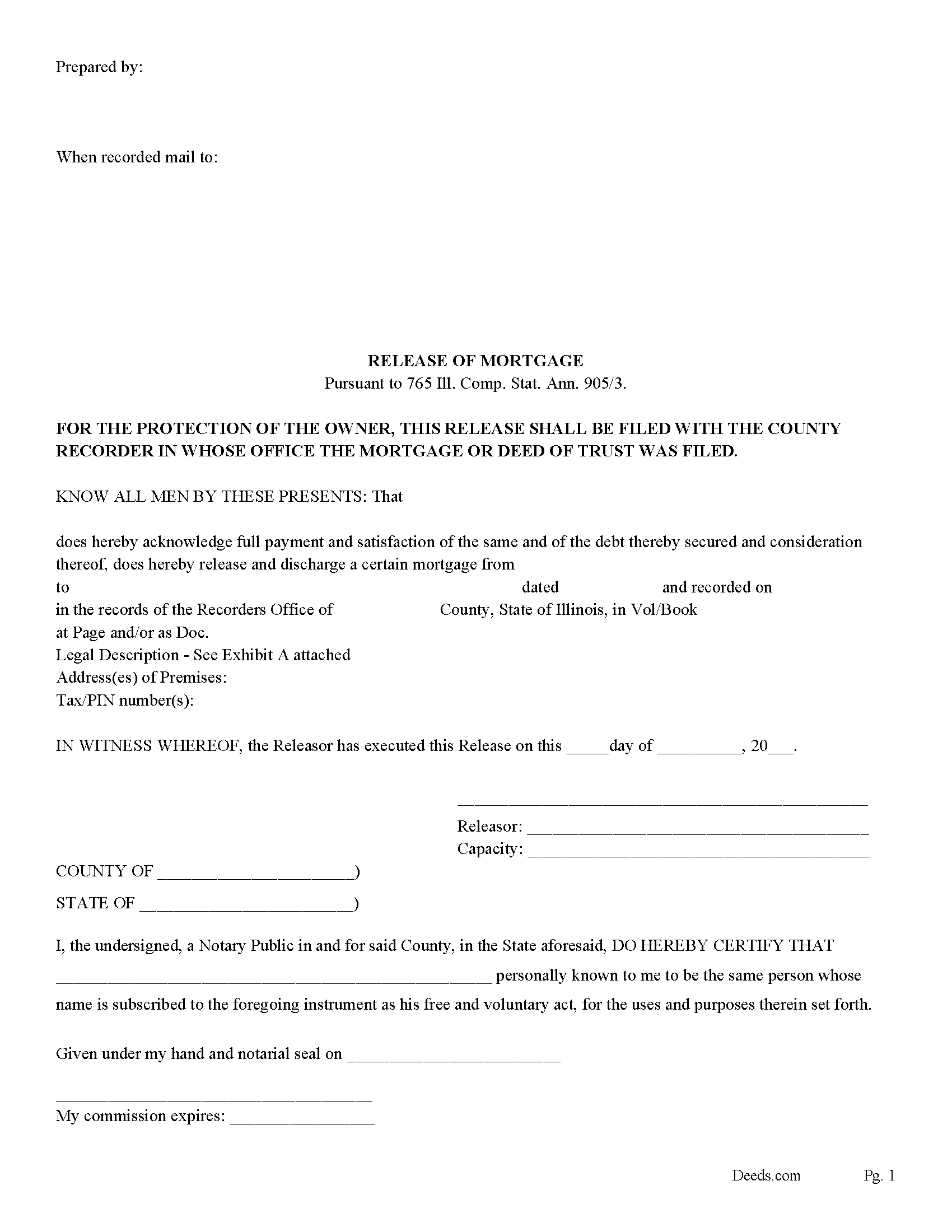

Clark County Release of Mortgage Form

Clark County Release of Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

