Fayette County Transfer on Death Instrument Form

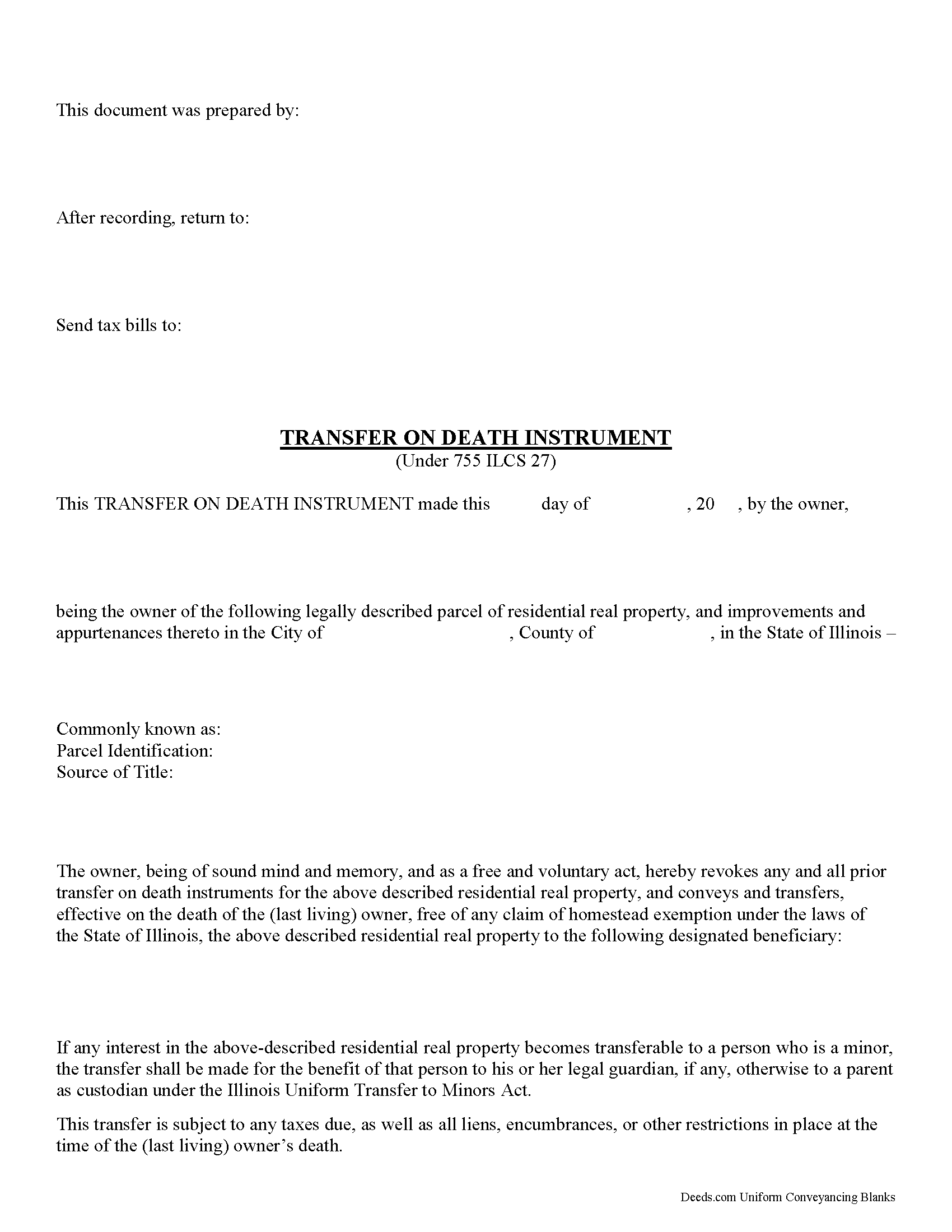

Fayette County Transfer on Death Instrument

Fill in the blank form formatted to comply with all recording and content requirements.

