Peoria County Release of Mortgage Form

Peoria County Release of Mortgage Form

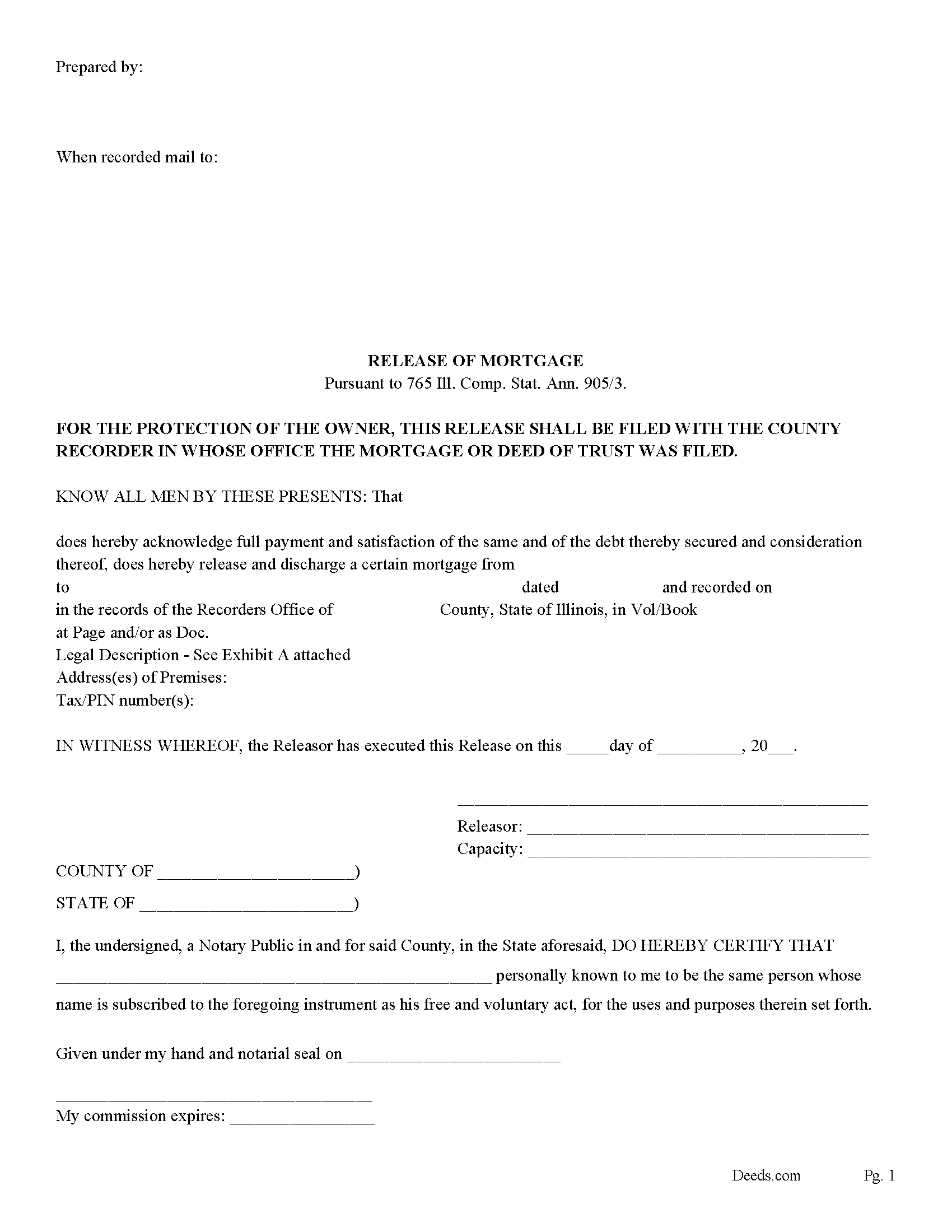

Fill in the blank form formatted to comply with all recording and content requirements.

