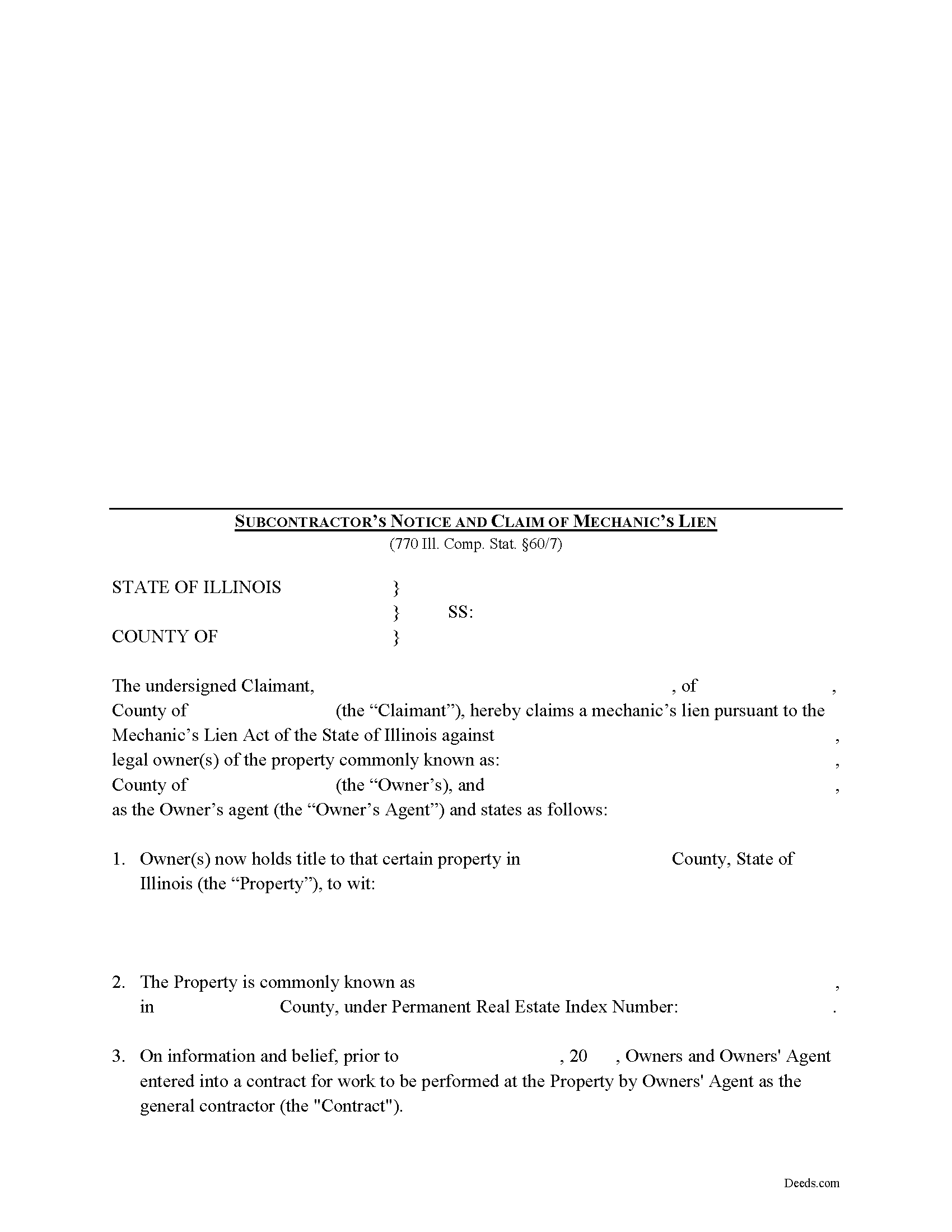

Calhoun County Mechanics Lien Subcontractor Form

Calhoun County Mechanics Lien Subcontractor Form

Fill in the blank Mechanics Lien Subcontractor form formatted to comply with all Illinois recording and content requirements.

