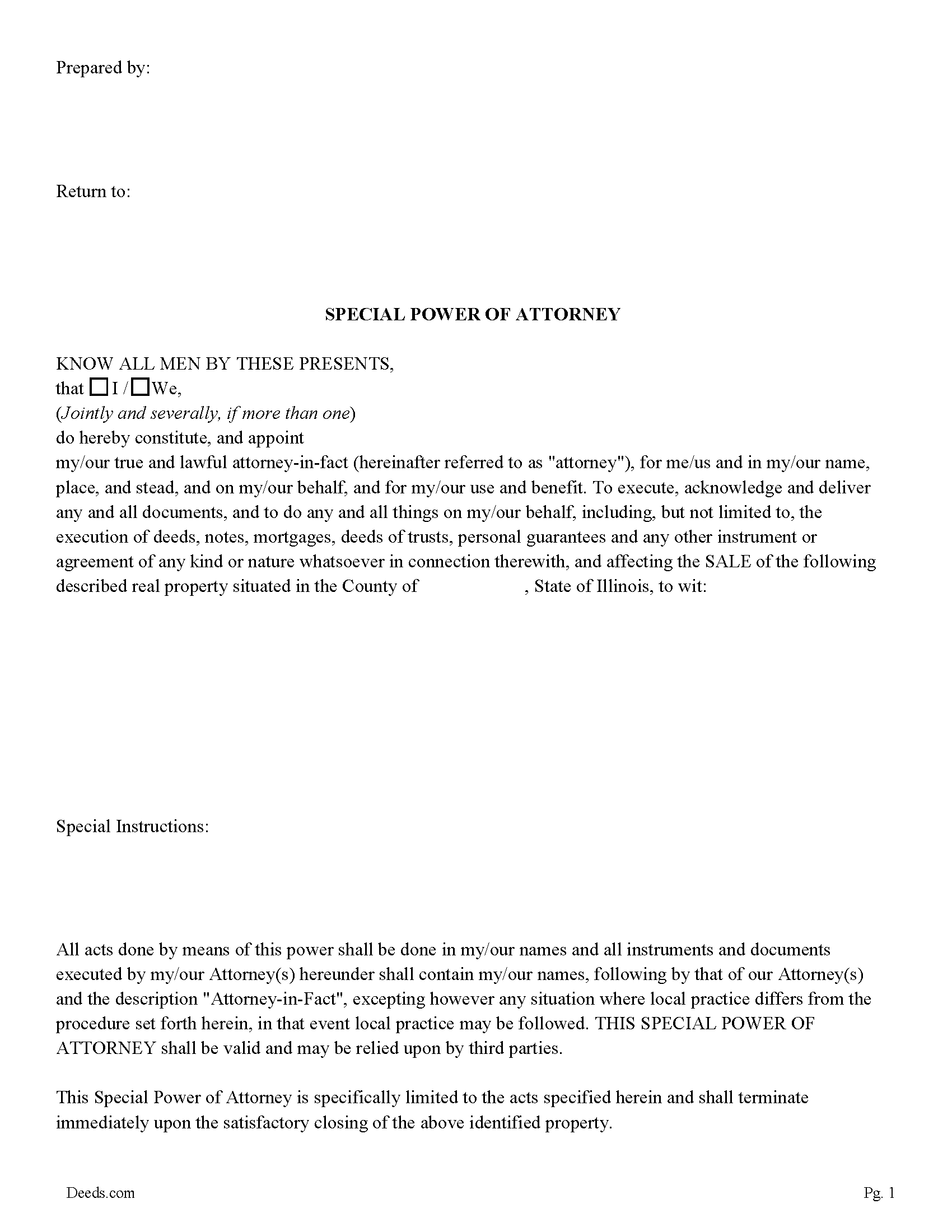

Wayne County Special Power of Attorney for the Sale of Property Form

Wayne County Special Power of Attorney Form for the Sale of Property

Fill in the blank form formatted to comply with all recording and content requirements.

