Bear Lake County Substitution of Trustee - for Deed of Trust Form

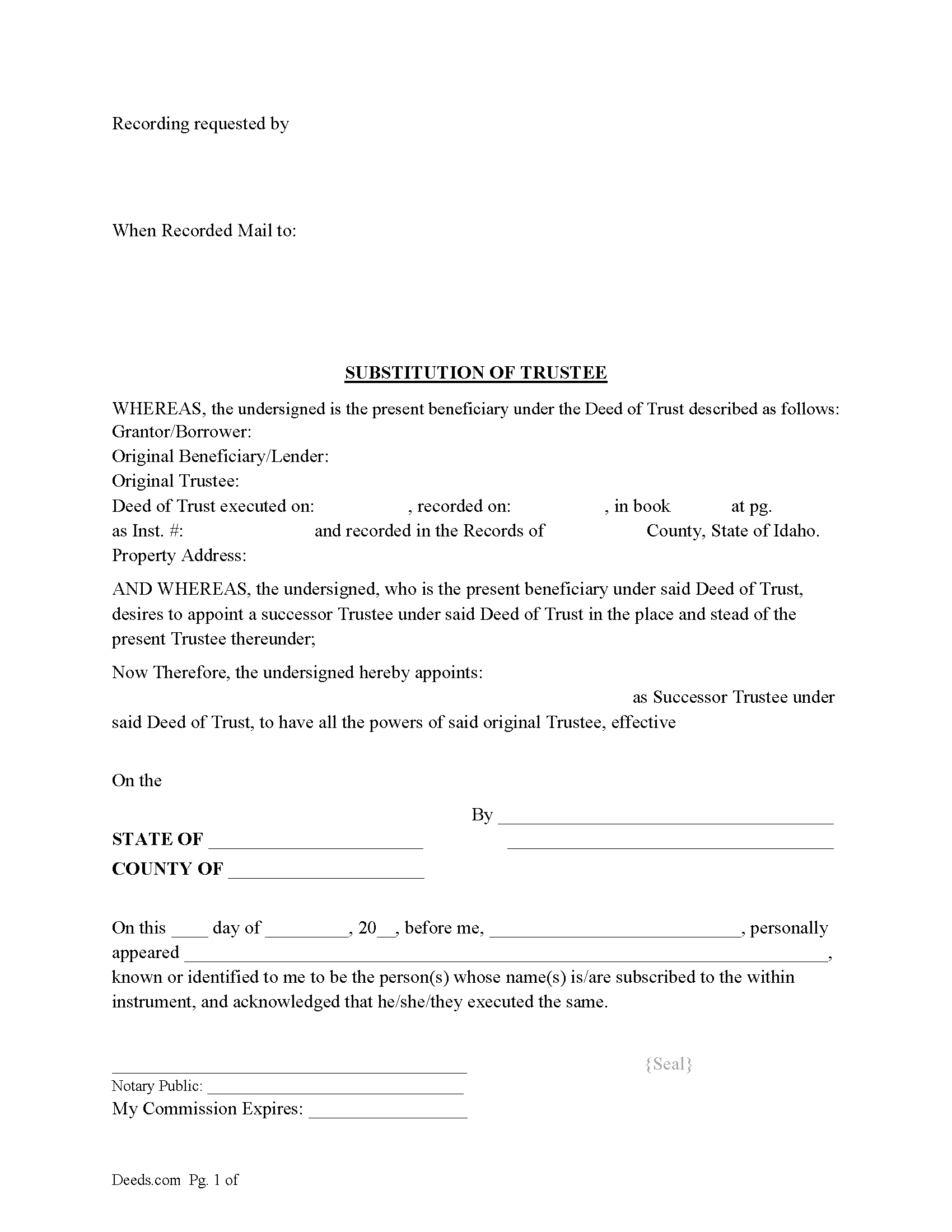

Bear Lake County Substitution of Trustee Form

Fill in the blank form formatted to comply with all recording and content requirements.

