Calhoun County Mortgage Secured by Promissory Note Form

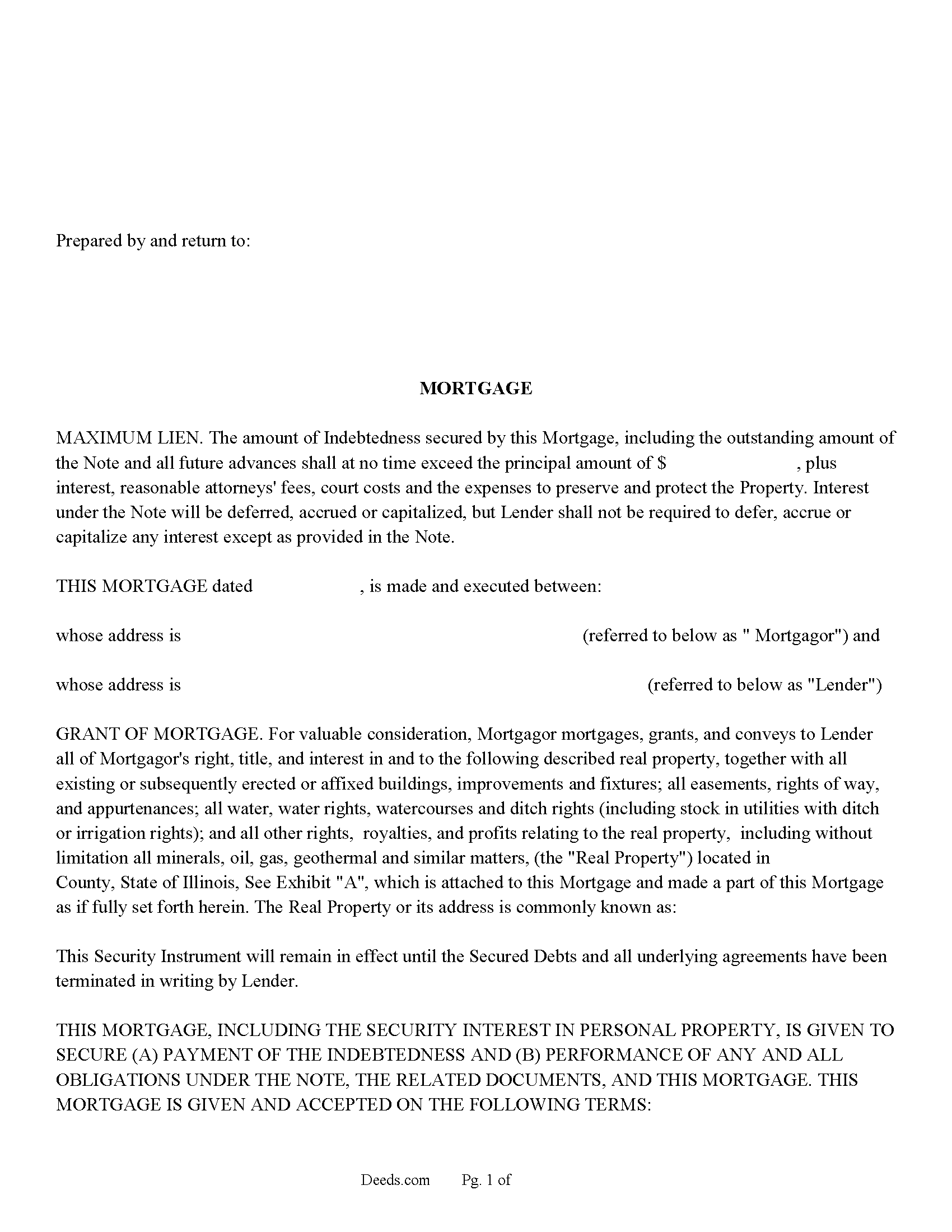

Calhoun County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