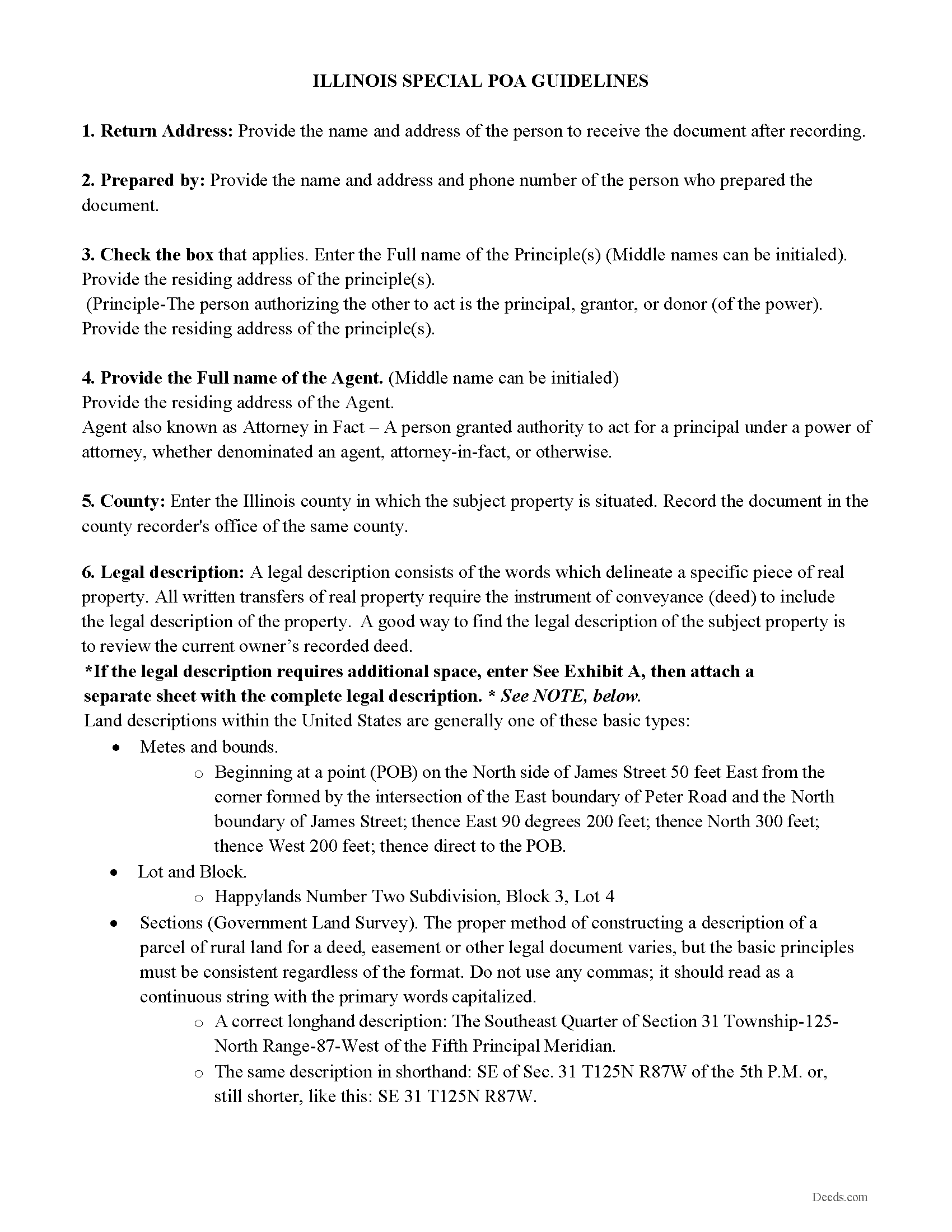

Wayne County Special Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

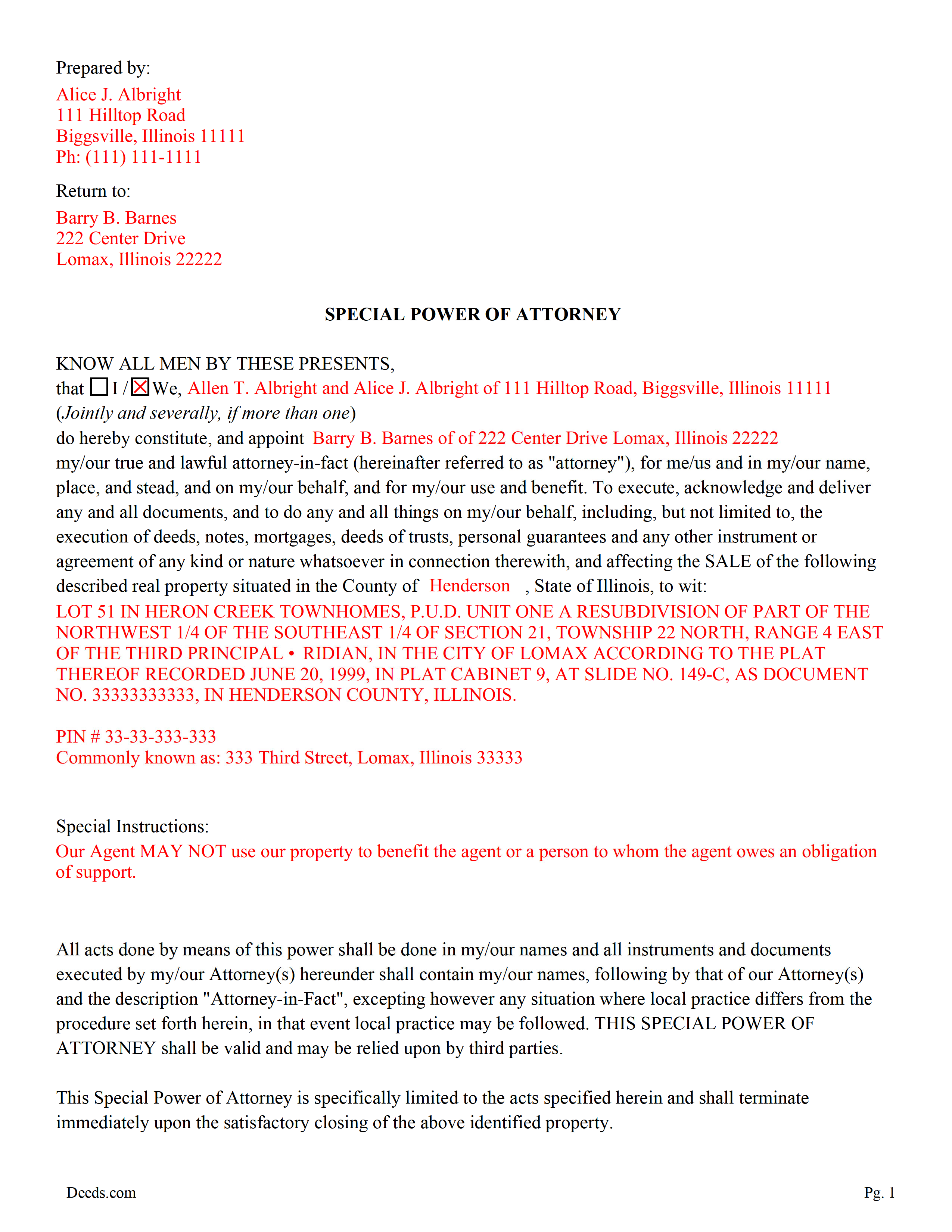

Wayne County Completed Example of the Special Power of Attorney Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Wayne County documents included at no extra charge:

Where to Record Your Documents

Wayne County Clerk/Recorder

Fairfield, Illinois 62837

Hours: 8:00 to 4:30 M-F

Phone: (618) 842-5182

Recording Tips for Wayne County:

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Wayne County

Properties in any of these areas use Wayne County forms:

- Barnhill

- Cisne

- Fairfield

- Geff

- Golden Gate

- Johnsonville

- Keenes

- Mount Erie

- Rinard

- Sims

- Wayne City

Hours, fees, requirements, and more for Wayne County

How do I get my forms?

Forms are available for immediate download after payment. The Wayne County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wayne County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wayne County?

Recording fees in Wayne County vary. Contact the recorder's office at (618) 842-5182 for current fees.

Questions answered? Let's get started!

This form is used for the SALE of real property. The principle designates an agent and empowers him/her to act in all necessary legal documents and instruments for the sale of a specific property and terminates immediately upon the satisfactory closing of the specified property. It includes a "special instructions" section where the principle can limit or further define actions taken by the agent.

For use in Illinois Only.

(Illinois Special POA-Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Wayne County to use these forms. Documents should be recorded at the office below.

This Special Power of Attorney for the Sale of Property meets all recording requirements specific to Wayne County.

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Special Power of Attorney for the Sale of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Michael S.

March 12th, 2021

Well designed easy to use system. Provided all instructions and updates required, as well as catching an extra form required by our county.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dorien C.

March 25th, 2023

Easy to use, thank you.

Thank you!

Brenda S.

April 9th, 2021

Awesome forms, filled them out on my computer, printed them out complete, notarized, recorded, wonderful process. THANKS

