Valley County Deed of Full Reconveyance - for Deed of Trust Form

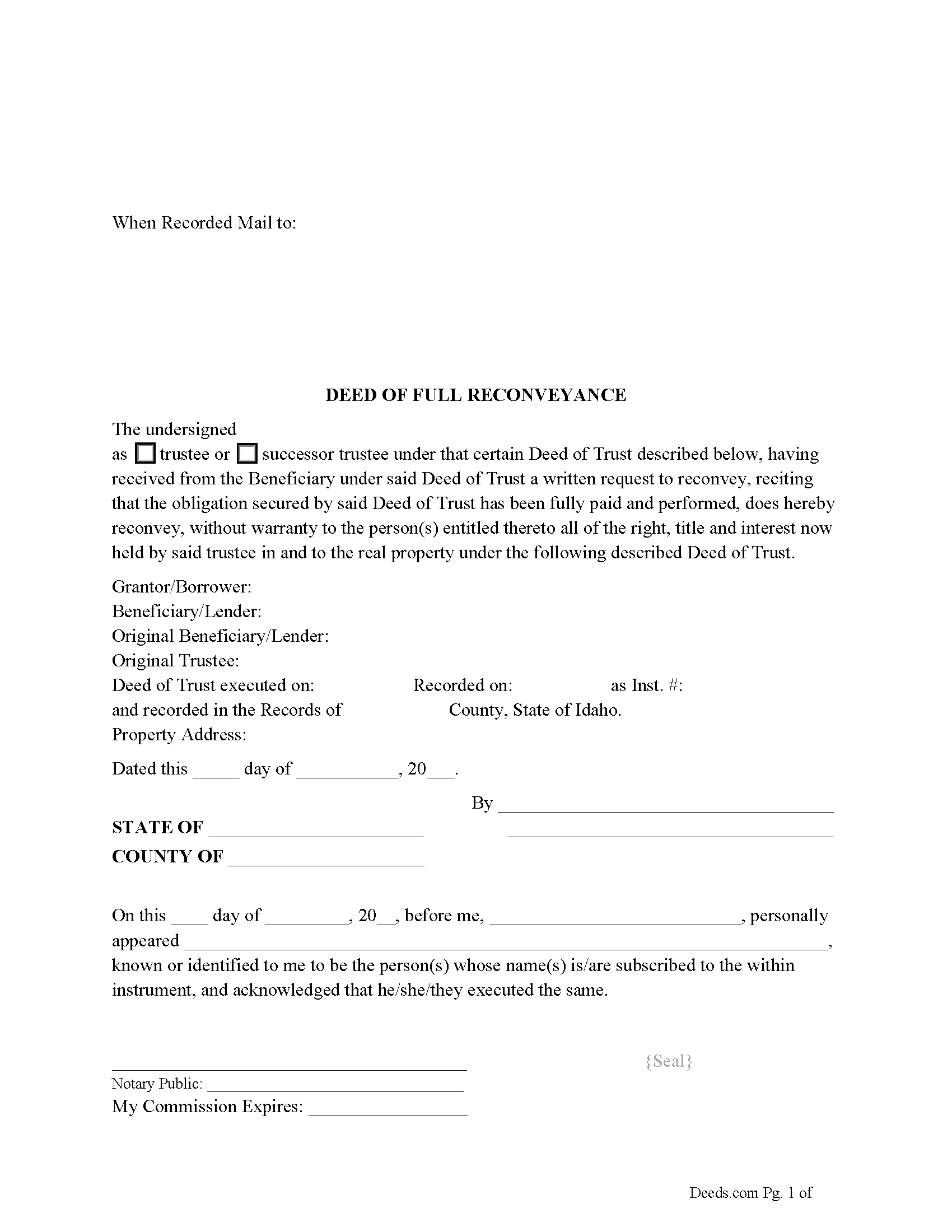

Valley County Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