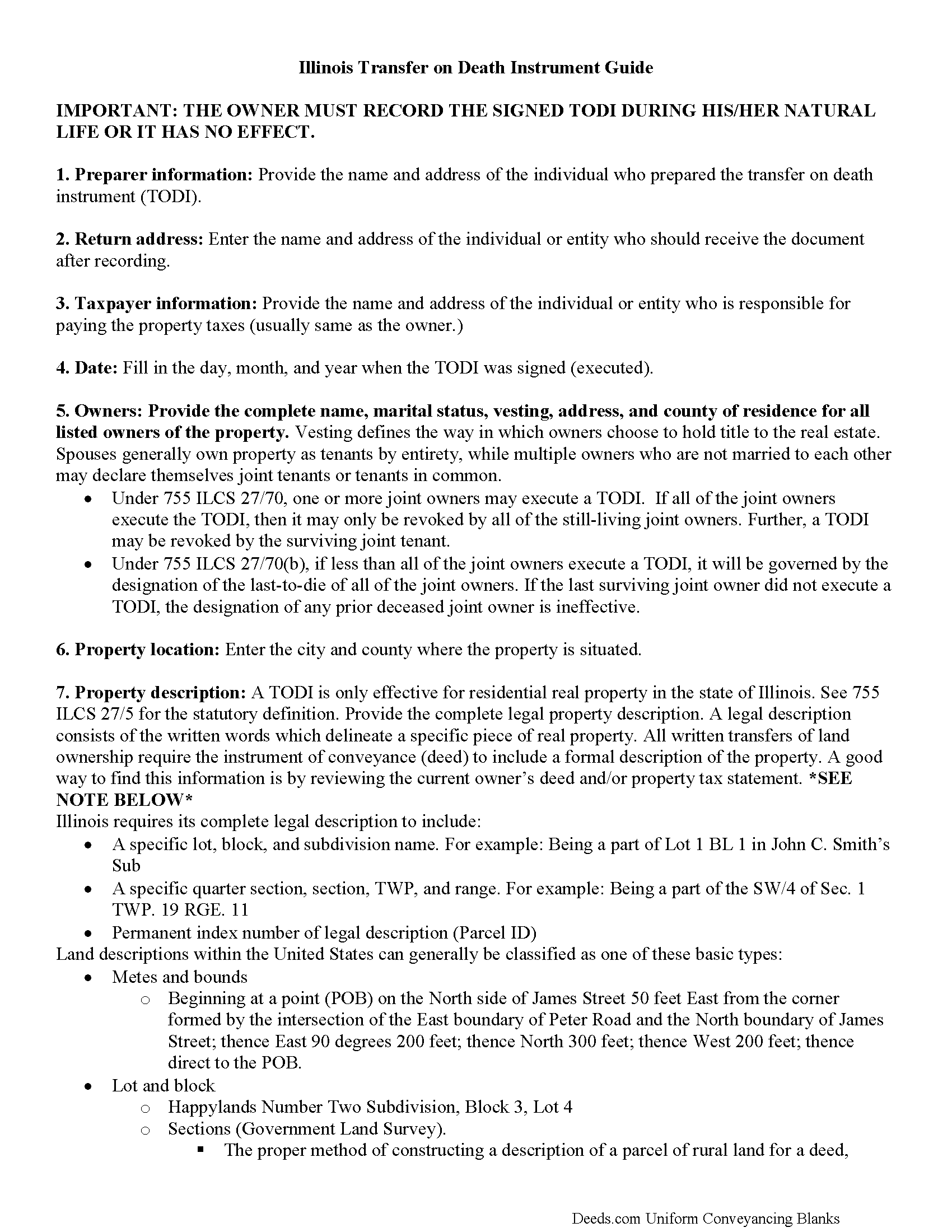

Fayette County Transfer on Death Instrument Guide

Line by line guide explaining every blank on the form.