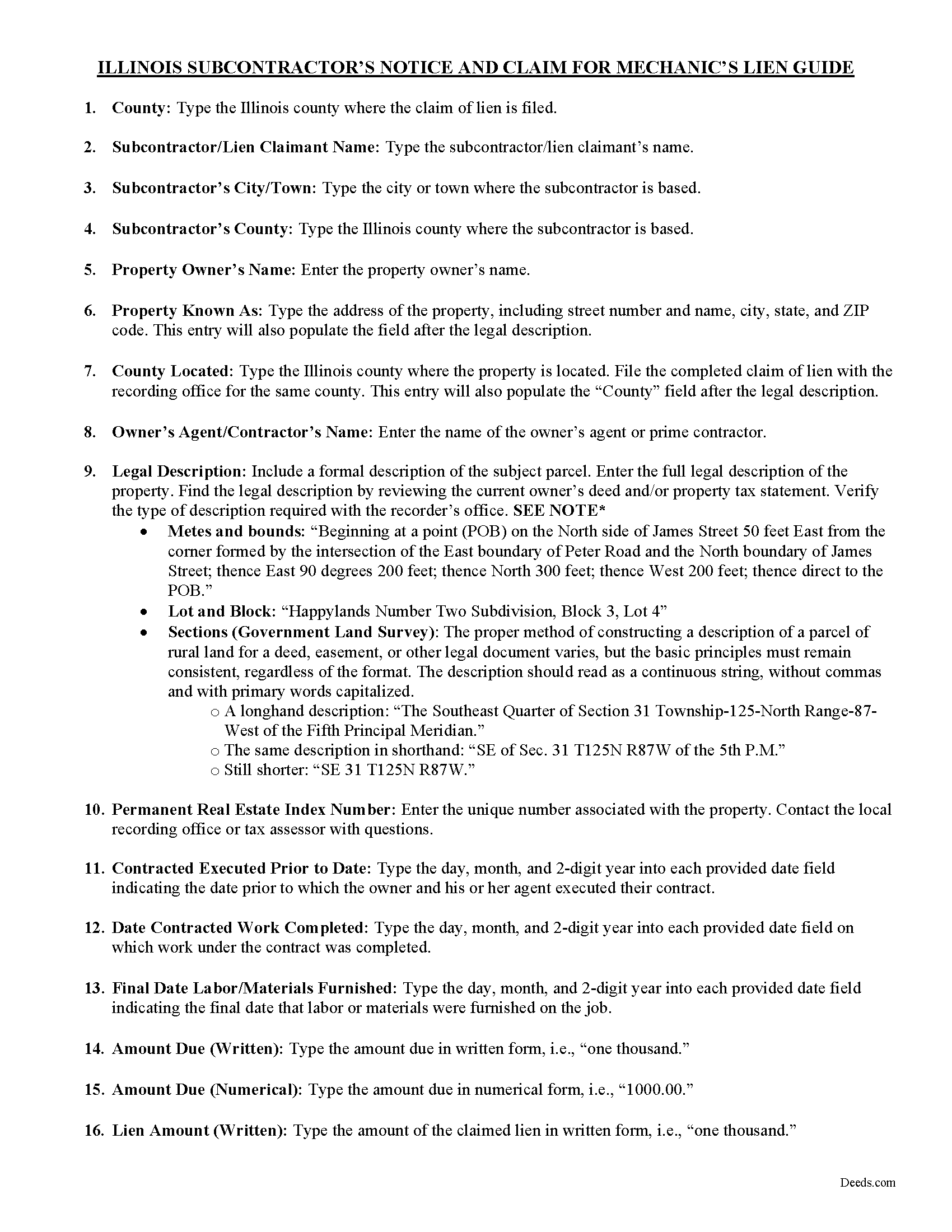

Calhoun County Mechanics Lien Subcontractor Guide

Line by line guide explaining every blank on the form.