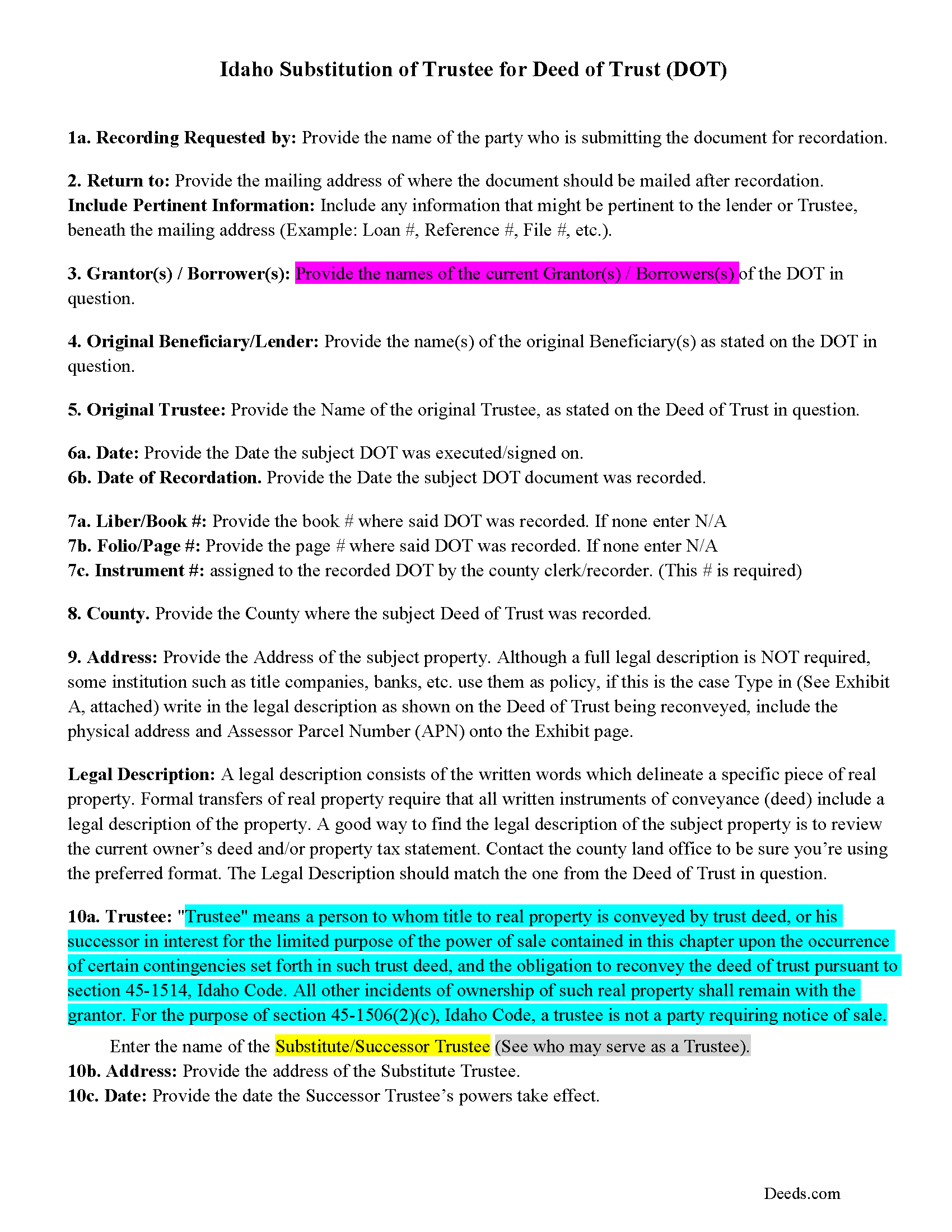

Bear Lake County Guidelines for Substitution of Trustee Form

Line by line guide explaining every blank on the form.

