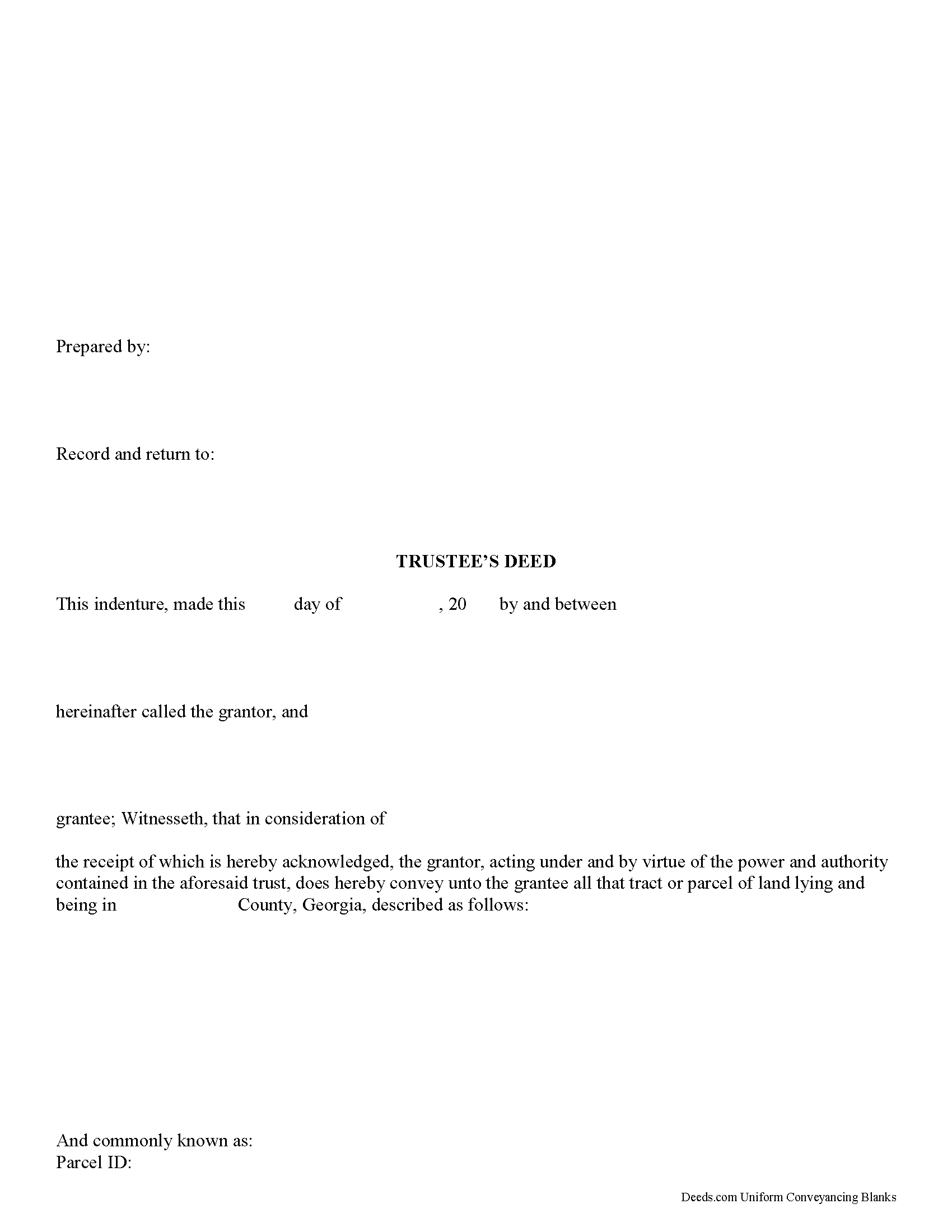

Rabun County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