Peoria County Guidelines Release of Mortgage

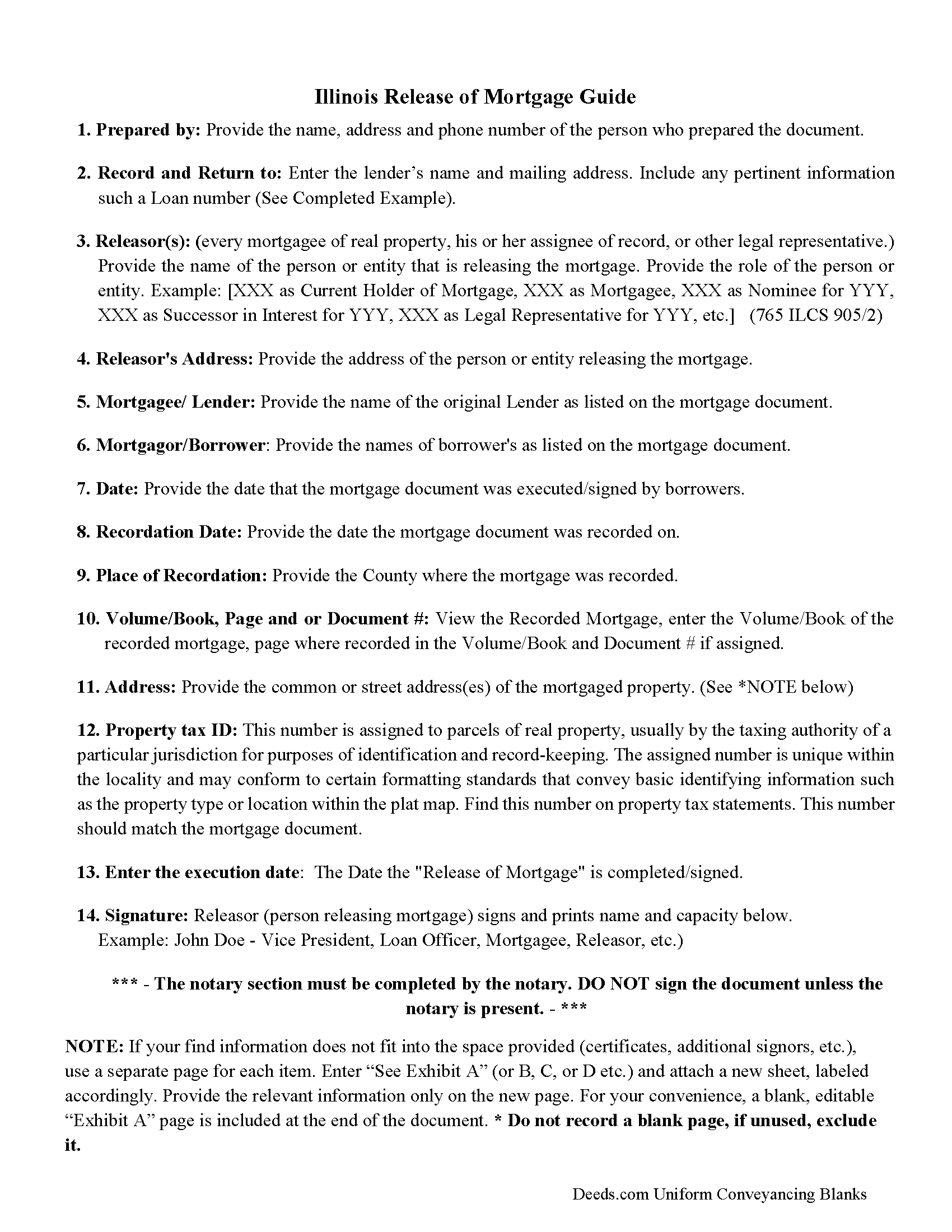

Line by line guide explaining every blank on the form.