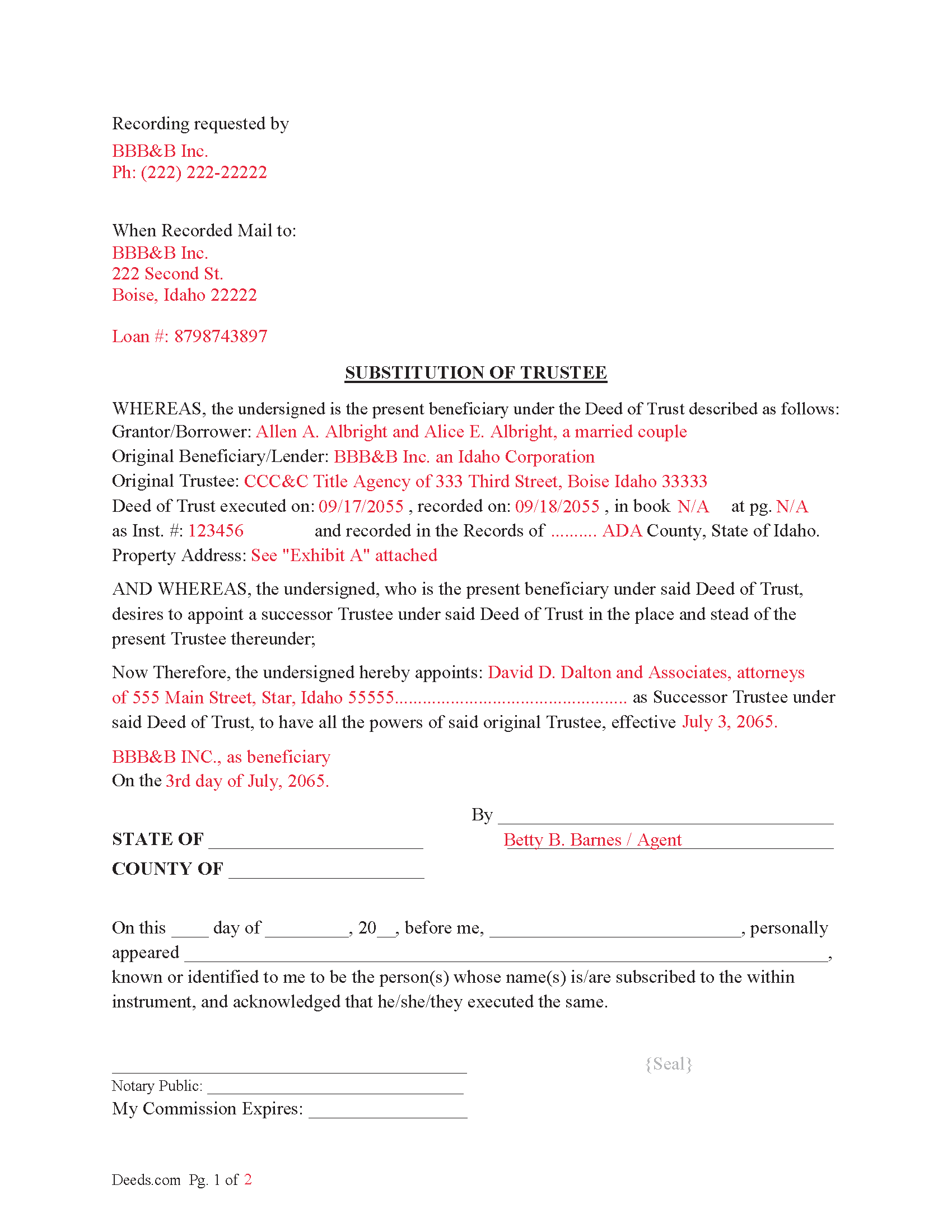

Bear Lake County Completed Example of the Substitution of Trustee Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Bear Lake County documents included at no extra charge:

Where to Record Your Documents

Bear Lake County Clerk

Paris, Idaho 83261

Hours: 8:30 to 5:00 M-F

Phone: (208) 945-2212 Ext. 5

Recording Tips for Bear Lake County:

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Bear Lake County

Properties in any of these areas use Bear Lake County forms:

- Bern

- Bloomington

- Dingle

- Fish Haven

- Geneva

- Georgetown

- Montpelier

- Paris

- Saint Charles

Hours, fees, requirements, and more for Bear Lake County

How do I get my forms?

Forms are available for immediate download after payment. The Bear Lake County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bear Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bear Lake County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bear Lake County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bear Lake County?

Recording fees in Bear Lake County vary. Contact the recorder's office at (208) 945-2212 Ext. 5 for current fees.

Questions answered? Let's get started!

This form is issued by the current beneficiary/lender to replace an existing trustee with a successor trustee in a Deed of Trust. This is commonly performed when the current trustee resigns, can't or won't act on a foreclosure, reconveyance, etc.

45-1504. TRUSTEE OF TRUST DEED --- WHO MAY SERVE --- SUCCESSORS.