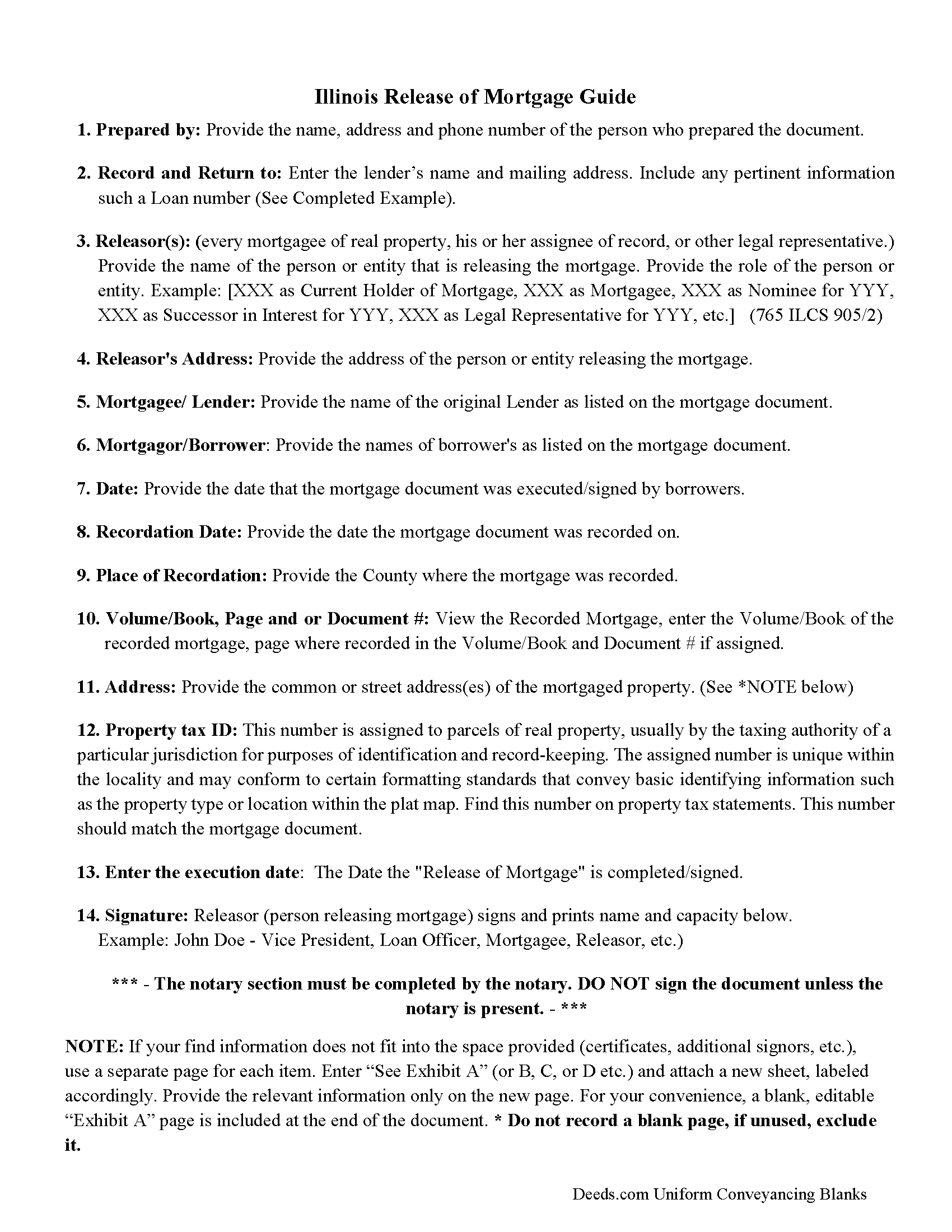

Clark County Guidelines Release of Mortgage

Line by line guide explaining every blank on the form.