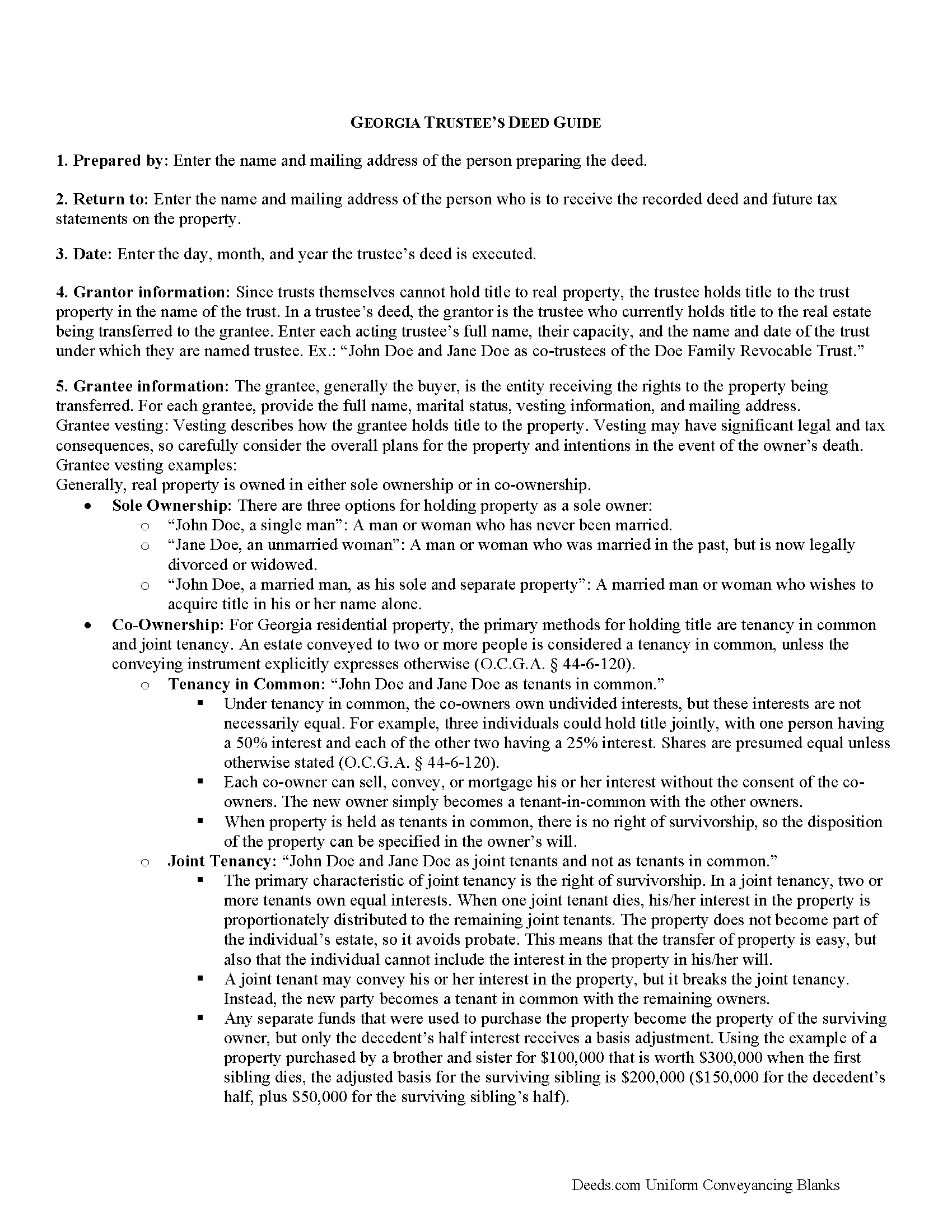

Rabun County Trustee Deed Guide

Line by line guide explaining every blank on the form.