Peoria County Completed Example of the Release of Mortgage Document

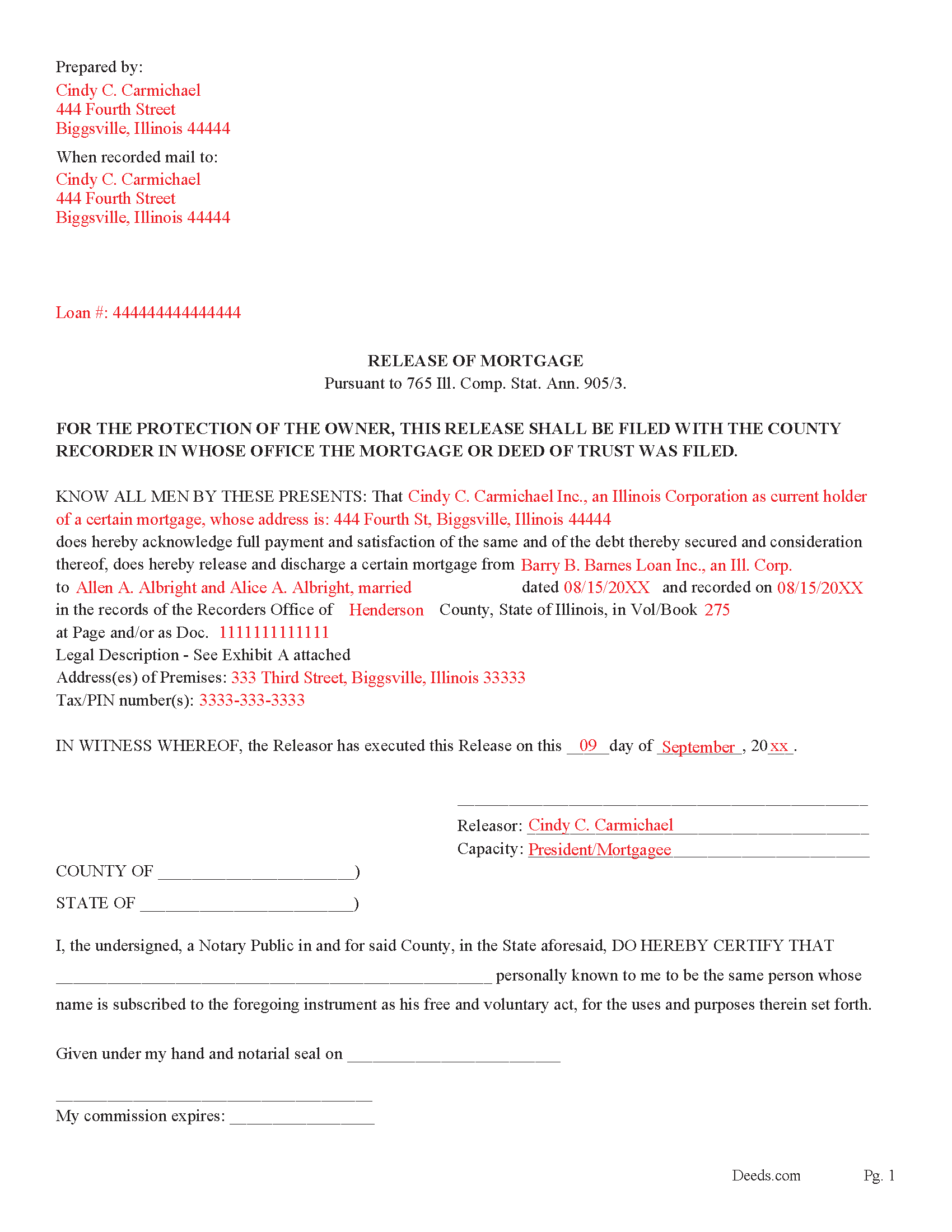

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Peoria County documents included at no extra charge:

Where to Record Your Documents

Recorder of Deeds

Peoria, Illinois 61602

Hours: Office Hours: Monday–Friday 8:30am–5:00pm / Recording Hours: Monday–Friday 8:30am–4:30pm

Phone: (309) 672-6090

Recording Tips for Peoria County:

- White-out or correction fluid may cause rejection

- Make copies of your documents before recording - keep originals safe

- Avoid the last business day of the month when possible

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Peoria County

Properties in any of these areas use Peoria County forms:

- Brimfield

- Chillicothe

- Dunlap

- Edelstein

- Edwards

- Elmwood

- Glasford

- Hanna City

- Kingston Mines

- Laura

- Mapleton

- Mossville

- Peoria

- Peoria Heights

- Princeville

- Rome

- Trivoli

Hours, fees, requirements, and more for Peoria County

How do I get my forms?