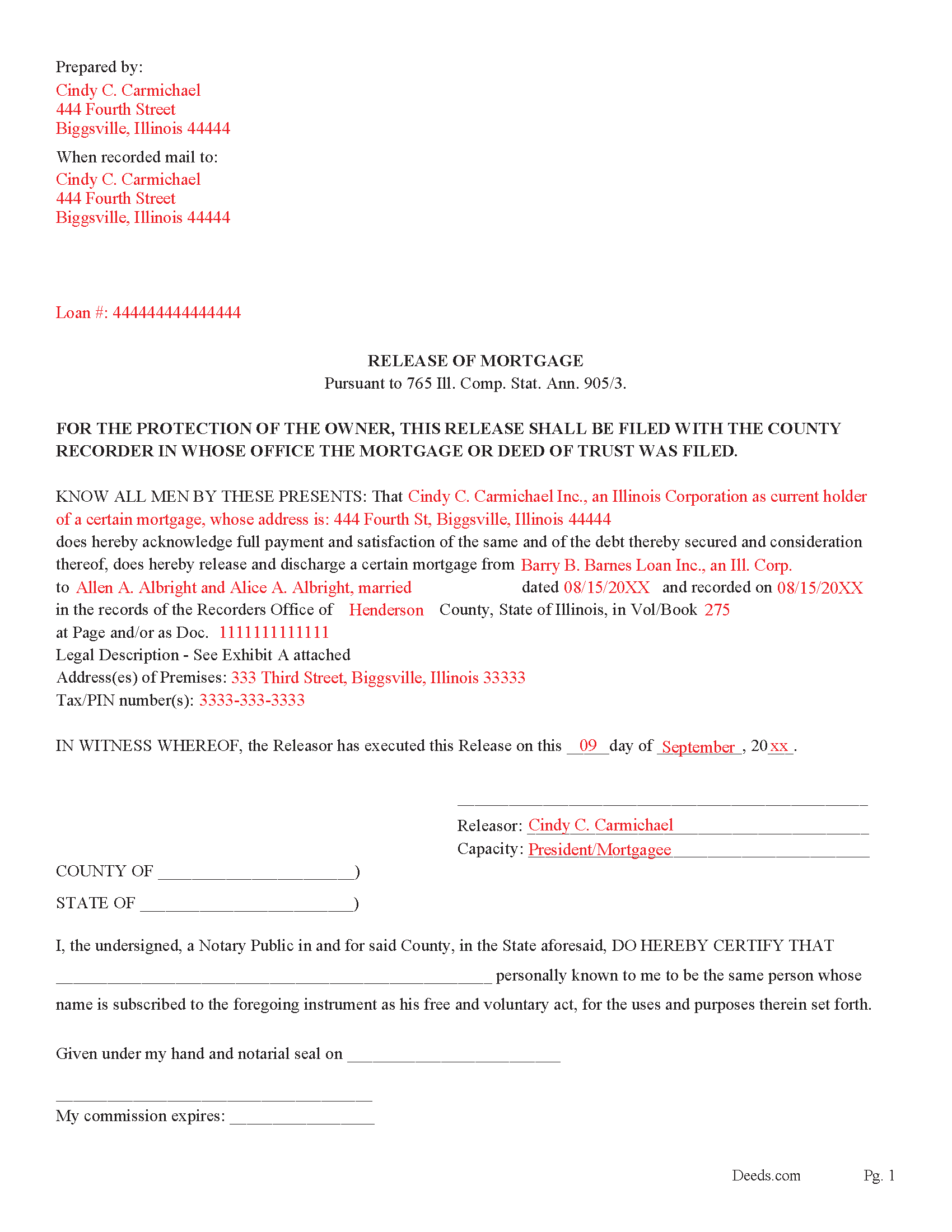

Clark County Completed Example of the Release of Mortgage Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Clark County documents included at no extra charge:

Where to Record Your Documents

Clark County Clerk/Recorder

Marshall, Illinois 62441

Hours: 8:00 to 4:00 Monday through Friday

Phone: (217) 826-8311

Recording Tips for Clark County:

- Bring your driver's license or state-issued photo ID

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Clark County

Properties in any of these areas use Clark County forms:

- Casey

- Dennison

- Marshall

- Martinsville

- West Union

- Westfield

Hours, fees, requirements, and more for Clark County

How do I get my forms?

Forms are available for immediate download after payment. The Clark County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clark County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clark County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clark County?

Recording fees in Clark County vary. Contact the recorder's office at (217) 826-8311 for current fees.