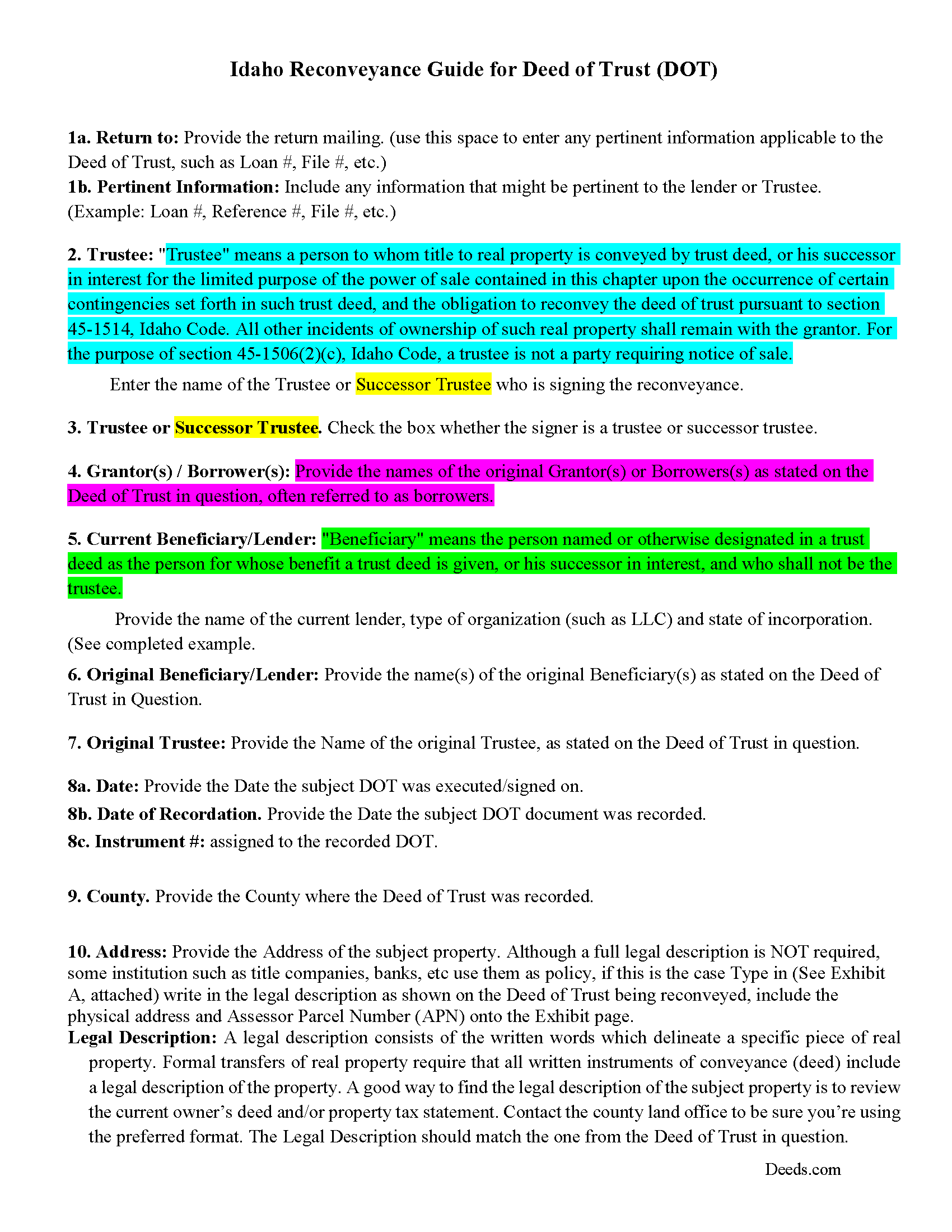

Valley County Deed of Full Reconveyance Guidelines

Line by line guide explaining every blank on the form.