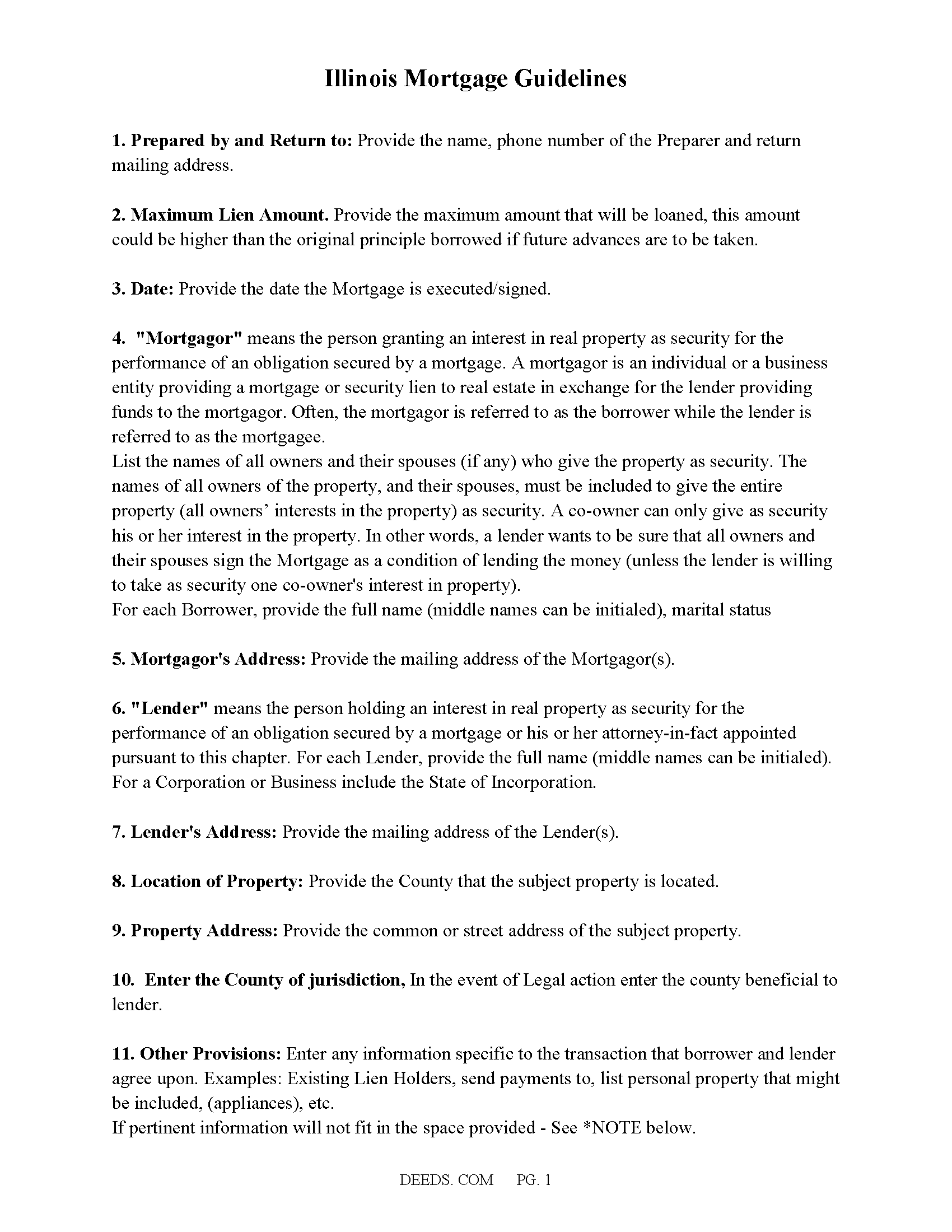

Calhoun County Mortgage Guide

Fill in the blank form formatted to comply with all recording and content requirements.