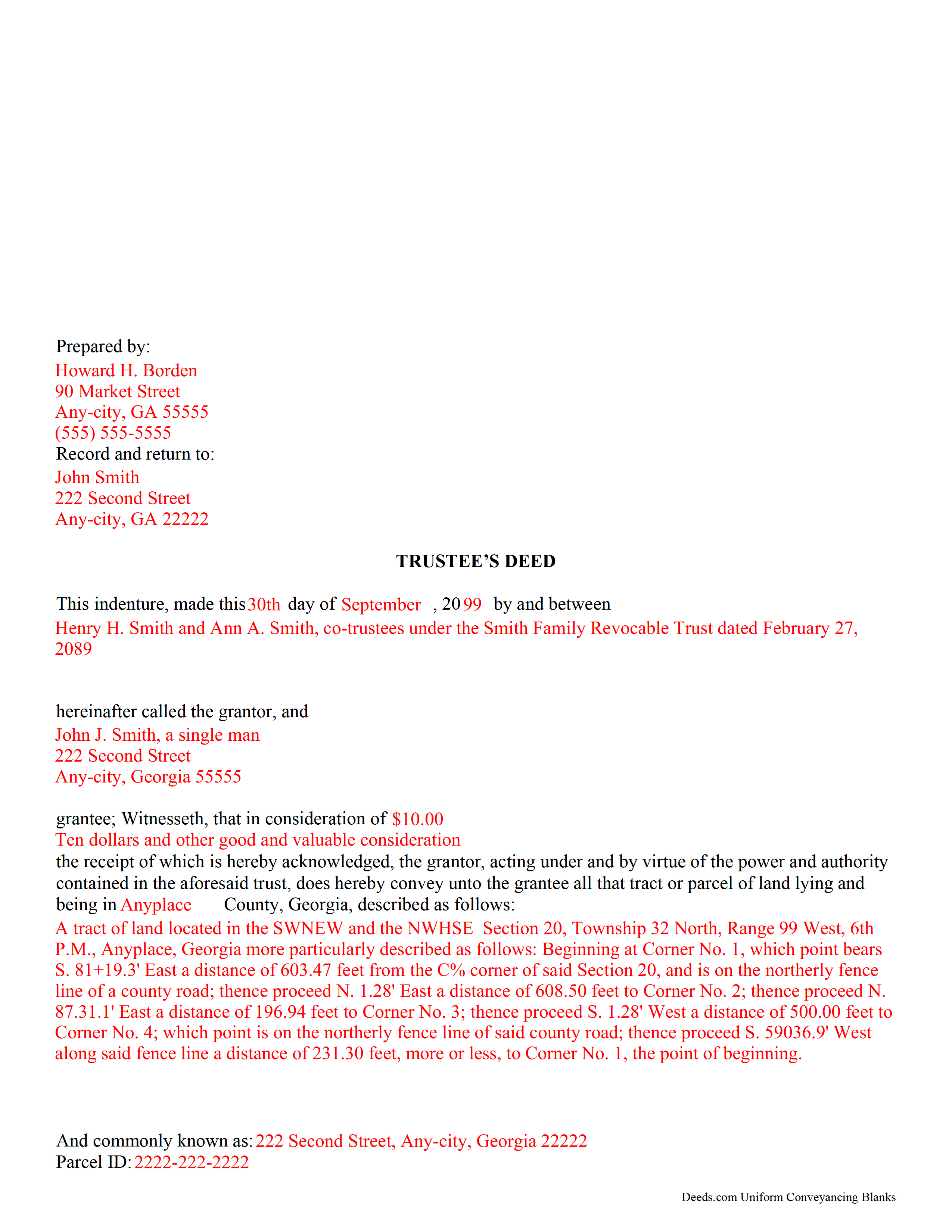

Rabun County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Rabun County documents included at no extra charge:

Where to Record Your Documents

Clerk of Superior Court

Clayton, Georgia 30525

Hours: 8:30 to 5:00 M-F

Phone: (706) 782-3615

Recording Tips for Rabun County:

- Ask if they accept credit cards - many offices are cash/check only

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Rabun County

Properties in any of these areas use Rabun County forms:

- Clayton

- Dillard

- Lakemont

- Mountain City

- Rabun Gap

- Tallulah Falls

- Tiger

- Wiley

Hours, fees, requirements, and more for Rabun County

How do I get my forms?

Forms are available for immediate download after payment. The Rabun County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rabun County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rabun County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rabun County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rabun County?

Recording fees in Rabun County vary. Contact the recorder's office at (706) 782-3615 for current fees.

Questions answered? Let's get started!

A trustee's deed is an instrument of trust administration used by a trustee to convey real property out of a trust.

A trust is created by a settlor, who funds the trust with real and/or personal property for estate planning purposes. Since a trust is not a person and cannot hold title, when the settlor transfers real property into the trust, title to the property is vested in the name of the trustee. The trustee manages the trust's assets according to the directions set out in the trust document, often for the benefit of a third party, called a beneficiary.