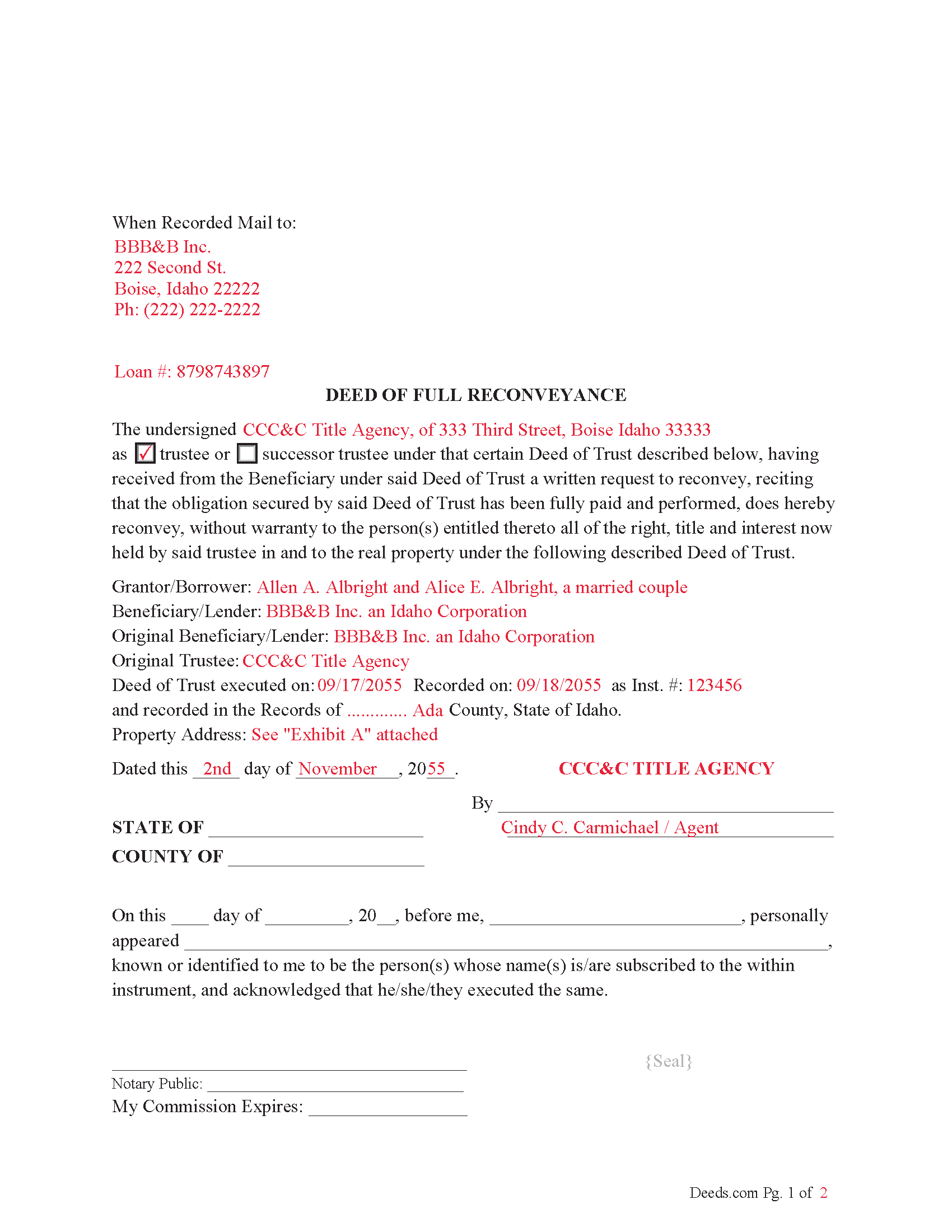

Valley County Completed Example of the Deed of Full Reconveyance Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Valley County documents included at no extra charge:

Where to Record Your Documents

Valley County Clerk/Auditor/Recorder

Cascade, Idaho 83611

Hours: 8:00 am - 5:00 pm Monday - Friday

Phone: (208) 382-7100

Recording Tips for Valley County:

- Ask if they accept credit cards - many offices are cash/check only

- Request a receipt showing your recording numbers

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Valley County

Properties in any of these areas use Valley County forms:

- Cascade

- Donnelly

- Lake Fork

- Mccall

- Yellow Pine

Hours, fees, requirements, and more for Valley County

How do I get my forms?