(1) The trustee of a trust deed under this act shall be:

(a) Any member of the Idaho state bar;

(b) Any bank or savings and loan association authorized to do business under the laws of Idaho or the United States;

(c) An authorized trust institution having a charter under chapter 32, title 26, Idaho Code, or any corporation authorized to conduct a trust business under the laws of the United States; or

(d) A licensed title insurance agent or title insurance company authorized to transact business under the laws of the state of Idaho.

(2) The trustee may resign at its own election or be replaced by the beneficiary. The trustee shall give prompt written notice of its resignation to the beneficiary. The resignation of the trustee shall become effective upon the recording of the notice of resignation in each county in which the deed of trust is recorded. If a trustee is not appointed in the deed of trust, or upon the resignation, incapacity, disability, absence, or death of the trustee, or the election of the beneficiary to replace the trustee, the beneficiary shall appoint a trustee or a successor trustee. Upon recording the appointment of a successor trustee in each county in which the deed of trust is recorded, the successor trustee shall be vested with all powers of an original trustee. (2) The trustee may resign at its own election or be replaced by the beneficiary. The trustee shall give prompt written notice of its resignation to the beneficiary. The resignation of the trustee shall become effective upon the recording of the notice of resignation in each county in which the deed of trust is recorded. If a trustee is not appointed in the deed of trust, or upon the resignation, incapacity, disability, absence, or death of the trustee, or the election of the beneficiary to replace the trustee, the beneficiary shall appoint a trustee or a successor trustee. Upon recording the appointment of a successor trustee in each county in which the deed of trust is recorded, the successor trustee shall be vested with all powers of an original trustee.

For use in Idaho only.

Important: Your property must be located in Bear Lake County to use these forms. Documents should be recorded at the office below.

This Substitution of Trustee - for Deed of Trust meets all recording requirements specific to Bear Lake County.

Our Promise

The documents you receive here will meet, or exceed, the Bear Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bear Lake County Substitution of Trustee - for Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Anne J.

September 25th, 2023

I could not be happier with the service. Shortly after I uploaded my documents, my package was prepared and invoiced. It was only minutes before the document was recorded with the County I selected and returned to me with their seal for download.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Troy B.

July 8th, 2020

Very pleased with website very simple to navigate through

Thank you for your feedback. We really appreciate it. Have a great day!

Crystal W.

October 19th, 2022

This is the easiest process.

Thank you for your feedback. We really appreciate it. Have a great day!

Carol H.

October 8th, 2022

Easy to understand, quick access, inexpensive, and I took it to my registrar's office and he said the warranty deed was good to go. Thanks for saving me a bundle in lawyer's fees.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Arthur S.

July 19th, 2019

It is great and fast you get 5 stars from me

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ALFRED B.

September 2nd, 2020

I was counting on deeds.com to help me with a closing I was working on. I stumbled with the instructions but when I recovered there were no problems. The instructions were helpful and the deeds etc. were just what I needed. I give deeds five stars. I am 76 years old and when the application asks for the user's name I always think they want my name. WRONG. I am trying to learn computer speak.

Thank you Alfred, have an amazing day!

Joseph N.

September 17th, 2020

The site is easy to navigate and exceptional services. Unfortunately, they could find no information on a tract of land that I own, and they canceled the search and refunded my payment.

Sorry we were unable to help you find what you were looking for Joseph.

Joyce S.

August 5th, 2019

Download very easy. Forms are just what I need. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine V.

January 29th, 2023

I love simple and easy! This is the model that many businesses should use!

Thank you!

Stacey H.

October 23rd, 2024

This was my first time using Deeds.com and I was very impressed on the professionalism and the expediency of the recording. Will definitely be using them again. Stacey H.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Dean P.

October 6th, 2021

Very fast, efficient, and convenient - thanks Deeds.com! I would recommend this service to everyone needing to record documents, especially out-of-state customers such as myself.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephanie F.

August 15th, 2024

Thorough, efficient, couldn't ask for better support. I refer everyone I know in real estate to use Deeds.com

Thank you for your positive words! We’re thrilled to hear about your experience.

Kimberly H.

December 17th, 2021

Exceptional Service all Year~ I wish Deeds.com A Happy Holidays & A Happy New Year.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

raymond w.

February 24th, 2022

answeed many questions I had.

Thank you!

Gillian G.

July 4th, 2021

Looks good and provides lots of instruction.

Thank you!