Questions answered? Let's get started!

This form may be used by the current mortgage holder or representative to release a mortgage that is paid in full.

To avoid penalty the (mortgagee)/lender, (his or her executor or administrator, heirs and assigns), generally has (30 days) to file the release (after the payment of the debt secured by such mortgage) (765 ILCS 905/4)

(765 ILCS 905/3) (from Ch. 95, par. 53)

Sec. 3. An instrument in writing which releases a mortgage or trust deed of real property may be acknowledged or proved in the same manner as deeds for the conveyance of land.

(Source: Laws 1961, 1st Spec.Sess., p. 42.)

If the release is delivered to the mortgagor or grantor, it must have imprinted on its face in bold letters at least 1/4 inch in height the following: "FOR THE PROTECTION OF THE OWNER, THIS RELEASE SHALL BE FILED WITH THE RECORDER OR THE REGISTRAR OF TITLES IN WHOSE OFFICE THE MORTGAGE OR DEED OF TRUST WAS FILED".

(765 ILCS 905/2)

(Illinois Release of Mortgage Package includes form, guidelines, and completed example)

Important: Your property must be located in Clark County to use these forms. Documents should be recorded at the office below.

This Release of Mortgage meets all recording requirements specific to Clark County.

Our Promise

The documents you receive here will meet, or exceed, the Clark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clark County Release of Mortgage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Donna G.

April 26th, 2023

Very happy with this service, comprehensive detailed instructions as well as correct forms for my location

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RONDA S.

March 18th, 2021

I just love this site!

Thank you!

ed d.

December 23rd, 2020

Fast efficient hassle free

Thank you for your feedback. We really appreciate it. Have a great day!

Deana A.

April 30th, 2020

Great forms and info, easy step-by-step guidance.

Thank you!

Lydia E.

December 16th, 2021

Very intuitive to use and comprehensive enough for the most complex of cases.

Thank you!

Luwana C.

April 2nd, 2019

I think the Website takes out a lot of leg work, Makes it easier to take care of paperwork 10 times faster.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Corinna N.

October 20th, 2024

The website made it easy to find and print out the documents I needed. The whole process was straightforward and user-friendly. Highly recommend!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Michael S.

March 12th, 2021

Well designed easy to use system. Provided all instructions and updates required, as well as catching an extra form required by our county.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

joni e.

October 25th, 2019

It was everything that I needed. The county clerk's office kept telling me to get a lawyer for this form, but I didn't need one. Saved myself hundreds of dollars. I've used them many times.

Thank you for your feedback. We really appreciate it. Have a great day!

Tom L.

January 10th, 2023

For better grammatical structure you should add the word "BE" after the first three words.... Your review may ..... BE....displayed.

Thanks for letting us know!

Jayne J.

May 21st, 2025

We have used this service two times and now going for third. Would recommend. So glad this service is available.

Thank you for your positive words! We’re thrilled to hear about your experience.

Bobby Y.

June 7th, 2024

I like the content and the availability to conduct valuable business online

Thank you!

Toni M.

June 24th, 2019

I liked having the forms. Some may need to know they can look at the legal Description from online county records, then type up in Word document line by line, the degree sign in Word program is achieved by using alt and 248 on number pad. Then on the form page one write SEE Exibit A and title your Word program description as Exibit A. Goes without saying the legal description should be looked over many times and it is easier to do so if you format your Word the same lineage as the legal description online which is usually not text which is why you have to retype it.

Thank you for your feedback. We really appreciate it. Have a great day!

Kristi L.

May 11th, 2021

Fantastic Experience! I have been through several different companies offering to do the same thing but only offering subscriptions. I have no negative reviews, took 1 business day from submission, professional and timely updates and extremely fair pricing considering the amount of time it saves you.

Thank you!

Sheryl L.

December 1st, 2021

EZ to use program....was able to print all forms ordered. I expect to go back to to use recording ability. Instructions are easily followed...would be nice to have confirmation included but they are available to purchase. Hope for successful recording of TOD affidavit. Pretty good value...attorney quoted well over the price I paid for package.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!