Forms are available for immediate download after payment. The Valley County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Valley County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Valley County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Valley County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Valley County?

Recording fees in Valley County vary. Contact the recorder's office at (208) 382-7100 for current fees.

Questions answered? Let's get started!

This form is used by the trustee or successor trustee to reconvey a Deed of Trust when fully paid and performed. This takes place when the current trustee is notified in writing from the beneficiary/lender. The full reconveyance is then recorded in the county where the property is located, generally within 30 days of satisfaction and notification, to avoid penalty.

45-1514. RECONVEYANCE UPON SATISFACTION OF OBLIGATION. Upon performance of the obligation secured by the deed of trust, the trustee upon written request of the beneficiary shall reconvey the estate of real property described in the deed of trust to the grantor; providing that in the event of such performance and the refusal of any beneficiary to so request or the trustee to so reconvey, as above provided, such beneficiary or trustee shall be liable as provided by law in the case of refusal to execute a discharge or satisfaction of a mortgage on real property.

For use in Idaho only.

Important: Your property must be located in Valley County to use these forms. Documents should be recorded at the office below.

This Deed of Full Reconveyance - for Deed of Trust meets all recording requirements specific to Valley County.

Our Promise

The documents you receive here will meet, or exceed, the Valley County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Valley County Deed of Full Reconveyance - for Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Jennifer S.

December 11th, 2019

Fabulous

Thank you!

Craig L.

October 14th, 2020

Fast and easy and saved me $240. What's not to like? Five stars.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tressa P.

November 17th, 2020

This online service was very easy to use. I highly recommend Deeds.com. The quick response from the representative upon submitting your document is quick. If something needed to be adjusted they will send you message and you can in turn respond right away with a message. The pricing of this service is very reasonable.

Thank you!

Lenore B.

January 13th, 2019

Thank you for making this deed available. The guide was such a big help.

Thanks Lenore, have a great day!

Elaine E. W.

February 13th, 2021

Your product package was thorough and I am the one who does not know how to use or begin to be interactive with a computer. I wish I had learned long ago....ok your directions appear to be clear but when you are not familiar to the words.....it can and is difficult.....I downloaded the forms and completed them by hand/pen.....I just hope it will be acceptable to the recorder....Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas B.

May 29th, 2020

My deeds were filed with Pinellas County Florida with a simple process and with no problems. 5 star for sure.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brooksye G.

January 15th, 2019

Very helpful. I live in Arkansas and needed information and documents for a Missouri transaction. I got everything I needed without any hassle.

Thank you Brooksye, we really appreciate your feedback.

Alfred M.

March 12th, 2023

It was a simple process and easily understood the process was seamless and I would highly recommend this to anyone looking to do this.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberaley J.

May 24th, 2021

I had no problem printing out the forms, very easy. Also when I called, customer service was very helpful and very polite. Thank you for that, have a great day.

Thank you!

scott m.

February 21st, 2021

thanks- easy as pie.

Thank you!

David P.

February 12th, 2024

This service and company are THE best. We are out of State and needed to efile, and we got it done for the closing. Thanks Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kay C.

November 16th, 2020

that worked great I like to see what I'm filling out and the extra info is really helpful..

Thank you!

Julie G.

December 15th, 2020

Such a great site!! Everyone is so helpful! Thanks again! Julie

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephenie A.

January 11th, 2019

No review provided.

Thank you!

Terreva B.

August 9th, 2019

Yes it helped with some things but I need more info

Thank you!