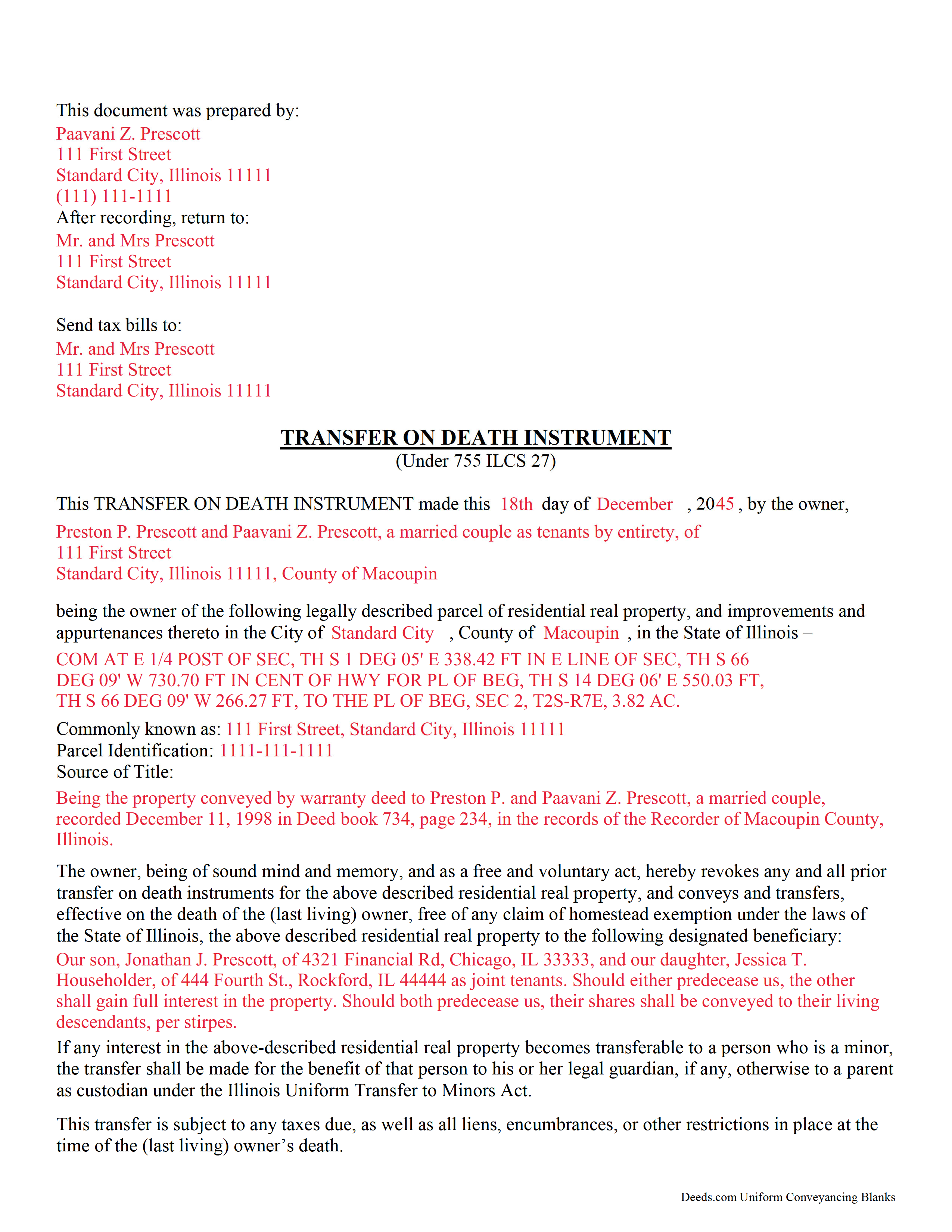

Fayette County Completed Example of the Transfer on Death Instrument Document

Example of a properly completed Illinois Transfer on Death Instrument document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Fayette County documents included at no extra charge:

Where to Record Your Documents

Fayette County Clerk/Recorder

Vandalia, Illinois 62471

Hours: 8:00 to 4:00 M-F

Phone: (618) 283-5000

Recording Tips for Fayette County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Fayette County

Properties in any of these areas use Fayette County forms:

- Bingham

- Brownstown

- Farina

- Hagarstown

- Loogootee

- Ramsey

- Saint Elmo

- Saint Peter

- Shobonier

- Vandalia

Hours, fees, requirements, and more for Fayette County

How do I get my forms?

Forms are available for immediate download after payment. The Fayette County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Fayette County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fayette County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Fayette County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Fayette County?

Recording fees in Fayette County vary. Contact the recorder's office at (618) 283-5000 for current fees.

Questions answered? Let's get started!

Comparable to Ladybird, beneficiary, and enhanced life estate deeds, these instruments permit homeowners to name a beneficiary to gain title to their residential real property following the owner's death, while retaining absolute possession of and control over the property while alive. Because the Illinois document DOES NOT transfer ownership when it's executed, the owner may revoke the transfer at will, and is allowed to reallocate, sell, or otherwise dispose of the real estate as desired with no penalties, restrictions or obligation.

(Illinois Transfer on Death Package includes form, guidelines, and completed example)

Important: Your property must be located in Fayette County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Instrument meets all recording requirements specific to Fayette County.

Our Promise

The documents you receive here will meet, or exceed, the Fayette County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fayette County Transfer on Death Instrument form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Charlotte V.

June 13th, 2024

t was a bit confusing at first. I am really old though. It was fairly easy to use. I will continue to use Deeds. com for all my future needs. Thank you Deeds.com for making life so much easier.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Myrna P.

March 18th, 2019

Easy to download, form very user friendly, and its customized to our county. Very much worth the money.

Thank you Myrna. Have a fantastic day!

Missie R.

June 17th, 2020

Very fast and professionally handled.

Thank you!

Elizabeth F.

February 14th, 2022

This was great other than exemption codes did not populate and I couldn't refer to it.

Thank you for your feedback. We really appreciate it. Have a great day!

Nanette G.

March 4th, 2020

The Website was easy to use. I live in Houston Texas and mother recently passed away in California and I need affidavit of joint tenant forms. I was provided all the forms necessary to complete the documents. I had been a legal secretary in California about 20 years ago and just need the current forms and received them all very quickly.

Thank you!

James A.

January 2nd, 2020

Good.

Thank you!

Marck G.

March 23rd, 2022

This is an excellent service..thank you

Thank you!

michael k.

February 24th, 2023

fast and easy to fill out forms.

Thank you!

Richard G.

August 28th, 2022

I was not able to add more linea to the deed and add up to four people and their addresses. The document should be able to be expanded.

Thank you for your feedback. We really appreciate it. Have a great day!

Isaac T.

November 14th, 2022

Had no problem getting my forms. It was quick,easy, and reasonable priced. Will use again if needed

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andrew H.

November 11th, 2020

Very efficient does what it says on the box.

Thank you!

Bobbie N.

February 24th, 2022

Thank you so much for making the site so easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara B.

February 17th, 2019

Great forms and instructions!

Thank you Barbara.

William C.

February 23rd, 2020

Excellent, easy to use. Technically accurate in all information offered.

Thank you!

Walter T.

December 12th, 2020

Awesome thanks

Thank you for your feedback. We really appreciate it. Have a great day!