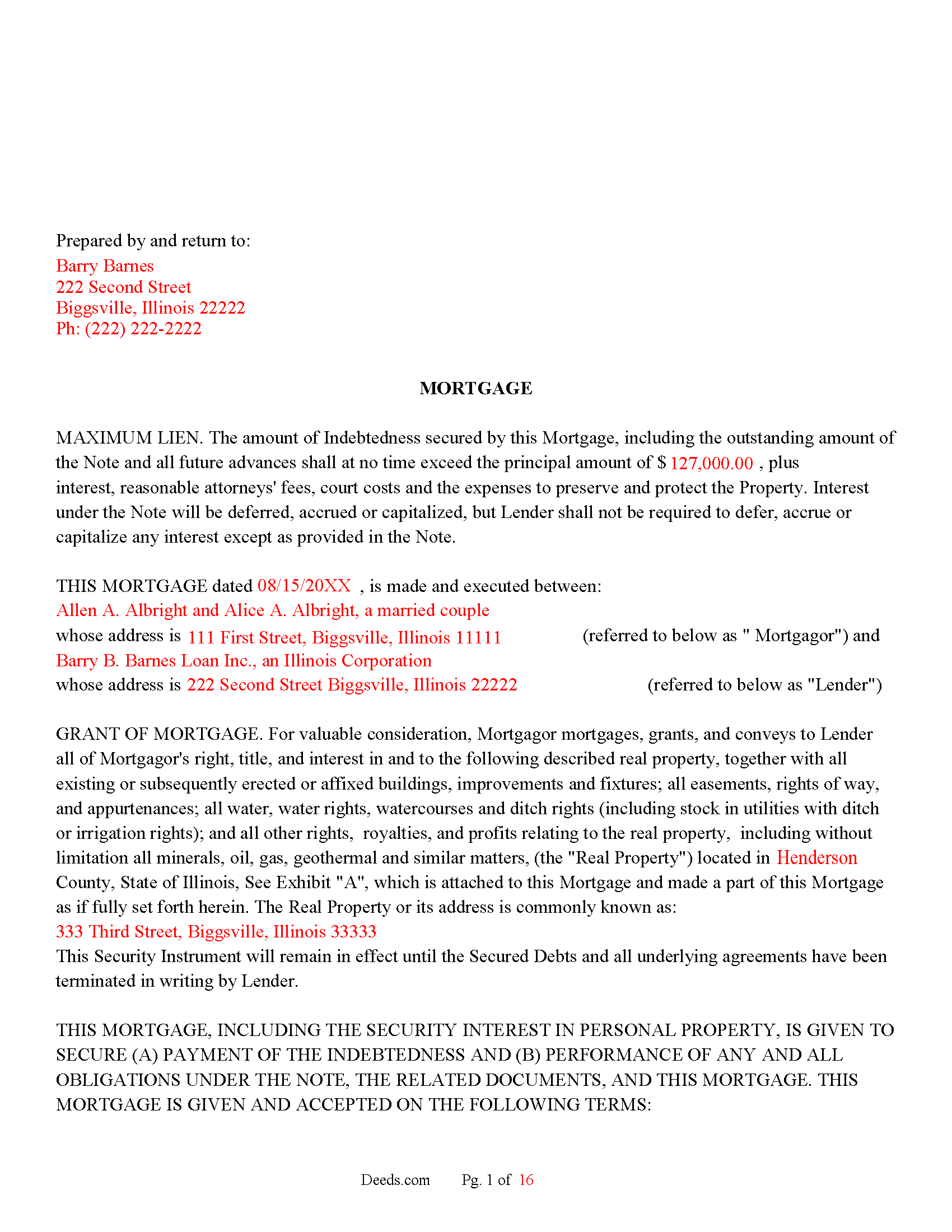

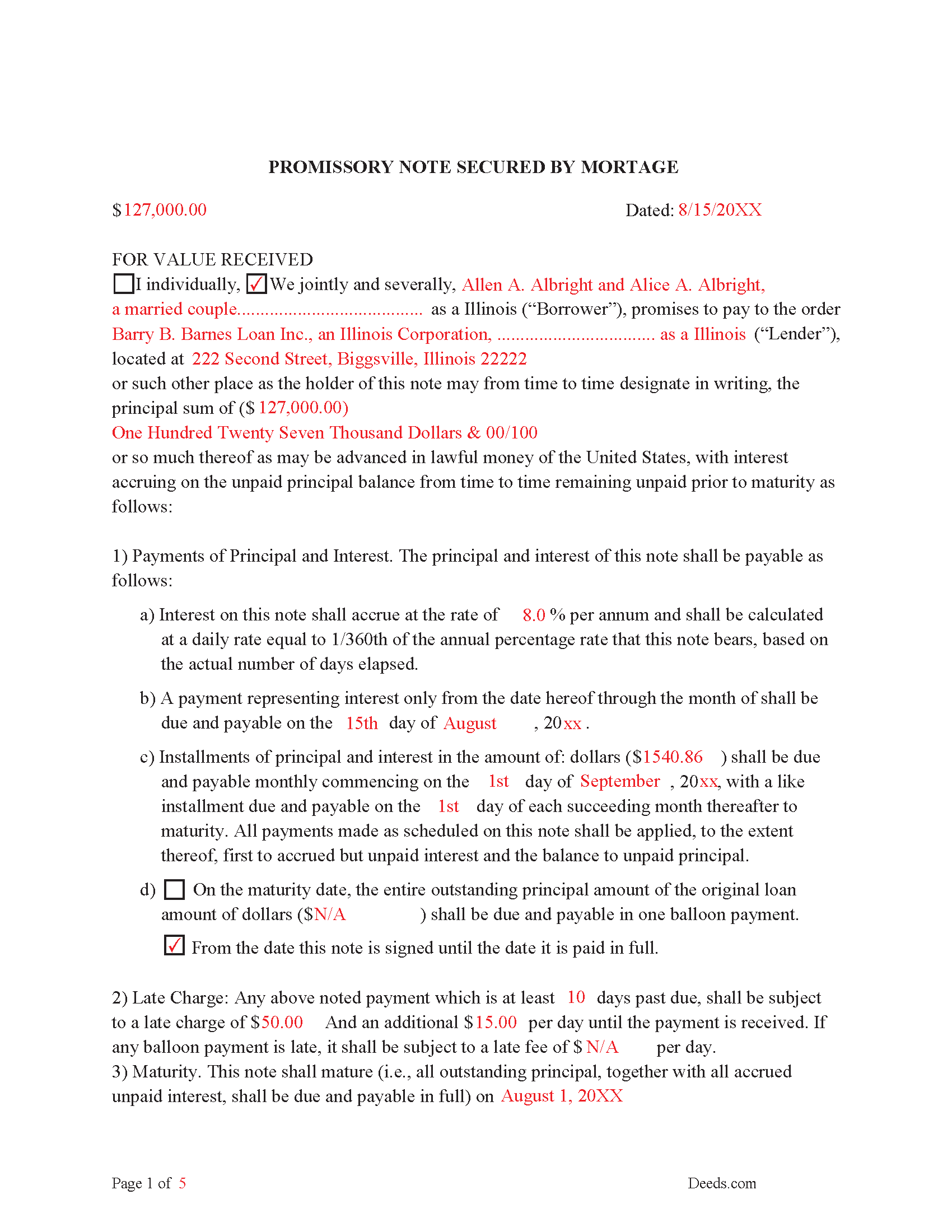

Calhoun County Completed Example of the Mortgage Secured by Promissory Note Document

Example of a properly completed Illinois Mortgage Secured by Promissory Note document for reference.