There is no statutory form for conveyances in Georgia, so long as the transfer between parties is clear (O.C.G.A. 44-5-33). A valid trustee's deed names the trustee as the grantor and provides basic information about the trust under which the trustee is acting, including the name and date of the trust. The settlor is not involved in the transfer. However, a certificate of trust is sometimes included, which names the original settlor of the trust, verifies the trust's existence and the trustee's authority to act on its behalf, and confirms the power of sale that the trustee has under the trust.

In Georgia, the basic trustee's deed is similar to a quitclaim deed, in that it offers no warranty of title. Depending on the situation, the trustee can add guarantees to bring the deed in line with special warranty or warranty deeds.

Since a trustee's deed affects real property, in addition to the information regarding the trust, it must also meet the content requirements for recording other deeds, including a legal description of the property subject to the transaction, the parcel identification number, and any restrictions or easements the transfer is subject to. All trustees must sign the deed, which must be witnessed by two people (one of which may be the notary) and acknowledged in the presence of a notary. The deed is then recorded in the county in which the real property subject to the trust is situated.

Trust law can quickly become complicated, and each situation is unique. Contact a lawyer with any specific questions and for guidance on trust law.

(Georgia Trustee Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Rabun County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Rabun County.

Our Promise

The documents you receive here will meet, or exceed, the Rabun County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rabun County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Jacqueline T.

June 17th, 2021

Worth it for the time saved as the supplemental forms required were included the purchase. First time user, easy peasy. 5 stars from me.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeff H.

November 7th, 2020

Fast, inexpensive, great customer service. I will definitely use them a gain.

Thank you!

Deborah B.

February 18th, 2019

EVERYTHING WENT WELL, HAD NO PROBLEMS DOWNLOADING MY FORMS. THE ORDER QUICK AND EASY. THANKS IF I EVER NEED AND OF THESES FORMS AGAIN I WILL BE BACK.

Thanks Deborah, we really appreciate your feedback.

Maurice M.

January 29th, 2019

It was very convenient to be able to purchase the forms that I needed and save an extra trip downtown. I really appreciated the instructions that came with the forms.

Thank you Maurice. Have a great day!

Tanya H.

July 21st, 2020

Could not be happier with deeds.com forms. The guide helped more than one can imagine, great resource.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael S.

December 22nd, 2020

I was very impressed. I needed a Grant Deed that would comply with Calif. law. I haven't tried to record it yet, but I think it's spot-on. References to statutes very helpful. I'm a retired Idaho attorney, and my first attempt was politely rejected by the recorder. (documentary transfer fee exemption, etc.)

Thank you!

Laurie B.

May 30th, 2022

easy to use, good experience

Thank you!

Gail W.

July 2nd, 2019

Easy to use!!

Thank you!

Angela J M.

September 29th, 2023

Quick turnaround (about 24hrs) easy process.

Thank you for your feedback. We really appreciate it. Have a great day!

Adriane L.

November 20th, 2024

great experience. Great communication and very fast turn around ty Adriane

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Cynthia (Cindy) R.

August 24th, 2020

This has been the most seamless process I have ever experienced. Thank you for addressing my needs so quickly and professionally.

Thank you!

Philip S.

May 2nd, 2019

You're service saved the day! I had gone to several lawyers and title companies who all said, at a Minimum, preparing a deed costs $1000... Through your service and some work reading about the requirements as well as calling my county clerks office, I was able to complete the deed and it read accepted and recorded today! Thanks so much.

Thank you for your feedback. We really appreciate it. Have a great day!

ZENOBIA D.

November 11th, 2021

I Love Deeds.com. They have all of the documents you need to take care of your needs. IT is also safe and convenient way to send your documents safely and secure.

Thank you!

Elizabeth M.

August 18th, 2021

So fare easy and straight forward

Thank you for your feedback. We really appreciate it. Have a great day!

Larry T.

July 28th, 2020

Ordered a 'Gift Deed' form The 'Example' form was most helpful. The actual form was very detailed, and seemed to 'cover all the bases'

We appreciate your business and value your feedback. Thank you. Have a wonderful day!