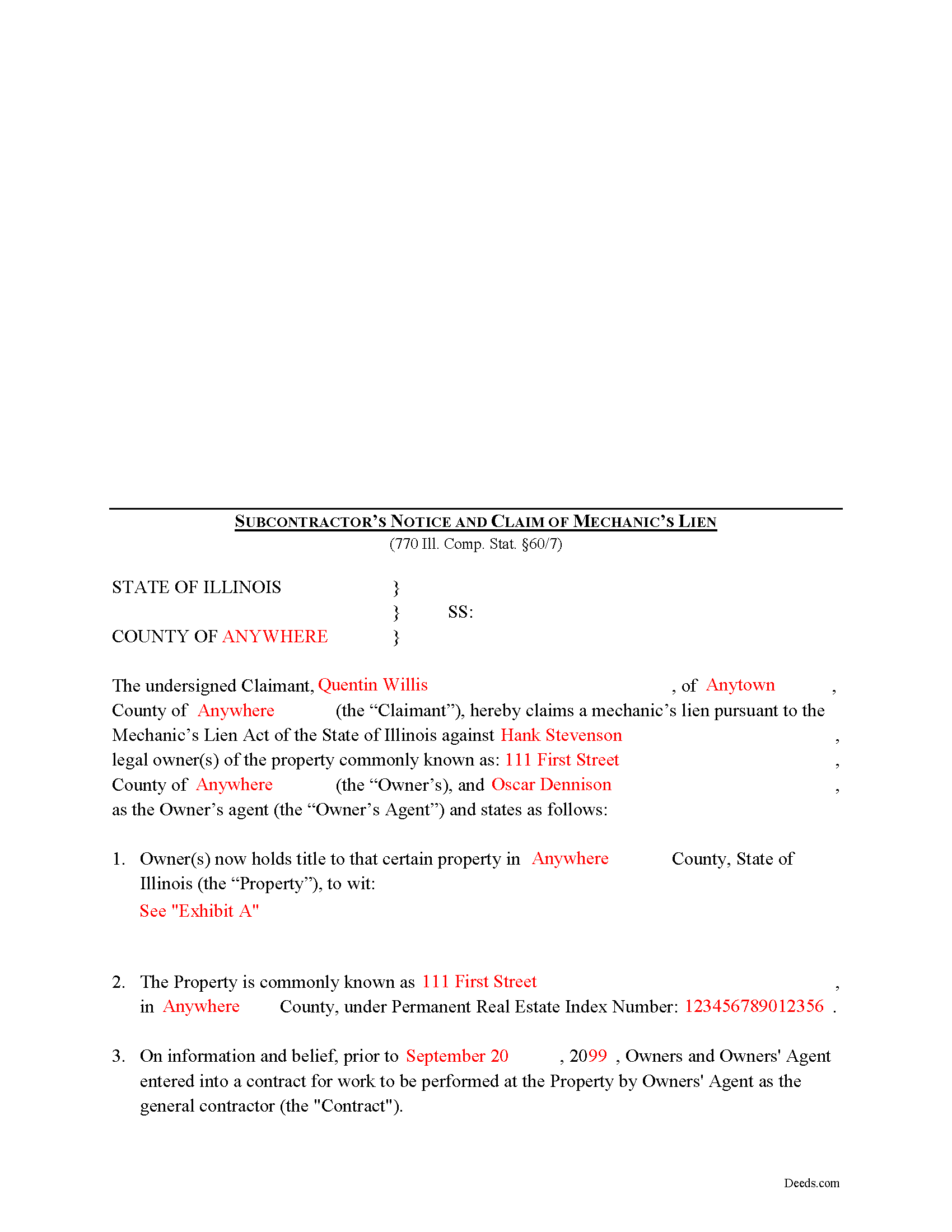

Calhoun County Completed Example of the Mechanics Lien Subcontractor Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Calhoun County documents included at no extra charge:

Where to Record Your Documents

Calhoun County Clerk & Recorder

Hardin, Illinois 62047

Hours: 8:30 to 4:30 M-F

Phone: 618-576-9700 ext. 2

Recording Tips for Calhoun County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Check that your notary's commission hasn't expired

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Calhoun County

Properties in any of these areas use Calhoun County forms:

- Batchtown

- Brussels

- Golden Eagle

- Hamburg

- Hardin

- Kampsville

- Michael

- Mozier

Hours, fees, requirements, and more for Calhoun County

How do I get my forms?

Forms are available for immediate download after payment. The Calhoun County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Calhoun County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Calhoun County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Calhoun County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Calhoun County?

Recording fees in Calhoun County vary. Contact the recorder's office at 618-576-9700 ext. 2 for current fees.

Questions answered? Let's get started!

Lien Claims by Subcontractor in Illinois

Mechanic's liens are available in Illinois pursuant to the Mechanic's Lien Act compiled under 770 ILCS 60. Liens are generally available for contractors, subcontractors, material or equipment suppliers, architects, and other design professionals. Subcontractors claiming a mechanic's lien should use the specialized form that references the contract between the property owner and the contractor (referred to as his or her agent in the lien claim document).

A lien is a type of property interest, like a mortgage. There are many types of liens such as tax liens, attorneys' liens, and judgment liens. A lien operates by allowing the lienor to make a claim against the property if it is later sold. Therefore, for a sale to occur, the property owner is required to disclose the existence of the lien to any potential purchaser and the sales proceeds must be used to pay off that lien. If the lien exceeds the value of the property this creates something known as a "deficiency," which must be recovered through a lawsuit. The lienor can also force a sale through foreclosure. Illinois only authorizes mechanic's liens on private projects and not those associated with public (government) entities.