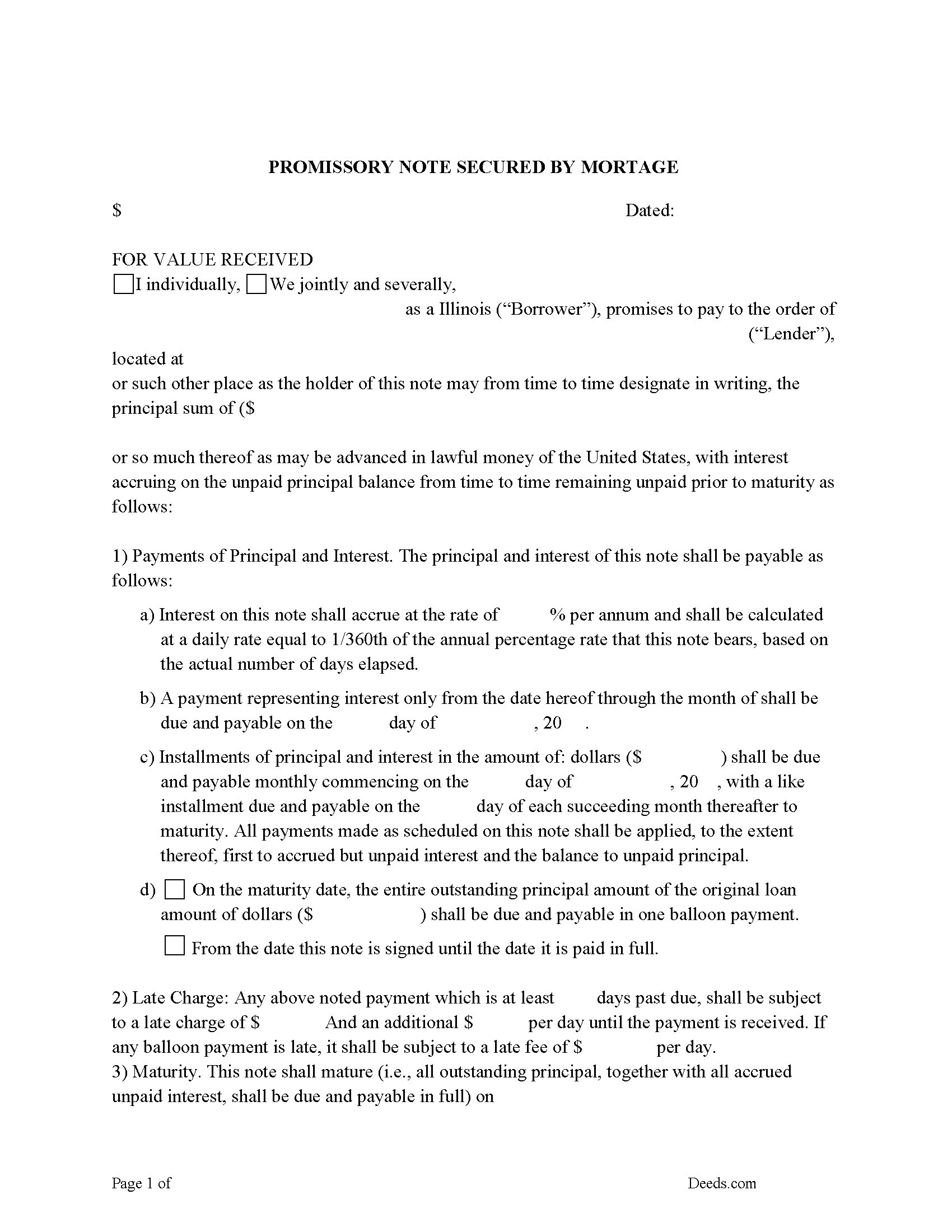

Calhoun County Promissory Note Form

Fill in the Blank Promissory Note secured by Mortgage

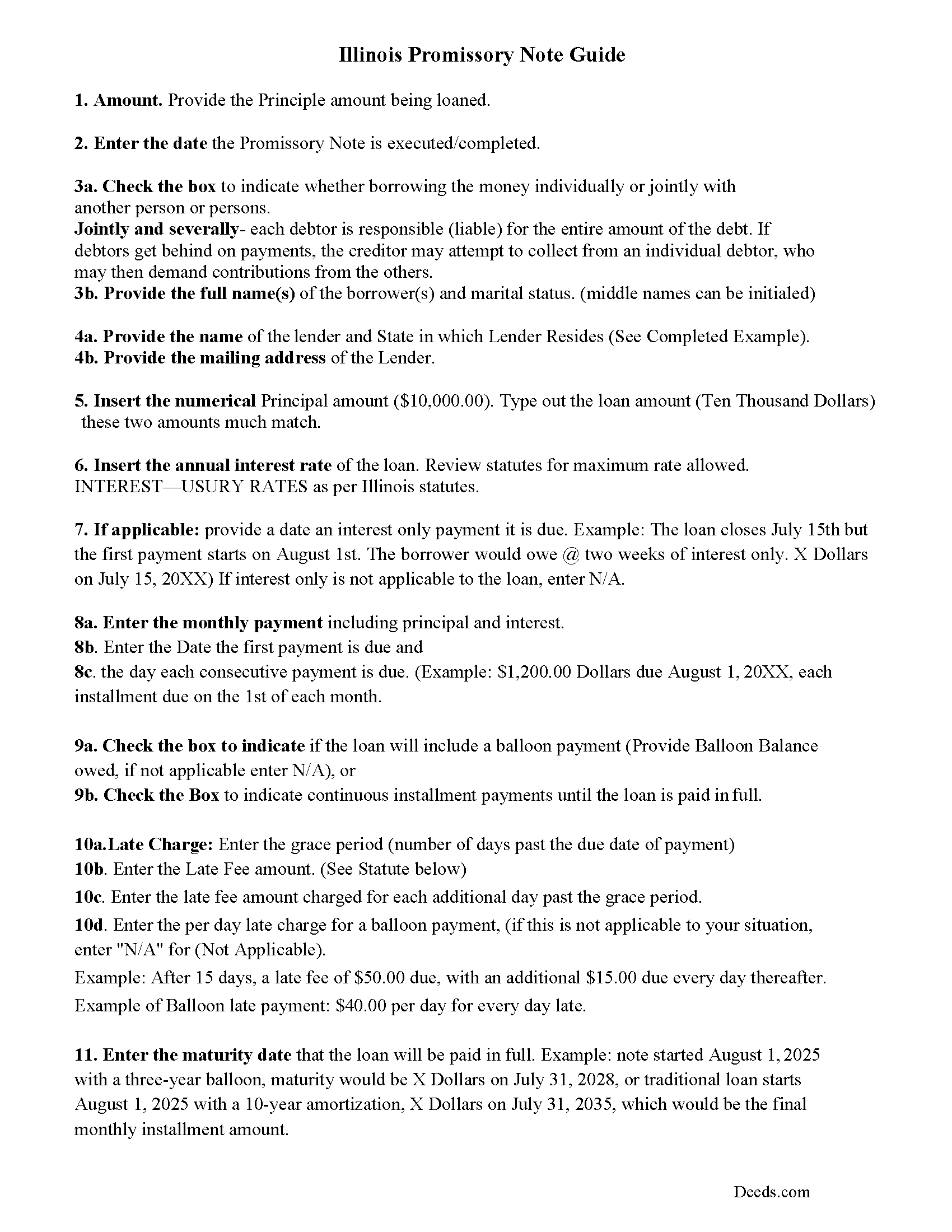

Calhoun County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Calhoun County Completed Example of the Promissory Note Document

Line by line guide explaining every blank on the form.