Thank you for the kind words Brenda. Have a great day!

Todd J.

February 4th, 2021

Super Easy!

Thank you!

Kari G.

July 15th, 2021

The service was prompt and attentive to my questions. I would've just appreciated a heads up that I also needed to contact the county directly (and provide contact info) to receive a certified copy of the document (Notice of Commencement) in order to submit the certified copy to the Building Department. This was an extra step that I haven't had to complete before using another eRecording service. Even if this extra step is a result of the county's system. I would still have expected a head's up (since there wasn't any info regarding this on the county's site for eRecording).

Thank you for your feedback. We really appreciate it. Have a great day!

heather i.

December 5th, 2022

I don't pay very close attention to what I'm doing all the time which leads to mistakes. Deeds.com was helpful in correcting my error and getting me on my way.

Thank you!

Kevin H.

August 6th, 2024

Quick and easy to find the forms I needed. And the download was easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia C.

December 29th, 2021

Deeds.com saved me time and research by offering a beneficiary deed and full instructions for filling it out. My home will now pass directly to my only son without probate. This form and other complimentary forms was an excellent value.

Thank you for your feedback. We really appreciate it. Have a great day!

GARY S.

April 16th, 2021

I thought your forms are great. Easy to use with instructions provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael L.

September 5th, 2020

Pretty good stuff, not exactly clear on the deed transfer costs and all

Thank you for your feedback. We really appreciate it. Have a great day!

Steven b.

November 21st, 2021

We used this document in 2018 and it was acceptable to Jackson County Missouri. It worked and is valid. Very happy with the product.

Thanks for the kind words, glad to see you back again. Have a great day!

Scott W.

February 5th, 2024

Quick and simple.

Thank you!

Justine John S.

February 17th, 2022

Splendid! I will definitely and absolutely recommend you guys and this company to my co-investors !

Thank you!

William C.

September 9th, 2020

Good service, great price, the website is a bit hard to maneuver in places.

Thank you for your feedback. We really appreciate it. Have a great day!

Dan V.

December 24th, 2021

Very happy, thanks.

Thank you!