When you provide labor or materials as a subcontractor to a general contractor and the general contractor never pays his or her invoice, filing a mechanic's lien is usually the next step in recovering the amount due. Subcontractors must also individually file 60-day (owner-occupied residential projects only) and 90-day notices to access their lien rights under State law. It is also helpful to attach these previous filed documents to the lien claim as exhibits to further support your case.

Mechanic's liens demand strict deadlines and missing the filing date by even one day can cost you your right to a lien. In Illinois, the time to file a lien arises within four (4) months from the last date of furnishing labor or delivered materials to the jobsite pursuant to the contract between the owner and his or her agent (contractor). The four-month period applies to your right against all third parties and subsequent owners. You have two (2) years to file suit against the original owner to foreclose on a mechanic's lien. 770 ILCS 60/9.

The claim for lien must state the parties to the contract and its terms, identify the general contractor and property owner, state a legal description of the owner's property, and state the total amount due and unpaid as of the date the notice is recorded. The lien amount includes the invoice amount owed minus all credits and offsets. A lienor may not include extras such as attorney's fees (unless a suit is filed to enforce the lien) or lost profits but may charge interest measured by the legal rate in Illinois. 770 ILCS 60/1(a).

Before recording the lien, sign it in the presence of a notary public who then notarizes it with his or her seal. The lien should be recorded at the recording office for the county where the property is situated. For residential projects, you must serve the owner with a copy of the recorded lien within ten (10) days' time.

The deadlines for filing a lien are set in stone, and failure to file on time will cost you your right to a lien. Additionally, putting in improper amounts or exaggerating the claim will invalidate the lien. If you lose your lien rights, the only remedy is to sue the property owner under contract law. As lawsuits are expensive, time-consuming, and stressful, this will become a much more challenging endeavor as opposed to enforcing a lien.

Each case is unique. Contact an attorney with specific questions regarding filing a subcontractor's claim or any other issues related to mechanic's liens in Illinois

Important: Your property must be located in Calhoun County to use these forms. Documents should be recorded at the office below.

This Mechanics Lien Subcontractor meets all recording requirements specific to Calhoun County.

Our Promise

The documents you receive here will meet, or exceed, the Calhoun County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Calhoun County Mechanics Lien Subcontractor form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

JAMES V.

August 5th, 2020

I initiated an order at 8:30PM on a Tuesday. I already had a response waiting for me when I opened my email the next morning. Very responsive. I'm very happy with this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ryan J.

September 5th, 2024

This was an excellent experience. The jurisdiction I was registering the Deed with, entrusts Deeds.com with their filing needs. And the staff held my hand through the process, and worked to submit the best package, and the Deed was successfully recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christopher B.

January 13th, 2021

Process went smoothly and will use for my next recording. Only area for improvement would be to provide the ability for the user to delete and replace uploaded documents.

Thank you for your feedback. We really appreciate it. Have a great day!

John N.

July 19th, 2020

Very easy to navigate.

Thank you!

Robert S.

November 15th, 2021

Very nice!

Thank you!

Linda Munguia N.

May 29th, 2021

Easy process. Appreciated the detailed instructions for filing.

Thank you!

Richard S.

July 12th, 2019

Prompt and reliable service!!

Thank you!

David O.

March 19th, 2022

Service was top-notch....fast, accurate, cost-effective.

Thank you!

Linda I.

August 16th, 2023

So far so good. It was reasonably easy to download and complete the form using information found in my closing paperwork. I haven't yet had my form notarized but plan to do so this week and submit the packet to my county auditor.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie Z.

December 7th, 2024

Just getting started with this process, but I was delighted to find this resource to speed up the decision making. Excellent! Very helpful!

Thank you for your positive words! We’re thrilled to hear about your experience.

John v.

November 13th, 2019

I don't have any experience with real estate legal forms and these were fairly easy to understand. The guide helped a bunch and the information provided on the site filled in any gaps. Overall I would definitely use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Buster T.

April 19th, 2022

Very comprehensive - lots of additional forms and instructions. Top-notch!

Thank you!

Cheryl C.

November 19th, 2020

So far this looks like exactly what I need and at a reasonable price. Glad it was so easy to find online. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Anne M H.

April 23rd, 2020

Appears to be just what I need. Quick and easy to download. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia N.

February 25th, 2021

great service, quick and easy!

Thank you!