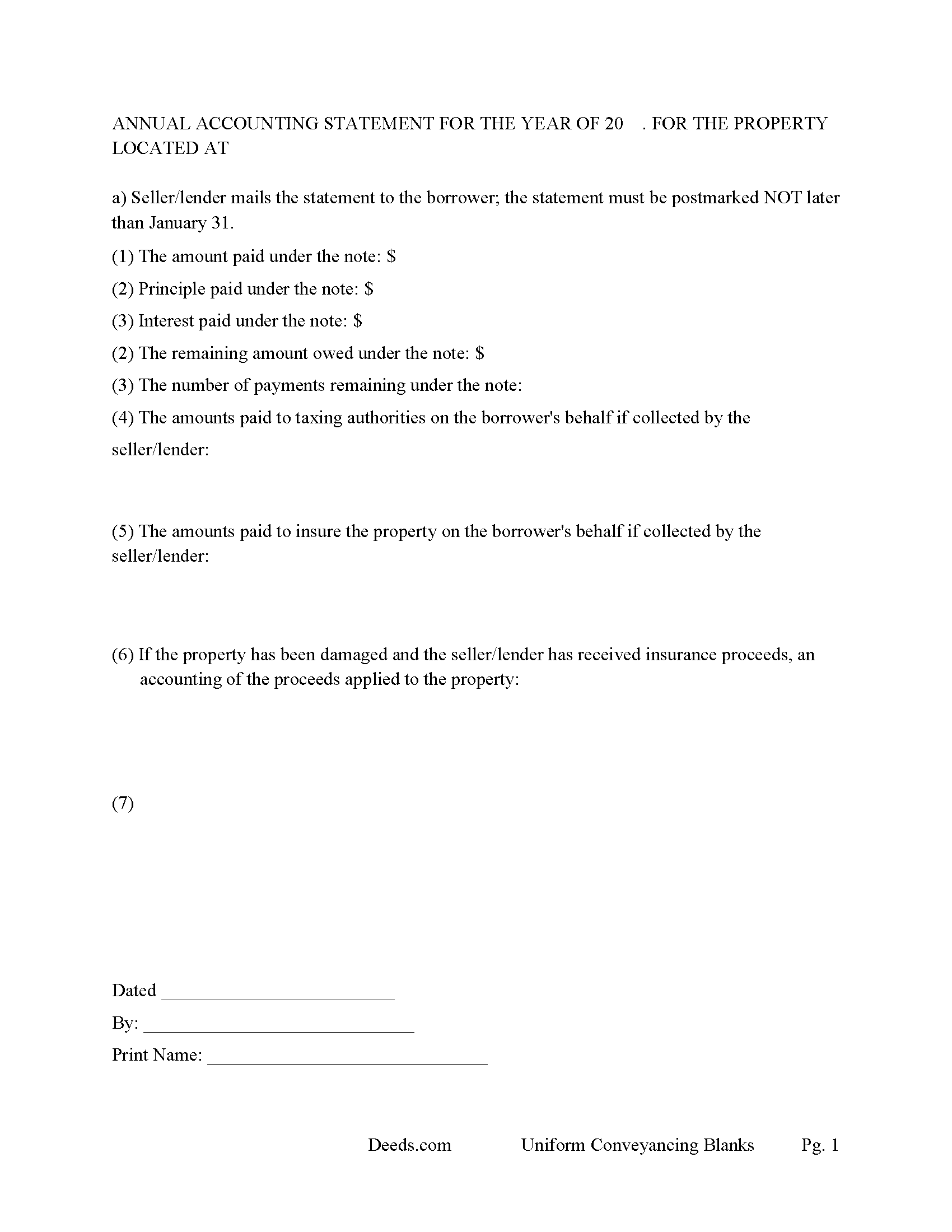

Calhoun County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Calhoun County documents included at no extra charge:

Where to Record Your Documents

Calhoun County Clerk & Recorder

Hardin, Illinois 62047

Hours: 8:30 to 4:30 M-F

Phone: 618-576-9700 ext. 2

Recording Tips for Calhoun County:

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Calhoun County

Properties in any of these areas use Calhoun County forms:

- Batchtown

- Brussels

- Golden Eagle

- Hamburg

- Hardin

- Kampsville

- Michael

- Mozier

Hours, fees, requirements, and more for Calhoun County

How do I get my forms?

Forms are available for immediate download after payment. The Calhoun County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Calhoun County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Calhoun County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Calhoun County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Calhoun County?

Recording fees in Calhoun County vary. Contact the recorder's office at 618-576-9700 ext. 2 for current fees.

Questions answered? Let's get started!

This Mortgage has stringent default provisions that is typically suited for a private Lender with financing of residential property, small business property, Rental units (up to 4 units), Condominiums, planned unit development and vacant land.