Forms are available for immediate download after payment. The Peoria County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Peoria County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Peoria County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Peoria County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Peoria County?

Recording fees in Peoria County vary. Contact the recorder's office at (309) 672-6090 for current fees.

Questions answered? Let's get started!

This form may be used by the current mortgage holder or representative to release a mortgage that is paid in full.

To avoid penalty the (mortgagee)/lender, (his or her executor or administrator, heirs and assigns), generally has (30 days) to file the release (after the payment of the debt secured by such mortgage) (765 ILCS 905/4)

(765 ILCS 905/3) (from Ch. 95, par. 53)

Sec. 3. An instrument in writing which releases a mortgage or trust deed of real property may be acknowledged or proved in the same manner as deeds for the conveyance of land.

(Source: Laws 1961, 1st Spec.Sess., p. 42.)

If the release is delivered to the mortgagor or grantor, it must have imprinted on its face in bold letters at least 1/4 inch in height the following: "FOR THE PROTECTION OF THE OWNER, THIS RELEASE SHALL BE FILED WITH THE RECORDER OR THE REGISTRAR OF TITLES IN WHOSE OFFICE THE MORTGAGE OR DEED OF TRUST WAS FILED".

(765 ILCS 905/2)

(Illinois Release of Mortgage Package includes form, guidelines, and completed example)

Important: Your property must be located in Peoria County to use these forms. Documents should be recorded at the office below.

This Release of Mortgage meets all recording requirements specific to Peoria County.

Our Promise

The documents you receive here will meet, or exceed, the Peoria County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Peoria County Release of Mortgage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Dennis D.

August 4th, 2022

Heard about this service from a lawyer who said their offic used it quite a bit.

Thank you for your feedback. We really appreciate it. Have a great day!

Monica S.

February 21st, 2020

Great forms, thank you so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Thanh P.

July 18th, 2024

Awesome services. Quick and efficient.

Thank you for your kind words Thanh, we appreciate you.

TIFFANY B.

April 24th, 2024

THIS SERVICE IS AMAZING! IT SAVES ME SO MUCH TIME!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Shelleen A.

May 11th, 2022

Very helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sylvia H.

December 22nd, 2023

Deeds.com really made the process of completing and submitting the Lien application easy. Thank you, and I will be using you whenever I need a real estate document that you carry.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lydia E.

December 16th, 2021

Very intuitive to use and comprehensive enough for the most complex of cases.

Thank you!

Richard O.

June 2nd, 2020

Thank you for providing this service. It was quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Jim W.

June 2nd, 2022

ALL I CAN SAY IS WOW. I AM SO GLAD THAT SOMEONE THOUGHT OF THIS OPROCESS FOR NON-TITLE COMPANIES, SMALL COMPANIES, ETC. I REALLY APPRECIATED THE SERVICE WHEN I RECORDED MY FIRST SET OF DOCS HERE. THEY WERE A MESS AND I HAD A LOT OF QUESTIONS. AGAIN THANK YOU!

Thank you for your feedback. We really appreciate it. Have a great day!

Thelma S.

October 5th, 2019

So easy to navigate.

Thank you!

Kevin B.

May 28th, 2023

Easy to use and very helpful

Thank you for taking the time to give us your feedback Kevin. Hope you have an amazing day.

Sandra G.

January 3rd, 2019

We were referred to the site by banking friend. It does take time to read through and figure out what a person needs, form-wise, to accomplish the goal. Once that was decided, check out and the download was very easy. What a great savings in cost and time.

Thank you Sandra, glad we could help. Also, please thank your friend for us. Have a wonderful day.

Rachel C.

January 18th, 2021

This service is a game-changer. I work all over and being able to e-record so easily has been so effective for my business.

Thank you for your feedback. We really appreciate it. Have a great day!

Teresa R.

May 7th, 2022

FANTASTIC. Sometimes we think know something, glad I found out I was wrong before it was too late.

Thank you!

Virginia M.

August 26th, 2020

This was the easiest web page ive ever navigated .Found just what i needed fast !

Thank you!