EVENTS OF DEFAULT. Each of the following, at Lender's option, shall constitute an Event of Default under this Mortgage:

Payment Default. Mortgagor fails to make any payment when due under the Indebtedness.

Default on Other Payments.

Other Defaults.

Default in Favor of Third Parties.

False Statements.

Defective Collateralization.

Death or Insolvency.

Creditor or Forfeiture Proceedings.

Events Affecting Guarantor.

Adverse Change.

RIGHTS AND REMEDIES ON DEFAULT. Upon the occurrence of an Event of Default and at any time thereafter, Lender, at Lender's option, may exercise any one or more of the following rights and remedies, in addition to any other rights or remedies provided by law:

Accelerate Indebtedness.

UCC Remedies.

Appoint Receiver.

Judicial Foreclosure.

Nonjudicial Sale.

Deficiency Judgment.

Tenancy at Sufferance.

Other Remedies - Lender shall have all other rights and remedies provided in this Mortgage or the Note or available at law or in equity.

Sale of the Property.

Notice of Sale.

Election of Remedies

Attorneys' Fees; Expenses.

Promissory Note can be used for installment or balloon payments.

Includes default rates (interest rate that occurs when borrower is in default)

In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, which fee shall be due at the time this Note is otherwise paid in full. The "Overdue Loan Fee" shall be determined based upon the outstanding principal balance of this Note as of the Maturity Date and shall be:

(a)one percent (1.0%) Of such principal balance if the Note is paid in full on or after thirty(30)days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b)two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty(60)days after the Maturity Date.

Late Payment Fees. Any payment which is at least ___ days past due, shall be subject to a late charge of $___ And an additional $___ per day until the payment is received. If any balloon payment is late, it shall be subject to a late fee of $___ per day.

(Illinois Mortgage Package includes forms, guidelines, and completed examples) For Use in Illinois Only.

Important: Your property must be located in Calhoun County to use these forms. Documents should be recorded at the office below.

This Mortgage Secured by Promissory Note meets all recording requirements specific to Calhoun County.

Our Promise

The documents you receive here will meet, or exceed, the Calhoun County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Calhoun County Mortgage Secured by Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Tong B.

May 7th, 2020

hi, It is very easy to do it. tanks.

Thank you!

Alan K.

September 4th, 2020

All I needed was a simple Certificate of Trust. Deeds.com had a template for exactly what I needed. I didn't have to make an appt with an attorney, wait for one to be available, nor pay a ridiculous amount for a standardized document. Super easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Beaugwynn Wigley S.

October 26th, 2021

Thanks so much for all your help! That was painless.

Thank you!

Ed H.

June 28th, 2025

I filled out the Kansas form and presented it to the Clerk of Deeds in Rawlins Co and there were no problems and no expensive attorney involved for a simple transaction.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Chris B.

March 3rd, 2023

Accurate information and easy to use website.

Thank you for your feedback. We really appreciate it. Have a great day!

Darrel V.

September 27th, 2020

Pretty easy to use and timely, too!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!

John C.

May 30th, 2023

So far it's OK but have not filed it with the the county so can't say if it will be what they want

Thank you for your feedback. We really appreciate it. Have a great day!

Steven M.

February 13th, 2025

Happy with your service. Everything as advertised.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Lillian F.

May 2nd, 2019

I LOVE THE EASE OF GETTING THE INFORMATION I REQUESTED. YOUR SERVICE IS MORE THAN WHAT I EXPECTED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Martha V.

August 30th, 2020

Great service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bernique C.

May 18th, 2022

Was very pleased to be referred by another user for needed documents. Add me to "satisfied customers"

Thank you for your feedback. We really appreciate it. Have a great day!

Oldemar T.

June 23rd, 2020

You guys simplified my life. You offer very convenient services. Thank you.

Thank you!

LISA B.

December 5th, 2019

GOT WHAT I NEEDED FORMS WORKED FINE.

Thank you!

EILEEN K.

March 17th, 2022

I received my product in great condition and it works ok. Thankyou!!!

Thank you!